Robinhood Alternatives: Better Platforms to Use Instead

Looking for apps like Robinhood but with a twist? Find the best alternatives with superior features. Do better in online trading with these apps.

|

J.P. Morgan Self-Directed Investing - Get Up to $700

- Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account with qualifying new money.

- $700 when you fund with $250,000 or more

- $325 when you fund with $100,000-$249,999

- $150 when you fund with $25,000-$99,999

- $50 when you fund with $5,000-$24,999

- Get unlimited commission-free online stock, ETF, fixed income, and options trades when you open an account.

- $0 Online Commission trades

- Choose an account that's right for you: General Investing, Traditional IRA or Roth IRA.

- Access our secure, easy-to-use trading experience online or through the Chase Mobile® app.

- Our powerful tools and resources are built to help you take control of your investments.

INVESTMENT AND INSURANCE PRODUCTS ARE:

Deposit and Get 30 Free Stocks plus 8.1% APY on uninvested cash

Enroll in Cash Sweep to enjoy 4.1% APY base rate plus 4.0% APY booster for the first 3 months after opening your account

Make a net deposit of $2,000 or more to receive 30 draws, each for a free stock worth $2 - $2,000 each. Maintain average assets totaling $2,000 or more for 60 days to unlock the free stocks.

This offer is available to new and existing customers who have not opened a brokerage account before January 15, 2025, 04:00 ET, or who have opened a brokerage account but have not made a deposit or an ACATS transfer yet and plan to make the first deposit or ACATS transfer that settles before March 31, 2025, 23:59 PM ET. Terms and conditions apply.

20 Free Fractional Shares

Open a new Webull individual brokerage account. Make a qualifying single initial deposit of $500 or more during the promotional period to get 20 fractional shares, each valued between $3 - $3,000. Maintain a balance of $500 or more in the account for 30 days or more. Terms and conditions apply.

Invest and Earn $150 Bonus

Open a new account using promo code TSTVAGLL. Fund the account with new and qualifying assets of $5,000 or more. Maintain a balance of $5,000 or more in the account for 60 days.

Here are the top 5 alternatives to Robinhood:

Most retail investors will know the name Robinhood. Before they launched, it was common to pay $5 to $10 for a trade. And account minimums started at $500.

But Robinhood changed all that. They got rid of most fees and minimums, which started an industry-wide trend.

Then, the Gamestop snafu happened. Lately, they've faced lawsuits, SEC scrutiny [1], and were fined by FINRA.[2]

So are there better investment apps? And which app is best for crypto, fractional shares, and trading tools?

Read on for the top 5 alternatives to Robinhood. These are best for newbies and young investors. Further, see which apps made our list of honorable mentions.

What is Robinhood?

Robinhood is a 100% commission-free investing app. There are no account or trade minimums, so you can start investing with as little as $1.

Robinhood lets US investors trade stocks listed on the Nasdaq and New York Stock Exchange. Or you can trade a range of popular stocks from international exchanges. You can also invest in ETFs, options, and cryptocurrencies.

For $5 a month, you can sign up for Robinhood Gold. It gives you instant access to larger deposits (from $5,000 to $50,000). You can see ~1,700 stock reports from Morningstar and access Level II Market Data.

Many new investors will love Robinhood's simple and easy-to-use interface. But they're no longer the only fee-free investing app. Most apps now offer this. So depending on your priorities, you may find a better alternative.

According to their CEO, this was due to insufficient capital to process all the trades being ordered. Since then, they have been subject to investigation by the SEC, a lawsuit filed in the Southern District of New York, potential investigations by the New York and Texas attorneys general, and at least one class-action lawsuit.

Why Robinhood May Not Be for You

While Robinhood has some things going for it, several factors make it a poor choice for some investors. Here's why Robinhood may not be right for you.

- Limited research and tools: While Robinhood lets you create watchlists and view real-market data, that's really about it. Many online brokerages offer a wealth of research, data, and advanced investing tools to help investors succeed.

