How to Make $1,000,000 in the Stock Market

It is possible to earn a million dollars in the stock market, but how do you do that realistically? Read on.

|

When investing, always remember—high risk, high returns.

On average, banks can give an interest rate of less than 1% in your savings account.[1] Meanwhile, the annualized stock market return over the last decade is about 10% based on the S&P 500 stock market index.[2]

That's why, despite the risks, some choose to invest or trade their money.

In this article, you'll learn about various steps to earn a million dollars in the stock market, from the least to the most risky.

You'll also learn about the basics such as preparing for risks, stock picking, and maximizing your earnings.

Invest in Learning

Before you invest in the stock market, invest in yourself. The stock market is risky and can have negative impacts on your mental and financial health if done without proper research.

Here are a few things you can do before you start investing:

- Clear all your bad debts

- Save enough emergency funds

- Determine your risk appetite

- Learn the basic terminologies of the stock market

- Find a strategy, and then test it

- Do not invest more than what you can afford

If you're still not sure how to determine the amount that you can afford to lose, think of it this way:

"If I lose this money overnight, am I completely confident that I will not stress about it after?"

Prepare well and avoid any instances in which you'll withdraw your investments to pay for your necessities.

Yes, there are multiple success stories from individuals who became a millionaire through stocks like Warren Buffet, George Soros, and Peter Lynch. However, stocks tend to be risky, so it's important to research well before investing.

How Much Do I Need to Invest to Make $1,000,000?

It depends on how fast you want to earn a million. If you want to get $1 million in 15 years, you'd need to invest $3,000 every month in an investment vehicle that earns at least 8% annually.

Here are 7 other scenarios for earning $1 million, assuming that the inflation rate is 3% and you invested in a fund or stock with 8% annual returns:

| Monthly Investment | Years to $1,000,000 |

|---|---|

| $13,500 | 5 |

| $5,500 | 10 |

| $3,000 | 15 |

| $2,500 | 17 |

| $2,000 | 19 |

| $1,000 | 26 |

| $500 | 34 |

If you have a lot of cash on hand, you can also choose to invest one-time in a fund with at least 8% annual returns.

If you re-invest your yearly earnings through compounding interest, all you have to do is invest $315,000 at the start and wait for 15 years to get $1,000,000.

Here are the other scenarios for one-time investments:

| Initial Capital Required (rounded to the nearest thousand) | Holding Period (Years) |

|---|---|

| $681,000.00 | 5 |

| $463,000.00 | 10 |

| $315,000.00 | 15 |

| $215,000.00 | 20 |

| $99,000.00 | 30 |

| $68,000.00 | 35 |

| $46,000.00 | 40 |

Factors to Consider in Stock Picking

There's no perfect way to choose a stock, but you can significantly lower your risk by having a systematic approach.

For beginners, the simplest way to pick a stock is to choose the company that you fully understand and use in your daily life.

For example, if you have an existing account with Ally and you are happy with the service, you might want to buy ALLY stock and hold it long-term.

Another option is to look for undervalued stocks just like Warren Buffet. This means picking stocks that you think are trading for less than they should be. This can be done by using financial analysis or looking at stocks that other investors aren't even thinking about.

If you don't have time to study or do heavy analysis on each stock, you can also consider stock research websites to get stock recommendations from analysts.

Earn a Million as a Beginner Investor

|

You don't need to be an expert to start investing in stocks. Check out your various options below.

As a long-term investor in the S&P 500, you can earn 10% annual returns.[2] But in day trading, most traders lose their money and eventually quit. Nonetheless, skilled day traders can make 5-10% or even more a month.

Dollar Cost Averaging

Dollar cost averaging (DCA) is when you invest money regularly in an asset, regardless of the price, to reduce volatility. This is your best option if you do not know how to read the market trend.

First, you need to select a stock or fund. Then, you have to invest money regularly in that same stock or fund.

Most investors prefer buying every time they receive their bi-weekly or monthly paycheck. You can even automate this by setting recurring deposits if your broker allows you to do so.

If you don't know what company to invest in, consider an index fund like Schwab S&P 500 Index Fund (SWPPX) or Vanguard S&P 500 ETF (VOO) as they track the returns of the market index. This way, you automatically diversify your risk exposure.

Try: If you prefer an easy and safe way of earning a million.

Avoid: If you don't want a long-term investment plan and if you prefer timing the bear market and bulk buy as it comes.

