Apps Like Brigit

Brigit is a popular no-interest cash advance app. But it isn't alone in that regard. Read on to learn more.

|

Here are 9 Brigit alternatives:

- Dave®: Up to $500 with ExtraCash™

- EarnIn: Up to $750 with Cash Out

- Empower: Up to $300 with Empower Cash Advance

- Albert: Up to $250 with Instant

- MoneyLion®: Up to $1,000 with Instacash℠

- FloatMe: Up to $100 Float

- Chime®: Up to $200 with SpotMe®

- Varo: Up to $500 with Varo Advance

- Branch: Up to 50% of earned but unpaid wages

Whether you need early access to some of your paycheck proceeds for an unexpected car repair or a small cash emergency, there's no shortage of options like Brigit.

In this article, you'll discover such alternatives, highlighting not just their similarities to Brigit, but also what makes them unique.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

The SMART rule helps individuals remember the key aspects to consider when choosing an app like Brigit:

- Speed: Look for apps that offer fast access to funds.

- Minimal fees: Ensure the app has low or no fees.

- Accessibility: The app should be easy to use and accessible on multiple devices.

- Reliability: Choose a reputable app with positive reviews.

- Transparency: The app should have clear and transparent terms.

9 Best Cash Advance Apps like Brigit

Apps like Brigit offer a quick and easy way to access cash advances, almost always without credit checks. Here are the top picks.

Let's begin with an app where you can advance twice the amount available on Brigit.

Dave®: Up to $500 with ExtraCash™

|

| CREDIT DAVE |

| Timing and Repayment | |

|---|---|

| Get Money | Seconds to a Dave® checking account (with fee) or within three business days |

| Repay | Next payday or nearest Friday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $1 monthly subscription fee |

| Instant Transfer Fee | Starts at 3% or $3, whichever is higher[1] |

| App Rating | |

| Google Play | 4.4 out of 5 ✰ from 528K+ reviews on Google Play[2] |

| App Store | 4.8 out of 5 ✰ from 692K+ reviews on App Store[3] |

With ExtraCash™ from Dave®, you can get an advance of up to $500. If you do, note that it puts your account into a negative balance since it essentially acts like an overdraft.

Don't worry—even if you're technically overdrawing your account, Dave® will not charge you any overdraft fees.

If you need your advance sooner, you must pay 3% of your advance amount as an express fee. This applies to instant transfers to a Dave® account. For external bank accounts, it's 5%.

Dave® ExtraCash™ eligibility contributing factors:

- Sign up for a Dave® account.

- Linked bank account details or Dave® checking account with a minimum 60-day history and a positive balance.

- At least three recurring verified bank deposits.

- Minimum $1,000 total monthly deposit.

- Pay a monthly membership fee.

Transactions or any other actions you authorize through Dave's mobile banking services may be denied if you fail to cover your ExtraCash™ during the repayment period. In addition, if the funds in your linked account are not enough, partial amounts may be deducted until the overdraft is brought to $0.

Pros + Cons

|

|

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Now you know what to expect from Dave®, what if you need a little more than $500?

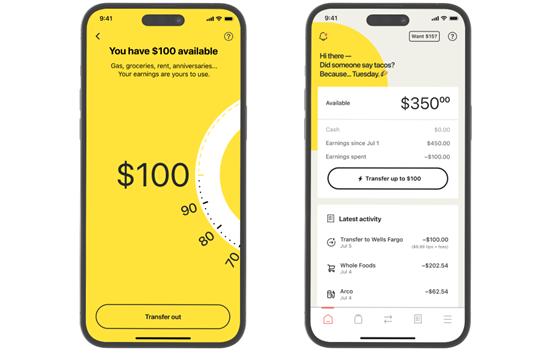

EarnIn: Up to $750 with Cash Out

|

| credit earnin |

| Timing and Repayment | |

|---|---|

| Get Money | Within 1-3 business days via ACH |

| Repay | Upcoming payday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | $2.99 to $5.99/Cash Out transfer[4] |

| App Rating | |

| Google Play | 4.7 out of 5 ✰ from 244K+ reviews on Google Play[5] |

| App Store | 4.7 out of 5 ✰ from 285K+ reviews on App Store[6] |

EarnIn offers more flexibility than Brigit, especially with its pay-as-you-go tipping model, which is a big plus for anyone living paycheck-to-paycheck. But again, tips are welcome.

With EarnIn's Cash Out feature, it maxes out at $750, but there's a daily cap of $150. This means, that if you need $500, you'd have to make four transactions over several days to reach the amount.

In addition, EarnIn has Balance Shield, which helps prevent overdrafts. You'll receive alerts whenever your balance falls below a set threshold. And if your balance drops too low, EarnIn will automatically add $100 to your account to keep you covered.

Aside from the amount you took from your EarnIn Cash Out limit, any Lightning Speed Transfer fee will also be deducted from your incoming paycheck.

EarnIn Cash Out requirements:

- Sign up for an EarnIn account if you're at least 18 and with a valid U.S. mobile number.

- A linked checking account where paychecks are received consistently.

- Employment details.

- Minimum $320 per pay period.

Pros + Cons

|

|

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $150 a day

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get paid as you work

Get money in your bank in minutes with Lightning Speed for a small fee, or in 1-3 business days at no cost.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

Let's see how this next app can help with emergency cash needs.

Empower: Up to $300 with Cash Advance

| Timing and Repayment | |

|---|---|

| Get Money | 15 minutes via Instant Delivery |

| Repay | Whenever you can |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $8 monthly subscription fee[7] |

| Instant Transfer Fee | Starts at $1/transfer[8] |

| App Rating | |

| Google Play | 4.7 out of 5 ✰ from 180K+ reviews on Google Play[9] |

| App Store | 4.8 out of 5 ✰ from 200K+ reviews on App Store[10] |

Like Brigit, Empower is a multipurpose financial app with robust budgeting, savings, and money tools.

Nonetheless, both tools forego credit checks. Instead, your checking account's paycheck transactions practically dictate how much you can advance.

Sure, you can repay at any time without late fees. However, outstanding balances will limit your ability to take additional advances.

Empower Cash Advance requirements:

- Sign up for an Empower account.

- A linked active bank account with regular direct deposits.

- Click Check Eligibility under the Cash Advance section of your Empower app to see how much you can advance.

Empower might have an edge over Brigit thanks to its slightly higher maximum loan amount and lower monthly subscription fee. Both apps start with a similar fee for fast funding, though Brigit waives this for its Premium members. Brigit also offers identity theft protection up to $1 million, adding an extra layer of security for its users.

Pros + Cons

|

|

This next app also offers the same maximum cash advance amount as Brigit.

Albert: Up to $250 with Instant

| Timing and Repayment | |

|---|---|

| Get Money | Real-time via Albert Cash debit purchases and ATM withdrawals; two to three business days via standard ACH transfer |

| Repay | Within a six-day grace period |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $16.99/mo. Genius account fee[12] |

| Instant Transfer Fee | $4.99/transfer to an external bank account[13] |

| App Rating | |

| Google Play | 4.3 out of 5 ✰ from 99K+ reviews on Google Play[14] |

| App Store | 4.6 out of 5 ✰ from 189K+ reviews on App Store[15] |

Albert's Instant feature gives you up to $250 in overdraft coverage. Simply overdraw your Albert Cash account for immediate access to funds.

Note that this feature requires a paid Genius subscription. Since you're paying anyway, use the integrated budgeting tools to organize your accounts and track expenses in one place.

Overdrafts must be paid back within six days, but you can extend for another seven days if necessary. You can't request additional overdrafts until your balance is settled.

Albert Instant requirements:

- Sign up for a Genius membership.

- An Albert Cash account in good standing.

- Activate Smart Money transfers in your settings.

- Opt into overdrafts on debit card purchases, ATM withdrawals, ACH, and other electronic transfers.

- A qualifying direct deposit in the linked account.

While both are very similar, Brigit may provide better income opportunities to its users. With its in-app job board, it lists potential side gigs and paid surveys where you can earn extra money.

Pros + Cons

|

|

Ready for even more apps that can be better than Brigit? You won't be disappointed with this one below.

MoneyLion®: Up to $1,000 w/ Instacash℠

| Timing and Repayment | |

|---|---|

| Get Money | Within 8 hours (with fee) or at least one business day |

| Repay | On scheduled repayment date (usually next paycheck) |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | Tiered fee starts at $0.49/transfer[16] |

| App Rating | |

| Google Play | 4.5/5 ✰ (123K+ reviews)[17] |

| App Store | 4.7/5 ✰ (135K+ reviews)[18] |

In terms of cash advance amounts, MoneyLion®'s blows the competition out of the water. It lets you advance up to four times the amount you can access at Brigit with Instacash℠.

However, you need to have a recurring direct deposit into a RoarMoney℠ account to potentially get the maximum amount of $1,000. Otherwise, the ceiling amount drops to $500.[19]

The app also has tools that help improve your financial literacy and manage your cash flow. This, among other things, makes MoneyLion® a great partner to avoid falling into a cycle of debt and not rely too much on the cash advance feature.

MoneyLion® Instacash℠ requirements:

- Sign up for a MoneyLion® account.

- A linked checking account with a minimum 60-day history and a positive balance.

- At least three direct deposits from the same source or payroll provider into the linked account.

Pros + Cons

|

|

MoneyLion®'s Instacash℠ boosts increase your cash advance limit temporarily. You can acquire them by performing certain in-app activities such as repaying Instacash℠ or Credit Builder Plus loan balances on time.

Of course, there's more. Check out this next one.

FloatMe: Up to $100 with Float

| Timing and Repayment | |

|---|---|

| Get Money | Minutes (with fee) or at least one business day |

| Repay | On your next payday |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $4.99/mo.[20] |

| Instant Transfer Fee | Starts at $1/transfer;[21] |

| App Rating | |

| Google Play | 4.5 out of 5 ✰ from 50K+ reviews on Google Play[22] |

| App Store | 4.8 out of 5 ✰ from 83K+ reviews on App Store[23] |

FloatMe claims to be your BFF, as in Best Financial Friend. Whether that's true or simply a playful use of a popular acronym, you can rely on this Brigit alternative during times of need.

It's simple to use and offers a no-interest cash advance service, Float. Instead of traditional bank fees, it charges a monthly subscription.

FloatMe isn't exactly bare-bones. Features like Personal Financial Management (PFM) Services presents you with information about your linked accounts and transactions to help you better understand and monitor your spending habits.

FloatMe requirements:

- Sign up for a paid FloatMe subscription by downloading the mobile app.

- Deposits of at least $150 per pay period for two consecutive pay periods from an eligible income source.[24]

- Linked checking account with recurring income deposits.

Pros + Cons

|

|

Want one without fees? This next tool is exactly that!

Chime®: Up to $200 with SpotMe®

|

| credit chime |

| Timing and Repayment | |

|---|---|

| Get Money | Immediately after initiating a SpotMe® transaction |

| Repay | On your next direct deposit or fund transfer, whichever comes first |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | $0 |

| App Rating | |

| Google Play | 4.6 out of 5 ✰ from 663K+ reviews on Google Play[25] |

| App Store | 4.8 out of 5 ✰ from 838K+ reviews on App Store[26] |

Chime® is a mobile banking app users love for its no-fee approach. This applies even to their SpotMe® feature. When money is tight, not having extra fees is a big plus.

SpotMe® offers fee-free overdraft protection of up to $200. When used via debit card purchase, you'll receive this notification, "SpotMe has you covered. Your debit purchase at (Store Name) was taken care of by SpotMe."

If you prefer, you can also access your SpotMe® limit at any of its 50,000+ ATMs.

Chime® SpotMe® requirements:

- Apply for a Chime® debit card or Credit Builder card.

- Activate SpotMe® in your app settings.

- At least a $200 qualifying direct deposit from an employer or benefits provider is sent regularly.

Pros + Cons

|

|

What if you're not employed? All hope isn't lost.

Varo: Up to $500 with Varo Advance

| Timing and Repayment | |

|---|---|

| Get Money | Instantly |

| Repay | Within 30 days |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | Tiered cash advance fee starts at $1.60[27] |

| Instant Transfer Fee | $0 |

| App Rating | |

| Google Play | 4.7 out of 5 ✰ from 235K+ reviews on Google Play[28] |

| App Store | 4.9 out of 5 ✰ from 224K+ reviews on App Store[29] |

Varo can spot cash up to $500, which is great for handling unexpected expenses without long wait times.

Like Brigit, this app doesn't ask for optional tips, nor do you have to be employed. You may qualify as long as you have consistent recurring deposits from the same source.

However, it has a mandatory cash advance fee. But that's it. You'll only pay whenever you advance your paycheck.

In exchange, you won't have to pay monthly subscription fees that other cash advance apps ask from you. With your online bank account, Varo has other banking services you can use conveniently.

Varo Advance requirements:

- Sign up for a Varo account. If you already have one, it must be active and in positive standing.

- At least $800 in total qualifying direct deposits[30] to either your Varo Bank Account or Savings Account, or combined.

