How to Start an LLC in Florida

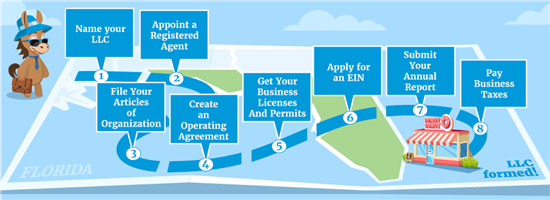

Are you interested in starting a Florida LLC but don't know how it works in the Sunshine State? Then this step-by-step guide can help you out.

|

Starting a Florida LLC is easy and simple.

You can do it yourself, hire a formation service, or ask for the help of an attorney.

Regardless of which option you choose, the LLC formation process is the same. And you'll learn all 8 easy steps in this article.

Let's talk about them.

How to Start a Florida LLC?

|

The steps to starting an LLC in Florida aren't so different from other states. But there are some important reminders you should take note of.

Let's start with the naming requirements.

It costs $125 ($100 filing fee + $25 registered agent fee) to start an LLC in Florida. They accept payments using credit cards, debit cards, checks, money orders, or from a Sunbiz prepaid account.

You can also request a Certified Copy of your documents for an extra $30. Or you can request a Certificate of Status instead, which costs $5 per filing.[1]

Name your LLC

Registering a business name is one of the main requirements for forming an LLC. Fortunately, LLC names generally have fewer restrictions than sole proprietors or partnerships.

For one, you don't have to include your own name in your business name. But you still need to follow certain guidelines when naming your Florida LLC.

For example, your business name should:

- Contain words that indicate it's an LLC (e.g., LLC, L.L.C., Limited Liability Company, etc.)

- Not indicate an unlawful, illegal, or criminal business purpose

- Not indicate a business purpose other than its official one

- Not imply an association with any government agency/organization

- Not infringe on any registered trademarks

Most importantly, it should be unique and distinct from other registered businesses in the state. You can search the state's online database to see if the LLC name you want is still up for grabs.

Be sure to also check Florida's LLC naming rules. There may be additional restrictions you need to observe.

Don't worry if you can't form your LLC yet. You can reserve your business name instead. Just write a letter addressed to the Secretary of State. It should include your name, address, and the business name you want to reserve.

Make it domain-friendly

Even if you're not planning to create a website soon, choosing a domain-friendly name for your Florida LLC is still a good idea.

Matching your domain with your LLC name will make it easier for customers to recall and find your website. And if you can secure the domain name before registering your LLC, that's even better. This will save you a lot of headaches and hassle later on.

You can use domain registrars like GoDaddy or Domain.com to check if your LLC name is still available as a domain.

If you want to use a different name for your LLC (e.g., for marketing purposes), you'll need to register a fictitious name, also known as a DBA.

Fictitious names for Florida LLCs

In Florida, you need to advertise your fictitious name in a local publication before you can register it. You only have to do it once. And you don't need to submit proof as long as you do it.

You can apply online or through mail. To apply by mail, just fill out an Application for Registration of Fictitious Name. Then send it to the state's Division of Corporations office.

Keep in mind that there's a $50 non-refundable processing fee to register. Pay through credit card, check, or money order.

And if you need a Certificate of Status? There's an additional $10 fee for that. A certified copy of your registration will cost an extra $30 per filing.[2]

If you already use a fictitious name, you'll need to cancel its registration if you want to use it as your official LLC name. But you need to do this before you file your Articles of Organization.

Appoint a registered agent

You need to appoint a registered agent before you can form an LLC. The state won't accept your application without one.

In Florida, anyone can be your LLC's registered agent. You can assign it to someone else, like another member or a registered agent service. You can also serve as your own agent.

What matters is that whoever you choose for the role should meet the following criteria:

- A resident of Florida with a physical street address in the state (no PO boxes or virtual addresses allowed)

- Must be authorized to do business within the state (for registered agent services)

- Have a physical business address in Florida

- Is always available during regular business hours (Mondays to Fridays, 9 AM to 5 PM)

You need to have your designated registered agent's consent. They need to fill out the "Registered Agent Signature" section of your Articles of Organization. You can fill this section out yourself as long as you have their authorized permission.

Keep in mind that there's a $25 designation fee for registered agents in Florida. You can pay this with the state filing fee when you submit your Articles of Organization.

If you need to change your registered agent, just fill out a Statement of Change of Registered Agent/Office. You need to file this with the state's Division of Corporations office. It costs $25 per filing and an extra $30 for a certified copy.

File your Articles of Organization

To form an LLC in Florida, you need to file your Articles of Organization with the Secretary of State's office. These will serve as your LLC's application and official paperwork.

That said, your Articles of Organization should include the following information:

- LLC name

- Principal business address

- Mailing address (if different from your business address)

- Registered agent's name and address

- Registered agent's signature

- Official business purpose

- Management structure (member- or manager-managed)

- Effective date (if different from approval date)

- Authorized representative's signature

You can file your application in 2 ways: online using the state's official portal or by mail.

If you're mailing your application, you need to print and fill out this form. Then send it to the state secretary's Division of Corporations office and pay the state filing fee.

Generally, it takes 3 to 4 weeks to process mailed applications. Online filings are processed much faster because there's no transit time. It only usually takes 1 to 2 business days. You can check this page for status updates.

If there are mistakes in your LLC's documents, you need to file a Statement of Correction with the Florida Division of Corporations office. You can also do this using their online portal. Take note there's a $25 filing fee, which you can pay via credit card, check, and money order.

Create an operating agreement

Florida doesn't require LLCs to have an operating agreement. But it's still strongly advised to draft one for your company.

An LLC operating agreement has several benefits, like helping reinforce your company's liability protection. It can also prevent misunderstandings and resolve internal conflicts when they arise.

It generally contains the same information as your Articles of Organization. This includes your LLC name, registered agent details, business purpose, etc. But you can also include specific details about your company's operations, like:

- Details about your LLC's formation and dissolution

- Management structure

- Distribution of profits and losses among members

- Members' ownership interests, contributions, and responsibilities

- Protocols for transferring membership interests/admitting new members

- Voting rights and decision-making procedures

- Bookkeeping methods

Adding these can create a stronger operating agreement and help keep your LLC running smoothly and efficiently.

Of course, a Florida LLC operating agreement is still optional. So you don't need to file it with the state. You can keep it with your company's records instead.

To dissolve a Florida LLC, you need to file your Articles of Dissolution with the state's Division of Corporations office. You can do this via mail or online using their portal. Besides the form, you also need to pay a $25 filing fee. They accept payment via credit card, debit card, and a Sunbiz prepaid account.

Get your business licenses and permits

Unlike other states, you don't need a state-wide general business license to operate in Florida.

But you may need to apply for special permits or licenses, depending on your specific industry and business activities.

Some fields that may need special licenses/permits are:

- Accountants

- Real estate brokers

- Medical professionals

- Contractors and construction

- Engineers, architects, interior designers

You can usually get them from Florida's 3 main licensing agencies:

- Department of Business and Professional Regulation (DBPR)

- Florida Department of Agriculture and Consumer Services (FDACS)

- Florida Department of Health (FDOH)

You can check this list of state agencies if your business isn't covered by the 3 mentioned above.

You might also need business licenses or permits from your city or county. Many areas require a general business license called a "business tax receipt" to operate within their jurisdiction.

Make sure you check with your local county's office to see if you need one and where you can apply.

To register a foreign LLC in Florida, you need to submit an Application for Authorization to Transact Business in Florida. You also need to submit a Certificate of Existence (aka Certificate of Good Standing) and pay the $100 fee.

Apply for an EIN

Once your Florida LLC has been approved, you can apply for an Employer Identification Number (EIN). This is necessary for any LLC, even if you don't have any employees.

The only exceptions are single-member LLCs because they can still use the owner's Social Security number (SSN) as their tax ID. But it's still highly recommended that you get a separate EIN, even as a single-member LLC.

EINs are mainly used for tax purposes. But you'll also need it for other LLC requirements, like opening a business bank account.

How to Apply for an EIN

You can apply for an EIN directly with the IRS. If you do it online, you'll receive it immediately after your application is approved.

You can only apply for 1 EIN per person each day. And you need to finish the application in one session because you can't save your progress for later.

Some third-party companies also offer EIN applications as part of their services. But these usually cost extra, while directly applying with the IRS is free.

Submit your annual report

Filing your annual reports is required. It ensures your LLC's record with the state is always accurate. If you need to make changes to your LLC's information, you can do so through the annual report.

Before you file, be sure to prepare the following information:

- LLC document number

- Business entity name

- EIN (if not yet listed)

- Principal business address

- Mailing address (if different from principal address)

- Registered agent details

- Main LLC owners' information

- Valid email address

- Certificate of Status (optional)

In Florida, you can file your LLC's annual report using the state's online business portal, Sunbiz. There's a $138.75 filing fee, which you can pay using a credit card, debit card, check, money order, or a Sunbiz prepaid account.

Keep in mind that the filing deadline in Florida is May 1st, 11:59 PM EST. And you need to pay a $400 late fee if you submit late.[3]

Business entities that don't file their annual reports by the 3rd Friday of September will be dissolved/closed the following Friday. You'll need to apply for reinstatement and pay the associated fees to re-establish your LLC.

Pay business taxes

Business taxes are another ongoing requirement for Florida LLCs. There are two types of taxes for LLCs, federal and state.

Here are the ones that apply in Florida:

- Income tax

In Florida, a limited liability company doesn't have to pay taxes on a state level. You only have to worry about federal income taxes.Like in other states, Florida LLCs are considered disregarded entities by default, like sole proprietors or partnerships. Your company will only have to pay income taxes as part of the owner's personal tax returns.

You can also opt to be taxed like C- or S-Corporations, which can offer additional benefits. But this means your LLC will have to pay income taxes on individual and corporate levels.

Florida's corporate income tax rate is currently 5.5%.[4] - Self-employment tax

LLC owners aren't paid a salary and are considered self-employed by default unless they're taxed like a corporation.So, they also have to pay self-employment taxes on any profits they receive from the company. The federal self-employment tax rate is currently 15.3%.[5]

- Sales and use tax

Your Florida LLC might also need to pay sales and use taxes if it sells taxable goods or services. The current sales and use tax rate in Florida is 6%[6], with a few exceptions.Take note that some counties may charge a discretionary sales surtax.[7] Double-check with your local county to see if it applies to your LLC. - Reemployment (unemployment) tax

If you hire employees, you might also need to pay Florida's reemployment tax. It's a state requirement for all eligible businesses with employees, but you can choose to pay it on a voluntary basis if yours is exempt.[8]Florida's reemployment tax rate ranges from 2.7% to 5.4%[9]. The lowest rate automatically applies for the first 10 quarters. After that, the state will reevaluate and adjust the rate.

- Industry-specific taxes

Depending on your LLC's business activities or industry, you may need to pay additional taxes to the state.Some examples are the communication services tax, fuel and pollutant tax, and solid waste and surcharge returns fee.

Things to Do After Creating a Florida LLC

Aside from what's mentioned, there are a few other things you need to do after starting a limited liability company in Florida.

Here they are:

Open a business bank account.

Florida LLCs need to open a separate LLC bank account to reinforce their liability protection.

A dedicated bank account draws a clear line between your personal and business transactions. You won't risk losing personal assets because you can prove you're not using business funds for personal transactions and vice-versa.

It also comes in handy when applying for additional funding, like getting a small business loan.

Get business insurance.

Even if you have liability protection as an LLC, it's still a good idea to get business insurance for your company. It will protect your business from financial losses. It can even cover your legal fees and damages in lawsuits.

Plus, depending on your industry and business activities, business insurance might actually be required for your LLC. For example, if you have employees, you need to get workers' compensation.

Some other common business insurance for LLCs are:

- General liability

- Commercial property

- Business income

- Professional liability

- Data breach

Create a business website.

A business website is not required. But it's good to have, especially if you want to reach a wider customer base.

A company website will make it easier for potential customers to find your LLC and learn more about it. It can also boost your credibility, especially if you have a strong online presence.

Is It Good to Form an LLC in Florida?

Florida may be best known for its beautiful beaches, warm weather, and family-friendly communities.

But its growing economy and business-friendly climate also make it one of the best states for aspiring entrepreneurs.

If you're still weighing it out, here are the main benefits of starting an LLC in Florida:

- Limited liability protection

Unlike sole proprietors and partnerships, an LLC gives your business another layer of protection. You don't have to worry about losing your personal assets if your company has financial troubles. - Multiple tax options

As an LLC, you can formalize your business structure without paying additional taxes on your business income. You can report all of your company's profits and losses as part of your personal tax returns.What's more, Florida doesn't charge income taxes on the state level. But if you want the ability to sell company shares to investors, you can always opt for a C- or S-Corporation tax status instead.

- Fewer requirements

Starting and maintaining an LLC is easier and simpler because of the fewer requirements. The main regular requirement you need to comply with is the annual report. No need to hold annual meetings or create company by-laws like corporations. - Better credibility and flexibility

Starting an LLC in Florida lets you retain a simple management structure while boosting your company's credibility. This can make it easier to get additional business funding without giving up the flexibility.

However, there are downsides, too. For example, if you want to add another LLC member, all of the current owners need to give their approval. And you need to update your LLC operating agreement to reflect the new changes.

You also need to comply with regular requirements to keep your good standing, like filing your annual report and paying taxes.

Yes, a foreigner can start an LLC in Florida. The state doesn't require business owners to be US residents or citizens to start an LLC. They just have to comply with the requirements.

Ways to Start an LLC in Florida

You can start an LLC in Florida in three ways, namely:

Do it yourself

Doing it yourself is the cheapest way to start an LLC in Florida since you just have to worry about the state fees.

However, the downside is that you'll be doing everything yourself, including filling out the forms, ensuring the information's correct, and filing them with the state.

Use a formation service

You can hire an LLC service if you're not sure how to start an LLC in Florida yourself. They can handle the entire process for you, usually for an additional fee.

Although it costs more than doing it yourself, this option can give you peace of mind since most LLC companies have accuracy and money-back guarantees. Most of them also offer other services to help run your LLC, like registered agents and annual report filing.

Hire a lawyer

Working with an attorney to start your LLC is a good option if your business has more complex needs. A business lawyer will have the necessary expertise in the state's laws and regulations to keep your company compliant.

The downside is the cost. You may have to pay more than expected since professional fees will depend on the lawyer or law firm.

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Florida is a great place to start an LLC. But it's important to familiarize yourself with the process. That way, your application goes as smoothly as possible.

There are differences in how you apply compared to other states. But these 8 steps should help paint the picture of what to expect. You can set up your LLC in Florida in no time.

References

- ^ Florida Department of State. Limited Liability Company Fees, Retrieved 4/12/2023

- ^ Florida Department of State. Fictitious Name Fees, Retrieved 4/12/2023

- ^ Florida Department of State. Limited Liability Company Annual Report Help, Retrieved 4/12/2023

- ^ Florida Department of Revenue. Corporate Tax, Retrieved 01/08/2024

- ^ Internal Revenue Service. Self-Employment Tax, Retrieved 01/08/2024

- ^ Florida Department of Revenue. Florida Sales and Use Tax, Retrieved 01/08/2024

- ^ Florida Department of Revenue. Discretionary Sales Surtax, Retrieved 01/08/2024

- ^ Florida Department of Revenue. What Employers Need to Know About Reemployment Tax, Retrieved 01/08/2024

- ^ Florida Department of Revenue. Reemployment Tax Rate, Retrieved 01/08/2024

Write to Alyssa Supetran at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|