- Candlestick charting options: Robinhood's candlestick charting options are limited at best. You cannot adjust the candle period to minutes or hours. On mobile, the design is difficult to view with the white background. Without this essential trading feature, you could be at a disadvantage.

- Limited educational resources: Newcomers and young investors are Robinhood's target audience, yet it lacks the vast educational resources you'd find at other online brokerages. Robinhood Learn offers articles covering basic topics like, "What Is a Portfolio?" But Webull has step-by-step courses to walk you through financial concepts like IPO Basics.

- No mutual funds or bonds: Mutual funds offer diversification, while bonds offer low-risk, predictable returns. If you're hoping to invest in either of those, you'll have to look at other online trading platforms.

- Poor customer service: If you want speedy customer service, Robinhood won't be a good fit. The app is known for long customer wait times and has struggled with lawsuits and regulatory inquiries.

What to Look for in a Robinhood Alternative

There are plenty of excellent alternatives to Robinhood, but they're not all the same. Below, check out the important factors to look for when choosing your next platform.

- Fees: Luckily, many trading apps are free. But some make you pay per trade, or charge a yearly or monthly fee. Review the fees to see if an app makes sense for your trading behaviors and portfolio.

- Variety of offerings: Not all investing apps offer every type of trade or account type. Make sure the app supports what you're looking for, be it mutual funds, IRAs, bonds, or others. For instance, an app like Webull lets you invest in Rollover, Roth, and Traditional IRAs.

- Accessibility: Some apps work on both iOS and Android devices, and others are best suited for desktop. Be sure to look for compatibility with your preferred device before downloading an app.

- Research and tools: This is important if you count on research to make informed decisions. Many online brokerage accounts offer in-depth company research and market analysis, while Robinhood is more bare-bones.

- Automated investing: Apps with robo-advisors offer investment guidance at lower fees than those with human advisors. Investors who are saving for a financial milestone, like a new home, can use this feature to optimize their returns with a minimal time investment.

Top 5 Robinhood Alternatives

|

Choosing your trading platform depends on whether you want to trade stocks, or crypto, or a combination of both. Also, ask yourself how much you want to invest. And do you value privacy more than security, or vice versa?

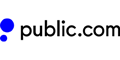

Coinbase: Best for Crypto

|

| Screenshot of Coinbase |

If you're interested in trading crypto rather than stocks, you might want to look at Coinbase. While Robinhood does offer a limited range of cryptocurrencies (11, at time of writing), crypto is what Coinbase is known for. They offer over 150 coins to buy sell and trade, with more added regularly.

New investors will find Coinbase just as easy to use as Robinhood, and in fact, their interfaces are quite similar. Coinbase is known for being one of the easiest places to start trading crypto.

In addition to their crypto exchange, Coinbase has a variety of other features. If you own a large amount of Bitcoin, you can use it as collateral for a crypto-backed loan.

Coinbase has partnered with Visa to offer a crypto rewards card that will get users up to 4% cash back on purchases.

The Coinbase Wallet offers users a safe place to store their crypto as well.

It is important to keep in mind that Coinbase does have relatively high fees.

Pros and Cons of Coinbase

|

|

Key Features:

- Trade over 150 cryptocurrencies

- Earn crypto while you learn with Coinbase rewards

- Buy via credit, debit, bank, or wire transfer

- Cash holdings FDIC insured

- Security: Most crypto held in cold storage

Those with some experience looking to save may consider Coinbase Pro, Coinbase's expert-oriented app with lower fees.

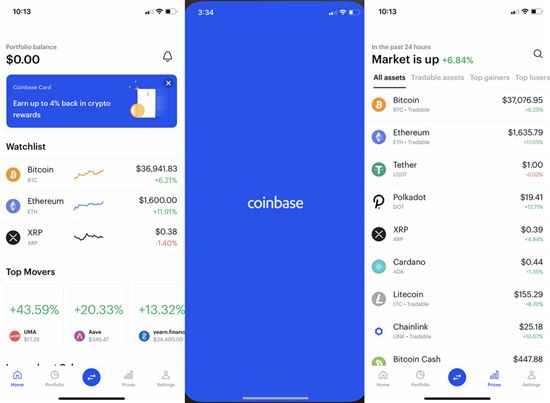

Acorns: Best for Young Investors

|

| Screenshot of Acorns |

Acorns is an app that aims to make it easy for average people to level up their finances. They got started offering people an easy way to save by rounding up the spare change on their purchases and putting it away to save or invest.

