Apps Like MoneyLion

MoneyLion is a good app that offers a $500 cash advance. Not quite enough for you? Here are other similar cash advance apps to look at.

|

MoneyLion is a great cash advance app with all of its perks. You can borrow up to $500, plus access features for investing and building credit.

But what if you don't need all that? Or what if you actually need more than that?

Finding a trustworthy lender is hard. You're already cash-strapped as it is. It'd be awful to end up with a predatory lender.

It's a good thing there are many other cash advance apps like MoneyLion. And they come with their own perks too. Read on to find a better fit for you.

Here are other cash advance apps like MoneyLion:

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

10 Best Apps Like MoneyLion

Just like MoneyLion, the best cash advance apps get you your money when you need it. They offer complimentary features too.

Let's start with an app that can get you a couple of bucks.

Dave

|

| CREDIT DAVE |

|

|

Advance amount: Up to $500

Processing time: 1-3 days for ACH transfers. For a fee, you can transfer to a connected account within minutes with express delivery.

Settlement date: On your next payday or the nearest Friday if Dave can't detect your payday.

Why we like it:

You can get your advance with Dave through ExtraCash™. Similar to MoneyLion, there are no credit checks or interest.

Dave also doesn't charge an ATM fee from nearly 40,000 MoneyPass ATMs. But they do charge a monthly membership fee of $1 (one of the lowest in the market).

Dave ExtraCash™ Eligibility Contributing Factors:

To qualify for a higher advance, here's what you'll need on your account:[1]

- 3 or more recurring deposits

- Total deposit of $1,000 or more per month

- An external account with a 60-day history and positive balance

Other Features:

Dave offers Side Hustle which helps you make more income through job opportunities from Dave's trusted partners. You can apply through the app and start earning.

Dave charges a $1 monthly membership fee.[2] Depending on your advance amount, optional express delivery costs $3 to $15 for Dave Spending transfers and $5 to $25 for external transfers.[3] They also accept optional tips. All these are nonrefundable. But other than that, Dave doesn't charge a late fee or interest.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

If having a set repayment date is not for you, we have a few apps where you can set your own repayment date. Check out our next app, Brigit.

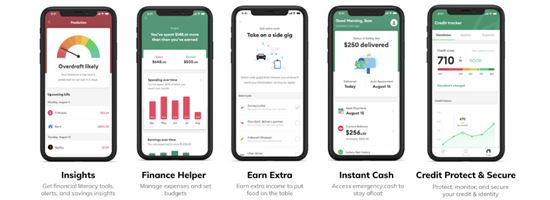

Brigit

|

| CREDIT hellobrigit |

|

|

Loan amount: Up to $250

Processing time: 1-3 business days; w/in 20 mins. for a fee

Repayment date: Choose your own repayment date; pay earlier or get an extension

Why we like it:

Brigit offers instant cash advances through Instant Cash for a monthly fee starting at $8.99.[4] Though this advance amount is not the highest on the list, it comes with flexible repayment. They also have other handy features for when you are low on funds.

Unlike most cash advance apps that set an automatic repayment on your next payday, Brigit lets you choose when you want to repay. There are also no credit checks or interest.

Brigit Requirements:

Once you've paid for a subscription, Brigit's requires:[5]

- A checking account has been active for at least 60 days

- More than $0 in your balance

- 3 recurring deposits on your account from the same source

Other Features:

When you're on the brink of an overdraft, Brigit automatically covers you with an auto-advance. While the Earn & Save feature shows you several opportunities to increase your income.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

For $8.99, you can enjoy identity theft protection, financial helper, credit monitoring, and credit protect and secure.

For a higher cash out amount, we have EarnIn.

