How to Start an LLC in New York

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Every state has different rules when it comes to starting an LLC. Find out how it works in New York and what you need to do to start one. Read on.

|

New York enforces strict regulations on businesses in the area. They often charge expensive penalties for violations.

That's why you need to familiarize yourself with the process if you want to start an LLC here. Especially since the requirements may differ in other states.

So, how does starting an LLC in New York work? What do you need to create one?

We've got your back in this article.

How to Start an LLC in New York?

|

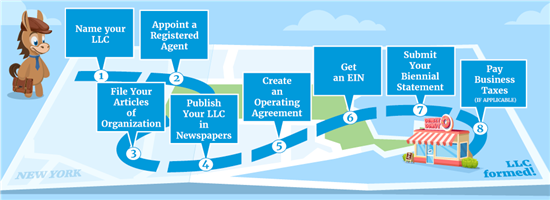

We've nailed down the details of New York's requirements. You can start your LLC in 8 straightforward steps.

Here's what to do first:

1. Name your LLC

Before you can file your formation documents, you need to choose a business name. Preferably something that represents your brand and customers can easily recall.

But it can be anything you want. Just make sure that whatever name you choose follows the state's guidelines.

Here are New York's LLC name requirements:

- It should include words that indicate it's an LLC (like LLC, Limited Liability Company, or L.L.C.)

- It should be unique and can't be confused with other registered companies in the state

- It shouldn't imply an association with any government agency or department

- It cannot be confused with any government agency or department

New York also restricts certain words and phrases. And in some cases, you might need the approval of other state agencies for specific business names.

You can verify if your preferred LLC name is still up for grabs by searching the state's Corporation and Business Entity Database. You can also call the New York State Department's Division of Corporations at (518) 473-2492 if you need extra help. Take note that they charge a $5 search fee for each request.[1]

Make it domain-friendly

Besides the state guidelines, you should also consider how well it'll work as your domain name. Even if you don't plan on creating a business website just yet. That way, you can check its availability and secure it before another company does.

Having the same domain name as your LLC name creates consistency with your brand. And it'll help customers find your business more easily, as well as learn more about it.

Of course, your LLC and domain names don't have to be an exact match. But they should be similar enough that customers won't mistake it for another company and be redirected elsewhere when they search for your company's website.

What if you already have the perfect business name but don't want to form a limited liability company yet?

The good news is that you can reserve it first to make sure no other business registers it before you can.

Reserving your LLC name

You can secure your preferred LLC name by filing an Application of Reservation of Name with the state. Name reservations cost $20 per filing and only last for 60 days.

But if you need an extension, you can file a Request for Extension of Reservation of Name to extend it for another 60 days. Of course, this costs another $20.

Using a DBA for a New York LLC

If you want to use another name to conduct business, you'll need to get a DBA (or "assumed name" in New York). This can give your business additional flexibility, especially for marketing campaigns.

The state requires all companies, including LLCs, to register their assumed names before they can use them in their business activities. You'll have to file a Certificate of Assumed Name with the New York Secretary of State and pay the $25 filing fee.

Just note that your DBA/assumed name, like an LLC name, must be available before registering. You can use the same database to check if it's already taken by another business.

You can still register your DBA as your LLC name as long as no other business has already done so. For example, if your DBA is "Donkey's Donuts," you can register it as "Donkey's Donuts LLC" if it's still available. Or you can cancel your DBA by submitting a Certificate of Discontinuance of Assumed Name to the New York Secretary of State and paying the $25 filing fee.

Aside from your LLC name, you need to secure this next step before filing your Articles of Organization.

2. Appoint a registered agent

Registered agents are a requirement for business entities like LLCs and corporations. You can't form an LLC or corporation without listing one in your formation documents.

In New York, the Secretary of State serves as the default agent for service of process (aka registered agent) for all LLCs in the area. But you can still assign your own if you want.

You just need to file a Certificate of Change with the state department and pay the $30 filing fee to appoint your own agent.

You can assign either an individual or a business to the role. Just make sure that whoever you choose meets the following criteria:

- At least 18 years old at the time of assignment

- Must be a resident of New York

- Has a physical street address in the state (no PO boxes or virtual addresses)

- Is authorized to conduct business in New York (for professional registered agent services)

- Is always available to receive documents in person during regular business hours

You can also be your own registered agent as long as you meet the requirements mentioned. But it's still generally better to assign the role to someone else or use a registered agent service.

Registered agents act as a company's main point of contact. They receive legal documents (like lawsuits, tax notices, and compliance reminders) on your behalf. With their help, you can focus on running your business without worrying about missing important documents as they come in.

Why hire registered agent services in New York?

Assigning yourself or someone you trust to the role is usually less expensive than hiring a professional registered agent service.

But there are a few other reasons it's a good idea, like:

- To save on publication costs

New York has a publication requirement for all LLCs in the state (more on this in another section). And their announcement must run in the county where their principal business address is located.This can be expensive if your office is located in neighborhoods like Manhattan and Brooklyn, where the publication fees can cost upwards of $1,000.

To avoid this, you can hire registered agent services in more rural counties (where it's usually cheaper). And run your announcement there instead.

- To safeguard your privacy

Another major benefit of registered agent services is they can input their address on all public forms instead of yours.So you don't have to worry about your personal information being available to the public.

- To preserve your credibility

A professional registered agent also protects your credibility by receiving service of process documents like lawsuits at their office instead of yours.That way, you don't have to worry about customers, investors, or even neighbors witnessing your business being served.

Once you've already decided on a business name and have a registered agent, it's time to officially form your limited liability company. The next step is how you do it.

3. File your Articles of Organization

You'll need to file your Articles of Organization with the New York State Department and pay the state filing fee. If you're a foreign LLC (NY isn't your home state), you need to file an Application for Authority with the filing fee instead.

It costs $200 per filing to start a domestic LLC in New York,[2] while it costs $250 per filing to create a foreign LLC.[3] You can also request certified copies of your documents for an additional $5 to $25 per document.

Keep in mind that these are just the state fees. Other costs you need to consider are business name reservation, expedited processing, and publication fees.

Your Articles of Organization serve as your LLC's application and official documents after approval. It contains all the relevant information about your New York LLC, such as:

- Entity name

- Official county (where your LLC will be)

- Registered agent details (if appointing your own)

- Mailing and email address

- Management structure

- Effective date (if applicable)

- Dissolution date (if applicable)

- Applicant's name and address

You can file them online using the state's official platform. Or just mail it to the state department's Division of Corporations. You can drop them off in person or send them via fax.

The state will issue an official filing receipt after you submit the documents. Remember to keep this since the state doesn't replace or issue duplicates for lost/damaged receipts.

Also, be sure to double-check the information since this will be the official proof of your LLC application. If there are mistakes in your documents, you'll need to file a Certificate of Correction with the state department and pay the $60 filing fee to correct them.

The average processing time for New York LLCs is 7 business days. You can shorten this by getting expedited processing. But this will cost extra.

After the state approves your LLC, there are a few other requirements you need to comply with, starting with the next step.

4. Publish your LLC in newspapers

New York is 1 of the 3 states with a publication requirement for newly formed LLCs. You need to publish a notice of your LLC's creation in local newspapers within 120 days of its approval.

Your notice should include the following details:

- LLC name

- Official formation date (as indicated in your Articles of Organization)

- Principal business address

- Registered agent's name and address or a statement that the Secretary of State is your registered agent

- LLC's official purpose

- Dissolution date (if applicable)

It should run once a week for 6 consecutive weeks in 2 different newspapers (daily and weekly) in your county. After the 6 weeks are up, the newspapers will give you an Affidavit of Publication.

No, you can't. The newspapers should be in your principal business address's county and approved by the county clerk. Otherwise, the state won't consider it.

You need to submit this to the New York Department of State's Division of Corporations together with your Certificate of Publication and the $50 filing fee[4]. (Foreign LLCs need to use this form instead.)

Complying with New York's publication requirement is a must. Your LLC can lose its good standing with the government if you don't fulfill this requirement.