They offer quick setup on investment accounts for the whole family, as well as retirement and checking accounts that users can add to in increments.

Users can take advantage of portfolios designed by experts that automatically adjust to keep their investments on track.

Their accounts do require a monthly fee of $3 to $12 a month.[3]

Pros and Cons of Acorns

|

|

Key Features:

- Round up spare change

- Investment, retirement, and checking accounts

- Prebuilt portfolios of stocks, ETFs, and bonds

- Investor risk assessment

- Investing for kids

- IRA match

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

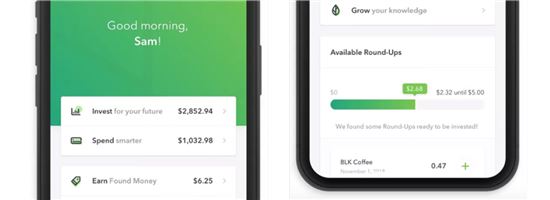

Public: Best for Fractional Shares

|

| Screenshot of Public |

New York-based Public is an investing social network. Their goal is to make investing accessible by promoting financial literacy and offering fractional shares of expensive stocks. Like Robinhood, they focus on the trading of stocks and ETFs.

Public is free to download and commission-free as well. Where it stands out from Robinhood is the ability to see what others are trading.

Users can also follow curated themes. These are groups of stocks that support a central cause. Examples include: The Crypto Revolution, For the Win! (gaming and eSports), Women in Charge, and Growing Diversity.

Pros and Cons of Public

|

|

Key Features:

- Over 9,000 stocks and ETFs

- Curated theme-based portfolios

- Collaborative community

- Commission-free trading

- Fractional shares

- Fund account with debit card

- SIPC insured

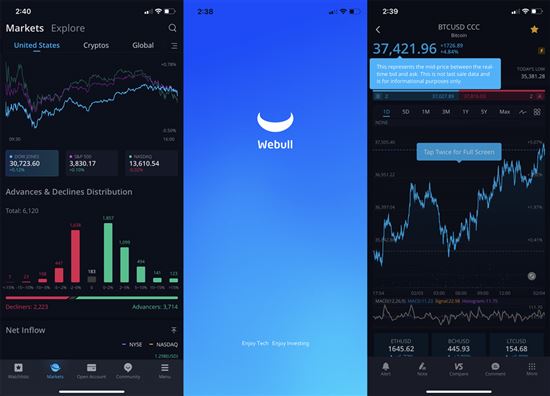

Webull: Best Analytical Tools

|

| Screenshot of Webull |

Webull is considered a major competitor to Robinhood with millennials. They offer a wide range of investment options, including stocks, ETFs, and options—all commission-free.

A feature that sets Webull apart is its extensive research and analytical tools, something that many retail investor-oriented apps aren't known for.

Webull also offers a free paper trading account that allows you to play around with $1M fake dollars. Users get 3 trades per 5-day period, a restriction lifted for accounts over $25,000. Short selling and options trading are also available.

Pros and Cons of Webull

|

|

Key Features:

- Commission-free trades

- No account minimums

- Free extended trading accounts

- Free margin account with $2,000 minimum

- Trading Simulator

- Advanced research tools and charting

- Trade stocks, ETFs, and options

- No fractional shares

20 Free Fractional Shares

Open a new Webull individual brokerage account. Make a qualifying single initial deposit of $500 or more during the promotional period to get 20 fractional shares, each valued between $3 - $3,000. Maintain a balance of $500 or more in the account for 30 days or more. Terms and conditions apply.

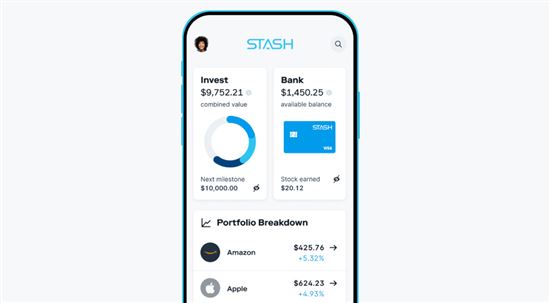

Stash: Best for Investment Guidance

|

| COURTESY OF STASH |

Stash is a micro-investing app geared toward beginners to the world of investing. While they aren't a robo-advisor, they do offer a lot of guidance to those who are still finding their feet when it comes to choosing what to invest in.

They offer more than 400 stocks and ETFs, which they've organized by risk to help you pick the investments that suit your goals and personality, whether you're a conservative or ambitious trader.

They offer traditional and Roth IRA accounts for those interested in saving for retirement as well.

Their accounts come with monthly fees. If you're only investing small amounts, be careful not to let the fees eat up all your earnings.

Pros and Cons of Stash

|

|

Key Features:

- Guidance for beginners

- 400+ stocks and ETFs

- Invest in themes

- Risk assessment

- Retirement accounts

- Fractional shares

More Robinhood Alternatives to Try Out

TD Ameritrade

A familiar name among online brokerages, TD Ameritrade is now also offering commission-free trading on stocks, ETFs, and options. If you're looking for an extensive range of analytical tools, this platform may be for you.

They offer heat maps and earnings calendars, as well as the ability to do backtesting, a research technique involving testing investment strategies against historical market data. Best of all, there are no account minimums required to access the top-tier features.

Fidelity

Fidelity is another well-known broker that has something to offer for beginners and experts alike. With in-depth research tools as well as articles and videos to get you started, every trader will find something that works for them.

Traders can invest in stocks, mutual funds, ETFs, bonds, and CDs, and open IRA accounts, 529 college savings accounts, or cash management accounts. Normal trades are commission-free.

E*Trade

E*Trade is a popular online brokerage that caters to low-frequency traders and beginners, offering helpful guidance and even access to investing professionals for advice. They offer a wide range of investments like stocks, bonds, ETFs, and mutual funds.

Traders can also open checking accounts and IRAs, or apply for a mortgage through E*Trade. Keep in mind, there is a $500 minimum required to open an account.

Binance

For those looking to trade a wide range of cryptocurrencies at low fees, Binance has a lot to offer. Consistently one of the biggest cryptocurrency exchanges by volume, Binance is available all over the world, with Binance.US for residents of the United States.

They offer over 100 currencies in the U.S., and more than 600 worldwide.

Binance

Kraken

Kraken is a cryptocurrency exchange that offers good rates on an extensive number of trading pairs. They use an advanced market interface that may not be ideal for beginners to the crypto space.

The difficulty to fund an account may have some investors looking for other avenues, but those who use Kraken will find competitive pricing compared to many other popular exchanges.

Bottom Line

If you think that Robinhood isn't the place you want to be trading, don't worry. There are plenty of platforms offering comparable services for retail investors.

It doesn't matter if you want to buy stocks and bonds, crypto or ETFs, invest in a mutual fund, or save for retirement with an IRA.

Whether you want an easy app or desktop access, helpful guides or friendly advice, analytical tools or just to take your hands off the wheel and let someone else decide, there's an investment platform that's right for you.

And in most cases, sign-up takes just a couple of minutes. Why wait?

References

- ^ U.S. Securities and Exchange Commission. SEC Charges Robinhood Financial With Misleading Customers About Revenue Sources and Failing to Satisfy Duty of Best Execution, Retrieved 4/27/2022

- ^ FINRA. FINRA Orders Record Financial Penalties Against Robinhood Financial LLC, Retrieved 4/27/2022

- ^ Acorns. Pricing, Retrieved 07/01/2024

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC

- Sign up for an eToro account

- Deposit funds

- Invest in $100 worth of crypto

You'll automatically receive $10 directly to your account balance. Offer only applies to US customers. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Jeremy Harshman is a creative assistant at CreditDonkey, a personal finance comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: