Best Cash Advance Apps

Cash advance apps get you up to $750 without a credit check or interest. Keep reading to find out the top 10 cash advance apps in the market.

|

The best cash advance apps you can count on are:

- Brigit for flexibility to choose repayment date

- EarnIn for hourly wages loan

- MoneyLion for multiple features

- Albert for no late or overdraft fees

- Empower for instant cash advance

- Dave for small amount advances

- Chime for overdraft protection

- Current for the overdrive protection feature

- Kora for college students

- Klover for no interest or late fees

Needing a little more cash to get through the week is a struggle. When emergencies come, they call for quick cash that doesn't magically appear out of thin air.

But all hope is not lost.

If you are ever in a tough spot, cash advance apps come in handy. They have fewer requirements and lower charges compared to bank loans.

Let's talk about the 10 best cash advance apps you can choose from. Read on.

10 Best Cash Advance Apps

The best cash advance app depends on what you actually need. In this list, take note of the possible loan amount, processing time, and repayment terms.

Also, weigh in the pros and cons and if you could make the most of the extra features. Let's start with the flexible option.

Cash advance apps give you access to money with no credit checks. These apps include Brigit, MoneyLion, Empower, and Chime.

Brigit: Best for flexibility to choose repayment date

|

| CREDIT hellobrigit |

|

|

Brigit offers a flexible repayment option through Instant Cash. But there is a subscription fee of $8.99/mo.[1]

There are no credit checks, no interest, no late fees, AND free repayment extensions. Auto-advances also help you prevent overdraft fees.

What You Get:

- Loan Amount: Up to $250.00

- Processing Time: 1-3 business days; get your cash in 20 minutes for a small fee

- Repayment Date: Based on your income deposit schedule; flexible repayment options let you pay earlier or ask for an extension[2]

Brigit Instant Cash Requirements:[3]

- Checking account has been active for at least 60 days

- More than $0 in your balance

- Must have 3 recurring deposits from the same source

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

What if you need a higher loan amount? The next app can be better for you.

EarnIn: Best for hourly wages loan

|

| CREDIT earnin |

|

|

With EarnIn's Cash Out feature, you get access to your pay before payday. It has a limit that's one of the highest in the market. But this limit depends on the hours you've worked.

They charge no mandatory fees, interest, or hidden costs. If you appreciate EarnIn's service, you can even give them a tip.

It also has Balance Shield which notifies you if your balance falls below your selected threshold amount (0-$500). You'll get access to $100.00 of your earnings to help keep you afloat.[4]

What You Get:

- Loan Amount: up to $150/day, with a max of $750 between paydays [5]

- Processing Time: 1-3 business days via ACH

, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer.

- Repayment Date: Automatic deduction on or after your payday

EarnIn Cash Out Requirements:[6]

- A linked checking account

- A regular pay schedule

- A permanent work location, an electronic timekeeping system, or a PDF timesheet to track your hourly earnings [7]

Your credit score will not be affected. However, EarnIn will put your account on hold and send you an email about your repayment.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $150 a day

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get paid as you work

Get money in your bank in minutes with Lightning Speed for a small fee, or in 1-3 business days at no cost.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

Our next app has so many features that you can consider it an all-in-one cash advance app!

MoneyLion: Best for multiple features

|

|

Out of all the apps on the list, MoneyLion has the most features to get your finances in good shape. Their cash advance is called Instacash, and it comes with no monthly fees and no interest.

You won't need a membership. There also won't be credit checks needed. The free Financial Heartbeat feature even monitors your credit health, savings, and spending.

Like most cash advance apps, tips and express deliveries are optional.

What You Get:

- Loan Amount: Up to $500.00

- Processing Time: 12 to 48 hours; get your cash within minutes through Turbo delivery for a fee[8]

- Repayment Date: Automated repayment on your next payday

MoneyLion Instacash Requirements:[9]

- An account that has been active for two or more months and continues to be active

- History of recurring income deposits in the account

- Positive balance on the account

Do you always forget to pay on time? This next app can be just what you need.

Albert: Best for no late or overdraft fees

|

|

Albert provides overdraft spotting through Albert Instant. There are no late fees, interest, and credit checks.

You can also get your paycheck up to 2 days earlier as long as you set up your direct deposit with Albert Cash. Albert Cash is Albert's debit card feature.

Albert does not offer cash advance but it offers overdraft coverage with similar flexibility to a cash advance. With Albert Instant, you can overdraw your Cash account balance for transactions such as debit card purchases, ATM withdrawals, ACH transfers, and electronic transfers, including ACH.

What You Get:

- Loan Amount: Up to $250.00

- Processing Time: Instantly

- Repayment Date: Automatic upon Albert Cash account fund deposit

Albert Instant Requirements:[11]

- An active bank account linked to an Albert Cash account

- Has activated Smart Money feature on the app

- Has turned on overdraft coverage in app settings

- An Albert Cash account and Genius account in good standing

To protect your sensitive information, Albert encrypts your data using Secure Sockets Layer (SSL), which is also used by major financial institutions.[12]

Need a cash advance instantly? Empower has one of the fastest processing time!

Empower: Best for instant cash advance

|

|

Empower Cash Advance offers one of the quickest cash advances in the market. You can receive your money within a minute for a fee. There's also no credit check needed.[13] Empower charges a monthly subscription fee of $8.00.[14]

You can also opt for the Empower Card. It's the debit card feature that has no overdraft fees. You get free instant deliveries for your cash advances AND get cashback deals of up to 10%.

What You Get:

- Loan Amount: Up to $300.00

- Processing Time: 2-5 days; w/in 15 minutes for a fee

[15]

- Repayment Date: Next Payday

Empower Cash Advance Requirements:[16]

Eligibility for the cash advance depends on your account activity (checking or external bank account).[17] They don't explicitly state what their requirements are. But they check on:

- Frequency of your paycheck

- Amount of your paycheck

- Spending habits

They constantly update your account for eligibility. That means you can get eligible (or not) anytime. Be sure to check your account regularly.

Among the cash advance apps on the market, Empower is the fastest. They can get your advance within 15 minutes for a fee.

If you're looking for a smaller cash advance, look no further.

Dave: Best for small amount advances

|

| CREDIT DAVE |

|

|

Dave offers ExtraCash™ advances up to $500. You can also get small advances. It's also very convenient when you need just a little extra to fill up your tank or add to your groceries.

Keep in mind that there is a membership fee of $1.00/mo. Included in this are services such as access to account monitoring, notification services, and maintaining a connection to your external bank account.[18] There are no late fees if you need more time to settle your advance.

What You Get:

- Advance Amount: Up to $500.00

- Processing Time: 1-3 days for ACH transfers. For a fee, you can transfer to a connected account within minutes with express delivery.[19]

- Settlement Date: Next payday or the nearest Friday if Dave can't detect your payday.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Dave ExtraCash™ Eligibility Contributing Factors:[20]

- 3 or more recurring deposits

- Total deposit of $1,000 or more per month

- 60-day history (for setting up external accounts); Dave will also check for possible negative balance

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Have you heard of overdraft spotting? Let us introduce you to Chime.

Chime: Best for overdraft protection

|

| credit chime |

|

|

Chime SpotMe can spot you up to $200 to avoid overdraft fees. They require no credit check, no minimum balance, and no monthly fees.

Alongside that, you can opt for a Chime checking account. It has no overdraft or monthly service fees. And it allows you to access your earnings up to 2 days earlier than your payday.

What You Get:

- Loan Amount: Spot from $20.00 to $200.00.

- Processing Time: Spots overdraft fees immediately

- Repayment Date: Next deposit or payday

An overdraft fee is charged by your bank when you exceed your account balance. With Chime SpotMe, you can overdraw up to $200 without the overdraft fee.

Chime SpotMe Requirements:[21]

- Deposit account connected to Chime

- At least 18 years of age or older

- Activated Chime Visa Debit Card

- Qualifying deposit of $200 or above (34 days before you request for an overdraft spotting)

Our next app has a debit card that lets you have overdrafts. It also has awesome cashback deals!

Current: Best for the overdrive protection feature

|

| CREDIT CURRENT |

|

|

Current Overdrive offers an Overdrive Protection wherein it covers overdrafts with no penalties. But you'll need to use a Current debit card. You'll be notified when it's activated, so you can start being more aware of your spending.

Because you use a Current debit card, you also get Current Cash Back. It gives you points that turn into cash from using the card in participating stores such as Burger King and Forever 21.

What You Get:

- Loan Amount: Overdraft from $25.00 to $200.00

- Processing Time: Overdrive protection is activated after your purchase exceeds your balance

- Repayment Date: Next deposit or payday

Current Overdrive Requirements:[23]

- Active Current account and debit card

- Deposit of $500 and above in your account every 30 days

- At least 18 years of age

Current's banking services are provided by Choice Financial Group, Member FDIC, and Cross River Bank, Member FDIC.[24] Your money is protected up to $250,000 by the federal government.

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Textbooks can cost an arm and one kidney. For students looking for extra cash, check out Kora.

Kora: Best for college students

|

|

Kora is an app that focuses on students' financial needs. Through KoraCash, you can get flexible terms with no annual fees.

Compared to other apps on the list, borrowing from Kora works more like a loan. They charge interest and report your payments to 3 credit bureaus. This makes Kora an excellent app for students trying to build credit.

Why choose Kora? We know how expensive studying in college could be. So, if you are a student who needs a cash advance, sometimes the $250 maximum loan amount is not enough.

What You Get:

- Loan Amount: Up to $3,000

- Processing Time: Depends on the loan amount

- Repayment Date: Up to 12 months; you can pay it off early or set a manual payment date

KoraCash Requirements:

- Must be over 18 years old

- Must be a recent university or college graduate or are currently enrolled

- Valid ID with a Social Security number

Our next app doesn't charge interest or late fees! Keep scrolling to know more.

Klover: Best for no interest or late fees

|

|

Klover has no interest or late fees for their services. You can access their cash advance, which is Klover's Balance Advance Service for free.

There's also Klover+ if you need more features. You'll get Personal Financial Management Services. The subscription is worth $4.99/mo which gives you access to a financial advisor, real-time price comparisons, and credit monitoring.[25]

What You Get:

- Loan Amount: Up to $200.00

- Processing Time: 1-3 days; get an advance within 24 hours for a fee ($1.49 to $20.78)[26]

- Repayment Date: Automatically set based on your next payday

Klover's Balance Advance Service Requirements:[27]

- A checking account that has received at least 3 direct deposits and that has been consistent for 60 days

- Checking account must be in good standing for 90 days or more

- Must have no gaps in pay

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Now that we've talked about the best choices, you might ask, how do they exactly work?

How Cash Advance Apps Work

Cash advance apps can get you between $5 and $750 of your earned wage before your payday with no credit check required. Repayment is usually on your next payday and no interest is charged.

Unlike a credit card advance you can withdraw from an ATM, cash advance apps usually take 1 to 3 days before you can get your money. But for a small fee, you can get your cash within minutes.

Instead of charging interest or overdraft fees, cash advance apps can charge a subscription fee ranging from $1.00 to $8.99. But don't worry, some offer their cash advance feature for free!

Yes, loan apps are safe. Cash advance apps take measures to protect your personal information and banking details. For example, EarnIn requires your bank information and they use encryption technology to keep your bank details safe.[28]

If you're still unsure about using cash advance apps, it's better to weigh the pros and cons.

Pros and Cons of Cash Advance

Solutions to money problems aren't always perfect. Here are the pros and cons of using cash advance apps.

Pros:

- For quick emergencies

Cash advance apps offer some of the fastest processing time. Their express delivery options are reliable for times of urgent financial needs. - Low fees

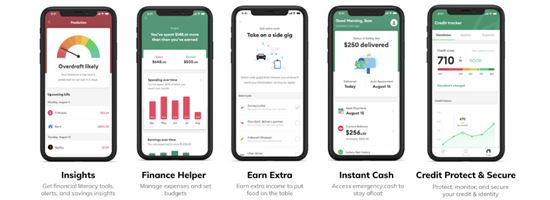

For most of the apps, cash advance is a free feature. Some of them charge a subscription fee that starts at $1.00. Unlike loans, most don't charge you interest. - Finance tools

Many cash advance apps feature financial tools. These tools include side hustle opportunities and ways to improve your credit score. - Fewer requirements

Compared to most lenders and banks, cash advance apps have fewer requirements and they are easier to comply with.

Cons:

- Cash advance cycle

If taking cash advances becomes a habit, then you will depend on money from these apps. A cash advance is a good last resort and not a long-term plan. - Total fees

There's typically a small subscription fee, an express delivery fee, and an optional tip. If you can avoid cash advances, you can save on these fees and place them instead in your emergency fund. - Varying loan amount

The amount of cash advance you can take depends on your qualifications.

So, have you decided to use a cash advance app? The next step would be to check which one of them fits you and suits your needs.

How to choose the best cash advance app

- Check their eligibility requirements

The largest amount you can borrow could be $500.00, but it will vary based on your eligibility. See what requirements you can meet best to have a better chance of qualifying for a higher cash advance. - Look into their possible subscription fee and features

Cash advance apps that don't need a subscription fee are great. But don't overlook apps that charge a fee. They have advanced features that could help you improve your finances in the long run. - Processing time

If you want an instant cash advance, consider an app that has a quicker processing time. Or pick one that can perform an express delivery for a fee.

Cash advance apps do not require a credit check, and using their cash advance feature will not impact your credit score. [29]

What if you've decided not to go for cash advance apps?

Alternatives to Cash Advance Apps

Here are some other options for when you're cash-strapped. But some of these are BAD alternatives you should avoid.

- Borrow from your family or friend

If you're sure to pay on time, you can borrow from your family or friends. It could be uncomfortable, but it could be faster and less tricky than borrowing from lenders. - Buy Now, Pay Later Apps

There are apps (like Klarna and Affirm) that give you the option to pay your purchase in installments. This spreads out your payment and gives you more space to buy your other needs. - Personal Loans

These are unsecured, short-term loans you can pay within 2-5 years. Compared to cash advance apps, lenders have a higher loan amount of $5,000 - $100,000, but they charge interest and origination fees.

BAD alternatives (not recommended!):

- Payday Loans

These are loans with a high-interest rate of 391%! This loan is paid in a lump sum and lenders secure the loan by gaining access to your bank account. In short: it's a trap. - Credit Card Advances

These are loans from your credit card you can take from an ATM. Credit card cash advance charges a fee and very high-interest rates - often from the moment you take it out until it's paid off.You should only use a credit card advance as a last resort if you really need cash fast. And it's good ONLY IF you can pay it off right away.

Cash advance apps give you a better deal because there's no interest. And you automatically pay it back on your next payday.

Cash advance apps can help with your needs until your next payday. But it might be better to learn how to not end up borrowing money for unexpected situations.

Should You Apply For a Cash Advance?

Emergencies are challenging, especially if you're living from paycheck-to-paycheck. But with a cash advance app, you can borrow money even without a credit check.

Applying for a paycheck advance is a reliable option with lower fees to help you save money. They have fewer requirements and can get your money faster with express delivery.

But if you want to finance an impulsive splurge or repay a huge loan, think twice before borrowing from a cash app. Cash advances are best used for emergencies rather than luxuries.

How to Break the Paycheck-to-Paycheck Cycle

When you are considering a cash advance, it's probably because you're in a paycheck-to-paycheck cycle.

If you are hanging by a thread, here are some helpful tips to free you from this financial limbo:

- Assess your financial situation

This advice sounds generic but still rings true. Evaluate your income and expenses to see which spending you can save on. - Make some cuts

Subscription to a streaming service is important, but sacrifices must be made. Cut off some unnecessary expenses and allocate them to more urgent matters. - Budget

Keep track of how much you spend on everything. From rent to the commute, write it down and plan before spending. - Set a goal

Having a financial goal can motivate you to manage your finances better. It can look like paying off all your student debt, having emergency savings, or picking up a side hustle. - Stay consistent

It can be tempting to give in to instant joys in life, like that hotel staycation you've been craving. But a vital step in having a goal is actually following through it. - Savings

While working toward your goal, it could be helpful to start saving up as well. Why pay for hefty interests and fees when you can have your own emergency fund to get you through a rainy day.

How we came up with this list

In creating the list of best cash advance apps, our focus was on finding cash advance apps that had little to no fees. This was important to help our readers avoid excessive charges.

To give you an idea of what cash advance apps need, we included their different criteria for eligibility. We made sure that these requirements are simple and reasonable.

Besides cash advances, we also looked into their useful financial features that can guide you in making better financial choices. So, in this list, we included the cash advance apps' features and tools.

Bottom Line

It is a real challenge when your income does not match the spending for your necessities. You've been working so hard only to run a couple of dollars short. And when you approach banks for a loan, they present you with complicated requirements that make the situation worse.

Now, we have more options for where to get money. There are numerous cash advance apps that can be a quick, short-term solution to our financial problems. The cash advance apps in this article can help you out.

References

- ^ Brigit. How much does Brigit cost?, Retrieved 3/5/23

- ^ Brigit. Can I change my due date, Retrieved 12/19/2022

- ^ Brigit. How to access Instant Cash, Retrieved 3/5/23

- ^ EarnIn. Why did I automatically receive a transfer?, Retrieved 04/18/2024

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. Who can use EarnIn?, Retrieved 12/19/2022

- ^ EarnIn. What are Timesheet Earnings?, Retrieved 12/19/2022

- ^ Moneylion. How soon will I receive my Instacash funds? , Retrieved 12/16/2022

- ^ Moneylion. How do I qualify for Instacash advances? , Retrieved 12/22/2022

- ^ MoneyLion. Moneylion Fee Schedule, Retrieved 3/5/23

- ^ Albert. How do I qualify for Albert Instant?, Retrieved 4/3/2024

- ^ Albert. How you're protected, Retrieved 12/26/2022

- ^ Empower. Terms of Service, Retrieved 12/19/2022

- ^ Empower Finance. Fees, Retrieved 3/5/23

- ^ Empower. Terms of Service, Retrieved 12/28/2022

- ^ Empower. Cash Advance Qualifications, Retrieved 03/14/23

- ^ Empower. Terms and Conditions, Retrieved 03/14/23

- ^ Dave. Dave Membership, Retrieved 3/5/23

- ^ Dave. How the ExtraCash account works, Retrieved 6/10/2023

- ^ Dave. Taking an ExtraCash advance + contributing factors, Retrieved 3/5/23

- ^ Chime. FAQs: Who is eligible for SpotMe?, Retrieved 3/5/23

- ^ Chime. Can I use my Chime Visa Debit Card outside of the United States of America? , Retrieved 12/22/2022

- ^ Current. Overdrive, Retrieved 3/5/23

- ^ Current. Home, Retrieved 12/22/2022

- ^ Klover. Membership fees, Retrieved 04/18/2024

- ^ Klover. 6.2 Express Fees, Retrieved 04/18/2024

- ^ Klover. Eligibility requirements, Retrieved 3/5/23

- ^ EarnIn. Why does the app need my bank account info? Is this safe?, Retrieved 12/19/2022

- ^ Empower. Getting a Cash Advance, Brigit. Does Brigit affect my credit, EarnIn. Does EarnIn affect credit scores?, Moneylion. Will Instacash affect my credit?, Retrieved 01/03/2023

Write to Helen Papellero at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

|

|

| ||||||

|

|

|