44 Best Passive Income Ideas to Make Money

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Find out how the affluent grow their wealth: 44 brilliant passive income streams. Start now with this guide.

|

Want to grow your money without working non-stop? Let your money do the work instead.

Passive income helps make money over time without constant effort. This means earning cash during vacations, family time, and even while sleeping.

But starting can be tough. It needs time and work to create different income sources, and some might not be a good fit.

In this guide, discover over 40+ amazing ways to earn passive income. Also, learn how much money each idea could bring in.

- Robo-Advisor

- Real Estate Crowdfunding

- High-Yield Savings

- Peer-to-Peer Lending

- Dividend-Paying Stocks

- Reduce Your Consumer Debt

- CD Ladders

- Bond Ladders

- Invest in Small Business Inventory

- Refinance Your Mortgage

- Wrap Your Car in Advertisements

- Rent Your Car on Turo

- Rent Your Home on Airbnb

- Rent Storage Space

- Earn rental income from unused space

- Rent Parking Space

- Ecommerce Drop Shipping

- Diversify investments with rental properties

- Start a Blog

- Create an Online Course

- Create an Alexa Skill

- Start a YouTube Channel

- Write an eBook

- Create a Podcast

- Invest In Small Businesses

- Buy an Existing Business

- Sell Digital Files

- Sell Stock Photography Photos

- Sell Your Music

- Sell on Merch by Amazon

- Affiliate Marketing

- Run Ads

- Sell Non-Display Ads

- Buy and Sell Domain Names

- Buy Vending Machines

- Buy a Laundromat

- Create an App

- Be a Social Media Influencer

- Lead Generation

- Get Paid to Take Surveys

- Save up to 30% off your electricity bill

- Credit Card Rewards

- Cashback for Online Shopping

- Cashback for Dining Out

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

What Is Passive Income?

Passive income is money earned without constant effort. It often comes from investments, rentals, or businesses requiring minimal upkeep. While it's appealing, setting it up can take time and work.

Passive income can be separated into two categories:

- Investing some capital into assets that can grow (investing in stocks, rental properties, business, etc.)

- Putting in time and effort to create something that will earn money (creating a blog, product, music, book, etc.)

In reality, all passive income needs some effort—making money without any work is unrealistic. However, picking smart methods and putting in hard work can lead to great results.

Read on for the best passive income ideas, whether you have start-up cash or have time.

- Your job - Passive income is supposed to bring in income without active effort so you can spend more time on hobbies and with loved ones.

- Side hustles - Again, passive income is not the same as active income.

- Consulting - You need to be able to step away from the work and still make money with passive income streams.

- Investing for speculation - Stock appreciation is not income because you only see the return if you sell the investment (exceptions are dividends and cash on cash returns).

Why Passive Income Is Important

While it doesn't really replace active income sources (like your full-time job), it can still be a good idea to explore passive income opportunities.

Here are some of the benefits of passive income investments:

- Have a safety net if you lose your day job

- Earn extra cash to supplement your retirement plan

- Have more time to spend doing the things you love

- Earn multiple passive income streams at once

- Flexibility to work from anywhere (just need internet)

- Potential to grow into your own business

How to Choose a Passive Income Stream

|

| © CreditDonkey |

To maximize its potential, you need to find the best passive income stream for you. Here are some tips that can help you out:

- Assess your current situation.

To find the best passive income strategy for you, think about what you can utilize. You can start by asking yourself questions like:- Do you have money?

- Do you have debt?

- What skills do you have?

- Do you have enough resources?

Knowing what you have or don't have can be a good way to identify how you can start earning passive income.

- Do you have money?

- Stay realistic.

Before you decide on a passive income stream, make sure you stay realistic about your goals and capacity to commit. That way, you can sustain whatever source you choose.After all, even though passive income ideas require less effort, that doesn't mean there's zero effort involved.

- Do your due diligence.

It's best to do your research and learn everything you can about your preferred passive income source before committing. That way, you can avoid wasting time and resources on something that won't work.

Read on for the best passive income ideas, as well as the difficulty level to get started and make money.

Hopefully, this list will inspire you to start your journey to build passive income and achieve financial independence.

How much passive income you earn depends on what you do. Refinancing your mortgage could save you a few hundred a month, while a successful blog or podcast could earn several thousand.

By combining several of these passive income strategies, it's possible to add an extra $1,000 a month to your bank account.

Passive Income Ideas with an Upfront Investment

|

The following passive income streams require investing some money upfront. Depending on the income source, your upfront investment could be as little as $5. Find the right one for you below.

Auto-Invest with Robo-Advisors

Difficulty level: Easy

Potential earnings: 2.91%-6.10%[1]

Robo-advisors automatically invest for you. They pick investments for you and manage your portfolio, so you don't even need any investing knowledge or practice. Just sit back and let the investing platform do all the work.

Just answer some questions about your goals and risk tolerance, and the software algorithms will create an investment strategy for you. All you have to do is fund your account.

A lot of robo-advisors don't have a minimum, so you can open an investment account even if you don't have a lot of money.

See our complete guide to the best robo-advisors.

Pros

- Invest without the need to micro-manage your financial accounts

- Lower fees than most true stockbrokers

- Small minimum investment, depending on the platform

- Access to tried-and-true investment strategies

Cons

- No personalized service—you work with a computer program

- Limited options to customize your portfolio

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Passive income is money earned when you're not actively working. Residual income is a type of passive income. Residual income is money you continue to receive even after all the work is done (such as song royalties, YouTube ads, or stock photo downloads).

Real Estate Crowdfunding

|

| © CreditDonkey |

Difficulty level: Easy

Potential earnings: 10% - 15%[2][3]

With real estate crowdfunding, you pool money with other investors to fund properties together. The platform will automatically invest your money in different properties, so there's little to no learning curve.

You can earn returns from dividends (generated by rental income) and when the property appreciates in value. This is generally a longer-term investment of at least five years.

These real estate crowdfunding sites are open to everyone:

- Fundrise: $10 minimum. Invest in diverse new and stabilized projects across the US.

- DiversyFund: $500 minimum. Focuses on multi-family buildings to collect rental income.

- Rich Uncles: $5 minimum. Focuses on commercial rental properties and paying dividends.

- RealtyMogul: $5,000 minimum. Focuses on small-balance commercial real estate opportunities.

Another benefit is that you don't have to deal with tenants, repairs, and other headaches associated with owning rental properties.

Investing in real estate is a great way to diversify your portfolio. Historically, real estate investment has seen a higher return compared to the stock market.

These are companies that buy and manage real estate projects. The difference with these is that you can sell your share of the stocks at any time.

Pros

- Start investing with only a small amount of capital

- Real estate allows portfolio diversification

- You don't have to deal with tenants, repairs, and other headaches associated with owning rental property

Cons

- Real estate isn't liquid, which puts your investment at risk

- Long wait for returns depending on the property's condition and status

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Invest in Real Estate with $100

- Short-term real estate investments lasting just 6-18 months

- Open to non-accredited investors

- Low fees

High-Yield Savings Accounts

Difficulty level: Easy

Potential earnings: 0.15% - 5%[4]

Earning interest on the money you already have is arguably the most effortless way to generate passive income. Online savings accounts pay more interest and have less fees than traditional banks.

Sure, an APY between 1% and 3% may not net you thousands of dollars. But if you continually save more money, your interest will compound over time with zero risk.

A savings account is an ideal place to park your emergency fund and money for short term goals.

Pros

- Hundreds of online bank options

- Minimal risk with an FDIC-insured bank

- Earn a higher interest rate than with traditional banks

- Few, if any, fees for online savings accounts

- Easy to open and maintain

Cons

- Even "high-yield" APYs may be rather low

- You have to conduct your banking business online

- External transfers may take a few days

- Small minimum investment

CIT Bank Platinum Savings - $300 Bonus

- Transfer a one-time deposit of $50,000+ for a Bonus of $300

- 4.10% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- No monthly maintenance fee

- Member FDIC

Discover® Online Savings - $200 Cash Bonus

To qualify for Bonus: Apply for your first Discover Online Savings Account, enter Offer Code CY325 at application, deposit into your Account a total of at least $15,000 to earn a $150 Bonus or deposit a total of at least $25,000 to earn a $200 Bonus. Qualifying deposit(s) may consist of multiple deposits and must post to Account within 45 days of account open date. Maximum bonus eligibility is $200.

What to know: Offer not valid for existing or prior Discover savings customers. Eligibility is based on primary account owner. Account must be open when bonus is credited. Bonus will be credited to the account within 60 days of qualifying for the bonus. Bonus is subject to tax reporting. Offer ends 09/11/2025, 11:59 PM ET. Offer may be modified or withdrawn without notice. Due to new customer funding limits, you may wish to initiate fund transfers at your other institution. For information on funding, see FAQs on Discover.com/Bank. See advertiser website for full details.

Peer-to-Peer Lending

|

| © CreditDonkey |

Difficulty level: Moderate

Potential earnings: 5.7%[5]

Peer-to-peer (P2P) lending platforms let you lend money to individuals who don't qualify for traditional bank loans. You'll earn returns as people pay back the loan with interest.

However, there is the risk that a borrower won't pay back the loan. You can lower the risk through diversification by investing in multiple loans in micro amounts.

Here are two popular P2P lending sites and their lender requirements:

- Prosper: $25 min investment in each loan;[6] gross annual income of $80,000; net worth of $80,000 (California residents have higher requirements.)[7]

- Upstart: $100 min investment; you must be an accredited investor (net worth of $1 million or an income of $200,000 or more in the last two years)[8]

With P2P platforms like Upstart and Prosper, you can typically start investing with small amounts of money and choose loans based on your preferences.

Pros

- Earn approximately 6% in interest

- Diversify your risk by investing in multiple loans in micro amounts

- The P2P platform vets borrowers and provides you with the information you need to make a decision

Cons

- Borrower defaults can leave you with a loss

- No collateral on loans

- Illiquid—most platforms don't have a secondary market for you to sell your investment

Dividend-Paying Stocks

Difficulty level: Easy

Potential earnings: 1% - 2%[9]

Dividends are company profits that are shared with stockholders. Companies often pay dividends as cash, but sometimes they pay them as shares of stocks. These stocks are lower risk and can provide a steady stream of passive income, combined with capital appreciation.

You can decide what to do with the dividends. You can either withdraw or reinvest the dividends to compound the growth.

Typically, more established companies offer dividend-paying stocks. However, there's no guarantee that a company will consistently pay dividends.

Dividend index funds contains companies expected to pay higher dividends than average. Real Estate Investment Trusts (REITs) also pay dividends.

You can invest in high dividend stocks with any online brokerage. Here are the best free stock trading apps.

Pros

- Earn profit from dividends without having to wait for the stock to increase in price

- Dividend stocks may hold their value even when the stock market drops

- Typically older (established) companies offer dividend-paying stocks

Cons

- No guarantee a company will offer dividends—it's up to the board of directors

- Dividend-paying stocks may not increase in price like other stocks when the market does well

- Potentially high tax rates for investing

Pay Down Your Consumer Debt

|

| © CreditDonkey |

Difficulty level: Moderate

Potential earnings: Varies by your debt interest rate

It may not be a flashy option, but paying off high-interest debt is always a smart move.

Think about it this way: If you completely pay off a credit card that charges 15%[10] in interest, you've just earned 15% on your money. That's pretty significant! You're unlikely to find an investment with returns that high in such a short amount of time.

If you cannot pay your debt off in full, consider refinancing debts, such as student loans or personal loans with high interest rates. Any money you can save on interest is passive income.

You can use online budgeting tools like Mint or YNAB to help with debt payoff planning.

Pros

- Improve your credit score while you generate passive income

- Refinance or transfer your credit card debt to a low interest credit card and save money

- Help your financial future by paying off your debts now

Cons

- If you don't have the money to pay off the debts in full, it can take a long time to see a return

- You have to be consistent about your payments in order to get out of high interest debt

- Getting out of debt takes money (and effort)

Get Personal Loan Offers

- Borrow Between $1,000 - $100,000

- Loan Terms from 24 - 84 months

CD Ladders

|

| © CreditDonkey |

Difficulty level: Easy

Potential earnings: 0.24%-1.54% (Average CD rate)[11]

Certificate of Deposits involves putting away your money for specified period. Typically, the longer term you commit to, the higher interest rate you earn.

But if you don't want to tie up your money in the long-term CD, consider CD laddering. You split your investments into different CDs with different rates and lengths. As each CDs matures, you can take out your money, or reinvest into another CD.

And if CD rates go up, you can reinvest into a new CD with a higher rate.

With an FDIC-insured CD account, your principal is safe (up to $250,000). However, your buying power may decrease over time due to inflation. Still, a CD will give you better returns than holding your savings in cash or in a non-interest-earning account.

- $1,000 in a 1-year CD at 2.30%

- $1,000 in a 2-year CD at 2.50%

- $1,000 in a 3-year CD at 2.70%

- $1,000 in a 4-year CD at 2.80%

- $1,000 in a 5-year CD at 2.90%

After the first year, you can withdraw the money plus interest in your 1-year CD. You can then reinvest all that into a 5-year CD.

Another year later, your 2-year CD will have matured, and you can reinvest that into another 5-year CD. And so on.

Pros

- Increase your liquidity by investing in multiple CD terms

- Control over how much money you invest in each CD

- The more money you put in longer-term CDs, the more interest you earn

- Reinvest the money earned from the shorter-term CDs into longer terms if rates rise

Cons

- If rates rise and your CD hasn't matured, you can't liquidate to take advantage of the higher rates

- Learning curve to figure out how to successfully set up a CD ladder

High-Yield CD Rates - Up to 4.30% APY

- No fees

- $1 minimum deposit

- FDIC insured

| Term | CD Rates |

|---|---|

| 3 Month | 4.30% APY |

| 5 Month | 4.10% APY |

| 6 Month | 4.30% APY |

| 9 Month | 3.95% APY |

| 12 Month | 3.95% APY |

Bond Ladders

Difficulty level: Easy

Potential earnings: 4% - 7%[12]

Bonds are fixed income investments that pay you fixed-rate interest payments over a set period of time. When the bond matures, you'll get your principal back. Unlike stocks, there is very little risk, so it's smart to include some bonds in your portfolio.

Bond ladders work like CD ladders. You purchase bonds of different amounts and maturities. As each bond matures, you collect the interest payments and can reinvest the funds in another bond (if you wish).

The idea is to have a series of bonds with staggered maturity dates so that you always have liquid funds and earnings. Ideally, you keep reinvesting the funds to generate more growth.

Pros

- Low-risk investment

- Control over how you invest, giving you certainty regarding when you'll have your funds back

- Reinvest funds from matured bonds to "extend the ladder"

Cons

- If rates rise, you're stuck with the lower interest rate promised when you bought the bond

- Slight risk of default, which means a loss of your capital

- Not a great idea for short-term financial needs

There are plenty of passive income ideas that don't require an upfront investment. This usually means sacrificing your time (like creating an e-course or starting a blog) or renting items you already own (like renting a room, equipment, garage space, etc.).

Just remember that not all passive income ideas are guaranteed to work, which means you may be putting forth effort without reward.

Invest in Small Business Inventory

Difficulty level: Moderate

Potential earnings: Specified by retailer

Kickfurther.com has a unique crowdfunding concept where you help a company purchase inventory. The company specifies a rate of return and an expected time frame to sell.

Essentially, you are buying the inventory on consignment. You actually own the products. Once the products sell, you'll earn your share of the profits.

All buyers also get their own Kickfurther site, so you can help sell the inventory on your own. If you sell items directly from your store, you'll receive extra 5% commission.

Pros

- Invest in companies that are already up and running rather than taking a chance on new businesses

- A great way to diversify your investments, taking some money out of the stock market

- Open your own Kickfurther store to generate more cash flow

Cons

- Not a lot of support—you have to do your own due diligence

- Risk of the product never selling

- No guarantee that you'll earn anything

Refinance Your Mortgage

Difficulty level: Easy

Potential earnings: Depends on your mortgage and refinance rate

If mortgage rates have decreased or your credit score has improved, refinancing your house can save you money. A lower interest rate can help you save hundreds each month.

Generally, if you can lower your rate by at least 1%, it's worth refinancing. For example, on a $300,000 mortgage, the difference between 5% and 4% interest could be over $300 a month. Over the life of the loan, you can save tens of thousands of dollars.

You can then take that extra savings to pay bills, invest, or save for retirement.

Pros

- Higher long-term savings

- Frees up your money

- No initial investment needed

Cons

- Doesn't really generate new income

Wrap Your Car in Advertisements

Difficulty level: Easy

Potential earnings: $181 - $452 per month[13][14]

If you don't mind driving a car that looks like a mobile billboard, you can get paid to wrap it in company advertising. Wrapify and Carvertise matches you with available campaigns and pays you to wrap your car and drive it around.

You can choose how much you wrap your car (panel, partial, or full).

For Wrapify, lite wraps pay about $181-$280 per month, partial wraps pay about $196 - $280 per month, while full wraps pay about $264 - $452 a month. While for Carvertise, you can earn up to $300/month. You could easily make a few extra thousand per year.

If you live in a big city, this is an easy way to earn passive income while driving your normal daily commutes. You can earn better rates if you drive during "high traffic times."

Pros

- No-cost way to improve your financial outlook

- Keep your normal routine—you get paid for the miles you drive

- Choose how much you wrap your car (panel, partial, or full)

- Earn premium rates if you drive during "high traffic times"

Cons

- Must be at least 21 years old

- Car must be 2010 model or newer

- Company campaigns may be sparse at times

Rent Your Car on Turo

|

| © CreditDonkey |

Difficulty level: Easy

Potential earnings: Use Turo's Carculator to find out

If you have a car you don't use on a daily basis, you can make money by renting it out to those in need.

Turo is the Airbnb of car sharing. You list your vehicle, add pictures and available dates, and set the price. There's no penalty if you turn down a request to rent, so it doesn't hurt to keep your listing active as an extra passive income source.

Turo even provides liability insurance coverage for car owners up to $750,000.[15]

Pros

- Turo provides liability insurance up to $750,000

- Add more protection if you choose (this does take away from your profit)

- Keep older cars (12 years old is the max for regular cars; more than 25 years for specialty/classic cars) and make money on them rather than trading them in

Cons

- Works best with a spare care that you can list a majority of the time

- Must meet the renter at a location to provide the car

- Risk of damage to your vehicle

Rent Your Home on Airbnb

Difficulty level: Moderate

Potential earnings: $13,800/year[16]

If you have an extra room or you don't live in your home year-round, consider listing it on Airbnb. This platform connects private renters with travelers looking for a place to stay.

Rentals can be either a shared room, private room, or entire house. You set the availability and price.

Keep in mind, there is some work required. You'll be responsible for keeping the place clean for guests, as well as taking care of any problems during their stay.

Guests pay through the Airbnb platform before their stay, so you don't have to worry about payment. Hosts pay 3% to the platform.[17]

Roofstock is a marketplace that easily lets you buy a property online. You can buy a house already with tenants. Unlike REITS, with Roofstock, you actually own the house.

Pros

- A profitable way to fill an otherwise empty property

- No need to commit to a long-term lease

- Guests pay before their stay, so you don't have to worry about payment

Cons

- Your house/room could sit vacant for long periods

- Risk of damage to your property (or added insurance costs)

- Strangers staying in your home

Rent Storage Space

Difficulty level: Easy

Potential earnings: Depends on location and size of storage space, but check out Neighbor's listings to get an idea

If you're not sure about sharing your place with strangers, you can rent a part of your home to store people's stuff instead.

Have an extra bedroom, garage, attic, or basement? Sites like Neighbor lets you list your extra space and earn income when someone rents it for storage.

This lets you make money on an empty room that would otherwise just collect junk. A garage in Los Angeles can rent for $100 - $1200 per month. This can provide a consistent passive income stream.

Pros

- No fees to list—Neighbor only charges if someone rents your space

- Set your own price and terms to earn rental income

- Rent space that would otherwise collect junk or sit empty

Cons

- Sharing your personal space with a potential stranger

- You assume responsibility of keeping your tenant's possessions safe

- May increase insurance costs

Earn rental income from unused space

Difficulty level: Easy

Potential earnings: 60% - 100+% increase in existing rental income[18][19]

Already dabble in real estate investing? PadSplit is a housing marketplace that connects property owners with residents who need an affordable place to live.

