What Is a Good PE Ratio?

P/E ratios are always mentioned by investors, but what is it? And how can you use it to make smarter investment decisions?

|

Think of the price-to-earnings (P/E) ratio as a price tag on a company. Investors use it to decide if they're paying too much, just the right amount, or getting a bargain on its shares.

The question is: what is considered to be a good P/E ratio, and how can you use it to your advantage?

What is P/E Ratio?

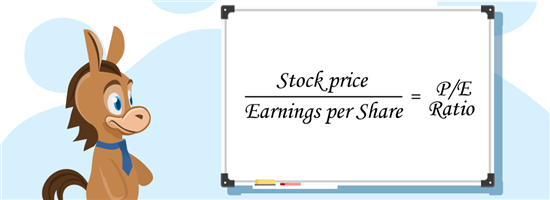

The P/E ratio is a figure that compares a company's stock price to its earnings. To calculate it, divide the stock's current market price by its earnings per share (EPS). The EPS represents how much profit a company makes for every share of stock it has. Here's what the formula looks like:

P/E Ratio = Current Market Price per Share / Earnings per Share (EPS)

A high P/E ratio means investors expect strong growth, while a low ratio indicates less optimism about future earnings potential.

Why Is It Important?

Let's say you're shopping for a pair of sneakers. You wouldn't just grab the first ones you see, you'd compare prices and styles to other brands.

The P/E ratio is like that for stocks. By comparing a company's P/E ratio (either to its competitors or the whole market), investors can compare companies within the same industry and see if a company is overpriced or undervalued.

Essentially, this means that a high P/E ratio means investors think the company is more expensive compared to its earnings than others. A low P/E means it's cheaper. And a middling P/E means it's about right.

- Industry growth rates - Companies in fast-growing industries have higher P/E ratios due to higher earnings growth expectations.

- Company-specific factors - Strong management, innovative products, and competitive advantage can lead to higher P/E ratios.

- Market expectations - Overall market sentiment and expectations for future economic conditions can impact P/E ratios across industries.

What Is a Good P/E Ratio?

There's no fixed value for a good P/E ratio. A good P/E ratio varies depending on the industry, company-specific factors, and market conditions.

Generally, a P/E ratio between 15 and 25 is considered to be a moderate range, while a P/E ratio above 25 is considered high, and P/E ratio below 15 is considered low.

A high P/E ratio can indicate strong growth expectations but carries more risk. Investors should carefully evaluate the company's financials and growth prospects before investing in stocks with high P/E ratios.

A low P/E ratio may suggest that the company is undervalued or that the investors aren't optimistic about its future earnings. However, it could also be a sign of underlying issues that could impact future growth.

- Is 30 a good P/E ratio?

A P/E ratio of 30 may be considered high, indicating high expectations for future earnings. However, this differs by industry. Investors should assess the company's growth potential and compare it to industry peers.

- Is 5 a good P/E ratio?

A P/E ratio of 5 might be considered low, but it depends on the context. A low P/E ratio may be justified if the company is in a slow-growth industry. However, further analysis is needed to determine the underlying reasons.

- Why is a P/E ratio of 15 good?

A P/E ratio of 15 might be considered good if it aligns with the industry average and the company's growth prospects. It suggests a balanced valuation relative to earnings.

What Is a Good P/E Ratio To Buy?

The decision of whether or not to buy a stock based on its P/E ratio depends on various factors. This includes the company's industry, financials, growth prospects, and overall market conditions.

Investors should carefully consider these factors and conduct thorough research before making investment decisions.

A stock could be considered overvalued if:

- P/E is higher than industry average or overall market

This suggests that investors pay a premium for each dollar of the company's earnings, indicating high growth expectations that may not be justified. For example, a company with a P/E ratio of 30 in an industry where the average is 15 could be considered overvalued.

- P/E is high despite inconsistent/declining earnings

This shows investors still value the company at a premium even though its earnings performance isn't strong. For example, a company with a P/E ratio of 25 but has declining earnings could be considered overvalued due to the disconnect between its valuation and its financial performance.

- P/E is high despite limited/uncertain growth

This means investors are paying a premium for growth that may or may not materialize. For example, a company with a P/E ratio of 20 but has limited growth opportunities could be considered overvalued due to unrealistic expectations baked into its valuation.

Meanwhile, a stock could be considered undervalued if:

- P/E is lower than industry average or overall market

This suggests that investors aren't paying enough for each dollar of the company's earnings, which indicates potential undervaluation. For example, a company with a P/E ratio of 10 in an industry where the average is 15 could be considered undervalued.

- P/E is low despite consistent/increasing earnings

This indicates that investors aren't valuing the company despite its strong earnings performance. For example, a company with a P/E ratio of 12 but has consistently growing earnings could be considered undervalued due to its valuation relative to its financial performance.

- P/E is low despite promising/untapped growth

This indicates that investors are undervaluing the company's potential for future growth. For example, a company with a P/E ratio of 15 but has significant growth opportunities in a developing market could be considered undervalued due to its potential for future earnings expansion.

Risks Of Using P/E Ratio Evaluation

While the P/E ratio can be a valuable tool, relying solely on it for investment decisions can be risky. Here are some risks to consider:

- Oversimplification

The P/E ratio only captures a single snapshot of a company's valuation. It doesn't take future growth potential, debt levels, or other essential factors into account. Overlooking these can lead to misjudging a company's true value. - Industry comparison issues

Comparing P/E ratios across different industries can be misleading. Industries have varying growth rates and profit margins, making direct comparisons inaccurate. A high P/E ratio in a high-growth industry might not be as concerning as a high P/E in a mature industry. - Manipulation and accounting distortions

Companies can manipulate their financial statements to influence their P/E ratios. Understanding accounting principles and red flags is crucial to avoid being fooled by inflated numbers. - Market sentiment and bubbles

High P/E ratios can sometimes reflect market bubbles, where investor enthusiasm inflates prices beyond fundamentals. Chasing high P/E stocks solely based on market sentiment can lead to significant losses if the bubble bursts. - Over-reliance on historical data

The P/E ratio is based on past earnings. While it can be a starting point, it doesn't guarantee future performance. Companies can experience unexpected changes in earnings, making past P/E ratios less relevant. - Neglecting qualitative factors

The P/E ratio is a quantitative measure. It doesn't capture qualitative factors like a company's management, competitive advantage, and brand reputation. These factors can significantly impact a company's future performance and should be considered alongside the P/E ratio.

Bottom Line

The P/E ratio can be a valuable tool for evaluating a company's financial health and growth potential, but it isn't an end-all, be-all.

If you're researching about which stocks to buy, you should consider other factors, conduct thorough research, and understand the risks involved before making any investment decisions.

Write to Miel Ysabel at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|