Salary To Hourly Calculator

Want to find out how much you're earning per hour of work? Use this calculator to convert your salary into hourly pay.

|

Being paid a salary is different from being paid by the hour. Instead of an hourly rate, you get paid a certain amount every payday.

Knowing how much you earn per hour can help you understand how you're compensated, plan your finances, and more.

If you're looking to compute your hourly rate, check out this calculator to help you out.

How to use the salary-to-hourly calculator

The salary-to-hourly calculator is simple and easy to use. All you need to do is follow these steps:

- Enter your salary and choose a timeframe from the dropdown menu.

- Input the number of hours and days you work per week.

- Specify the number of weeks you work per year.

From there, click "Calculate" and let it work its magic. You should now see your salary converted into an hourly rate.

The average American usually works 40 hours per week and 52 weeks a year.[1]

In January 2024, the average workweek for employees within US private nonfarm payrolls was 34.1 hours. [2]

Why use this calculator?

Knowing your hourly rate is especially helpful when it comes to budgeting. If you're in a part-time or flexible job, you can plan how many hours you need to work to meet your financial needs.

Let's say that you earn $30/hour (after taxes). If your monthly budget is $4,000, you'll need to work at least 30 hours a week to cover it all.

Your hourly rate is also a good indicator of whether or not you're being compensated fairly. For reference, the federal minimum wage in the US is $7.25 per hour.[3] You could also compare your hourly rate to your industry average.

It could also help if you're transitioning from an hourly rate to a salary rate (or vice versa). For example, you could be earning an hourly rate now but your boss could offer to make you a salaried employee.

If you use the calculator to convert the salary offer into an hourly rate, it'd be easier to find out if you're getting a pay raise or not.

Convert Annual Salary Into Hourly Rate

Your annual salary is the amount that you'll be earning for the entire year.

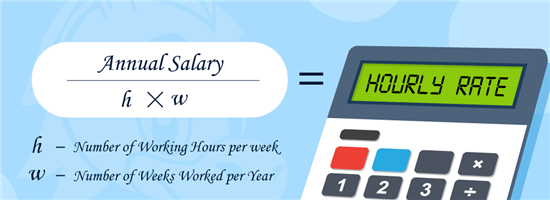

To convert it into an hourly rate, multiply the number of hours you work per week by the number of weeks you work per year. Then, divide your annual salary by that figure. Here's what it looks like in a formula:

Hourly Rate = Annual Salary ÷ (No. of Hours Worked per Week x No. of Weeks Worked per Year)

Let's say that you're earning an annual salary of $83,200. You work 40 hours a week and 52 weeks a year. Here's what the calculation would look like:

$83,200 ÷ (40 x 52) = $40

Salary vs. Hourly - What's the Difference?

Salaried and hourly employees are similar in that they're both compensated for the work they do. However, there are a few key differences between the two:

| Salaried Employee | Hourly Employee |

|---|---|

| Receives fixed pay based on their agreement with their employer | Receives pay based on the hours they worked for a particular pay period |

| Receives pay no matter how many hours they work | No work means no pay |

| Exempted from overtime pay (unless agreed upon) | Opportunities to get paid more due to overtime |

| Usually provided with benefits (e.g. health insurance) | Usually only receives hourly wage (no additional benefits) |

How to Calculate Hourly Rate If You're Not a Salaried Employee

The calculations above work best for salaried employees or those who work 40 hours a week. However, not everyone is a regular salaried employee. There are those who:

- Work irregular hours (e.g. working 20 hours one week, then working 30 hours the next)

- Work exclusively on a per-project basis

- Earn tips on top of their wages

- Are self-employed

Let's say you're someone who works a different number of hours per week. You can calculate your hourly rate either on a weekly, bi-weekly, or monthly basis. It'll depend on how frequently you're getting paid. Here's what the formula would look like:

Hourly Rate = Compensation Received ÷ No. of Hours Worked

Let's say you earned $500 for working 20 hours this week. Here's what the calculation would look like:

$500 ÷ 20 = $25

How to Calculate Hourly Rate If You're Self-Employed

Self-employed, freelancers, or independent contractors are those who don't work for a specific employer. Rather than being paid a consistent salary, they earn income by directly offering their expertise to a client.

To calculate your hourly rate, divide your total income (including business expenses) by the total number of hours worked (including unpaid time). Here's what the formula would look like:

Hourly Rate = (Income - Business Expenses) ÷ No. of Hours Worked

Let's say that you earned $9,000 for the month of October. However, you spent $2,500 for supplies, hired labor, and other costs. You also worked 100 hours and spent 30 hours purchasing supplies and getting clients. Here's what your hourly rate calculation would look like:

($9,000 - $2,500) ÷ (100 + 30) = $50

How Tips Affect Your Hourly Rate

Some jobs can earn you cash tips on top of your hourly pay. This means that you can potentially earn more than just your regular wage, meaning your hourly rate is actually higher.

To calculate your hourly rate, remember to add up and keep track of all the cash tips you received for a certain period. From there, divide it by the number of hours worked and add it to your hourly wage. Here's what the formula looks like:

Hourly Rate = Hourly Wage + (Cash Tips ÷ No. of Hours Worked)

Let's say that on top of your $6 hourly wage, you earned $3,500 in tips in October. You worked a total of 140 hours for that month. Here's what the calculation would look like:

$6 + ($3,500 ÷ 140) = $31

Bottom Line

Once you know what your hourly rate is, you can use it to plan your daily or monthly budget. You can even use it as an indicator of whether or not you're being compensated fairly for your work.

Converting your salary into your hourly rate is made quick and easy with this salary to hourly calculator. Just enter your data, press "Calculate," and in a matter of seconds, you'll know what your hourly rate is.

References

- ^ U.S. Bureau of Labor Statistics. Average hours employed people spent working on days worked by day of week, Retrieved 02/08/2024

- ^ U.S. Bureau of Labor Statistics. Table B-2. Average weekly hours and overtime of all employees on private nonfarm payrolls by industry sector, seasonally adjusted, Retrieved 02/08/2024

- ^ U.S. Department of Labor. Minimum Wage, Retrieved 02/08/2024

Write to Patrick Santos at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|