Pros + Cons

|

|

If you're employed, ask your HR if they offer this next service.

Branch: Up to 50% of your salary with Earned Wage Access

| Timing and Repayment | |

|---|---|

| Get Money | Instant transfer (with fee) or three business days via ACH transfer |

| Repay | On scheduled repayment date (usually next paycheck) |

| Fees | |

| Interest Rate | 0% |

| Mandatory Fee | $0 |

| Instant Transfer Fee | Starts at $2.99/transfer[31] |

| App Rating | |

| Google Play | 4.3 out of 5 ✰ from 34K+ reviews on Google Play[32] |

| App Store | 4.7 out of 5 ✰ from 59K+ reviews on App Store[33] |

Branch is a financial wellness platform offering Earned Wage Access (EWA). Unlike Brigit, it's an employer-provided benefit that allows employees to access up to 50% of their earned but unpaid wages ahead of payday.

You already have this feature if your employer has issued you a Branch Mastercard® debit card. Otherwise, try suggesting Branch EWA to your HR.

For an entirely fee-free experience, just wait three days to withdraw your cash advance.

Branch app doesn't have a lot of fees for the employee user. There are no monthly or overdraft fees, among others. You may only encounter one if:

- You want to transfer funds instantly off of your Branch wallet

- Exceed 8 in-network ATM transactions in a month

- Use ATMs outside the Branch network

Branch EWA requirements:

- Check if your EWA is available with your employer first.

- Sign up for a Branch account.

Pros + Cons

|

|

Now that you've explored apps like Brigit, you can review its features in the following section for a more informed comparison.

How does the Brigit app work?

Brigit works by providing multiple built-in financial tools for borrowing, credit-building, saving, managing, and making money.

While you can use the app for free, you need to be a Plus member at least to enjoy the more complex features. This costs $8.99 per month, $14.99 for a Premium plan.[34]

With Instant Cash, you can access up to $250 as a cash advance. Like most cash advance apps, this amount primarily depends on recurring deposits from a common source. However, unlike paycheck advance apps, the main difference is that this source can either be an employer or a government benefits provider.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Brigit allows a maximum cash advance amount of $250. That said, you may also be entitled to a minimum of $50. This amount is mostly based on your linked checking account's activity.

How to Choose Brigit Alternatives

Getting an advance from Brigit alternatives can be the best solution to your financial hurdle.

But before you sign up for one, here are things to consider:

- Processing time

When you're in a rush, the processing time is a top priority. It will determine how fast you can get the money. Most cash advance apps take less than 24 hours to process and have express delivery options. - Cash advance amount

Determine how much cash you need. Many apps cap their cash advance anywhere from $250 to $500. So before signing up, check if the app can cover your target amount. - Repayment date

Paycheck advance apps on this list set an automatic repayment on your next payday. But there are other repayment options, too. Some let you pay in installments, while others let you choose your repayment date. - Fees

Check for any possible cash advance charges, such as monthly subscriptions and instant delivery fees.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

A cash advance obtained through dedicated apps and fintech providers won't usually affect your credit. This is because it isn't reported to credit bureaus. But when taken out of your credit card, it may increase your credit use. During this instance, it can impact your credit score.

How to get out of a cash advance cycle

Repayment can sometimes be its own challenge. Budgeting your next salary to pay bills alongside your cash advance can be difficult.

Tips to breaking the cash advance and repayment cycle include:

Use budgeting and spending tools.

Many apps on this list offer budgeting assistance and saving tools. Use them to help improve your financial health.

Earn extra income.

Instead of payday loans, why not go for apps that can make you some money first? Or try a few side hustles to capitalize on your other skills.

Take note of your due dates.

Needless to say, you must be responsible for the cash advance you make. Set reminders of your repayment dates to help you prepare and pay on time.

Cash advances are great for minimal cash emergencies in between paychecks. Instead of resorting to traditional payday loans, you can advance a portion of your earned wages without interest or the usual banking fees through instant cash advance apps.

Alternatives to Cash Advance/Loan Apps

Other than cash advance apps, here are a few more ways to access cash for emergencies:

- Borrowing money from a friend

Accessing money from someone close to you with extra cash is an option. Family loans may be even better, if possible. - Use your credit card

Especially if you're running short on groceries before your paycheck arrives, a credit card can be a lifesaver. And then, pay it in full on the due date to avoid interest. - Personal loan

For emergencies that call for more than a thousand dollars, taking out a loan could be your best bet. Try nearby credit unions, some of which offer small-dollar loans with lower fees and more manageable repayment terms.

For instant cash transfers, you must sign up with a fintech app that offers cash advances. You also have to link the bank account where you receive consistent direct deposits. You will either pay a fast-funding fee or be a premium app member (as in the case with Brigit Instant Cash) to get your money in seconds.

Methodology

Brigit is a reliable cash advance app. So when making this list, we looked for other apps that you can count on during emergencies.

We also made sure that they could offer you a range of loan amounts. Need only a couple hundred? No problem. Want your full pay right away? We got an app for that, too.

Furthermore, we looked into other features like having financial tools that help you manage your money. That way, we know you're in good hands every time you get strapped for cash.

Bottom Line

While Brigit may be excellent for small cash advances, it still might not be for every financial situation.

Consider similar apps like Dave®, MoneyLion®, and Empower. They share Brigit's no-frills advance service but may be better in terms of offering higher amounts, faster processing times, and flexible repayment terms.

But, if you find yourself using such apps too often, it may be better to get a side hustle and spend responsibly to avoid a cycle of debt.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

References

- ^ Dave®. Get up to $500 in 5 minutes or less, Retrieved 03/20/2025

- ^ Google Play. Dave: Fast Cash & Banking, Retrieved 03/20/2025

- ^ App Store. Dave: Fast Cash & Banking, Retrieved 03/20/2025

- ^ EarnIn. Lightning Speed fees and Details, Retrieved 03/20/2025

- ^ Google Play. EarnIn: Make Every Day Payday, Retrieved 03/20/2025

- ^ App Store. EarnIn: Make Every Day Payday, Retrieved 03/20/2025

- ^ Empower. Why Empower Cash Advance, Retrieved 03/20/2025

- ^ Empower. Why Empower Cash Advance, Retrieved 03/20/2025

- ^ Google Play. Empower: Advance & Credit, Retrieved 03/20/2025

- ^ App Store. Empower: Cash Advance & Credit, Retrieved 03/20/2025

- ^ Empower. Why Empower Thrive?, Retrieved 03/20/2025

- ^ Albert. How much does Albert cost?, Retrieved 03/20/2025

- ^ Albert. What are direct transfers?, Retrieved 03/20/2025

- ^ Google Play. Albert: Budgeting and Banking, Retrieved 03/20/2025

- ^ App Store. Albert: Budgeting and Banking, Retrieved 03/20/2025

- ^ MoneyLion®. MoneyLion fee schedule, Retrieved 03/20/2025

- ^ Google Play. MoneyLion: Bank & Earn Rewards, Retrieved 03/20/2025

- ^ App Store. MoneyLion: Banking & Rewards, Retrieved 03/20/2025

- ^ MoneyLion®. Get Paid Any Day, Retrieved 03/20/2025

- ^ FloatMe. Meet your Best Financial Friend, Retrieved 03/20/2025

- ^ FloatMe. Terms and Conditions, Retrieved 03/20/2025

- ^ Google Play. FloatMe: Budget & Cash Advance, Retrieved 03/20/2025

- ^ App Store. FloatMe: Fast Cash Advance, Retrieved 03/20/2025

- ^ FloatMe. Why do I need recurring income?, Retrieved 03/20/2025

- ^ Google Play. Chime - Mobile Banking, Retrieved 03/20/2025

- ^ App Store. Chime - Mobile Banking, Retrieved 03/20/2025

- ^ Varo. Varo Advance Fees, Retrieved 03/20/2025

- ^ Google Play. Varo Bank: Mobile Banking, Retrieved 03/20/2025

- ^ App Store. Varo Bank: Mobile Banking, Retrieved 03/20/2025

- ^ Varo. Varo Advance Overview, Retrieved 03/20/2025

- ^ Branch. Fee Schedule, Retrieved 03/20/2025

- ^ Google Play. Branch: A Better Payday, Retrieved 03/20/2025

- ^ App Store. Branch: A Better Payday, Retrieved 03/20/2025

- ^ Brigit. How much does Brigit cost?, Retrieved 03/20/2025

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Build Credit While You Bank

- Get Paid Up to 2 Days Faster

- Build credit and earn points with every swipe

- 40,000 fee-free Allpoint ATMs in the U.S.

- No credit check, minimum balance or hidden fees

Write to Penny Besana at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

|

|

| ||||||

|

|

|

Compare: