Starting Check Number

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Your starting check number has a big impact on recordkeeping. Take a look at how to find this reference number.

|

There are several ways to identify your starting check number.

Keep reading to learn how to make sense of all the numbers on your personal check. Plus, find out the best ways to order checks from your bank quickly.

What is a Check Number?

|

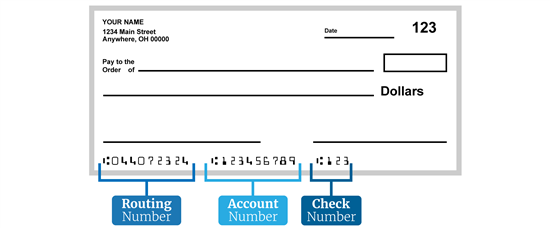

The check number is generally the last set of numbers (usually 3 or 4 digits long) on a personal check. You can also find this number on the top right of your check.

There are three groups of numbers at the bottom of a check.

- The first group is the routing number

- The second group is the account number

- The third group is the check number

Your check number helps your balance your checkbook, and track which checks have been processed by the bank and which checks are still outstanding.

Do Starter Checks Have Check Numbers?

|

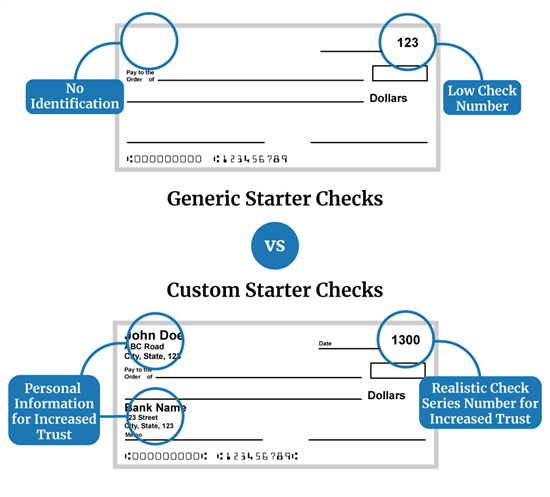

Some starter checks do not have pre-printed check numbers.

There isn't a set rule. Starter checks contain the routing information needed to process the check but they do not include personal information, such as your name or address.

How Do You Find Your Starting Check Number?

Your starting number is the check number that your checking account started with.

Many starting numbers are 1001 because it makes your account look older. You or the bank decide the starting number. But there's no set rule - you can start your first checkbook with whatever number you'd like.

If it's an existing account, you should start your check number where your last check left off.

With a brand-new checkbook, you can find your starting check number on the first check. If that check has been used, contact your bank for this number.

Why Do Checks Start at 101?

You can choose any starting number you'd like. Most people start with 001 but it's up to you.

If you want the starting number to be 101, you would just specify 101 when you order your checks. This number is used to keep track of your own checks and the bank doesn't care what you start with.

You cannot use the same check number twice for one checking account. The bank may void the check and you might be charged a fraud fee.

How Do You Order Your First Check?

When you open a checking account, the bank will give you a few checks to start off. But if you run out, you will need to order more on your own.

There are three ways to order checks for the first time ever.

- Get your checks in-person at the bank - Just head over to your local branch, speak with a representative and order directly. Be sure to verify prices. If you bring your initial set of checks, the process will go much smoother and faster.

- Order online or with the mobile app - Nowadays, most banks, like Chase Bank, let you order via their mobile app. This is a convenient way to order while you're on the go.

- Get checks by phone - You will need to provide your account number and routing number to the representative over the phone.

Compare Checking Account Promotions

Bank of America Advantage Banking - $300 Bonus Offer

- The $300 bonus offer is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new checking customers only.

- Offer expires 05/31/2025.

- To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* totaling $2,000 or more into that new eligible account within 90 days of account opening. Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Once all requirements are met, Bank of America will attempt to pay bonus within 60 days.

- Additional terms and conditions apply. See offer page for more details.

- *A Qualifying Direct Deposit is a direct deposit of regular monthly income – such as your salary, pension or Social Security benefits, which are made by your employer or other payer – using account and routing numbers that you provide to them.

- Bank of America, N.A. Member FDIC.

Chase Total Checking® - $300 Bonus

- New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities

- Chase Mobile® app - Manage accounts, pay bills, send money to friends with Zelle® and deposit checks from almost anywhere.

- Chase Overdraft Assist℠ - no overdraft fees if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*

- Help keep your money protected with features like Zero Liability Protection, fraud monitoring and card lock.

- Chase Total Checking includes FDIC insurance up to the maximum amount allowed by law.

- With over 4,700 branches, Chase has the largest branch network in the U.S. plus access to more than 15,000 ATMs.

- Open your account online now

- Available online nationwide except in Alaska, Hawaii and Puerto Rico. For branch locations, visit locator.chase.com.

Online Checking Account - Earn Cash Back

- 1% cash back on up to $3,000 in debit card purchases each month. See website for details

- No fees

- Early Pay - Get your paycheck up to two days early with no charge

- No credit impact - You can apply without affecting your credit score.

- Access to over 60,000 no-fee ATMs in the U.S.

Bottom line

It's pretty simple to find your check number. You can get the info from a physical check or by contacting your bank. Remember, you can choose any starting number you'd like. This number is for your own recordkeeping. Just make sure it's a number that makes sense to you.

Amber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|