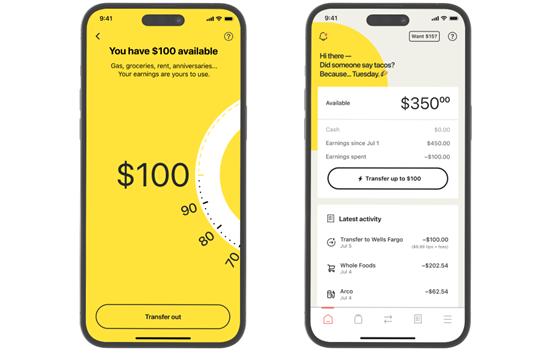

EarnIn

|

| credit earnin |

|

|

Loan amount: up to $150/day, with a max of $750 between paydays [6]

Processing time: 1-3 business days via ACH, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer

Repayment date: Automatic deduction on or after your payday

Why we like it:

With EarnIn's Cash Out feature, you get access to your pay before payday. And it holds one of the highest cash out max amounts at a whopping $750 per pay period. That's $250 higher than Dave!

But be warned, this maximum amount depends on your hourly wages. This makes EarnIn a good idea when you want to ensure you don't cash out more than what you can pay. There are also no credit checks or interest.

EarnIn will not affect or hurt your credit score. If you fail to pay, you will receive an email. They will not report you to a bank or debt collector.

EarnIn Requirements:

To take a Cash Out, you will need:[7]

- A permanent work location or an employer-provided email address

- A regular pay schedule

- A valid US phone number

- A linked Checking account

- Paychecks from a Verified Employer

Other Features:

EarnIn's Balance Shield notifies you when your balance falls below your selected threshold amount (0-$500) and automatically transfers $100 of your earnings.[8]

Yes, EarnIn uses advanced security technology to ensure your data is safe.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $150 a day

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get paid as you work

Get money in your bank in minutes with Lightning Speed for a small fee, or in 1-3 business days at no cost.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

If you usually run low on your account, maybe you've heard of an overdraw and its hefty overdraft fee. Well, this next app can help with that.

Chime SpotMe

|

| credit chime |

|

|

Loan amount: Spot $20 to $200

Processing time: Immediately

Repayment date: On your next deposit or payday

Why we like it:

With no credit check, monthly fee, or minimum balance, you can get a Chime debit card and their immediate $200 cash spotting.

So when you have a low balance, you can avoid the expensive overdraft fee. Of course, you can also make debit card purchases and ATM withdrawals.

An overdraft fee is charged by your bank when your transaction amount exceeds your account balance. It is usually around $35.

Chime Requirements:

Here's what you need to use Chime SpotMe:[9]

- Have an activated Chime Visa Debit Card

- Have a deposit account that is connected to Chime

- Have a qualifying deposit of $200 or above 34 days before requesting an overdraft spotting

- You should be at least 18 years or older

- Have the Chime mobile app

Other Features:

With a Chime Checking Account, you can access your pay 2 days before payday.

No, Chime doesn't charge a monthly fee. Withdrawals are also fee-free in more than 60,000 ATMS. But if you withdraw from ATMs not included in the 60,000, you can be charged $2.50.[10]

Our next app is set by your employer. So you can skip checking off all the requirements needed. Here's Branch.

Branch

|

|

Loan amount: Up to 50% of your pay

Processing time: Instantly (through the Branch digital wallet); 3 business days (bank account)

Repayment date: On your next payday

Why we like it:

Like EarnIn, Branch gives you a cash advance off your pay (through Earned Wage Access). But this time, you can access up to 50% of it. So if you make $2,000 per pay period, the highest amount you can borrow would be $1,000.

And Branch is employer-sponsored, so it's only available through your company. The account would be set up by your employer.

Other Features:

Branch's CashFlow feature helps you make better financial decisions by informing you about your spending.

If your employer doesn't use Branch, try this next one.

Klover

|

|

Loan amount: Up to $200

Processing time: 1-3 days; w/in 24 hrs. for an express fee ($1.49 to $20.78)[11]

Repayment date: On your next payday

Why we like it:

Klover's cash advance feature is called Klover Balance Advance Service. There are no cash advance fees, no interest, and no credit checks.

You can also advance your money 2 weeks before your payday. You'll just have to meet their requirements.

Klover Requirements:

To use Klover, here's what you need:[12]

- A checking account that has received at least 3 direct deposits and has been consistent for 60 days

- Checking account in good standing for 90 days or more

- No gaps in pay

- You are paid on a weekly or bi-weekly pay schedule, 7 or 14 days apart

Other Features:

You can get Personal Financial Management Services through Klover+. This subscription feature, worth $4.99 per month, also gives you access to Klover Cash Out Program and Budget Tools.[13]

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Now, if you're interested in more instant spotting like Chime, our next app has got that in the bag (and more).

Albert

|

|

Loan amount: Up to $250 of spotting

Processing time: Instant (spotting)

Repayment date: Automatic upon Albert Cash account fund deposit.

Why we like it:

Albert's spotting feature is called Albert Instant Overdraft Coverage. With it, you get an app that charges no interest and no late fees. There are also no credit checks.

You can get your overdrafts covered instantly for up to $250. But you need to pay a Genius account fee to access it.

The app is also complete with budgeting and finance improvement tools. You can get your transaction overdrafts covered and develop your finances in one app.

Albert Requirements:

To qualify for Albert Instant, you need to:[14]

- An active bank account linked to an Albert Cash account

- Has activated Smart Money feature on the app

- Has turned on overdraft coverage in app settings

- An Albert Cash account and Genius account in good standing

Other Features:

Albert Cash is Albert's debit card feature. And it lets you get your paycheck 2 days early.

Albert does not charge late fees or overdraft fees, however, failure to repay overdrafts within 10 days may result in temporary suspension from accessing additional overdrafts.

Cash advance apps on the list can't get you tens of thousands. So if you need a higher loan, check out Avant and see if it's worth it.

Avant

|

| credit avant |

|

|

Loan amount: $2,000 to $35,000

Processing time: 1 business day (through ACH)

Repayment date: Monthly installments (1-5 years)[15]

Why we like it:

Avant offers a personal loan from $2,000 to $35,000. It's the highest loan amount on the list. But it comes with a credit check, fees, and APR of around 9.95% - 35.99%.

The amount you get also depends on your credit score, income[16], and state law. [15]

It's not a cash advance app, so it's different from apps like MoneyLion, Empower, and EarnIn.

Other Features:

You can get Avant Loans for more specific needs. This includes adoption, weddings, home improvement, and emergency loans.

You can also opt for an Avant Credit Card. You don't need a security deposit for it and there are no over-limit fees.

Most clients who take a loan from Avant have a credit score from 600-700.[17]

Next on the list has one of the fastest processing time. Let's talk about Empower.

Empower

|

|

Loan amount: Up to $300

Processing time: 2-5 days; w/in 15 minutes for a fee

Repayment date: Next payday

Why we like it:

Empower Cash Advance charges a subscription fee of $8 for up to $300 cash advance.[18] What makes this fee worth it is the quick processing period of the optional instant delivery. There are also no interest, late fees, or credit checks involved.

Other Features:

You can get an Empower Card which is a debit card with no overdraft fees. It comes with free instant delivery of your cash advance. You can also get up to 10% cashback deals.[19]

Last but not the least, the app you can use at Walmart.

ONE@Work

|

|

Loan amount: Up to 50% of your salary

Processing time: 1 business day (no extra charge)

Repayment date: On or after your payday

Why we like it:

Instapay is ONE@Work's cash advance feature. And it lets you access up to 50% of your pay before payday. There are no interest or taxes you need to think about.

It's also complete with a budgeting feature to help you manage the money you're taking. Plus, it's employer-sponsored, so you don't have to worry about requirements.

Not to mention, it has a quick processing time. And you can choose to claim your cash at a Walmart MoneyCenter. But you can also receive your money through your bank account.

You just need to bring your One debit card or barcode, and your valid ID.

Other Features:

ONE@Work's Budgeting feature offers tools for tracking bills and paying them on time. It certainly makes budgeting efficient.

How we came up with the list

MoneyLion is great for its features, especially cash advance. In creating this list, we searched for apps with convenient cash advance and lower fees.

The range of loan amounts you can borrow from apps is huge. In this list, there are apps that can lend you enough for a cheeseburger or build a small fast-food business. And most apps on the list have no interest and no credit check needed!

We also included different features offered by these apps. From budgeting tools to debit cards, you can find a practical addition to your cash advance.

What Is MoneyLion?

MoneyLion is a trusted finance app. It can get you a cash advance of up to $500. You can also buy crypto, invest, and build credit with it.

Unlike banks, MoneyLion doesn't charge interest. And unlike lenders, MoneyLion doesn't need a credit check. What's more, their cash advance feature doesn't require a monthly fee!

MoneyLion is definitely an all-in-one app that's tough to beat. So if you're looking to get some quick cash or a reliable app to help you improve your finances, MoneyLion's got your back.

When should you use MoneyLion?

MoneyLion works well when you need cash, fast. It can get your money delivered within minutes through Turbo delivery. Or you can receive it in your bank account within 2-5 business days with no extra fee.

Keep in mind that using it to splurge may not be a good idea. If you rely on MoneyLion for an impulse buy, you can get trapped in debt quicker than Turbo Delivery. So it's best to stay safe and manage your borrowing.

Why are Apps Like MoneyLion better than Payday Loans?

Apps like MoneyLion are known and used for their convenience and speed. They are a simple sign-up away. And most apps offer express delivery where you can receive the money quickly. Perfect for when you need instant cash!

Not only that, but most of the apps on this list don't need a credit check and have no interest. They also typically have lower fees. Talk about real convenience.

How to choose MoneyLion alternatives?

Before choosing a MoneyLion alternative, you need to check off three things:

- Loan amount

Think about how much you need first. Then choose which app fits the bill. - Processing time

How badly do you need instant cash? The average processing time is around 1-3 days. But some offer express delivery. - Repayment date

Some apps, like Brigit, offer flexible repayment dates. While most apps stick to your next payday. See which repayment date options you can handle.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

Breaking the loan-and-repayment cycle

Getting stuck on a loan-and-repayment cycle is a struggle. You receive your pay only to pay for loans. So you take another loan to have money to spend. It's a nightmare!

But it's not hopeless. Here are some tips you can use to break the loan-and-repayment cycle:

- Find ways to make extra income

There are plenty of side hustles you can try to earn money from. And if you spend a lot of time on your phone, you can go for apps that can make you some money. - Take advantage of budgeting and spending tools

Most apps like MoneyLion offer budgeting tools that can help you spend and save better. - Take note of your due dates

After making money and budgeting, be sure to remember when your loans are due and pay on time. - Have an emergency fund

Having an emergency fund will allow you to rely on your own money more than apps. Save up some cash to avoid future loans. To start, learn about how much you need in an emergency fund.

Bottom Line

MoneyLion is a great option when you need fast cash. But if it's not your best bet, there are plenty of other apps to choose from.

It could be Brigit, which offers flexible repayment dates. Maybe try Branch or ONE@Work if you need 50% of your pay in advance.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

Avant even offers personal loans of up to $35,000. With all the apps on this list, you can find what's more suitable for your needs.

References

- ^ Dave. Taking an ExtraCash advance + contributing factors, Retrieved 4/22/2023

- ^ Dave. Dave Membership, Retrieved 3/22/23

- ^ Dave. How the ExtraCash account works, Retrieved 3/27/2024

- ^ Brigit. How much does Brigit cost?, Retrieved 04/16/2024

- ^ Brigit. How to access Instant Cash, Retrieved 4/22/2023

- ^ EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

- ^ EarnIn. Who can use EarnIn?, Retrieved 3/27/24

- ^ EarnIn. Why did I automatically receive a transfer?, Retrieved 4/16/2024

- ^ Chime. FAQs: Who is eligible for SpotMe?, Retrieved 3/27/24

- ^ Chime. FAQs: How much are Chime ATM fees?, Retrieved 4/22/2023

- ^ Klover. 6.2 Express Fees, Retrieved 3/27/24

- ^ Klover. Eligibility requirements, Retrieved 3/27/24

- ^ Klover. Membership fees, Retrieved 04/16/2024

- ^ Albert. How do I qualify for Albert Instant?, Retrieved 4/1/2024

- ^ Avant. Personal Loans, Retrieved 02/16/2023

- ^ Avant. How much can I borrow? , Retrieved 3/27/24

- ^ Avant. What is the typical credit score of an Avant customer?, Retrieved 4/22/2023

- ^ Empower. Fee Schedule, Retrieved 4/22/2023

- ^ Empower. About Empower Perks, Retrieved 4/22/2023

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Write to Helen Papellero at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

|

|

| ||||||

|

|

|

Compare: