Apps Like Possible Finance

Possible Finance lets you access small personal loans even if you have bad credit. But are there other apps like it? Read on.

|

While not exactly Possible Finance duplicates, these apps work similarly:

Looking for an app like Possible Finance but want to skip the interest charges? Don't worry—there's plenty of fish in the sea!

From top cash advance apps to all-in-one fintech platforms, you can access emergency funds interest-free, right from your phone.

Ready to explore the eight best alternatives? Let's dive in!

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

The SMART rule helps individuals remember the key aspects to consider when choosing an app like Possible Finance:

- Speed: Look for apps that offer fast access to funds.

- Minimal fees: Ensure the app has low or no fees.

- Accessibility: The app should be easy to use and accessible on multiple devices.

- Reliability: Choose a reputable app with positive reviews.

- Transparency: The app should have clear and transparent terms.

8 Best Cash Advance Apps like Possible Finance

Let's face it: Possible Finance isn't for everyone. And you don't have to be stuck with it.

Here's a go-to app for many users in need of emergency cash.

EarnIn: Up to $750 with Cash Out

|

| credit earnin |

| Timing and Repayment | |

|---|---|

| Get Money | Within 1-3 business days via ACH |

| Repay | Upcoming payday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | $2.99 to $5.99/Cash Out transfer[1] |

| App Rating | |

| Google Play | 4.7 out of 5 ✰ from 244K+ reviews on Google Play[2] |

| App Store | 4.7 out of 5 ✰ from 285K+ reviews on App Store[3] |

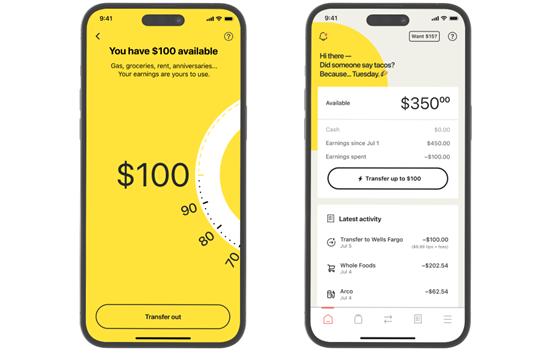

EarnIn is an app providing early access to your unpaid income—up to $750 per pay period. Generally, the daily cap for its Cash Out feature is $150.

That said, you might need to make transactions over consecutive days for higher amounts.

One key difference from Possible Finance is that EarnIn doesn't have borrowing costs, which can be very helpful for those living paycheck-to-paycheck. You can tip the service, though. The standard transfer time is pretty decent, so you may not have to pay extra for Lightning Speed

to get funds faster.

In addition, EarnIn has Balance Shield. It sends alerts when your bank balance falls below a threshold you set. When it drops into overdraft territory, Balance Shield automatically provides $100 to help protect your account from possible overdraft fees.

EarnIn doesn't have payment extensions with its Cash Out feature. However, you won't be penalized with fees if you don't make timely payments.

EarnIn Cash Out requirements:

- Sign up for an EarnIn account if you're at least 18 and with a valid U.S. mobile number.

- A linked checking account with consistent paychecks.

- Employment details.

- Minimum $320 per pay period.[4]

Pros + Cons

|

|

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $150 a day

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get paid as you work

Get money in your bank in minutes with Lightning Speed for a small fee, or in 1-3 business days at no cost.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

If you need a higher cash advance, try this next app.

MoneyLion®: Up to $1,000 w/ Instacash℠

| Timing and Repayment | |

|---|---|

| Get Money | Minutes (with fee) or at least one business day |

| Repay | On scheduled repayment date (usually next paycheck) |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | Tiered fee starts at $0.49/transfer[5] |

| App Rating | |

| Google Play | 4.5/5 ✰ (123K+ reviews)[6] |

| App Store | 4.7/5 ✰ (135K+ reviews)[7] |

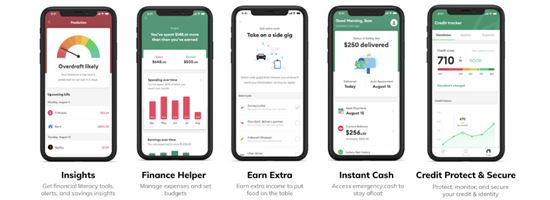

One of MoneyLion®'s standout features compared to Possible Finance is its ability to centralize your financial activities. It has banking, budgeting, credit-building, borrowing, earning, and investing products in one place.

With Instacash℠, you can access cash advances up to $1,000. To qualify for the full amount, you must set up a recurring direct deposit to a RoarMoney℠ account. Otherwise, the ceiling amount drops to $500.[8]

Another advantage of MoneyLion® is its personal finance tools that help you make more money. This way, you're less dependent on cash advances when you're in a pickle.

Yes, you may be able to borrow $1,000 or more from payday lenders even if you don't have a good credit history. However, this often comes with higher interest rates and other potential restrictions.

MoneyLion® Instacash℠ requirements:

- Sign up for a MoneyLion® account.

- A linked checking account with a minimum 60-day history and a positive balance.

- At least three direct deposits from the same source or payroll provider into the linked account.

Pros + Cons

|

|

Up next—an app that helps you borrow responsibly.

Dave®: Up to $500 with ExtraCash™

|

| CREDIT DAVE |

| Timing and Repayment | |

|---|---|

| Get Money | Seconds to a Dave® checking account (with fee) or within three business days |

| Repay | Next payday or nearest Friday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $1 monthly subscription fee |

| Instant Transfer Fee | Starts at 3% or $3, whichever is higher[9] |

| App Rating | |

| Google Play | 4.4 out of 5 ✰ from 528K+ reviews on Google Play[10] |

| App Store | 4.8 out of 5 ✰ from 692K+ reviews on App Store[11] |

Dave® is another versatile financial app that can be an excellent alternative to Possible Finance.

With ExtraCash™, you can get up to $500 in advance. However, unlike Possible Finance, this advance functions more like an overdraft. This means you might see a negative balance in your bank account after using it.

Don't worry, there are no overdraft fees, so you won't be penalized. Plus, seeing the negative balance can serve as a clear reminder of how much you owe.

If you need the advance sooner, you must pay 3% of your advance amount as an express fee. This applies to instant transfers to a Dave® account. For external bank accounts, it is 5%.

Dave® ExtraCash™ eligibility contributing factors:

- Sign up for a Dave® account.

- Linked bank account details or Dave® checking account with a minimum 60-day history and a positive balance.

- At least three recurring verified bank deposits.

- Minimum $1,000 total monthly deposit.

- Pay a monthly membership fee.

Direct deposits aren't required to maintain a Dave® account or to access ExtraCash™. However, having a direct deposit can be beneficial. It may allow you to receive your paycheck up to two days earlier and could increase your advance limit.

Pros + Cons

|

|

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Like Dave®, this next tool can be just as accommodating if you aren't employed.

Brigit: Up to $250 with Instant Cash

|

| CREDIT hellobrigit |

| Timing and Repayment | |

|---|---|

| Get Money | 20 minutes (with fee) or at least one business day |

| Repay | Next payday or preferred date using an extension. |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $8.99/mo. Plus plan or $14.99/mo. Premium plan[12] |

| Instant Transfer Fee | Starts at $0.99/transfer;[13] free for Premium members[14] |

| App Rating | |

| Google Play | 4.7 out of 5 ✰ from 206K+ reviews on Google Play[15] |

| App Store | 4.8 out of 5 ✰ from 312K+ reviews on App Store[16] |

Brigit's Instant Cash offers a cash advance of up to $250, which is a bit lower than some alternatives. However, it doesn't require employment.

While having a job can improve your approval chances, you may still qualify with regular direct deposits from other sources, such as government benefits. Brigit also reviews your account health and spending patterns to determine eligibility.

To access maximum cash advance, it helps if your financial indicators are strong. And like Possible Finance, you can't choose the amount. Once your limit is set, it remains fixed.

Brigit Instant Cash requirements:

- Sign up for a paid Brigit subscription.

- A linked external bank account with a minimum 60-day history, three recurring deposits from the same source, and a positive balance.

- A minimum average end-of-day balance on scheduled paydays or direct deposit.

Pros + Cons

|

|

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Unlike Possible Finance, this next option almost entirely removes fees from the equation.

Chime®: Up to $200 with SpotMe®

|

| credit chime |

| Timing and Repayment | |

|---|---|

| Get Money | Immediately after initiating a SpotMe® transaction |

| Repay | On your next direct deposit or fund transfer, whichever comes first |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | $0 |

| App Rating | |

| Google Play | 4.6 out of 5 ✰ from 663K+ reviews on Google Play[17] |

| App Store | 4.8 out of 5 ✰ from 838K+ reviews on App Store[18] |

Chime® is a popular mobile banking app known for its no-fee approach. This applies even to their SpotMe® feature, which helps you save money when you need it most.

SpotMe® offers fee-free overdraft protection up to $200, covering you on debit card purchases. When you use it, you'll receive a message like, "SpotMe has you covered. Your debit purchase at (Store Name) was taken care of by SpotMe."

If you prefer cash, you can access your SpotMe® limit at any of Chime®'s 50,000+ ATMs.

In addition, Chime®'s customer service sets it apart from Possible Finance. You can speak to a live human agent anytime, providing peace of mind and extra confidence in its support.

Chime® could be a great alternative to a traditional bank, especially if you want to avoid fees. With Chime®, most transactions come without extra costs, and it provides a range of products and services. If you're comfortable with online banking, Chime®, can be a solid choice.

Chime® SpotMe® requirements:

- Apply for a Chime® debit card or Credit Builder card.

- SpotMe® must be activated in your app settings.

- At least a $200 qualifying direct deposit from an employer or benefits provider sent regularly.[19]

Pros + Cons

|

|

What if you can use your overdraft and earn cash back at the same time? Find out how, up next.

Albert: Up to $250 with Instant

| Timing and Repayment | |

|---|---|

| Get Money | Real-time via Albert Cash debit purchases and ATM withdrawals; two to three business days via standard ACH transfer |

| Repay | Within a six-day grace period |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $16.99/mo. Genius account fee[20] |

| Instant Transfer Fee | $4.99/transfer to an external bank account[21] |

| App Rating | |

| Google Play | 4.3 out of 5 ✰ from 99K+ reviews on Google Play[22] |

| App Store | 4.6 out of 5 ✰ from 189K+ reviews on App Store[23] |

Albert's Instant feature lets you overdraw your Albert Cash account to access up to $250.

Unlike Possible Finance, however, Albert requires a paid subscription. However, if you use your Instant limit in real-time through your Albert Cash account, you won't be charged any additional fees. A $4.99 fee applies for transfers to external bank accounts.

Overdrafts must be repaid in six days, although a seven-day extension is available. Remember that you can't request additional overdrafts until the current one is repaid.

Albert Instant requirements:

- Sign up for a paid Albert membership.

- Maintain an Albert Cash account in good standing and link an active bank account.

- An activated Smart Money, which is found under Profile tab.

- Opt into overdrafts on debit card purchases, ATM withdrawals, ACH, and other electronic transfers.

Yes, Albert is a legitimate app. As a financial technology company operating for nearly a decade, it serves 10 million+ users and has a strong track record of positive customer ratings on Google Play and App Store. More importantly, funds in Albert Cash or Savings accounts are FDIC-insured up to $250,000 through partner banks.

Pros + Cons

|

|

Why pay interest for a Possible Loan when you can hit the same maximum loan amount without mandatory fees in this next app?

Cleo: Up to $500 cash advance

| Timing and Repayment | |

|---|---|

| Get Money | Within 24 hours for a fee, or four business days via standard transfer |

| Repay | On your set repayment date, usually within 14 days |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | Starts at $3.99/transfer[24] |

| App Rating | |

| Google Play | 4.4 out of 5 ✰ from 71K+ reviews on Google Play[25] |

| App Store | 4.6 out of 5 ✰ from 116K+ reviews on App Store[26] |

Qualifying for a Cleo cash advance is fairly straightforward—even with poor credit.

Cleo doesn't run credit checks, which makes it accessible to a broad range of users. However, that's not unusual in the cash advance world; even a payday lender like Possible Finance is also credit-friendly.

However, its flexible eligibility, including for part-time workers, makes it worth a second look. So, you could be a commission-based sales agent and still qualify for a cash advance. With Cleo, you can access up to $250, or even $500 if you set up direct deposits with them.[27]

There's one catch, though: As a new user, you'll start with a lower advance amount. But it might still be enough to cover a small financial emergency.

Yes, Cleo is a solid option for cash advances. Unlike many other cash advance apps, Cleo doesn't restrict access to people without a steady income, making it a more flexible choice for a wider range of users.

Cleo cash advance requirements:

- Sign up for a Cleo account.

- Choose between a Cleo Plus and a Cleo Builder subscription, or request by emailing team@meetcleo.com.

Favorable bank transaction histories and spending patterns remain crucial factors in determining your eligibility and advance amount.

Pros + Cons

|

|

We're near the end of the list, so we saved arguably the best for last, at least in terms of advance amount.

Payactiv: Up to 50% of your salary with Earned Wage Access

| Timing and Repayment | |

|---|---|

| Get Money | Real-time (with fee) |

| Repay | On your next payday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | Starts at $2.49/transfer[28] |

| App Rating | |

| Google Play | 4.4 out of 5 ✰ from 29K+ reviews on Google Play[29] |

| App Store | 4.7 out of 5 ✰ from 52K+ reviews on App Store[30] |

Payactiv is a financial wellness platform that offers Earned Wage Access (EWA). Unlike Possible Finance, which is more of a standalone service, Payactiv is an employer-provided benefit, allowing employees to access up to 50% of their earned but unpaid wages.

You can access your EWA funds through Walmart Cash Pickup. But to avoid fees, consider getting a Payactiv Visa® Card. To receive money immediately and without charge, you must set up direct deposits of at least $200 per deposit to your Payactiv Visa® Card or an affiliate card.

Payactiv EWA requirements:

- Check if your EWA is available with your employer first.

- Sign up for a Payactiv account.

Pros + Cons

|

|

Now that you've learned about apps like Possible Finance, here's an overview for a more informed comparison.

How does Possible Finance app work?

The Possible Finance app offers small-dollar loans of up to $500 and credit card opportunities, specifically designed for those with low credit scores or poor credit histories.

While there are eligibility requirements, using either of these products can help you build credit, as your payment behavior is reported to two major credit bureaus, TransUnion and Experian.

However, it's important to note that Possible Finance acts more like a payday loan provider, given its interest charges and longer repayment terms.

Instead of repaying the loan in full at once, you'll make four equal loan payments over eight weeks (or two months). This structure allows for more manageable payments and helps you establish a positive credit history.

How to Choose Possible Finance Alternatives

Getting an advance from Possible Finance alternatives can be the best solution to your financial hurdle.

But before you sign up for one, here are things to consider:

- Processing time

When you're in a rush, the processing time is a top priority. It will determine how fast you can get the money. Most cash advance apps take less than 24 hours to process and have express delivery options. - Cash advance amount

Determine how much cash you need. Many apps cap their cash advance anywhere from $250 to $500. So before signing up, check if the app can cover your target amount. - Repayment date

Paycheck advance apps on this list set an automatic repayment on your next payday. But there are other repayment options, too. Some let you pay in installments, while others let you choose your repayment date. - Fees

Check for any possible cash advance charges, such as monthly subscriptions and instant delivery fees.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

The Cash App borrow feature is still in testing, so it's not yet available to all users. As a financial services company, it focuses on sending and receiving money as well as trading stocks and bitcoin.

How to get out of a cash advance/loan cycle

Repayment can sometimes be its own challenge. Budgeting your next salary to pay bills alongside your cash advance can be difficult.

Tips to breaking the cash advance and repayment cycle include:

Use budgeting and spending tools.

Many apps on this list offer budgeting assistance and saving tools. Use them to help improve your financial health.

Earn extra income.

Instead of payday loans, why not go for apps that can make you some money first? Or try a few side hustles to capitalize on your other skills.

Take note of your due dates.

Needless to say, you must be responsible for the cash advance you make. Set reminders of your repayment dates to help you prepare and pay on time.

A cash advance can be considered a short-term loan since you're borrowing money with the expectation of repayment. However, some see it differently, especially in the case of paycheck advances.

Alternatives to Cash Advance/Loan Apps

Other than cash advance apps, here are a few more ways to access cash for emergencies:

- Borrowing money from a friend

Accessing money from someone close to you with extra cash is an option. Family loans may be even better, if possible. - Use your credit card

Especially if you're running short on groceries before your paycheck arrives, a credit card can be a lifesaver. And then, pay it in full on the due date to avoid interest. - Personal loan

For emergencies that call for more than a thousand dollars, taking out a loan could be your best bet. Try nearby credit unions, some of which offer small-dollar loans with lower fees and more manageable repayment terms.

Methodology

Possible Finance is a reliable loan app, but it charges interest. So, when creating this list, we looked for similar apps that don't charge interest.

We also made sure these apps offer you a range of loan amounts, whether you need just a couple hundred dollars or want instant access to a large portion of your paycheck.

Additionally, we considered apps with extra financial tools to help you manage your money better. This way, you don't just resort to loans or advances whenever you need a cash boost.

Bottom Line

Possible Finance is only one of several good options for emergency cash. For a similar or even larger loan amount, some apps like it can help you address minor financial setbacks without interest.

EarnIn, MoneyLion®, and others on this list may be worth considering. Especially those with personal finance tools to support your overall money management.

But despite their convenience, remember to access cash advances from these apps for true financial emergencies.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

References

- ^ EarnIn. Lightning Speed fees and Details, Retrieved 03/17/2025

- ^ Google Play. EarnIn: Make Every Day Payday, Retrieved 03/17/2025

- ^ App Store. EarnIn: Make Every Day Payday, Retrieved 03/17/2025

- ^ EarnIn. Frequently Asked Questions, Retrieved 03/17/2025

- ^ MoneyLion®. MoneyLion fee schedule, Retrieved 03/17/2025

- ^ Google Play. MoneyLion: Bank & Earn Rewards, Retrieved 03/17/2025

- ^ App Store. MoneyLion: Banking & Rewards, Retrieved 03/17/2025

- ^ MoneyLion®. Get Paid Any Day, Retrieved 03/17/2025

- ^ Dave®. Get up to $500 in 5 minutes or less, Retrieved 03/17/2025

- ^ Google Play. Dave: Fast Cash & Banking, Retrieved 03/17/2025

- ^ App Store. Dave: Fast Cash & Banking, Retrieved 03/17/2025

- ^ Brigit. How much does Brigit cost?, Retrieved 03/17/2025

- ^ Brigit. Brigit Terms of Service, Retrieved 03/17/2025

- ^ Brigit. Our pricing, Retrieved 03/17/2025

- ^ Google Play. Brigit: Borrow & Build Credit, Retrieved 03/17/2025

- ^ App Store. Brigit: Fast Cash Advance, Retrieved 03/17/2025

- ^ Google Play. Chime - Mobile Banking, Retrieved 03/17/2025

- ^ App Store. Chime - Mobile Banking, Retrieved 03/17/2025

- ^ Chime®. How to Use SpotMe, Retrieved 03/17/2025

- ^ Albert. How much does Albert cost?, Retrieved 03/17/2025

- ^ Albert. What are direct transfers?, Retrieved 03/17/2025

- ^ Google Play. Albert: Budgeting and Banking, Retrieved 03/17/2025

- ^ App Store. Albert: Budgeting and Banking, Retrieved 03/17/2025

- ^ Cleo. Terms and Conditions, Retrieved 03/17/2025

- ^ Google Play. Cleo: Budget & Cash Advance, Retrieved 03/17/2025

- ^ App Store. Cleo: Cash advance & Credit, Retrieved 03/17/2025

- ^ Cleo. Terms & Conditions, Retrieved 03/17/2025

- ^ Payactiv. EWA Transfer Timing, Retrieved 03/17/2025

- ^ Google Play. Payactiv, Retrieved 03/17/2025

- ^ App Store. Payactiv, Retrieved 03/17/2025

Penelope Besana is a research analyst at CreditDonkey, a personal finance comparison and reviews website. Write to Penelope Besana at penelope.besana@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

|

|

|