M1 Finance Review: Pros and Cons

Is M1 Finance legitimate and safe? Find out the pros, cons, fees, and more. An essential read for beginners interested in M1 Finance.

Overall Score | 3.9 | ||

Annual Fee | 5.0 | ||

Minimum Deposit | 5.0 | ||

Mobile App | 4.5 | ||

Customer Service | 3.5 | ||

Ease of Use | 4.5 | ||

Research | 1.0 | ||

Pros and Cons

- Choose your own investments

- Can invest in individual stocks

- Morning and afternoon trade windows

- No research

- No human advisors

- Platform fee

Bottom Line

Commission-free investing app that allows you to choose your own investments

If you want to be hands-off, but still with a say in your investments, M1 Finance may perfectly bridge the gap.

It stands out by letting you create and customize your own portfolio. Then the automated service will manage your account.

And what's more? There are no commission or trading fees.

Does its service live up to what it promises? Keep reading to find out.

- Who M1 Finance Is Best For

- How M1 Finance Works

- Portfolio Features

- How to Get Started

- Platform and App

- Fees

- M1 Borrow

- Downsides

- Is M1 Finance Safe?

- How M1 Compares

- FAQ

What is M1 Finance: Overview

M1 Finance offers 3 main services:

- M1 Invest: Build your own portfolio with stocks & ETFs or invest in premade portfolios. M1 will manage all of it for you. You get to choose exactly how much control you want over your investments.

There are no trade fees or management fees. Get started today with just $100 ($500 for retirement accounts).

- M1 Borrow: A loan service that lets you borrow up to 50% of your portfolio's value at a low interest rate.

- M1 Earn: M1 High-Yield Cash Account offering competitive APY on your Cash Account balance.

Who M1 Finance Best For

- DIY investors. M1 gives you the best of both worlds. You can customize your portfolio and invest in any individual stocks and ETFs you wish. M1 manages it all for you.

- Set it and forget it investors. You can set up an auto-invest schedule. M1 will withdraw the funds from your bank account and invest them automatically according to your portfolio.

- Beginners. If you don't know what to invest in, M1 Finance has over 60 pre-built Model portfolios. You can simply select one (or more) of those.

- Long-term investors. M1 Finance is geared towards long-term investors rather than day traders or frequent traders. The platform prioritizes the development of features that support wise financial decision-making

Commission Free Stock Trading

M1 Finance allows investors the choice of ETFs and stocks. M1 charges $0 commission fees on trading

Pros & Cons

PROS:

- Create custom portfolios

- Just $100 to start

- $0 commission or trading fees

- Buy fractional shares

- Rebalances your portfolio for you

- Pre-made Model portfolios created by M1

- Borrow against your portfolio balance

- Two trading windows per day

- See M1 Finance Deal >>

CONS:

- Learning curve to create pies

- No human financial advisors

- No tax loss harvesting

- Only offers stocks and ETFs

- No options and mutual funds

Read on to learn more about M1 Finance in detail.

How M1 Finance Works

|

| © CreditDonkey |

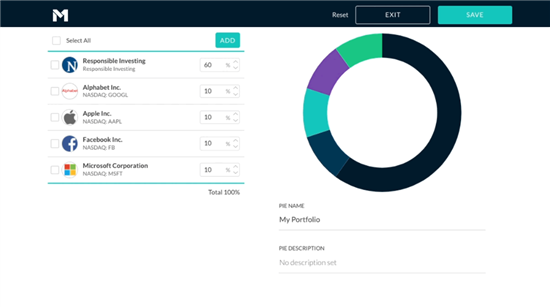

M1 Finance allows you to create a super customized portfolio. This may be a bit overwhelming at first, but the process is straightforward.

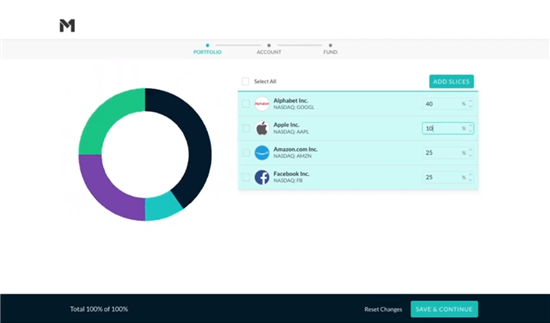

Here is how M1's Pie investing works:

1. Create Your Investment Portfolio

M1 lets users build what they call "Pies." Your Pie is a visual representation of your portfolio. Each Pie can consist of up to 100 "slices", or investments. Each slice can be a stock, ETF, or even another Pie.