If you invested $3,000 monthly in Vanguard S&P 500 ETF (VOO) since its inception in 2010, you would be a millionaire now as of Dec 2023. If that same monthly amount was saved in a bank, you will only have $480,000 now.

Here are the scenarios if you invested a different monthly amount in VOO:

| Monthly Deposit | Total Capital Invested | Total Value as of Dec. 13, 2023, with NAV of $432.35[3] (rounded to the nearest thousands) |

|---|---|---|

| $500 | $80,000.00 | $170,000.00 |

| $1,000 | $160,000.00 | $340,000.00 |

| $2,000 | $320,000.00 | $690,000.00 |

| $3,000 | $480,000.00 | $1,030,000.00 |

Growth Investing

Growth investing is looking for stocks with the highest potential for explosive growth in the future. This is a long-term strategy where you pick stocks that are likely to be market leaders later.

Growth stocks can be multibaggers. These are stocks that return at least 2x or more than your investment. But how do you pick those?

In general, when choosing growth stocks, the company must have:

- A strong balance sheet

- Capable and visionary leaders

- An innovative product and competitive edge

- Good track record in sales and profit

If you want to spot growth stocks easily, you'll need to read up on fundamental analysis. You'll also need to make sure that your picks are well-diversified and regularly-monitored to see if the returns are okay.

Try: If you are looking for multibagger stocks that can potentially gain 200% or even more than your initial capital.

Avoid: If you're not willing to lose all your investment.

Tesla (TSLA) is almost synonymous with electric vehicles now. However, its stock price was only $17 per share during its IPO in 2010.[4]

After getting great sales results, TSLA saw an explosive growth over the years. In November 2021, it reached an all-time high of $414.50.[5]

Say you invested $5,000 in TSLA during its IPO. As of Dec. 15, 2023, that $5,000 would be approximately worth $1,100,000. To be clear, you only had 294 shares initially, but because of the stock splits in 2020 and 2022, that changed to 4,410 shares.

Earn a Million as an Active Trader

|

Active trading can be a good way to earn a million, especially for risk-takers. Skilled traders can easily make 5% a month. In a few years, that monthly 5% gain can grow your capital to $1 million.

However, you can also lose all your money while trading. If you're fine with the risk, here are some options you can explore.

Yes, if you are fine with having around $100,000 annual interest income. The stock market on average returns 10% annually.[2] If you have $1,000,000 and all of that is invested in the stock market, you can get $100,000 (fees and taxes excluded). If you want a clearer picture of how much interest your $1 million could earn each year based on different investments, check out how much interest does $1 million dollars earn.

Margin Trading

Just like how you can borrow money to buy a new house and car, you can also borrow money from brokers to buy stocks.

Margin accounts increase your buying power and, therefore, increase your potential profit. However, you are also increasing your risk. So, how do you start margin trading?

- Choose a broker

Margin rates vary among brokers. Those with the lowest fees include Interactive Brokers and Moomoo. - Apply for a margin account

Submit the requirements for a margin account and fund it with a minimum of $2,000.[6] - Find a strategy to use

Master one strategy. The basic technicals you need to know are support and resistance, candlesticks, and indicators. - Trade on demo

Trade first in a simulated trading environment. Once you have become confident in your execution, move to live trading.

Try: If you want to earn more than your spot trading account with the same price move into the market.

Avoid: If you don't want to lose all your money and end up in debt.

Say you bought a stock at $100 per share with $10,000 as capital. If the price increases or decreases by half, you'll earn or lose half.

| Winning Scenario | Losing Scenario | |

|---|---|---|

| Capital | $10,000.00 | $10,000.00 |

| Stock Price When You Bought | $100.00 | $100.00 |

| Your Shares | 100.00 | 100.00 |

| Stock Price Now | $150.00 | $50.00 |

| Value Now | $15,000.00 | $5,000.00 |

| Total Gain/Loss | $5,000.00 | -$5,000.00 |

But that's not the case with a margin loan. You get $9,000 if you win but you're wiped out if you lose. Plus, you might end up owing money to your broker.

| Winning Scenario | Losing Scenario | |

|---|---|---|

| Your Capital | $10,000.00 | $10,000.00 |

| Total Invested (with 50% margin) | $20,000.00 | $20,000.00 |

| Stock Price When You Bought | $100.00 | $100.00 |

| Price Now | $150.00 | $50.00 |

| Profit | $30,000.00 | $10,000.00 |

| Repay Margin Loan | -$10,000.00 | -$10,000.00 |

| Margin Interest | -$1,000.00 | -$1,000.00 |

| Value Now | $19,000.00 | -$1,000.00 |

| Total Gain/Loss | $9,000.00 | -$11,000.00 |

Regardless of whether you win or lose, you still have to pay your broker the margin loan principal and interest.

The example in the losing scenario is a bit extreme, but losses this big in margin trading can be avoided if traders have a stop-loss order.

Options Trading

Options is a type of contract that gives you the right to buy or sell a stock at a specific price in the future. If you're wondering why someone would buy a "right to purchase" something, the key lies in the benefit of that contract.

Limited risk with unlimited reward. This is how call options work in an uptrend if you're the buyer of the option. Follow these steps to get started.

- Find an options broker

Options is complex. A good broker should help simplify trading it for you. - Study options strategies

Basic technical analysis may not be enough for options. Common strategies in options include covered call, straddle, butterfly, iron condor, etc. - Trade on demo

Check how well your strategy does through the demo.

The limited risk and unlimited reward are not only for buying call options. Even on a downtrend, you can take advantage of this by taking the opposite position, sell on a call option.

Try: If you know how to read the trends and prefer limited risk.

Avoid: If you don't want to study complex models and strategies.

When you enter into an options contract, you're setting a fixed price (strike) to buy a certain stock in the future (expiration date), in exchange for a premium or fee.

So in a call option (right-to-buy option), if the stock price goes above the strike you set, the difference between the strike and the market price is your profit, which can be unlimited. And if you lose? You're simply losing the fixed premium you paid.

You usually buy a call option if you think the price will increase in the future.

Using TSLA, check the sample profit and loss scenarios below:

| Winning Scenario | Breakeven Scenario | Losing Scenario | |

|---|---|---|---|

| No. of contract (100 shares) | 1 | 1 | 1 |

| Option Strike | $235.00 | $235.00 | $235.00 |

| Value Before | $23,500.00 | $23,500.00 | $23,500.00 |

| TSLA Price after 1 Month | $250.00 | $238.50 | $220.00 |

| Value After | $25,000.00 | $23,850.00 | $22,000.00 |

| Premium Fee ($3.5 per share) | -$350.00 | -$350.00 | -$350.00 |

| Total Gain/Loss | $1,150.00 | $0.00 | -$350.00 |

Take note, options are considered speculative and highly risky. Plus, although there are zero-commission offers for US clients, third-party fees for regulatory and clearing are still applied, and that could potentially increase the costs of your trade.

Futures Trading

Futures contracts are like the cross-over between options and margin trading. You're speculating on the future price of the asset just like options. Plus, you get leverage just like margin trading.

Technically, futures are not part of the stock market. However, by using futures, you can indirectly trade the stock market indexes like S&P 500. Here's how you can start trading:

- Open an account in a futures broker

Popular futures brokers include NinjaTrader, TradeStation, and Interactive Brokers. - Find a futures strategy to use

Any kind of trading strategy based on technical analysis can be profitable. However, since this is leveraged, the importance of short-term swings and trends is magnified. - Trade on demo

Test what trading with leverage is like first. Once you get a hang of it, move to the live market.

Futures typically allow you to use a higher leverage than margin trading. This way, you can trade large positions with a smaller initial margin amount.

Try: If you want even better leverage options in trading and prefer day trading.

Avoid: If you don't want to increase your risk as much as you increase your potential reward.

Just like options, you are entering into a contract to buy an asset at a fixed price at a later date. But, in this case, you don't have to buy the right. You're directly entering into the contract.

Similar to margin trading, you can trade with leverage in futures. However, unlike margin trading in stocks, you can simply deposit a fraction of the contract amount as an initial margin. As set by CME, it usually ranges from 3-12% of the position size, but it changes depending on your broker.

Say you bought one Standard E-mini S&P 500 Index Futures (ES) futures contract at $4,700. If the margin required is 5%, you are required to deposit an initial margin amount of $11,750. This amount is calculated as the product of the number of contracts (1), contract size (50), the contract price ($4,700), and the margin required rate (5%).

But in terms of profit or loss, it will be counted per contract point value. $1 = 1 point and 1 point = $50. So for every $1 change in the ES quote, you can earn or lose $50 for each contract. You also have the choice to either go long or short.

See below for the profit and loss scenarios:

| Winning Scenario | Losing Scenario | |

|---|---|---|

| Initial Margin Required | $11,750.00 | $11,750.00 |

| ES Price when the Futures Contract Is Bought | $4,700.00 | $4,700.00 |

| ES Price When the Futures Contract Expired | $4,750.00 | $4,650.00 |

| Total Profit/Loss if Long | $2,500.00 | -$2,500.00 |

| Total Profit/Loss if Short | -$2,500.00 | $2,500.00 |

That $2,500 will then be added or deducted to your initial margin depending on if you won or lost.

Other Ways to Earn $1M

Some alternative assets have performed just as well as the stock market index, if not better. These include real estate, art, private credit, rare whisky, etc.

Here are some of the platforms you can consider:

- Masterworks

Buy shares of securitized blue-chip paintings. Its collection includes multi-million artworks like Basquiat's. - Crowdstreet

Invest in commercial real estate hassle-free. Choose either individual properties or a diversified fund. - Percent

Get high returns despite a short holding period through private credit. Retail accredited investors can now access this previously institution-exclusive asset class. - Vinovest

Buy and hold fine wine and whisky for profit. You can even get it bottled and shipped to you if you want.

One of the downsides of alternative assets is its illiquidity. Most of these platforms follow the buy-and-hold strategy, so you can't easily exit your investment as you wish.

Can You Turn $100,000 into $1 Million in 5 Years?

It's not impossible, but it's also not easy to do. To turn $100,000 into $1 million, you need an annual compounded return of 58%. For context, the S&P 500 on average only returns about 10% (about 12% annualized if you include dividends paid).[2]

Only profitable traders usually have returns of 58% or more. That is just around 5% per month, which is doable and usually below their usual targets of 8% or 10% a month.

But to become a profitable trader, it will take you years and it requires a steep learning curve. On average, traders will only become profitable in their third year of learning. Some fail to be profitable even after 5 years.

So if you want to earn a million dollars in 5 years, your best action plan is to spend the first 3 years learning about trading with small amounts. Once you start being consistently profitable for 3 months straight, consider adding more capital to increase your pace.

Remember, the learning process itself can take a while. You should manage your expectations and don't risk more than what you can afford by trying to beat the market and by being impatient.

HOW TO MAXIMIZE YOUR EARNINGS

You've learned various ways to earn in the stock market, but adding these steps could help you earn more.

IRA Accounts

Use an IRA if you're investing for retirement since you can benefit from the tax advantages. Just take note of the 5-year rule and the withdrawal age to avoid penalties. You can apply this in long-term strategies like DCA.

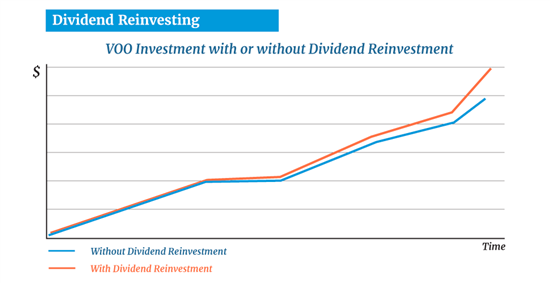

Dividend Reinvesting

|

Speed up the process of earning your first million by reinvesting your dividends. This means that every time the stock pays out a dividend, you don't spend that and you add it back in your fund.

Using the same example in the DCA section, your monthly DCA of $3,000 in VOO would've already hit the million mark last Sep 2021 instead of Dec 2023 if you reinvested your dividends.

Dividend reinvesting is ideal for any long-term buy-and-hold strategy for dividend-paying stocks or funds.

Choosing zero-commission brokers

Select zero-commission brokers to lessen the upfront fees that you are paying as a day and swing trader. US stocks, ETFs, and equity options are usually offered without commission thanks to the payment-for-order-flow model.

BOTTOM LINE

To get your first million, you need to build better financial habits, be mentally ready for the risks, and save consistently.

- Your long-term strategies include dollar-cost average and growth investing

- For short-term choices, you have margin, futures, or options trading

- If you're not looking to trade stocks, consider real estate, fine art, or private credit

Regardless of what you choose, you'll still face some risks. Protect yourself psychologically by only investing what you can afford to lose.

References

- ^ FDIC. National Rates and Rate Caps, Retrieved 12/15/2023

- ^ S&P Dow Jones Indices. S&P 500 , Retrieved 02/29/2024

- ^ VOO. Price, Retrieved 12/15/2023

- ^ U.S. Securities and Exchange Commission. Tesla, Inc., Retrieved 02/29/2024

- ^ Nasdaq. TSLA Historical Data, Retrieved 02/29/2024

- ^ FINRA. 4210. Margin Requirements, Retrieved 02/29/2024

Write to Stella Magay at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|