This can result in your company losing its authority to do business in the state and the ability to pursue legal action against others, like filing lawsuits.

Aside from announcing your LLC's formation, there's another requirement you need to comply with when forming an LLC in New York. Read on to find out what it is.

5. Create an operating agreement

An operating agreement is a document that outlines everything about your company's operations. This can range from daily operations to protocols to resolve possible member conflicts.

New York is one of the few states that require LLCs to have a written operating agreement.[5] In most states, having one is optional but highly recommended.

Yes, it does. A New York LLC operating agreement is required, regardless of how many LLC owners there are.

New York also doesn't impose strict rules on your LLC operating agreement's contents. But generally, it would be a good idea to include the following information:

- Ownership interests

- Initial contributions

- Members' roles, duties, and responsibilities

- Management structure

- Voting and member admissions/departure protocols

- Terms for division and distribution of company profits and losses

- Dissolution

An operating agreement can keep your company running smoothly and efficiently. It can also give you more control over what happens to your business. Having one can even reinforce your LLC's liability protection.

The law states that you need to create one before, during, or within 90 days of filing your Articles of Organization[6].

That said, even though it's a requirement, you don't need to file your LLC operating agreement with the state. You can just keep it with your company's other documents.

You need to file your Articles of Dissolution and pay the $60 filing fee to dissolve your New York LLC. If you're a foreign LLC, you need to file a Certificate of Termination of Existence instead.

6. Get an EIN

An Employer Identification Number (EIN) is a 9-digit number the Internal Revenue Service (IRS) assigns to businesses, mainly for tax purposes. You need to get one for your LLC, even if you don't have or don't plan on hiring employees.

That's because LLCs are separate entities from their owners. And an EIN will be the unique ID number that government agencies use to distinguish your business from other businesses.

Only single-member LLCs can opt not to get one because they can still use the owner's SSN.

To get an EIN, you can apply directly with the IRS or hire someone else to handle it. Applying directly is free but formation companies may charge you for this service.

7. Submit your Biennial Statement

Biennial Statements (called "annual reports" in other areas) ensure that the state's records of your LLC are still accurate and up to date.

They're a requirement for all New York LLCs (domestic and foreign). You have to file them to the State Department even if there are no changes to your information.

It's due every 2 years on your LLC's anniversary month. So, if you formed your LLC in June 2022, you need to submit it in June 2024. After that, the next due date would be June 2026.

The state department sends email reminders at the start of the month if they have your email address on file. So make sure you give them yours in your Articles of Organization to avoid missing the deadline.

How to file your Biennial Statement:

All statements should be filed via the state's e-Statement Filing Service. You need to contact the State Department's Division of Corporations if you can't do it online. They'll give you a paper form to fill out and submit instead.

It costs $9 per filing, which you can pay only using debit or credit cards. They accept Visa, Mastercard, and American Express cards.[7]

Your biennial statement isn't the only ongoing requirement you need to comply with. Next, we'll talk about LLC taxes in New York.

8. Pay business taxes, if applicable

You need to pay the appropriate taxes to keep your LLC compliant and in good standing. And there are a few you need to consider, like the following:

Federal and state income taxes

Like most states, New York LLCs are considered disregarded entities and taxed as either sole proprietorships (single-member) or partnerships (multi-member) by default. The main difference is how they report their federal income taxes.

A single-member LLC must report income taxes as part of the LLC owner's personal tax returns using Form 1040 Schedule C. While a multi-member LLC has to use Form 1065 for reporting federal income taxes.

New York also requires multi-member LLCs to pay estimated income taxes[9] or "annual filing fee." LLC owners need to use Form IT-204 to report this tax.

The annual filing fee is around 4% to 10.9% of your LLC's gross income from New York sources. So this would be $25 to $4,500, depending on how much your income is. You can check the state's full table to learn more about this.

If you choose a C-Corporation tax classification, you must also pay a Corporate Franchise Tax (or simply "corporate tax") in New York.

The exact rate varies per company. Most general business corporations use the following bases to compute their rates:

- Business income (usual rates range from 6.50% to 7.25%)

- Fixed-dollar minimum tax

- Business capital

Self-employment tax

New York LLC owners also need to pay self-employment taxes (FICA) unless they switch to a C- or S-corp tax classification. With corporations, the owners are considered employees.

So they can receive profits from the company's earnings as salaries. Keep in mind that the amount should be something the IRS considers "reasonable."

Pass-through entity tax (PTET)

New York also recently implemented a "pass-through entity tax" (PTET) for disregarded entities like partnerships, multi-member LLCs, and S-corporations.

However, filing this tax is completely optional. If you choose to pay this annual tax, your NY LLC can become eligible for tax credits when you report your income tax returns.

You can check the NY Department of Taxation and Finance's official page to learn more about it.

Other taxes

Aside from these, your LLC might also need to pay other taxes, depending on your business activities and industry. Some examples you need to consider are:

- Sales and use tax

- Employer tax

- Local taxes (city or county)

- Industry-specific taxes

Make sure you research the specific taxes your LLC needs to pay to remain compliant. Otherwise, your company may lose its good standing with the government and incur penalty fees.

Now that your LLC in New York is formed, let's talk about after.

What to do after forming an LLC in New York

Once the state approves your LLC, there are a few other things you need to do to keep everything running smoothly. It'll also help you maximize what your New York LLC offers.

Check them out below.

Open a business bank account.

Opening a separate LLC bank account is critical for reinforcing your LLC's liability protection. A business bank account separates your business and personal finances.

So, even if your company's financial records are scrutinized, you can quickly identify which transactions are for personal or for business use. Which limits the risks to your personal assets. Well-organized financial records will also come in handy during tax season.

You also need a business bank account if you want to apply for additional funding sources, like business loans. Not only will it help you build your company's credit score. But it's also where banks will deposit the funds if they approve your application.

Business Checking Account - $400 Bonus

- Open a new Truist Simple Business Checking or Dynamic Business Checking account online, via phone, or in a branch from 4/1/2025 through 9/30/2025 and earn $400 by making Qualifying Deposits* of $2,000 or more into your new account within 30 days of account opening. Must be a new Truist business checking client, Terms Apply.

- Enrollment in the promotion is required at the time of account opening using promo code SB25Q2BIZAFL to be eligible for a promotion reward. Refer to the Account Opening & Promotion Enrollment sections below for instructions.

- *Qualifying Deposits for new business checking accounts exclude debit card credit transactions and NSF fee refunds. Deposits can be made on a one-time basis or cumulatively over the 30 days.

Chase Business Complete Banking® - Up to $500 Bonus

- Earn up to $500 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities.

- Multiple ways to waive the $15 Monthly Service Fee, including maintaining a minimum daily balance or purchases on your Chase Ink® Business credit card.

- Full-service business banking. Convenient access to all your business banking services in one place -- lending, checking, credit card and payment solutions.

- Your choice of payment types. Choose from a full range of options for accepting payments and making deposits that include Zelle®, Online Bill Pay, wire transfers and ACH payments.

- Convenient access to payment processing. Process all major debit and credit cards with QuickAccept®. It's a built-in feature with your Business Complete Checking account.

- Get support you can rely on. Get access to our customer support team, plus a wide array of solutions that carter to every stage of your business

- Full-featured banking online and on-the-go. Manage your business' finances on your terms with the latest online and mobile banking technology.

- Associate Debit and Employee Deposit Cards available upon request

Bank of America® Business Advantage Banking Checking Account - $200 Bonus Offer

- The $200 bonus offer is an online only offer and must be opened through the Bank of America promotional page.

- The offer is for new eligible business checking customers only.

- Offer expires 12/31/2025.

- To qualify, deposit $5,000 or more in New Money* directly into a new eligible Bank of America Business Advantage Banking account within thirty (30) days of account opening.

- Maintain an average balance of $5,000 in that new Business Advantage Banking account during the Maintenance Period**.

- Once all requirements are met, Bank of America will attempt to pay bonus within 60 days.

- Additional terms and conditions apply. See offer page for more details.

- *New Money is new funds deposited into your business checking account that are not transfers from other Bank of America deposit accounts or

Merrill investment accounts.

- ** The Maintenance Period begins thirty-one (31) calendar days after account opening and ends ninety (90) calendar days after account opening.

- Bank of America, N.A. Member FDIC

Obtain the necessary business licenses and permits.

Make sure your LLC is operating legally by getting the required business licenses and permits. Which will depend on your industry, specific business activities, and location.

For example, if you're selling taxable goods and services, you need a sales tax certificate to collect and pay sales taxes. Some professions (like CPAs, lawyers, or medical professionals) will also need specific licenses and permits to operate within the state.

You can check this page for the most common ones.

Get business insurance.

While forming an LLC protects your personal assets, it doesn't cover any of the costs you incur during the legal process if your business is sued (e.g., lawyer fees, payment for damages, transportation costs, etc.).

That's where business insurance comes in. Your policy will cover these costs, so there is no need to do so using your own money or the company's. Just note that different types of business insurance exist, so make sure you get the ones your business needs.

Some examples are:

- General liability insurance

- Professional liability insurance

- Workers' compensation

- Commercial property insurance

- Business income insurance

You can also get several bundled in one policy, like the Business Owner's Policy (BOP). This usually combines general liability, commercial property, and business income insurance in one. You can check the state's guide for more information about New York business insurance.

Build your business website.

A solid online presence is a must-have for any modern business. That's why creating an official website for your new LLC is critical.

A business website can help customers find you more easily online and help them learn more about the company. That can influence their decision to buy. It can also help your business set itself apart from the competition, especially if it's well-optimized.

But why start an LLC in New York in the first place?

Benefits of starting a New York LLC

Turning your sole proprietorship or partnership into an LLC can offer extra perks for your business.

Here are some of them:

- Liability protection

An LLC is a separate legal entity from the LLC owner. So you don't have to worry about losing your personal assets if your business goes under or experiences issues like lawsuits, debt, or bankruptcy. - Fewer restrictions and requirements

Unlike corporations, a limited liability company doesn't need annual shareholders' meetings, company bylaws, strict recordkeeping, etc. You usually just need to submit an annual report (aka the biennial statement in New York) and pay the filing fees.You can also decide your LLC's management structure (member- or manager-managed). And adding a new member is easier because you just need to get the approval of the other LLC owners.

- Flexible tax options

You can also choose how you want your company to be taxed. By default, an LLC is taxed like a sole proprietor or a partnership. But you can opt for a C-corp or S-corp tax classification if you want additional tax benefits.

Bottom Line

New York tends to be stricter with their regulations compared to other states. And the requirements for LLC formation are somewhat different, too.

That's why it's important to familiarize yourself with how it works in the Empire State. That way, you're sure to comply with the different requirements.

References

- ^ New York Department of State. Reservation of Name for Domestic and Foreign Business Corporations, Retrieved 4/18/2023

- ^ New York Department of State. Articles of Organization for Domestic Limited Liability Company, Retrieved 4/18/2023

- ^ New York Department of State. Application for Authority –Foreign Limited Liability Companies, Retrieved 4/18/2023

- ^ New York Department of State. Certifcate of Publication for Domestic LLCs, Retrieved 09/04/2023

- ^ The New York State Senate. Limited Liability Company Law Section 417 Operating agreement, Retrieved 4/18/2023

- ^ The New York State Senate. Limited Liability Company Law Section 417, Retrieved 09/04/2023

- ^ New York Department of State. Biennial Statements for Business Corporations and Limited Liability Companies, Retrieved 4/18/2023

- ^ Internal Revenue Service. Estimated Tax for Individuals, Retrieved 09/04/2023

- ^ New York Department of Taxation and Finance, Instructions for Form IT-2105, Retrieved 09/04/2023

- ^ Internal Revenue Service. Self-Employment Tax, Retrieved 09/04/2023

Write to Alyssa Supetran at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|