You can invest in more than 6,000 stocks and ETFs listed on NYSE and the NASDAQ exchanges. This is different from robo-advisors, which don't let you choose individual stocks.

You set the percentage for each slice. For example, if you want 10% of your investment to be in Apple, that will be 10% of your Pie.

|

| screenshot from m1finance.com |

If you're not sure what to invest in, you can invest in one of the 60+ ready-made portfolios. You can also add Model Portfolios as slices into your custom portfolio.

- General Investing: Portfolio is based on your risk tolerance

- Plan for Retirement: Portfolio will adjust to your goals as you age

- Responsible Investing: Socially responsible portfolio

- Income Earners: More focused on dividends and income returns

- Stocks & Bonds: Just two ETFs; focuses on stocks and bonds

- Other Strategies: Additional investment strategies.

You can create multiple pies to meet your different financial planning goals. Each additional pie appears as a slice of your overall pie.

2. Fund Your Account

When you transfer money to your account, M1 Finance will automatically buy shares of your investments according to the percentages you set.

Using the above example, you've set 10% of your pie for Apple. If you add $1,000 to your portfolio. M1 would use $100 to purchase Apple stocks.

You can also set up automatic contributions if you want to "set it and forget it". M1 will withdraw the funds from your linked bank account and invest accordingly.

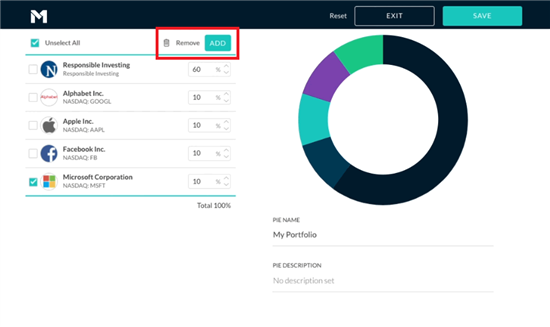

3. Modify Your Pie

You can make changes to your Pies at any time. Simply remove a slice if you want to sell an investment. Add another slice to invest in something new.

|

| screenshot from m1finance.com |

It's super simple. You don't have to worry about the trading yourself.

M1 will also rebalance your portfolio as needed. Keep reading to learn what this means and other features.

M1 Finance does not offer tax loss harvesting, but it does use tax minimization when selling securities. When you request a withdrawal, M1 will sell securities in order to help reduce the amount of taxes you'll owe. Losses that offset future gains will be sold first.

Portfolio Features

|

Here are some advantages of M1's investing service:

Portfolio Rebalancing

|

| © CreditDonkey |

Over time, your pie may shift from what you originally set. Investments that do well will grow, while slices with losses will shrink.

Let's say your pie has 2 investments. 50% is a high-risk stock and 50% is a low-risk bond. But after some time, the high-risk stock does well and accounts for 65%. Now, your portfolio is more risky.

To stay at the same risk level, you'll have to rebalance your portfolio. This means bringing it back to 50/50.

With a DIY broker, you have to rebalance yourself. This means calculating how much to buy or sell for each investment. And then manually placing the trades. Imagine if you have multiple stocks. It can be very time-consuming and confusing.

M1 Finance uses dynamic rebalancing to keep your portfolio on target. You start by choosing your target asset allocation. Then if that changes, M1 will rebalance your portfolio little by little when you add or withdraw funds.

For example, if you have an asset that's overweight, M1 will buy less of it when placing trades. This will bring your portfolio back to your original percentages.

Fractional Shares

You can buy just a small fraction of a stocks if you don't have enough for a full share. This means that every penny is invested. You won't have any uninvested cash sitting around.

For example, Stock A costs $500 per share, but you only have $100 to invest. M1 will just purchase $100 worth of Stock A for you (1/5 of a share).

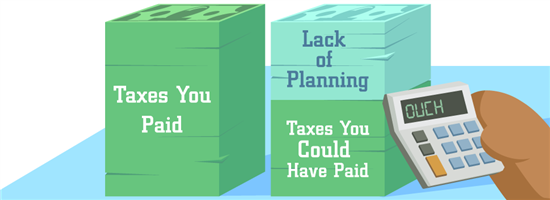

Tax-Efficient Investing

|

| © CreditDonkey |

When you withdraw funds from a taxable account, any gains will be taxed. M1 has a built-in tax efficiency strategy to help reduce taxes as much as possible, so you can keep more of your money.

When you request a withdrawal, M1 will sell securities in order of priority, based on how they affect taxes:

- Losses are sold first, as this reduces your gains

- Long-term gains, as they're taxed at a lower rate

- Finally short-term gains are sold last because these are taxed at the highest rate

Dividend Reinvestment

M1 lets you automate where your dividend payments go. You can set different rules for each security. By default, dividends are added to your cash balance and reinvested based on your Auto-invest settings.

You can also choose to automatically reinvest your dividends once they reach $1, buying more shares of the same security. This strategy, called a dividend reinvestment plan (DRIP), helps boost your earnings.

Alternatively, you can grow your dividends in cash instead of reinvesting them. Dividend payments of $1 or more will automatically be deposited into your High-Yield Cash Account.

Managing your dividend income is simple with M1. You can track paid, pending, and future dividends in one place, giving you a clear view of your earnings. This makes it easier to plan and manage your investments.

How to Get Started

Getting started with M1 is different than robo-advisors. You won't see the typical questionnaire about your risk tolerance, goals, net worth, and income.

Here are the steps to create an M1 investment account:

- Sign up. At this stage, you only need your email address and a password.

- Create Pie. The system will guide you through your first practice pie.

- Open official account: You'll need to verify your identity via your phone number. Then you'll officially sign up with your personal information (name, address, birth date, and Social Security number).

- Select account type. You can select from an individual taxable account, joint, IRAs (Traditional, Roth, or SEP), and Trust. After this, go on to create your pie(s)

- Fund account. You'll need to link a bank account to fund your account.

And that's it. Once the funds are transferred, M1 will do all the work. M1 will buy the investments for you according to your Pie. You can make changes at any time.

Commission Free Stock Trading

M1 Finance allows investors the choice of ETFs and stocks. M1 charges $0 commission fees on trading

Test Before Using

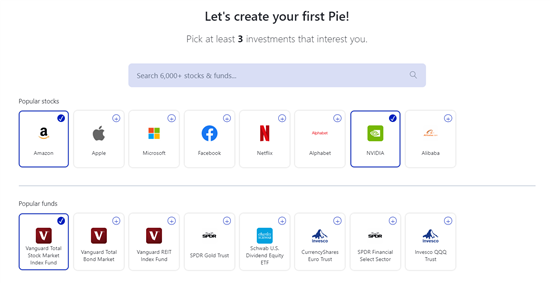

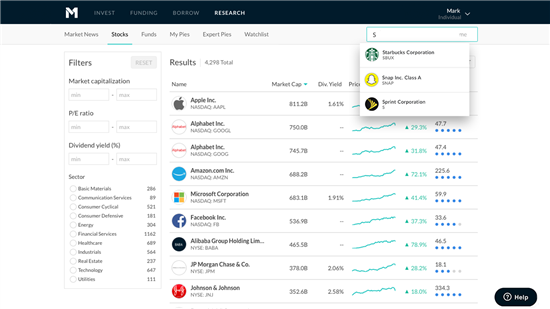

You have to register for an M1 account with your email. However, you have time to play around with the pie system before opening an official account. Here's what it'll look like:

Once you sign up, the tutorial starts. M1 will ask you to pick at least 3 investments to start your pie. It has a list of popular stocks, funds, and Model Portfolios. Or you can enter a specific stock in the search.

|

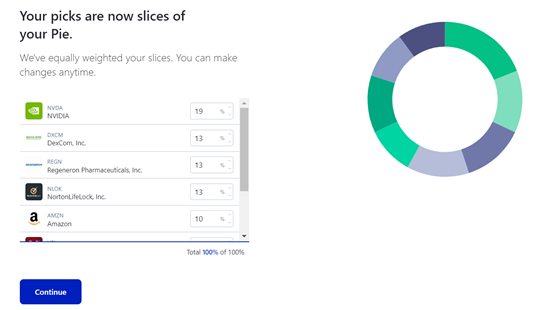

After you've chosen some investments, it's time to set the percentages. By default, your investments are equally weighted. You can change the numbers.

|

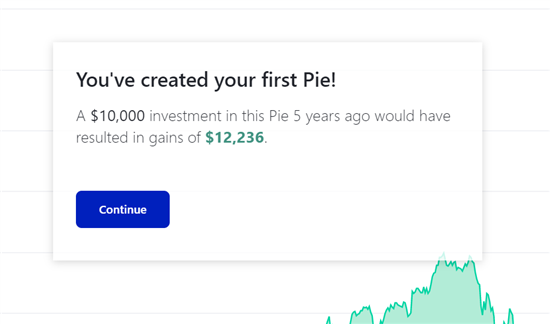

When you're happy with your pie, hit continue. M1 will come up with a projection of how well this portfolio would have done.

|

After this, you can go on to officially open your account with a phone verification and personal info.

M1 Platform and App

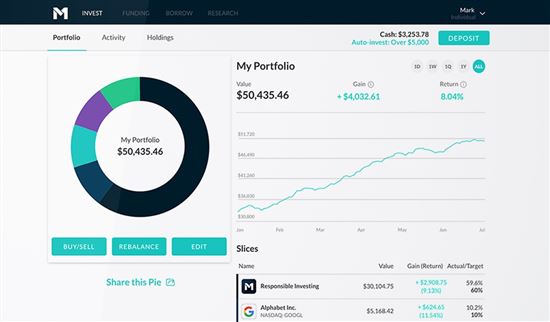

M1 Finance is strictly an online program. You can access the platform via your PC or the mobile app. It's available for both iOS and Android devices.

The platform itself is very user-friendly. You'll see a summary of your portfolio including its value, gain or loss, and return.

|

| screenshot from m1finance.com |

If you want to edit your Pie, simply press the "edit" button. You'll be taken to a page where you can change the target percentages and add or delete slices. M1 Finance will automatically readjust as you do so.

|

| screenshot from m1finance.com |

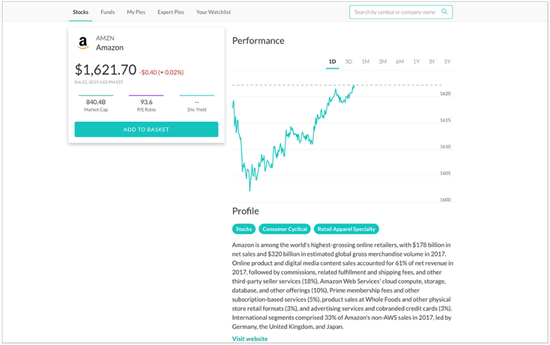

To add a new investment, just click on the "add" button. This will take you to the "Research" tab where you can search for any stock on the major U.S. stock exchanges.

|

| screenshot from m1finance.com |

To get more information about a certain stock, just click on it to find the stock's performance data, price history, and more.

|

| screenshot from m1finance.com |

Overall, the platform is very easy to navigate and creating the pies is intuitive. The mobile app is an excellent companion and works pretty much the same way.

M1 users can access up to two trading windows at 9:30 AM and 3:00 PM ET when the New York Stock Exchange is open. If your Invest Account has less than $25,000, you cannot trade in both the morning and afternoon trade window in a single day.

Fees

M1 is pretty close to being free to use. M1 charges:

- No account opening fees

- No trade fees

- No deposit or withdrawal fees to/from your linked bank

- A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active M1 Personal Loan.

There are some services that may cost you. For example, they will charge you for an account statement or wire transfer. M1 is transparent with their fees, as you can see here.

And there is an inactivity or a minimum balance fee of $50 (for accounts with $50 or less and no trading or deposit activity for 90+ days).

- From the monthly platform fee

- Charging interest on loans from M1 Borrow.

- Lending shares (to short sellers and earning a small profit from this).

- Earning interest from the uninvested cash in your account (instead of giving the interest to you).

M1 Borrow

Imagine if you need some money for a large purchase, like for a house down payment, upcoming wedding, or kitchen remodel.

Normally, you can either save up, get a loan (which is a hassle), or sell off some of your investments. But that'll knock you off track, not to mention having tax consequences.

M1 Borrow provides a super simple and low cost way to borrow money. You can borrow up to 50% of your portfolio balance at an interest rate much lower than traditional loans. This allows you to get access to funds while staying invested.

M1 Borrow is a margin account as well. You could use these loans to invest more. These are called margin loans. If the interest rate is lower than the rate of return, then this can be highly profitable. But you also risk losing more. This is an advanced trading strategy that new investors should avoid at first.

Other benefits include:

- Get a loan instantly with no credit check

- No payment schedule; pay back on your terms

The only requirement is that you have a taxable brokerage account with at least $2,000 invested balance (retirement and custodial accounts don't qualify).

If used responsibly, M1 Borrow can be a convenient tool to borrow money quickly without affecting your credit. However, there is still interest, so be sure to pay it back as soon as possible.

Downsides

- Learning curve. While the platform is straightforward, creating the pies may take some time to learn.

If you want a platform that will do all the work for you, robo-advisors may be a better choice.

- No human financial advisors. While you can ask customer service reps about your account, they are not licensed financial advisors who can offer investment advice.

- Limited investment options. M1 only offers stocks and ETFs - no mutual funds and options. It also offers crypto, but you'll need to open a Crypto account for that.

- No tax loss harvesting. While M1 does tax-efficient trading, it doesn't offer tax loss harvesting, which is a standard feature for many robo-advisors.

- Platform fee. The requirement to waive the monthly fee is quite high. A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active M1 Personal Loan.

Is M1 Finance Safe?

|

M1 is a safe investing app with reliable customer service for beginners. The investment platform gives you control over your money as you save for the long term. It's a registered broker/dealer with FINRA (CRD #281242) and a member of SIPC. You can have peace of mind that your assets and information are secure with M1.

- SIPC Insured. SIPC is a federal corporation that protects your securities up to $500,000 per account if the brokerage goes out of business. SIPC does NOT protect you from losing money through investing.

M1's clearing firm also has supplemental insurance to over beyond the SIPC limits.

- Military-grade encryption. All data transferred and stored within M1's system is protected with 4096-bit encryption.

- Extra login security M1 uses two-factor authentication and fingerprint ID/face ID login to keep your account secure.

M1 Finance is not a bank so it is not FDIC insured. However, the SIPC would cover your losses (up to $500,000 per account) should the platform go out of business. Keep in mind that SIPC does not protect against investing losses.

M1 High-Yield Savings Account does provides FDIC insurance up to $5 million through B2 Bank's Insured Deposit Network Program with other FDIC insured depository institutions.

How It Compares

M1 vs Betterment:

Betterment is often the robo-advisor of choice for beginners. It's completely hands-off. It chooses investments for you according to your risk level. Unlike M1, you don't have the ability to buy individual stocks.

There is no minimum investment. The annual management fee is 0.25% of the assets under management for accounts $20,000 or more, or if you set up recurring monthly deposits totaling $250 or more. Otherwise, it's $4/month.

Betterment also offers a premium account option for those with $100,000+. This gives you unlimited access to financial professionals. They can provide guidance on life events and other investments.

M1 Finance | Betterment | |

|---|---|---|

Commission Free Stock Trading - | Compare Pricing - | |

Benefits and Features | ||

| Savings |

| |

| Stock Trading | ||

| Options Trading | ||

| Annual Fee | A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active M1 Personal Loan. |

|

| Minimum Deposit | $100 ($500 for IRAs, $5,000 for Trust Account) | |

| Checking | ||

| Mutual Fund Trading | ||

| Phone Support | Monday - Friday 9:30 am to 4 pm EST | |

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Assets Under Management | ||

| Tax Loss Harvesting | No, but offers tax minimization features | |

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | Offers checking account with a free debit card, and a high-yield cash account | |

| Mobile App | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. M1 Finance: Pricing information from published website as of 12/26/2023. Betterment: Pricing information from published website as of 11/22/2025 | ||

M1 vs Robinhood:

Robinhood is a basic online brokerage that offers commission-free trades. It's completely DIY. You're in charge of making trades and managing your own portfolio.

Robinhood offers more investment options. You can trade stocks, ETFs, options, and cryptocurrencies.

Robinhood is better for active traders. You get free extended trading hours from 7:00 am to 8:00 pm. And certain accounts even allow for unlimited day trades. M1 Finance offers morning and afternoon trade windows, but you need an account value of at least $25,000 to use both daily trading windows.

| ||

| Learn More | Visit Site | |

M1 Finance | Robinhood | |

|---|---|---|

Commission Free Stock Trading - | Get a Free Stock (worth between $5 and $200) - | |

Benefits and Features | ||

| Stock Trading | ||

| Options Trading | ||

| Annual Fee | A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active M1 Personal Loan. | |

| Cryptocurrency Trading | ||

| Minimum Deposit | $100 ($500 for IRAs, $5,000 for Trust Account) | |

| Mutual Fund Trading | ||

| Commission Free ETFs | All U.S. listed ETFs | All U.S. listed ETFs |

| Phone Support | Monday - Friday 9:30 am to 4 pm EST | |

| Live Chat Support | Available 24/7 (requires sign in) | |

| Email Support | ||

| Human Advisors | ||

| Assets Under Management | ||

| Tax Loss Harvesting | No, but offers tax minimization features | |

| Goal Tracker | ||

| Automatic Deposits | ||

| Broker Assisted Trades | ||

| Good For | DIY investing with passive portfolio management | |

| Inactivity Fee | $50 (for accounts with $50 or less and no trading or deposit activity for 90+ days) | |

| Maintenance Fee | $3 monthly platform fee for accounts with less than $10,000 in M1 assets, or without an active M1 Personal Loan | |

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | Offers Robinhood spending account with Robinhood Cash Card issued by Sutton Bank | |

| Mobile App | ||

| Two-Factor Authentication | Device approvals, Authenticator app, SMS | |

| Forex Trading | ||

| Futures Trading | ||

| Locations | ||

| Online Community | ||

| Seminars | ||

| Trading Platform | ||

| Virtual Trading | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

| Learn More | Visit Site | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. M1 Finance: Pricing information from published website as of 12/26/2023. Robinhood: Pricing information from published websites as of 01/25/2025. | ||

M1 vs Acorns:

Acorns is a micro investing app. It's geared towards beginners who have trouble saving. You link up your cards and it automatically rounds up your purchases and invests the change into diversified portfolios.

Acorns charges a $3 monthly fee for the basic investing account, while the M1 platform fee can be waived if you meet certain requirements.

| ||

| Learn More | Visit Site | |

M1 Finance | Acorns | |

|---|---|---|

Commission Free Stock Trading - | $20 Investment Bonus - | |

Benefits and Features | ||

| Savings | ||

| Stock Trading | Part of service fee. No add-on trading fees. | |

| Options Trading | ||

| Annual Fee | A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active M1 Personal Loan. |

|

| Cryptocurrency Trading | ||

| Minimum Deposit | $100 ($500 for IRAs, $5,000 for Trust Account) | |

| Checking | ||

| Mutual Fund Trading | ||

| Commission Free ETFs | All U.S. listed ETFs | A selection automatically chosen by Acorns |

| Phone Support | Monday - Friday 9:30 am to 4 pm EST | |

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Assets Under Management | ||

| Tax Loss Harvesting | No, but offers tax minimization features | |

| Goal Tracker | ||

| Automatic Deposits | ||

| Broker Assisted Trades | Acorns automatically invest and trade for you | |

| Good For | DIY investing with passive portfolio management | Beginners; Passive investors; Those who have trouble saving/investing on their own |

| Inactivity Fee | $50 (for accounts with $50 or less and no trading or deposit activity for 90+ days) | None, but you will keep paying the monthly fee |

| Maintenance Fee | $3 monthly platform fee for accounts with less than $10,000 in M1 assets, or without an active M1 Personal Loan | |

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | Included in Acorns Bronze ($3/mo). Free metal debit card, no minimum balance, no overdraft fees, and 55,000+ fee-free ATMs nationwide. | |

| Mobile App | ||

| Two-Factor Authentication | ||

| Locations | ||

| Online Community | ||

| Seminars | ||

| Virtual Trading | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

| Learn More | Visit Site | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. M1 Finance: Pricing information from published website as of 12/26/2023. Acorns: Pricing information from published website as of 11/29/2024. | ||

M1 vs Wealthfront:

Wealthfront is a hands-off robo-advisor. You don't get to choose individual stocks. It charges a 0.25% annual fee and has a $500 minimum investment.

One disadvantage of Wealthfront is that it doesn't support fractional shares. So you could just have uninvested cash sitting around. But it does offer automatic tax loss harvesting.

Wealthfront also has a college 529 savings plan, which can be beneficial for parents saving for college.

M1 Finance | Wealthfront | |

|---|---|---|

Commission Free Stock Trading - | Wealthfront Cash Account - | |

Benefits and Features | ||

| Savings | ||

| Stock Trading | ||

| Options Trading | ||

| Annual Fee | A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active M1 Personal Loan. | |

| Minimum Deposit | $100 ($500 for IRAs, $5,000 for Trust Account) | |

| Mutual Fund Trading | ||

| Phone Support | Monday - Friday 9:30 am to 4 pm EST | |

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Assets Under Management | ||

| Tax Loss Harvesting | No, but offers tax minimization features | |

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Mobile App | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. M1 Finance: Pricing information from published website as of 12/26/2023. Wealthfront: Pricing information from published website as of 04/20/2024. | ||

FAQ

Can I use M1 Finance outside US?

No, M1 Finance is only available to US citizens and permanent residents over 18. You must have a US residential address and US phone number. M1 Finance does not let you verify your account with a VOIP phone number.

Can I hold cash in M1 Finance?

By default, M1 Finance automatically invests any idle cash in your account (over $25). But you can set a custom minimum cash balance, if you want to hold a certain amount of cash.

If you turn off Auto-Invest, M1 Finance will never automatically invest cash. So you can hold as much cash balance as you want.

Does M1 Finance automatically buy?

With Auto-Invest (which is the default setting), M1 Finance automatically buys shares according to your portfolio whenever you deposit money.

You can even set up an auto-transfer schedule from your linked bank account. Every time there's a transfer, M1 Finance will automatically buy more shares.

Does M1 Finance have cryptocurrency?

Yes, M1 Finance offers cryptocurrency. You must open a Crypto account to invest in coins and set up crypto pies.

Does M1 Finance have options?

No, M1 Finance does not offer options.

Does M1 Finance have limit orders?

No, M1 Finance does not have limit orders or other advanced orders. It's not meant for active trading. M1 is a long term investment platform for buy-and-hold investors.

How often can you buy and sell on M1 Finance?

M1 users can access morning and afternoon trade windows, whenever the NYSE is open.

Can I transfer my Robinhood account to M1 Finance?

Yes, you can transfer stocks from Robinhood to M1 Finance. You will need the most recent account statement from Robinhood. M1 does not charge a fee, but Robinhood charges a $100 fee to transfer assets out.

What the Experts Say

As part of our series on saving and investing, CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

M1 Finance is best for the DIY investor who also wants to be hands-off. You get to choose your own investments but don't have to handle tedious tasks, like performing manual trades and rebalancing (+1 for ease of use). It's also great that there are no commissions or trading fees.

However, it can take a little time to learn to create pies for beginners.

If you're not sure about making your own choices or you really just want the software to do the job for you, a robo-advisor may be the better option for you. And if you're an investing expert looking for a wider variety of investment options, like mutual funds, you may want to look elsewhere, as well.

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Fund and Get 2% Match Bonus

Enroll in this offer and complete one or more qualifying deposits of $2,000 or more into your Webull account. Maintain the funds in your account until the payment date of the final installment of the match bonus. The 2% match bonus will be automatically credited to your eligible Webull account in 12 equal monthly installments.

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Holly Zorbas is a assistant editor at CreditDonkey, a personal finance comparison and reviews website. Write to Holly Zorbas at holly.zorbas@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: