How to Start an LLC in Florida for Free

All LLCs in Florida must pay the $125 LLC formation filing fee. Here are a few cost-saving strategies to help you start an LLC in Florida for less.

|

Starting an LLC in Florida without spending might be a stretch, but cutting down costs can be done. Specifically, you could save on Florida LLC formation services.

In this article, you'll learn how to bypass certain fees for LLC formation services. If you keep reading, you'll find that this guide is sprinkled with helpful tips on trimming those extra LLC expenses.

Set Up Your LLC - $0 + State Fees

- Free business plan included (no credit card required)

- Lifetime compliance alerts

- Comprehensive name check

- Lifetime customer support via email and phone

You can't start an LLC in Florida for free. All LLC formation applications must be filed with the $125 filing fee.[1]

Do It Yourself: Form an LLC in Florida

|

If you plan to form an LLC in Florida and want to save costs, consider doing everything yourself. This way, you won't have to pay $50 to $399 for an LLC formation service depending on the additional services included.

That said, while you cut costs by doing everything yourself, there are still a few fees to take into account. Here are some of the LLC formation expenses you still need to prepare for:

| Florida LLC Fee | Cost |

|---|---|

| Legal and Tax Advice | Up to $1,000+ |

| Name Reservation Fee | $25[1] |

| Fictitious Name Fee | $50[2] |

| Fictitious Name Publication Fee | At least $25 |

| Operating Agreement Fee | Up to $1,000+ |

| Registered Agent Services Fee | Up to $399+ |

| Florida LLC Formation Fee | $125[1] |

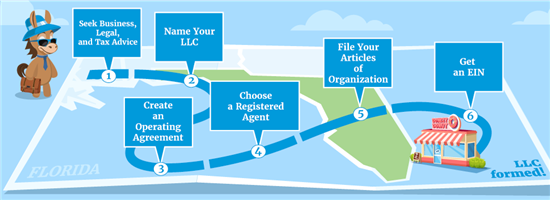

Ready to do it yourself and form your own LLC? Here are all the steps you need to take:

Seek Business, Legal, and Tax Advice

Professional advice upfront can save you time, money, and headaches in the long run. Yes, it costs money, but it's an investment in the success and longevity of your business.

A legal counsel can help ensure that you're complying with federal, state, and local policies. Meanwhile, hiring an accountant from the get-go can help you minimize your tax burden.

Some attorneys offer online services to help you form your LLC. This could be a cheaper alternative compared to hiring a lawyer from a big firm.

Name Your Florida LLC

There's no cost to naming your Florida LLC. It's included when you pay the LLC formation filing fee. And when completing the Articles of Organization, you'll be asked to write the desired name for your LLC.

But before choosing a business name, you must conduct a name search. The Division of Corporations offers a free online database that contains all the business names already being used in Florida.

Additionally, you must follow the state's naming requirements to prevent your Articles of Organization from getting rejected. For example, your LLC name must not include restricted words like "bank" and "government".

If you've already got a business name but you're not yet ready to form an LLC, you can reserve your desired name first. Paying Florida's $25 name reservation fee will prevent others from using that name for 120 days.[1]

For an additional $50, your Florida LLC can do business under a name different from its official registered name.[2] Also called a DBA (Doing Business As), it's ideal if you want to operate under a business name that is more marketable or doesn't have an "LLC" at the end.

Aside from the filing fee, you'll also need to publish a copy of your fictitious name application in a county newspaper where your LLC is doing business.[3]

Create an Operating Agreement

An Operating Agreement is a legally binding contract between the members and managers of an LLC. You're not required to have one in Florida, but it's highly recommended because it outlines how the business will operate.

Among other things, an Operating Agreement should state:

- The LLC's management structure (member or manager-managed)

- Each member/manager's initial contribution

- How the profits and losses are distributed

- The responsibilities of each member/manager

- The procedures for when a member/manager leaves or sells shares of the business

Ideally, you must already have a signed Operating Agreement before applying to form an LLC. But if your LLC is already formed, you can always make one.

You can create an Operating Agreement for free by using templates online. Alternatively, it could cost upward of $500 if you hire an attorney.

Your LLC will be subject to Florida's default rules without an Operating Agreement. These rules may not always align with your LLC's specific needs or preferences.

The lawyer's fee for drafting an LLC Operating Agreement depends on the complexity of your business.

A business attorney typically charges a flat fee ($500 to $2,000) for a standard Operating Agreement. You might be charged an hourly rate ($150 to $350 per hour) if you need a more complex Operating Agreement.

Choose a Registered Agent

Florida requires all LLCs to have a registered agent. In fact, the LLC formation filing fee is inclusive of the $25 registered agent filing fee.[1]

A registered agent is responsible for receiving business and legal documents on behalf of your LLC. You can be the LLC's registered agent as long as you're at least 18 years old and have a physical street address in Florida.

Although you can save money if you become your LLC's registered agent, there can be downsides. Since a registered agent's name and address will be included in the public record, you could be the target of unwanted solicitations, junk mail, or even identity theft attempts.

Alternatively, you could pay for registered agent services that cost as low as $35 a year. The price gets higher if you want to use additional business services. Some registered agents offer their services for free in the first year.

Shortcut: Do you need help forming your Florida LLC for free? Skip to free Florida LLC formation packages.

Florida LLCs with no registered agent and office address could get fined $500 per year.[4] This could increase to $1,000 for each day of noncompliance.[4]

File Your Articles of Organization

Once you have a business name and registered agent, you can begin completing the LLC's formation documents. Commonly called the Articles of Organization, this document contains important information about your LLC including:[5]

- LLC name (with an "LLC" or "Limited Liability Company" at the end)

- Principal place of business

- Registered agent's name and address

- Email address (where reminders for annual reports could be sent)

You must submit the Articles of Organization, along with the $125 domestic LLC formation filing fee, to the Secretary of State.[1]

Double-check all the documents to prevent having to pay the filing fee again. Once you have submitted the Articles of Organization, the details you wrote in it cannot be updated, removed, or canceled.

Depending on the number of applications, it could take a few days to a few weeks for the state to process your LLC application. The Division of Corporations does not offer expedited services. All LLC applications are processed in the order in which they are received.[6]

Get an Employer Identification Number

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS). This number is used to identify a business entity for tax-related purposes.

You're not required to get an EIN if you're operating a single-member LLC. However, you might still need it down the line if you want to hire employees or open a business bank account.

Some LLC formation services offer to process your EIN for a fee. However, the IRS never charges fees for obtaining an EIN. If you register online, you can get an EIN in a few minutes at no cost.[7]

Select a Free Florida LLC Formation Package

Forming a Florida LLC yourself can be a valuable learning experience. However, the formation process can be complex, especially for first-time entrepreneurs.

For this reason, consider getting expert advice and support offered by formation services. They can answer questions, clarify doubts, and ensure you're following the correct procedures.

Fortunately, you don't have to pay for Florida LLC formation services. Below are some companies that can process your Articles of Organization for free.

Some LLC formation services may offer to process your Articles of Organization for free. However, you still have to pay for other services like a registered agent service and operating agreement. Often, you'll see the total amount at checkout.

Bizee: Basic Package

Bizee, formerly known as Incfile, offers a Basic Package that comes with a free LLC formation. You just need to pay the state filing fee.

If you form an LLC with Bizee, it will ask for your basic company information. This includes the company name, designator (LLC, L.L.C., etc.), and business purpose. You can use Bizee's website to check if your desired business name is still available.

You won't pay any fees for the registered agent service during your first year with Bizee if you form your Florida LLC with them. Bizee's registered agent service includes receiving and scanning important legal documents on your behalf, such as tax notices and service of process.

ZenBusiness: Starter Package

ZenBusiness has a starter package for new entrepreneurs. It includes an LLC formation service and a 100% accuracy guarantee. This means your formation documents will be refiled for free if there is any mistake due to their error.

If you decide to form an LLC with ZenBusiness, it will ask you a few quick questions about you and your business. You also have the option to use their Worry-Free Compliance service, so you never have to worry about missing deadlines for your state-required annual report.

While ZenBusiness offers various business formation packages, its registered agent service comes with an additional annual fee regardless of what package you choose. The current starting price for their registered agent service is $199/year.[8]

Swyft Filings: Basic Package

Swyft Filings has a basic package that includes free LLC formation services. You just need to pay the $125 state filing fee.

Additionally, Swyft Filing's ComplianceGuard will automatically be added to your total bill. It's a 14-day free trial for a service that helps you stay compliant with annual state requirements. If you don't remove this from your bill before check-out, you'll be charged $199 after 14 days.

However, this processing time excludes government processing times. If you choose the free LLC formation package, the processing time is approximately 2 weeks, plus the time that it takes for the state to process the application after they receive the documents from Swyft Filings.[9]

Inc Authority: Free LLC Formation Package

Inc Authority helps you form an LLC online for free. As with all free LLC formation packages, you still need to pay the $125 Florida domestic LLC filing fee.

Inc Authority will prepare your Florida formation documents and submit them to the Division of Corporations. Depending on the stage of your LLC formation, whether it's opening in 30 days, 90 days, or more, it will suggest additional services that you might need.

Additionally, if you're interested in a business checking and business credit card, Inc Authority can help set you up with Bank of America.

You won't pay any fees for the registered agent service during your first year with Inc Authority if you form your Florida LLC with them. Inc Authority's registered agent service includes receiving important legal documents on your behalf, such as tax notices and service of process.

Other Steps After Forming a Florida LLC

Once the Division of Corporations approves your Articles of Organization, there are more things to do to get your business up and running while staying compliant with state rules.

Some registered agent services, like Bizee and ZenBusiness, offer additional services to help you maintain an LLC in Florida. This will cost more annually, but the idea is to let other people do smaller tasks so you can focus on growing your business.

Alternatively, take note of the additional steps below that you need to do after forming an LLC in Florida.

The cheapest way to start an LLC in Florida is to do everything on your own. File the Certificate of Formation, be the LLC's registered agent service, and create the Operating Agreement using a free template online. All of these cost-saving tips are discussed in detail below.

Register Business Permits and Licenses

Before officially offering your products and services to the public, you must first get the permits and licenses required for your business.

Florida does not have a state business license. However, you must obtain a sales tax certificate if your LLC sells a physical product that is subject to sales tax.[10] You can register online for free.

Aside from the sales tax certificate, the Sunshine State prefers leaving business licensing requirements to local jurisdictions and specific industries.

The number of permits and licenses your LLC needs depends on its business purpose. Some businesses may be regulated simultaneously by various governmental offices, racking up total costs of over $1,000.

You might need to renew business permits and licenses every year or every few years. Check Florida's Department of Business and Professional Regulation (DBPR) to know what permits your LLC needs and how frequently you need to renew them.

Active military members and honorably discharged veterans may be able to get a fee waiver for professional licenses.[11] This helps save costs for those who want to have a Professional Limited Liability Company (PLLC).

Open a Business Bank Account

An LLC provides limited liability, meaning personal assets (like your home and car) are protected from business debts and liabilities. However, mixing personal and business finances in one bank account can weaken this shield.

If you can't clearly distinguish between personal and business transactions, a court might hold you personally liable for business debts. A separate business bank account creates a clear separation of personal and business finances.

Opening a bank account for your Florida LLC must be done in person by someone with the authority to do so. You can give someone this authority in your Operating Agreement and Initial Resolution.

Often required by banks, a Certificate of Status is a document that proves your LLC is in good standing with the state. It means you've met all requirements and paid your LLC's fees and taxes. You can get a Certificate of Status from the Florida Secretary of State's office by paying the $5 fee. [1]

Create a Business Website

A website and social media presence are dedicated online spaces for your business. They're essential for marketing, customer engagement, and brand visibility in today's digital world.

Hire a professional web developer if you want a highly customized and unique website. Alternatively, do it yourself using a website template through popular content management systems (CMS) like WordPress and Wix. Doing this will cost you around $15 to $20 a month.

Even if you're not planning to build a business website now, it's a good idea to at least buy the domain name. This prevents others from using your LLC's name as a web address.

Domain squatters often monitor newly registered LLC names. They purchase corresponding website domains and then resell them at significantly higher prices.

Get Business Insurance

If your newly-formed Florida LLC needs to hire employees, you might need to get workers' compensation insurance.[12]

If you have no plans to hire employees soon, your LLC may still benefit from business insurance that covers expenses from unexpected events and damaged property.

When shopping around for business insurance, consider the specific risks your LLC faces. Prioritize getting the right coverage for your specific needs and get quotes from multiple providers.

Aside from getting workers' compensation insurance, all employers in Florida must report newly hired employees to the Florida Department of Revenue within 20 days of employment.[13]

Budget for Annual Expenses

All LLCs in Florida generally can't avoid two types of annual expenses—the annual report filing fee and the annual taxes.

Your LLC in Florida must submit an annual report to the Florida Division of Corporations, along with the $138.75 filing fee.[1] It can be filed online anytime between January 1st and May 1st of each year. There's a $400 late fee if you fail to submit the report on time.[14]

As for taxes, all LLC members must pay self-employment taxes on their share of the profits. The current combined self-employment tax rate is 15.3%, with 12.4% going to Social Security and 2.9% to Medicare.[15]

Fortunately, Florida is one of the few states that doesn't have a state income tax. However, you still have to pay the federal income tax, which ranges between 10% to 37% of your taxable income.[16] Depending on the purpose and nature of your business, your LLC might be subject to more tax.

There is no franchise tax fee on LLCs in Florida. However, you must submit an annual report to keep your company in good standing with the state.

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Why Should I Form an LLC in Florida?

There are many reasons why people form LLCs in Florida. For example, it's one of the few states with no income tax. As an LLC owner, you enjoy more of your business income.

Additionally, Florida's LLC filing fees are slightly lower than other business-centric states. The Division of Corporations also prepared a streamlined process for forming an LLC in Florida. Overall, this means cheaper and faster LLC formation for you.

Forming an LLC in Florida could be challenging because of steep competition. Florida's pro-business environment attracts many entrepreneurs, so startup LLCs may need to work harder to gain customers.

Types of LLCs in Florida

Florida allows different types of LLCs, namely:

- Single-Member LLC

You're the sole owner. However, you must still maintain a clear separation between personal and business finances to uphold liability protection. - Multiple-Member LLC

An LLC with two or more owners needs an operating agreement to outline roles, responsibilities, and profit sharing. - Member-Managed LLC

The owners or members directly manage the business operations. This is common for smaller LLCs. - Manager-Managed LLC

The members appoint a managerto run the business. This is used when owners prefer a more hands-off approach.

- Professional Limited Liability Company

This is designed for licensed professionals like doctors, lawyers, and accountants, but with specific rules and regulations that vary by state. - Low-Profit Limited Liability Company

This hybrid structure combines aspects of a for-profit LLC and a non-profit organization. It aims to pursue social goals while generating some profit. - Domestic LLC

An LLC is domestic in the state where it was formed. - Foreign LLC

If an LLC operates in a state other than where it was formed, it must register as a foreign LLC in that state.

The advantage of an LLC is the separation of personal and business liabilities. However, not maintaining proper separation (ex. mixing personal and business funds, failing to follow formalities), could "pierce the corporate veil." This means personal assets become vulnerable to business debts and lawsuits.

Florida LLC Resources

Here are some resources to help you form an LLC in Florida:

- Florida Division of Corporations

The Florida Division of Corporations lists the latest LLC filing fees. Download the forms for free, such as the Articles of Organization and Name Reservation forms. - Bizee

Bizee offers free and fast business formation services. You just need to pay the state filing fees and provide your business details so they can prepare and file the documents for you. - Northwest Registered Agent

You can download Northwest Registered Agent's operating agreement templates for free. No need to subscribe to formation services. - US Grants

The usgrants.gov offers funding sources for small businesses in Florida. You can apply for a business grant if your business belongs to certain sectors or industries

Bottom Line

You can find services, like Bizee and ZenBusiness, that waive their fees for forming an LLC. However, this doesn't mean that you can start an LLC in Florida completely free. You still need to pay the filing fees and potentially other expenses.

To reduce startup costs, you can take advantage of state-specific discounts and waivers, like waiver fees for active military and honorably discharged veterans. Additionally, consider doing everything yourself so you won't have to pay others to process your LLC's paperwork.

Ultimately, while the initial LLC formation service might be free, you must prepare for the financial responsibilities that come with doing business in Florida.

References

- ^ Florida Department of State. LLC Fees, Retrieved 02/07/2024

- ^ Florida Department of State. Fees, Retrieved 02/14/2024

- ^ Florida Department of State. Florida Fictitious Name Registration, Retrieved 02/07/2024

- ^ The Florida Legislature. The 2023 Florida Statutes (including Special Session C), Retrieved 02/07/2024

- ^ Florida Department of State. Instructions for Articles of Organization (FL LLC), Retrieved 03/04/2024

- ^ Florida Department of State. Florida Limited Liability Company, Retrieved 02/07/2024

- ^ Internal Revenue Service. How to Apply for an EIN, Retrieved 03/20/2024

- ^ ZenBusiness. Products & Pricing, Retrieved 03/20/2024

- ^ Swyft Filings. How long does the formation process take when starting an LLC?, Retrieved 05/15/2024

- ^ Florida Department of Revenue. Business Owner's Guide for the Major Florida Taxes, Retrieved 03/04/2024

- ^ Florida Department of Veterans' Affairs. DBPR to Veterans: Apply for Licensure Fee Waiver, Retrieved 02/07/2024

- ^ Florida Department of Financial Services. Coverage Requirements, Retrieved 02/07/2024

- ^ Florida Department of Revenue. Quick Start Guide for Employes, Retrieved 02/07/2024

- ^ Florida Department of State. File Annual Report, Retrieved 03/20/2024

- ^ Internal Revenue Service. Self-Employment Tax (Social Security and Medicare Taxes), Retrieved 02/07/2024

- ^ Internal Revenue Service. Federal income tax rates and brackets, Retrieved 02/07/2024

Nicole King is a research analyst at CreditDonkey, a business formation services comparison and reviews website. Write to Nicole King at nicole.king@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|