Investment Calculator

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

What will $10,000 be worth in 20 years? Find out how to calculate investment growth with this calculator, including what you'll earn in yearly interest.

|

Investing is all about timing.

The earlier you invest, the more interest you earn.

Wondering where your investment will stand in 5-, 10-, or 20-years' time? This calculator shows you:

- How much your investment will grow

- How much interest you'll earn in total (and per year)

- How much of your ending balance is interest vs. contributions

Find out how your investment is calculated, investment options to choose from, and which 3 things to do before you invest below.

How to Calculate Investment Growth

This calculator shows you how the initial investment will grow over a specific number of years. Here's how it works:

- First, enter your Initial Investment. This is the amount of money you put in the account when you first opened it.

It can also be the starting point from which you want to calculate your returns (regardless of when you opened the account).

- Then, add the Contribution Amount. This is a fixed amount of money you plan to add to your account each month.

If you don't plan to make contributions (reconsider this choice, if possible!), leave it blank.

- Next, specify the Years of Growth. This is the number of years you will hold and contribute to your investment.

- Then, enter your Interest Rate. If your investment has a fixed rate, add it in.

If your investment has a variable rate, add either the average rate or a low estimate (just to be safe).

- Finally, define the Compound Frequency. This is how frequently interest is added to your account.

Once you hit "Calculate" you'll see:

- Your End Balance

- Your Total Interest earned

- Your Total Contribution amount

The results are displayed in the form of a pie chart. This show you how much of your ending balance was contributions vs. interest. To see how much your investment earns per year from interest and contributions click, "Show Details".

Best Ways to Invest for Steady Returns

There's no shortage of investment products on the market today. Below, review a few of the most popular investment vehicles to decide which is right for you.

Certificate of Deposit

CDs are accounts offered by banks and credit unions. A CD requires you to deposit an initial investment and leave it untouched for a fixed amount of time.

No withdrawals or regular deposits are allowed. In exchange for the illiquidity, the bank usually offers higher interest rates, which are fixed.

Pros: Safe, low-risk investments, FDIC or NCUA-insured, higher fixed interest rates, usually no monthly fees

Cons: Not liquid, penalties for early withdrawal, may require a high minimum deposit ($1,000), usually no contributions allowed

High-Yield CD Rates - Up to 4.30% APY

- No fees

- $1 minimum deposit

- FDIC insured

| Term | CD Rates |

|---|---|

| 3 Month | 4.30% APY |

| 5 Month | 4.10% APY |

| 6 Month | 4.30% APY |

| 9 Month | 3.95% APY |

| 12 Month | 3.95% APY |

12-Month High-Yield CD - 3.90% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- NCUA insured

12-Month No-Penalty CD - 3.90% APY

- $1 minimum deposit

- 24/7 online access

- Federally insured by NCUA

Certificate of Deposit

- 4.00% APY for 12-month term

- 3.80% APY for 18-month term

- 3.80% APY for 24-month term

- 3.50% APY for 36-month term

- 3.50% APY for 5-year term

CIT Bank Term CDs - Up to 3.50% APY

- Up to 3.50% APY

- $1,000 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

| Term | CD Rates |

|---|---|

| 6 Month | 3.00% APY |

| 1 Year | 0.30% APY |

| 13 Month | 3.50% APY |

| 18 Month | 3.00% APY |

| 2 Year | 0.40% APY |

| 3 Year | 0.40% APY |

| 4 Year | 0.50% APY |

| 5 Year | 0.50% APY |

12-Month High-Yield CD - 3.95% APY

- No fees

- $1 minimum deposit

- 24/7 online access

- FDIC insured

Money Market Accounts

A money market account is like a savings account and a checking account combined. They offer higher interest rates like a savings account plus checking account features like an ATM card and checks.

Money market accounts are offered by banks and credit unions. The interest rates are variable, not fixed.

Pros: High liquidity, fairly safe, FDIC or NCUA-insured, reliable interest returns, minimal fees

Cons: Minimum balance requirement can be high, interest not as high as other investments, withdrawal limits (usually capped at 6 per month)

UFB Portfolio Money Market - Earn up to 4.01% APY

- Earn up to 4.01% APY*

- Enjoy no monthly maintenance fees with a $5,000.00 balance, otherwise fee is $10.00 per month.

- Access your funds 24/7 with easy-to-use digital banking tools.

- Have peace of mind with FDIC insurance up to the maximum allowable limit – Certificate #35546.

Money Market Deposit Account - 4.30% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- Federally insured by NCUA

Money Market Deposit Account - 4.29% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

Money Market Deposit Account - 4.29% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

Money Market Deposit Account - 4.25% APY

- No fees

- $1 minimum deposit to open

- 24/7 online access to funds

- Federally insured by NCUA

Money Market Deposit Account - 4.24% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- Federally insured by NCUA

Money Market Deposit Account - 4.20% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

Money Market Deposit Account - 4.17% APY

- $1 minimum deposit

- No fees

- 24/7 online access to funds

- FDIC insured

Bonds

Bonds are essentially a company's debt. You "lend" them money with your investment. The company then promises to pay it back at a specific time with a specific fixed interest rate.

In general, bonds are considered safe, predictable investments - but they're not without risk.

Pros: Generally safe, predictable/fixed returns, many bonds are rated by credit rating agencies to give you an idea of the company's credit worthiness

Cons: Not liquid, risk of loss if interest rates fall, some bonds require large upfront investment, interest rates aren't the highest

Stocks

Unlike the previous three investments, stocks are usually considered high-risk. You're buying a small piece (or share) of a company.

The value of the share you buy will fluctuate depending on the company's performance. Stocks can plummet as easily as they can sky-rocket, so invest with caution.

Pros: Potential for big returns, can buy "fractional shares" of companies with high stock price, fairly easy to buy and sell, don't need a lot of money to invest

Cons: Much higher risk/volatility, can require a lot of research to pick your stocks, nerve-wracking to watch stock prices go up and down

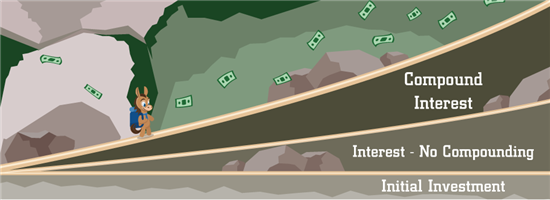

How Compound Interest Works in Investing

|

| © CreditDonkey |

Compound interest is when you earn interest on the interest you've already earned.

Not all investments earn interest, such as stocks. But products like CDs, bonds, and money market accounts do earn interest. The reason people choose products like this is because compound interest is a powerful earning tool.

Compound interest is powerful because it grows at a faster rate as time goes on. Each new interest payment is higher than the last. Simple interest, on the other hand, is only calculated based on the principal, so it always stays the same.

Because of this, time can play a huge part in growing your money. The earlier you start accruing interest, the more you'll have. (And we mean a lot more.)

What to Do Before You Invest

Investing is exciting, but don't dive in before you take care of these three things.

- Have a healthy emergency fund.

It's important to have funds set aside to cover emergencies like car repairs or medical bills. If you or a family member were to lose a job, it can act as a much-needed safety net and pay for your necessities.Find out how much your emergency fund should be with our emergency fund calculator.

- Make sure your debt is manageable.

If you have high-interest credit card debt, it's probably best to get it paid down to a more manageable amount. Aim to use no more than 30% of your credit limit.[1]Note: Fixed-term debt like mortgages or car loans are not as much of a problem. They have lower interest rates and a fixed payment plan.

- Have a retirement plan in place.

No matter your age, it's important to know how you will save for retirement and to get started soon. Take advantage of all the tax-advantaged retirement accounts that you can.The easiest way is to contribute to your company's 401(k). If you don't have one, then prioritize investing in an IRA over other types of investments.

Bottom Line

Investing opens up a world of possibility. It can grow your money, fund your retirement, and act as a safety net when you need it. Before you invest, take time to understand your goals, expectations, and current financial health.

Whatever investing approach you take, do your homework and due diligence to pick the best investment for you. And remember: Invest sooner than later to take advantage of compound interest.

References

- ^ "What is a Credit Utilization Rate?": Experian, 2020.

Holly Zorbas is a assistant editor at CreditDonkey, a personal finance comparison and reviews website. Write to Holly Zorbas at holly.zorbas@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|