With PadSplit, real estate investors can "optimize" their properties for more space and more income.

It's a win for residents, too. People living in PadSplit homes get access to invaluable resources like job matching, telehealth, and credit repair assistance.

Pros

- No additional investment needed

- Makes use of space you already have

- Access to additional benefits

Cons

- Potential conflicts with tenants

Rent Parking Space

Difficulty level: Easy

Potential earnings: Depends on location, availability, and number of parking spaces[20][21]

Got an extra parking space? If you live in a metro area with great access to local hotspots, you can make extra cash by renting your unused parking spaces.

Apps like CurbFlip and Pavemint lets you list your parking spots. Drivers reserve your spot and pay online through the app. You can offer bookings daily, weekly, or monthly.

Pros

- Generally high demand, especially in cities and busy locations

- No added costs

- More control over how often you want to rent it out

Cons

- Location is a key consideration

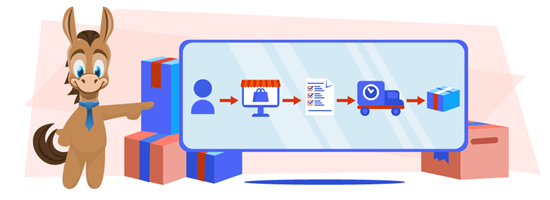

Ecommerce Drop Shipping

|

| © CreditDonkey |

Difficulty level: Difficult

Potential earnings: ~$1,000-$5,000 per month[22]

Drop shipping is a low-cost way to get into e-commerce. You don't need to carry your own inventory, you just sell other people's products.

You just handle the marketing and maintain your e-commerce store.

However, this business model isn't as easy as it sounds. There's lots of competition and it could be hard to make your site stand out. Your profit margins are also low since you're not selling your own goods.

If you want to consider this, Shopify is the most popular platform. Oberlo is a Shopify dropshipping app that was built to make it easy to find and add products and ship them directly to customers.

Pros

- Low overhead costs

- Offer a wide variety of products without the need to stock inventory

- Minimal startup costs

Cons

- Low profit margins

- Lots of competition due to the low barrier to entry

- Risk of slow fulfillment and shipment times since you are at the mercy of the supplier

Invest in rental properties

Difficulty level: Easy

Potential earnings: 1.50% (Fundrise)[23]

Did you know you could buy and flip houses from your laptop? Real estate consistently increases in value over time. But the cost and work involved are out of reach for most investors.

Enter real estate crowdfunding apps. These platforms are a good source of passive income. They'll do the research of purchasing undervalued properties and fixing them up to rent out the real estate at a profit.

Every app is a bit different so do your research and pick the right one for your investing style, financial timeline and budget.

- Groundfloor - minimum investment $100

- Fundrise - minimum investment $10

- FarmTogether - minimum investment $15,000

- EquityMultiple - minimum investment $5,000

Pros

- Property value appreciates over time

- Some expenses are tax-deductible

- Can provide a steady monthly income

Cons

- Can give you less control over your investments

- Less liquidity

Passive Income Ideas with Upfront Time Investment

|

Got time and a passion project? In this section, you will invest your sweat and hard work instead of money. Building your brand with a blog, Instagram or book can pay off in the future.

Start a Blog

|

| © CreditDonkey |

Difficulty level: Difficult

Potential earnings: ~$50,000 per year[24]

A blog takes a lot of time and hard work to start monetizing. However, a successful blog could be one of the most rewarding side hustles, and even turn into full-time work.

As you build an audience, you can earn money from affiliate marketing, selling ad space, sponsored posts, and more. But it's not completely passive as you'll have to keep on writing new articles and looking for partnerships.

Try to find a niche rather than being a general "lifestyle" blogger. Think about your interests. Even if you're not an amazing writer, everyone has insights to share. Just make sure the content is high quality.

Some popular topics that make good money include:

- Health and fitness

- Business and marketing

- Parenting / Baby

- Budgeting / Personal finance

- Crafting and DIY

- Technology

- Self-improvement / Relationships

If you have knowledge or passion for a particular topic, write about it to earn passive income. Chances are that there are other people out there interested in the same topic. Share your knowledge, opinion, or both—just make sure your words have value.

Monetize the blog by adding affiliate links for products or services that you trust or by selling ads right on your blog. When a reader clicks on your link and buys something, you earn a commission.

Pros

- Fairly easy to start a blog and keep it running

- Run a blog in your spare time while working a regular job

- Little monetary investment to start

- Make money through affiliate marketing, sponsor ads, and selling your own products or services.

Cons

- Takes a long time to build a following

- Lot of effort required to perfect search engine optimization and get your blog noticed

Create an Online Course

Difficulty level: Difficult

Potential earnings: ~$200-$500 per month for the average instructor[25]

If you have a special skill or professional certification, you can create an online course and teach others.

There are plenty of platforms that allow you to create online courses, market them, and sell to consumers around the world. Plus, they take care of all the technical setup for you.

Some reputable websites you can try are:

- Teachable: Customize a domain to host and promote your course. You can post PDFs, images, videos, and audio files to enhance your courses.

- Udemy: Create your own video course; has an established user base of over 50 million students.

- Skillshare: Teach a creative skill with video lessons. Teachers are paid on a royalty system.

- Coursera: The platform partners with educational institutions and companies to create courses. To make a course, your university or company needs to have a tie up with Coursera.

Pros

- Access to a built-in audience

- SEO efforts, as well as design and format, are done for you

- You don't have to worry about technical setup

Cons

- Platform fees will take away from your profits

- Fierce competition (depending on your topic)

- Little room for customization

Create an Alexa Skill

Difficulty level: Difficult

Potential earnings: Payment is based on your skill's customer engagement[26]

Just like smartphones have apps, Alexa-enabled devices have "skills", like setting alarms, playing music, getting weather report, and more.

If you are a developer, you can create your own Alexa skill on just about anything. Think of something that solves a problem. Some ideas are:

- Games that users can play

- Food and drink recipes

- Work outs and guided meditations

- Daily vocabulary or new language learning

- Trivia of your favorite books and shows

Skills can be either a one-time purchase, consumables (users buy, use, and buy again), or subscriptions.

Amazon offers free courses to teach you how to make an Alexa skill.

Pros

- View your skill's progress via the Amazon Developer Portal

- Amazon offers free courses that teach you how to make and monetize an Alexa skill

Cons

- Marketing fall on you—otherwise, your skill could get lost among the numerous others that Alexa has available

- Payment based on customer engagement, such as the minutes of use or frequency of purchase

Start a YouTube Channel

Difficulty level: Difficult

Potential earnings: ~$800-$1,400 per month[27]

Making YouTube videos does require a lot of work and effort, but it can be very lucrative once you have a following.

Most likely, you won't make anything in the beginning. But even one viral video can generate continuous passive income through ads. The most popular types of videos include:

- Video game walk-throughs

- How-to guides & video tutorials

- Product reviews

- Shopping & beauty

- Fitness

It takes time to grow your channel. And you'll need to frequently create fresh videos to keep your viewers engaged. But many people have been able to turn their YouTube channels into a full-time job.

Pros

- Easy to include ads on content you produce

- A fun way to earn money

Cons

- You'll need a big audience to compete for ad revenue

- Takes millions of views to make real money

- Need to frequently create fresh content to keep your audience engaged

Write an eBook

Difficulty level: Difficult

Potential earnings: 35% - 70%[28]

Ever dreamed of being an author? You can easily publish your own eBook using Amazon's self-publishing tool.

Amazon's Kindle Direct Publishing is a free program. The process is really simple and you can earn up to 70% royalties on your ebooks with each sale.

You'll be responsible for formatting, cover design, and your own marketing. But you'll be taking advantage of Kindle's huge customer base.

You can even use Audiobook Creation Exchange (ACX) to turn your e-book into an audiobook for distribution on Amazon, Audible, and iTunes. You'll be able to choose your own professional audiobook producer.

Pros

- Earn up to 70% royalties on your books

- If you choose Amazon Kindle Direct Publishing, you can also market your book with other eBook retailers

- Choose to publish a printed version of your eBook for a small investment

Cons

- Significant commitment including editing, designing, and formatting of the book

- You must handle all of the book's marketing

- Less support than if you used a traditional publisher

Semi-Passive Small Business Ideas

|

Being your own boss is tough but rewarding. You work on your own schedule and terms. Get inspiration below and build your empire.

Create a Podcast

Difficulty level: Difficult

Potential earnings: $100-$13,450 per month[29]

If you have a good speaking voice and can tell an engaging story, you can host your own podcast with just a little bit of equipment.

Your podcast can be about almost anything. Here are just some examples of things you can talk about:

- Teach a language

- Share books and shows recommendations

- Find strange news from around the world

- Interviews with local small business owners

- Answer weird questions people are too afraid to ask

After you have a following, you can monetize your podcast by including affiliate advertisements, sponsors, or selling your own products.

Pros

- No experience needed—just share your knowledge or expertise

- Very popular type of media

- Low startup costs

Cons

- Difficult to market podcasts, making it harder to get listeners (i.e., earn money)

- You'll need to know how to edit your audio, which can take time

Invest In Small Businesses

Difficulty level: Moderate

Potential earnings: As much as 24%[30]

Investing in startups can be a good way to support a small business while earning some passive returns.

With equity crowdfunding, you actually own a small piece of the company. You'll earn returns when the company is acquired or goes public. The business might also have a dividend agreement that pays investors a share of the profits.

These three equity crowdfunding platforms are open to non-accredited investors. You can become an angel investor even with very little capital. Since the minimums are low, you can invest in a few businesses to limit your risk.

- Wefunder: As little as $100 to invest. Wefunder does charge a 2% processing fee for bank ACH, wires, or checks, and a 5% processing fee for credit cards, Apple Pay, or Google Pay.

- SeedInvest: Min investments as low as $200. SeedInvest also charges a 2% processing fee.

- LocalStake: Invest in local food & beverage, consumer products, and retail companies. Typically $250 or $500 min. No processing fee.

- MainVest: Fund local entrepreneurs with as low as $100. MainVest doesn't charge investors any fees.

Pros

- Requires minimal initial investment

- Can invest in multiple businesses

- Can offer higher returns later on

Cons

- Riskier than other types of passive income sources

Buy an Existing Business

Difficulty level: Moderate

Potential earnings: Varies, but try Flippa's business valuation calculator to get an idea

Don't want to start a new business from the ground up? You can buy an online business or blog that's already making some revenue.

Then, you'll earn income by creating content and marketing the site. If you don't want to run the entire business yourself, you can always hire freelancers to help.

Here are some marketplaces to buy existing businesses:

- Flippa: Bid on blogs, websites, and e-commerce businesses. Keep an eye out on the thousands of listings on sale every day.

- BizBuySell: Buy established businesses and franchises.

- SocialTradia: Buy existing Instagram accounts with some following.

Pros

- Can offer quicker short-term returns

- Established credibility

- Multiple options available

Cons

- Finding the right company can be challenging

- Can be difficult to implement changes right away

Sell Digital Files

|

| © CreditDonkey |

Difficulty level: Moderate

Potential earnings: Depends on what you sell, but many people make $100+ per month

Got a knack for art and design? You can create digital products, such as printable wall art, coloring book pages, crochet patterns, invitations, or thank-you notes. You'll make money with each download.

If you're not artistic, you can sell things like budget spreadsheets, Lightroom presets, blog templates, meal plans, etc. The opportunities are endless.

The great thing about digital product sales is that you don't need to run to the post office to ship, making it a side hustle with a very minimal time commitment.

Etsy and Creative Market are some of the best places for digital products like graphic design files, fonts, and templates. There are tons of other online marketplaces for specific niches.

Pros

- No printing and shipping costs

- Low overhead if you already have the equipment

- People can easily purchase digital products than physical art

Cons

- Files have less value than unique, printed items

- Concerns about copyright infringements and illegal sharing of your products

- May need to lower prices of your products to compete

Sell Stock Photos

Difficulty level: Moderate

Potential earnings: 15% - 45%[31]

If you fancy yourself an amateur photographer, why not take the opportunity to profit from your photos? You can upload your pictures on a stock photo website and earn royalties whenever someone buys it.

An added benefit is that you can make money multiple times on the same picture. Some of the best websites to sell stock photos are:

- iStock Photo

- Shutterstock

- Adobe Stock (previously Fotolia)

- Alamy

- Getty Images

Pros

- Earn money multiple times on the same picture

- Make money through a fun hobby

- Decide how much time you want to spend

Cons

- Large portfolio needed to make significant income

- It may take a while for your pictures to rank high in the site's search

- Large upfront investment if you don't already own good photography equipment

Sell Your Music

Difficulty level: Moderate

Potential earnings: ~50% of your streaming revenue[32]

Got an original song, jingle, beat, or sound effect? Sell your music online and earn royalties every time someone uses it.

Some popular platforms to sell music are:

- SoundCloud: Monetize songs with ads (like YouTube). SoundCloud Premier pays 55% share of net revenue.

- Epidemic Sound: A music subscription platform for content creators. Music artists are paid up-front and split streaming revenue 50/50.

- Bandcamp: If you already have a following, this platform allows you to sell directly to your fans. Fans have paid artists $528 million on Bandcamp.

Pros

- Can be a steady long-term source of passive income (royalties)

- Great opportunity for exposure

- Multiple platforms available, especially online

Cons

- Risks of piracy/copycats

Sell on Merch by Amazon

Difficulty level: Moderate

Potential earnings: Depending on the item's purchase price less any tax and costs[33]

If you're already a content creator with a fan base, Merch by Amazon gives you another way to reach your audience. It's a print-on-demand service that allows you to easily sell your branded designs on t-shirts and hoodies.

All you have to do is upload your design. Merch by Amazon takes care of the rest, including production, shipping, and communicating with the customer. You earn a royalty each time someone orders your item.

There is no upfront cost for you at all.

Pros

- No worries about overhead or inventory

- Prime customers can use benefits like fast shipping on your products

- Take advantage of Amazon's global reach

Cons

- Amazon takes a portion of your profits in exchange for their service

- Significant competition on Merch (and Amazon)

- Invitation-only, due to the platform's popularity

Affiliate Marketing

Difficulty level: Moderate

Potential earnings: ~$65,000 per year[34]

Already have a blog or website with a decent amount of web traffic? Consider affiliate marketing for a truly passive revenue stream. Some people make thousands per month just from affiliate links.

You recommend products or services by including links on your site. Every time someone clicks on your affiliate link and makes a purchase, you earn a small commission.

The Amazon Associates Program is the most popular affiliate programs for beginners. Other popular ones are:

You can also contact companies you want to support and ask to join their affiliate marketing program.

Pros

- Profit by recommending the products/services you believe in the most

- Save your followers money by offering special deals only through your affiliate link

- The most passive income you can earn—once you place the link, you don't have to do anything

Cons

- Requires a website or social media page with a large amount of traffic to earn income

- Non-reputable affiliates that you support can ruin your reputation

- Need to find affiliates to get paid

Run Ads

Difficulty level: Moderate

Potential earnings: Depends on your audience, content, and more factors

Another way to earn passive income on your website or blog is to sell ads. Advertisers will pay a lot of money on blogs with a lot of traffic.

There are two ways you can do this:

- Display ads: These are ad banners on top or the sidebar of your website. An easy way to get started is Google AdSense. A downside is that you'll have ads clogging up your site.

- Native ads: This kind of ads match the look of your content. For example, you can slip in ads in your blog articles or videos. These ads are not so obvious and often pay a lot more.

While these won't make you rich, it's a nice way to add passive income to your website.

Pros

- Control who or what advertises on your website

- Loyal advertisers create a steady stream of passive income

- You can change out the advertisers if you feel as if your page is getting stale

Cons

- Need to have a decent amount of web traffic to attract advertisers

- If you use a service like Google AdSense, you have little control over which advertisements show up on your page

Sell Non-Display Ads

Difficulty level: Moderate

Potential earnings: Depends on your audience, content, and more factors

If you aren't into sharing your web space with other advertisers, consider non-display ads. While you'll have to be careful to disclose the presence of these ads in your privacy policy, it's a great way to market to your audience without being "in their face."

Advertisers use the audience from your website and retarget them by advertising on their social media pages.

Pros

- Control which advertisers use non-display advertising on your site

- Set prices for placing non-display ads on your site

Cons

- Run risk of losing viewership if they don't agree with your advertising techniques

- Need to be careful about disclosing the advertisements to avoid legal issues

Buy and Sell Domain Names

Difficulty level: Difficult

Potential earnings: $80-$8,000 per month[35]

You can buy domain names (website addresses) at a low cost and then sell at a profit. You can come up with your own names, or buy an existing domain name from a site owner who no longer wants it.

You'll have the best chance of making a decent profit if you buy popular or generic domain names. Many businesses are after generic names and will pay hundreds or even thousands for the domain.

There are a number of domain flipping sites. Start with these four:

Pros

- Little upfront investment required

- Thousands of "good" domain names available for sale every day

- Easy way to earn once you get the hang of it

Cons

- Can't buy trademarked domain names

- Steep learning curve in buying and selling domain names

Buy Vending Machines

Difficulty level: Moderate

Potential earnings: $5-$100 per week[36]

Vending machines are a great way to start a side business without a lot of startup costs or overhead. The hardest part is finding the best location to put the machine.

A used vending machine could cost just $800 to $2000. After that, your only other cost is replenishing inventory. You'll have to take time to restock the machines, so this venture does require some active work.

Pros

- Low cost of entry, even if you buy an existing vending machine franchise

- Control over the type of products you stock as well as the time and money you invest

Cons

- Need to find time to stock the machine

- Trial and error as you find the best locations to place vending machines

- High possibility of vandalism and theft

Buy a Laundromat

Difficulty level: Moderate

Potential earnings: $100-$1,500 per day[37]

Buying a laundromat can be a great passive income opportunity. After all, people need to do laundry no matter how the economy is.

Self-service laundromats require very minimal supervision. That makes it an ideal physical passive business that can generate a lot of cash flow each month.

You'll likely need to put down 25% - 40% of the purchase price.[38] If you finance the rest, your revenue can most likely cover the monthly payments. It's literally an investment that can pay for itself.

Pros

- Has a consistent demand/need

- Minimal supervision needed

- Potential for expansion and additional growth

Cons

- Operational costs can be an issue

- Can require substantial initial monetary investment

- Self-storage facility: Location and condition of the storage units is important

- Auto car wash: You'll need to invest in equipment like a pressure washer, dryers, cleaning solutions, etc.

- ATMs: You'll need to purchase a machine and put in money. Choose a good location.

Create an App

Difficulty level: Difficult

Potential earnings: Depends on what type of app you make[39]

If you know programming (or can pay for a software engineer) and have a great idea, try creating an app.

There's an app for almost everything today, so do your research first. After it's created, you'll also need to market it so it doesn't get lost in the millions of apps in the Google Play and App Store.

You can earn passive income by offering a premium version, ads, in-app purchases, or selling a subscription.

Pros

- Gain audience by offering a free version (teaser) to bring in paying customers

- Continually add features or ad-free versions to bring in more money

- Leave an app in the app store indefinitely

Cons

- Time of building the app (or paying a programmer to do it)

- Need to find a market for your app

- Will require frequent updates

Be a Social Media Influencer

Difficulty level: Difficult

Potential earnings: ~$2,900 per month[40]

Popular on Instagram, TikTok, or Facebook? Depending on the size of your following, social media influencers can earn good money by promoting products or services for other companies.

However, it can take a long time to build up a large enough following to attract sponsorships. You usually need at least a 5-digit following and plenty of engagement on your posts.

It's best to have a niche or particular aesthetic. And be sure to consistently post creative content!

Businesses pay influencers to talk about their products online, be it on social media, videos, or blogs.

Pros

- Make money from products and services that you don't have to own or run

- Learn about cool new products and services

- Help a brand build credibility based on your own influence in social media circles

- Very little upfront investment required

Cons

- Can take a long time to earn the audience necessary to be a social media influencer

- Opportunities may ebb and flow, making it hard to make a consistent income

Lead Generation

Difficulty level: Difficult

Potential earnings: ~$15.21 per hour[41]

A lot of small companies don't have time or don't know how to bring in new clients online.

If you're good at SEO and digital marketing, you can offer services to local businesses to help them bring in leads. This means helping the business rank on search engines, Google ads, and/or social media marketing.

This is called lead generation. The main goal is to develop a list of potential customers.

Industries that pay the most for lead generation include lending, mortgage, life insurance, contractors, and home service providers.

If you have the knowledge to create a website and bring in leads, you can sell the leads to businesses. It all comes down to the marketing efforts you can put forth.

You don't have to sell your own products or services. Instead, you gather the leads and get paid by other businesses or individuals for the information.

Pros

- Gather leads for just about any industry

- No need to sell anything

- Getting people to offer their contact information is a lot easier than making a sale

Cons

- Requires a thorough understanding of internet marketing to be successful

- Can take a while to build up your reputation in the industry

Easy Passive Income Ideas

|

Need a super easy side hustle? The following ideas can be accomplished while watching movies on Netflix or on-the-go. If you need something that's super low effort, these are the routes to take.

Get Paid to Take Surveys (Easy)

Many sites offer surveys in exchange for cash. You can get paid to share your opinions on products and services you already use.

Don't expect to get rich, but it's an easy way to make some extra money online while watching TV on the couch.

Try some of these reputable survey sites:

How much you earn will vary with each website. For example, Survey Junkie pays $0.50 to $3 per survey on average, while Swagbucks pay $0.10 to $2 per survey. Inbox Dollars could even pay up to $5 per survey.

Pros

- Earn cash while you do other things, like watch TV, wait at the doctor's office, or sit in the school pickup line

- There are some opportunities to take surveys in-person too, which pay more

- Help improve products and services by offering feedback

Cons

- Takes a while for the rewards to add up to anything substantial

- Sometimes hard to qualify for surveys because they want people in certain demographics

- Need to act quickly as surveys often fill up fast

Take Surveys. Get Paid

- Take surveys and earn points

- Redeem points for PayPal or e-Giftcards

Save up to 30% off your electricity bill

This idea is closer to passive saving than passive income but who doesn't want to save as much as possible on their utilities?

The Rocket Money app negotiates lower rates, finds refunds and even cancels forgotten subscriptions on your behalf. This includes gym memberships, slow but overpriced wi-fi, computer programs and more.

For things like electricity, the app searches for better power rates in your area and locks in better rates for you.

Simply connect your bill by logging in or by uploading a photo of your bill. They'll unleash an expert team of discount hunters to contact those pesky companies charging you. Once the negotiation is complete, you're notified of the update and how much you'll be saving.

Pros

- More long-term savings

- Can be done while on the go

- Efficient

Cons

- Doesn't really generate new income

Credit Card Rewards

If you already use credit cards for everyday expenses, a rewards credit card can earn a little passive income. This is a no-effort way to earn extra money on things you normally buy.

Cashback cards give you a percentage back on everything you buy. Travel rewards cards let you earn airline points to help save you money on travel.

In addition, credit cards often offer bonuses for new applicants. You can get bonus cash or points after spending a certain amount within a certain time.

But don't overspend just to earn more rewards. Make sure you can pay your bill in full or you'll be charged high interest.

Pros

- No extra effort—earn money just for doing what you normally do

- No added costs

- A chance to earn bonuses if you track the rewards well enough

Cons

- May encourage overspending

- If you don't pay your balance in full, you'll get charged interest, which takes away from your income

- Not all rewards cards translate into cash

Cashback for Online Shopping

Do you shop online often? Use a cash-back website to effortlessly earn some extra money when you make purchases. This is perhaps the easiest way to take your first steps to making passive income.

Instead of purchasing directly on your favorite stores' websites, just shop through a link on one of these cash-back sites.

Three common reward programs include:

- Swagbucks: Earn points when you shop online, take surveys, watch videos, and more. Trade in your SB points for gift cards or cash back from PayPal.

- Rakuten (formerly Ebates): Standard deals offer between 1% - 5% cash back on purchases. But there are often double-cash-back specials and other incentives. You'll get cash back in the form of quarterly checks or PayPal payments.

- Earny: Add the Chrome extension and earn up to 20% cashback when shopping online. It even offers refunds if prices drop after you make a purchase.

$10 Signup Bonus

Member must "Activate" the Bonus in the Swag Ups section of your account. Bonus value is earned in the form of points, called SB. Get a 1000 SB bonus, which is equivalent to $10 in value, when you spend at least $25 at a store featured in Swagbucks.com/Shop. You must receive a minimum of 25 SB for this purchase, which you must complete within 30 days of registration. MyGiftCardsPlus.com and travel purchases do not qualify.

When you sign up for an account, they give you offers or links. Shop for products through those links at online stores like Amazon, Best Buy, Kohl's, and Macy's to earn a portion of your purchase back.

Pros

- Earn money for shopping you are already doing

- Free to sign up and use

- Possible bonuses if you spend a specific amount within the introductory period

- Potential different ways to earn money, including completing surveys or watching videos

Cons

- Need to accumulate a certain amount of earnings to cash out

- Often exclusions even within the stores offered on the sites

- May encourage you to shop for things you otherwise wouldn't buy

Cashback for Dining Out

|

The Seated app gives you rewards for dining out.

Just simply make a walk-in or reservation with the app's partner restaurants. After you have dined there, just take a picture of the receipt with your phone and upload to the app. You can get up to 30% back.

You can use your rewards points for gift cards for Amazon, Uber, Airbnb, Delta, Nordstrom, and more.

Pros

- Reward points can be used for other retailers

- Can have additional rewards (e.g., bonuses, discounts, etc.)

Cons

- Cashback might not always be issued on time

- Maximum amount can be limited

How many passive income streams should you have?

There are a ton of options on this list. Which one should you go for? And how many?

Well, there is "no size fits all approach" when it comes to passive income streams. Your number of income sources should reflect your talents, interests/hobbies, career and financial goals, and your bandwidth. That said, exploring 2-3 income streams is a good start.

For instance, try to supplement your full-time job with stock investments and a weekend side hustle like writing a book or uploading YouTube videos.

Or if you're a freelancer who primarily works from home consider renting out your car and investing on real estate crowdfunding platforms.

The options and combinations are virtually endless.

Diversifying your income generated from human capital with rental properties, income-producing securities and business ventures are important to your financial future.

Remember to know your bandwidth and what you can balance. You don't want to lose focus on your existing income streams.

How to save up for your passive income investment

Building up a passive income stream is easier when you have some money to invest. How can you save up an initial investment?

Basically, you spend less and earn more.

But actually doing that can be harder than it sounds. Here are some tips you may not have considered:

- Track your spending: To start, you can take an honest look at your spending. You can use budgeting apps like Mint or Empower to easily track your transactions. Or, if you're old school, you can use a spreadsheet.

This may seem tedious, but seeing everything you spend money on can change your behavior. As you notice money going out, you'll naturally be more mindful of your spending. And you will notice some expenses you can easily cut.

- Automate your savings: You can set up daily, weekly, or monthly deposits that head straight into your account without taking any of your time. This makes it harder for you not to save money. The best automatic savings apps can save a portion of your paycheck or round up your transactions. You could even create your own "rules" to save every time you buy gas or your favorite fancy coffee drink.

- Save in a high-yield savings account: Parking your money in a high-yield savings account could grow your money 10 times faster than a traditional savings account. The average rate for a savings account with $2,500 deposited is only 0.3%, while some banks offer more than 4%.

You could also consider saving in CDs or money market accounts for higher interest rates, although those come with more limitations.

- Avoid monthly fees: If you are paying any monthly fees to bank, you may want to consider switching. Many banks offer free checking accounts that won't make you pay for basic services. Some banks, especially online banks, also could offer a higher yield.

- Increase your income: You can only cut your spending so much without making some severe lifestyle changes. To save more, you'll want to find ways to make more.

The easiest way to do this is to ask for a raise at your current job. Most people don't ask for regular raises, and if that's you, then build a case and approach your boss in a smart way.

Or you could generate extra income by starting a side hustle.

Is passive income taxable in the US?

Yes, the Internal Revenue Service (IRS) does tax passive income. Although the amount varies depending on the type of income and profit earned.

Your tax adviser can help you understand how passive income will affect your taxes.[42]

How to minimize your taxes on passive income

Passive income is important for a brighter financial future but make sure you keep an eye on your tax liability.

For some income streams, you can reduce your potential taxes by creating a business and setting up a retirement account. You have to be a legitimate business to qualify for this strategy.

Here's how to do it:

- Register with the IRA to receive a tax identification number for your business

- Contact a broker (like Charles Schwab or Fidelity) to help you open a self-employed retirement account

- Decide which type of retirement account works best for you (solo 401(k) and SEP IRA are very popular options)

With a traditional 401(k) or SEP IRA, you can get a tax break on this year's taxes. You can stash 100% of your earnings up to the annual maximum into your solo 401(k). SEP IRA lets you contribute at a 25% rate.[43]

What Experts Say

As part of our series on saving and investing, CreditDonkey assembled a panel of industry experts to answer readers' most pressing questions:

Here's what they said:

Bottom Line

Passive income is the holy grail of achieving financial freedom. There are a ton of ways to make different income streams no matter your financial situation.

For the passive income options that make the most sense for you, think about what you have on hand - whether that's cash, skills and/or resources. Once you choose a method, the key is to stick with it. Continue to remind yourself of your reason.

Earning a passive income is possible if you make a plan, put in the time, and have a strong work ethic. There's no guarantee as to how much you may earn. But if you diversify your efforts and build multiple revenue streams of passive income, you can make it into a reality.

Additional Resources

References

- ^ The Robo Report. The Robo Report & The Robo Ranking, Retrieved 12/29/2022

- ^ "How High are Real Estate Crowdfunding Returns [Case Study]": My Stock Market Basics, 2018.

- ^ "How much can I earn on my money?": Groundfloor, 2022.

- ^ CreditDonkey. Best High Yield Savings Accounts, Retrieved 11/20/2022

- ^ Prosper. Invest in personal loans, Retrieved 1/1/2023

- ^ Prosper. Is there a minimum investment required?, Retrieved 11/20/2022

- ^ Prosper. State Financial Suitability Requirements, Retrieved 11/20/2022

- ^ SEC. Accredited Investor, Retrieved 11/20/2022

- ^ "S&P 500 Dividend Yield": Nasdaq Data Link, 2022.

- ^ "Average Credit Card Interest Rate": CreditDonkey, 2019.

- ^ FDIC. National Rates and Rate Caps as of May 12, 2023, Retrieved 05/12/2023

- ^ "Historical Returns on Stocks, Bonds, and Bills: 1928-2021": New York University Stern School of Business, 2021.

- ^ Wrapify. How much can I make, Retrieved 2/1/2022

- ^ Carvertise. Earn Monthly Income Driving with Carvertise, Retrieved 12/29/2022

- ^ Turo. Insurance & vehicle protection for Turo hosts, Retrieved 11/20/2022

- ^ Airbnb. Host income is rising: Here are the best times of year and locations to host, Retrieved 12/30/2022

- ^ Airbnb. How much does Airbnb charge Hosts?, Retrieved 4/3/2022

- ^ "PadSplit Announces 179% Revenue Growth in 2020": Cision PR Web, 2020.

- ^ PadSplit. PadSplit Aligns Incentives To Grow Profits, Retrieved 12/30/2022

- ^ "How much can I potentially earn?": Pavemint, 2022.

- ^ CurbFlip. CurbFlip Listings, Retrieved 12/30/2022

- ^ "Is drop shipping worth it?": BlueCart, 2022.

- ^ "Track record": Fundrise, 2022.

- ^ Glassdoor. How much does a blog writer make?, Retrieved 12/30/2022

- ^ "How much do Udemy instructors make?": Teaching Guide, 2019.

- ^ "Alexa Skill": Amazon, 2022.

- ^ "How much do YouTubers make?": Influencer Marketing Hub, 2022.

- ^ "eBook Royalty Options": Kindle Direct Publishing, 2022.

- ^ Wired Clip. How Much Do Podcasters Make?, Retrieved 12/30/2022

- ^ "Past Performance": WeFunder, 2022.

- ^ "iStock Rate Card, effective January 1, 2022": Getty Images, 2022.

- ^ "Here's how indie artists will make money with SoundCloud Premier": The Verge, 2018.

- ^ "Royalties": Merch by Amazon, 2022.

- ^ Influencer Marketing Hub. How to Make Passive Monthly Income with Affiliate Marketing, Retrieved 12/30/2022

- ^ "What Is Domain Flipping: Definition, Cost & Providers": Fit Small Business, 2019.

- ^ VendSoft. Realistic Vending Machine Profits Explained, Retrieved 12/30/2022

- ^ "How much does the average laundromat make in a day?": Laundromat Resource, 2022.

- ^ "How to finance a Coin Laundry": Laundromat Resource, 2022.

- ^ "Average app revenue by Store Category": SurveyMonkey Intelligence, 2016.

- ^ "HypeAuditor 2021 Influencer Income Survey": HypeAuditor, 2021.

- ^ "Average Lead Generator Hourly Pay": PayScale, 2022.

- ^ IRS. Topic No. 425 Passive Activities Losses and Credits, Retrieved 11/20/2022

- ^ IRS. SEP Plan FAQs, Retrieved 2/1/2022

Holly Zorbas is a assistant editor at CreditDonkey, a personal finance comparison and reviews website. Write to Holly Zorbas at holly.zorbas@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Fundrise, LLC ("Fundrise") compensates CreditDonkey Inc for new leads. CreditDonkey Inc is not an investment client of Fundrise.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

| Must-Read | A visitor from Virginia read Residual Income |

| Trending | A visitor from Ohio read Charles Schwab Review |

| Must-Read | A visitor read Empower Review |

| Expert Insights | A visitor from New York read Side Hustle |

| Expert Insights | A visitor from Oklahoma read Multiple Streams of Income |

|

|

| ||||||

|

|

|