Best Investment Tracking Software

Explore the top picks for investment tracking software and apps to help you stay in control of your portfolio. See which suits you most.

| © CreditDonkey |

Keeping an eye on investments used to be hard work.

But now, there's no need to struggle with spreadsheets like Excel. Many easy-to-use tools and apps can track investments for you.

These helpful tools gather info from all your accounts. They show details about stocks, ETFs, funds, options, digital currencies, and more. This gives a clear picture of all investments in one spot, updated as things change.

- Empower for best overall

- Morningstar Portfolio Manager for serious investors

- SigFig for casual investors

- Quicken for comprehensive personal finance software

- Sharesight for financial professionals

- Stock Rover for advanced reports

Empower: Best Overall

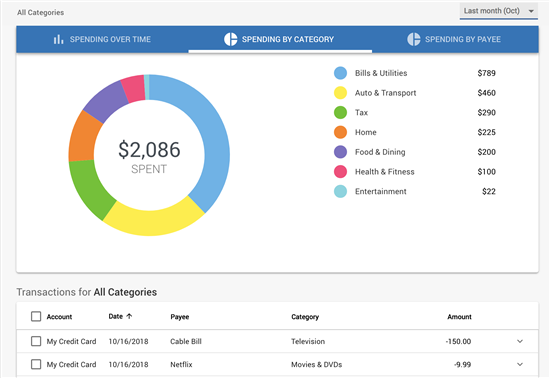

Empower is perhaps the best all-in-one free money management tool. You link up all your financial accounts to see an overall view of your finances.

It really shines in investment tracking. The app will analyze your strategy and provide personalized recommendations. It gives you suggestions on how you can adjust your portfolio to reduce risk and reach your goals.

Top features include:

- Compares your overall portfolio to market indexes

- Finds hidden fees and how they'll impact you in the long run

- Tells you the expense ratio within each fund

- Suggests a target allocation and how to rebalance your portfolio

- Finds extra cash that could be invested

- Provides retirement planning projections

Empower offers a full suite of other personal finance tools. You can track your net worth, income and expenses, and debts. It also helps you plan for retirement and higher education.

Morningstar Portfolio Manager: Best for Serious Investors

Morningstar is the most recognized name in investment research. It offers a Portfolio Manager to help track your investments. While free membership is available, Premium members get access to additional features.

This tool provides an insane level of detail, but it has a learning curve. Serious investors will be able to appreciate it, especially when combined with other Morningstar research tools.

Free features include:

- Import or manually input your holdings

- Detailed information about your stocks and funds

- See the weighted average expense ratio of your funds

Morningstar Investor gives members more advanced features like screeners and analyst reports. They also receive a monthly Portfolio Manager Report. This gives you an in-depth look into your portfolio, including top gainers and losers, stock statistics, projections, and more.

In addition, Windows users can also use Morningstar's X-Ray tool. This evaluates your portfolio's holdings and recommends a target allocation.

SigFig: Best for Casual Investors

SigFig is mostly known as a robo-advisor. But it also offers a free Portfolio Tracker that anyone can use, even if you don't use the robo service.

You can add all your investment accounts from over 80 brokerages. Then you can see an overall picture of your investments in one dashboard.

SigFig analyzes your portfolio and provides personalized guidance on how you can improve. Features include:

- Sync all your investment accounts in one place

- Track the performance of all your investments

- See reports on performance, fees, and holdings summary

- Fix issues like under-diversification and high fees

The platform is simple and user-friendly. It's good enough for casual investors to keep an eye on things and get some advice. But it may not be enough for more serious investors.

Quicken: Best Comprehensive Software

|

| Credit: Quicken |

Quicken is still one of the best personal finance software. It offers comprehensive tools, including budgeting, bill pay, investment tracker, retirement planner, and property and business accounting tools.

Investment tracking is available in Quicken's Deluxe, Premier, and Business & Personal plans. These plans range in cost from $71.88 to $131.88 per year.[3] This isn't cheap, but if you have a more complicated financial life, then it's a good deal to get everything in one place.

Features include:

- See all your investment fees and your true market returns

- Set up stock watchlists

- Run IRR and ROI reports

- Compare your portfolio to market benchmarks

- See realized and unrealized gains for tax planning

- Use "what if" scenarios to see tax implications of selling

- See market comparisons to help with buy/sell decisions

Sharesight: Best for Financial Professionals

Sharesight is an investment tracker combined with reporting tools. It's designed to allow sharing with financial professionals. It's a good option if you have a tax accountant (or if you are one).

To create your investment portfolio, you can either manually input your trades or import your Excel file. You don't link your brokerage accounts.

Features include:

- Daily price and currency updates

- Automatically track dividends and stock splits

- Run a variety of reports (diversity, asset allocation, and contribution analysis)

- Easily share your portfolio with your tax accountant

- Grant staff different levels of access

- Comprehensive tax reporting

Sharesight allows you to track up to 10 holdings for free. Additional holdings will require a subscription starting at $84/year.[4]

Stock Rover: Best for Advanced Reporting

Stock Rover has a comprehensive suite of tools to compare investments. It's best for experienced investors, who want to dig into the data.

You can easily link your brokerage accounts and use their Portfolio Management tool to make charts and tables. Stock Rover has a database with more than 700 metrics, some with 10+ years of historical data.

Features include:

- Extensive database of historical data

- Pre-built stock screeners help you find and track stocks

- Build your own custom stock screeners

- Free account option

- Rebalancing tool helps you maintain portfolio allocation

- Companies are scored for growth and quality

- Easy to link brokerage accounts

Stock Rover offers a completely free plan to help you track your investments. If you need more data and reporting features, Premium plans start at $7.99 per month.[5]

Stock Rover Free

- Comprehensive information on over 8,500 North American stocks

- Coverage of 4000 ETFs and 40,000 mutual funds

- Portfolio management

- Portfolio Brokerage integration for automated syncing of portfolios

- Portfolio dashboard with detailed portfolio performance information

- Activates a 14-day free trial of Stock Rover Premium Plus

Stock Rover Essentials

- Easy comparison of investment candidates via the Stock Rover dynamic table

- Fully customizable financial views and columns

- 275+ metrics with 5 years of detailed historical data

- Easy to use, fast and flexible stock screening

- Portfolio and watchlist tracking

Stock Rover Premium

- Over 100+ additional metrics, 375+ in total

- 10+ years of detailed financial history

- Data export

- ETF and Fund comparison data

- Powerful Stock and ETF screening

Stock Rover Premium Plus

- Over 300+ additional metrics, 700+ in total

- Custom metrics

- Equation screening

- Historical data screening

- ETF screening with 180+ ETF specific metrics

How to Choose the Right Tool for You

To pick the right investment tracking software for you, consider these features:

Sync or Manual Input

Some apps let you link your accounts and automatically sync the info. This is good if you want to combine all your accounts.

Other programs require that you manually input your trades. This could be good if you want to track specific investments. Or if you don't want all your data stored on the web/cloud.

Amount of Information

How much information do you really need? Do you need up-to-the-minute stock pricing changes? Active investors may need that feature, but that may be overload for buy-and-hold type of investors. Beginners may also find too much info to be overwhelming.

Other Features

Do you want an all-in-one financial management app? If so, apps like Empower can also track budgets, income, and expenses, loans, etc.

If you want to focus solely on tracking your investments, then a dedicated tool like Morningstar will give you more advanced investment tracking features.

Bottom Line

It's important for investors to keep track of their portfolio's performance. The best tracker for you depends on your needs. For more casual investors, a tracker that combines all your accounts would probably be enough. More serious investors may need more features, like custom watchlists and price alerts.

References

- ^ Empower. Wealth Management: Our fee structure, Retrieved 05/31/2024

- ^ SigFig. Pricing, Retrieved 05/31/2024

- ^ Quicken. Plans & Pricing, Retrieved 05/31/2024

- ^ Sharesight. Pricing & plans, Retrieved 05/31/2024

- ^ Stock Rover. Plans, Retrieved 05/31/2024

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Empower Personal Wealth, LLC (“EPW”) compensates CREDITDONKEY INC for new leads. CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.

|

|

|