How to Start an LLC in Colorado

Starting an LLC in Colorado? From the naming process to applying on the website, this step-by-step guide will help you out. Read on.

|

So you've made the choice of starting an LLC in Colorado.

It's a good choice, considering it's one of the best states for businesses in the country.

But there are requirements unique to it. You need the secretary's approval, for one.

Let's get into the nitty-gritty below.

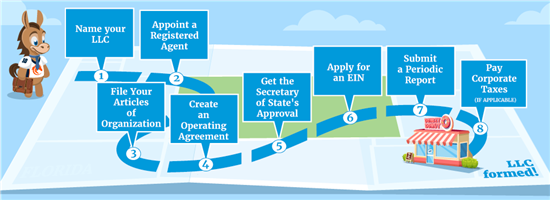

How to Start a Colorado LLC in 8 Steps

|

The things you have to do are not so different when you start an LLC in other states. But there are a few additions.

Let's start with your business name.

Colorado would be a great place to register your LLC. This is thanks to the state's many incentives that help small- to medium-sized companies thrive. And forming an LLC in the Centennial State can offer additional benefits that informal business structures cannot.

Name your LLC

Since LLCs are considered separate legal entities, you'll have to register a business name when filing your formation documents.

And while LLCs enjoy more flexibility for their business names, you still need to follow certain rules when picking out one.

You can check the complete list of Colorado's naming regulations for business entities for your reference. But here are the general naming requirements:

- Must be unique to your business (i.e., no other company has already registered the name)

- Cannot be confused with another registered business in the state (you also can't use articles, suffixes, abbreviations, etc., to create distinctions)

- Should indicate its business entity type (i.e., contains terms like "LLC," "L.L.C.," "Limited Liability Company," etc.)

- Shouldn't indicate or imply an association with government agencies (local, state, or federal)

- Cannot imply a business purpose other than what's registered in its official documents

- Must not suggest that your company engages in any illegal or criminal activities

Make it domain-friendly:

Aside from state guidelines, you should also consider if your LLC name is available as a domain name. Having a domain name that's as close as possible to your business name will make it easier for customers to find your business online.

And even if you're not planning to create a website soon, it's still a good idea to secure the domain name as soon as you decide on an LLC name. This will prevent others from taking it as their own.

You can use domain registrars like GoDaddy, Namecheap, and Bluehost to check its availability and to reserve it.

Reserving your LLC name:

You can reserve your chosen business name if you're not ready to form your LLC yet. Just file a Statement of Reservation of Name through the Secretary of State's website. They've also listed the complete instructions for your reference.

Take note that business name reservations in Colorado last for 120 days. But you can renew it if it expires. Just file a Statement of Renewal of Reservation of Name through the same site.

Colorado allows business owners to trademark LLC names on a state level. However, this generally just covers business names used in advertising or on products.[1] To register a trademark in Colorado, you can do so through the state's online platform.

Fictitious names or DBA in Colorado:

You'll still need to register an official business name even if you already use a DBA (aka "trade names" in Colorado).

Unfortunately, you can't convert your existing trade name into your business name. So, you'll have to withdraw and refile the name with your Articles of Organization.

Then, just file a trade name application if you want to use a DBA for transactions.

The state filing fee for domestic LLCs in Colorado normally costs $50. But it's been lowered to $1 until June 30, 2023, thanks to recent legislation. On the other hand, registration for foreign LLCs costs $100 per filing.[2]

Appoint a registered agent

You need a registered agent if you're starting an LLC in Colorado. The state won't accept your application if you don't have one listed.

Registered agents generally act as the company's primary point of contact. They receive important documents (like legal notices, tax forms, service of process, etc.) on your behalf. They can also remind you of upcoming compliance deadlines.

Anyone can be a registered agent for your LLC as long as they meet the following criteria:[3]

- At least 18 years old (for individuals)

- A resident of and have a physical street address in Colorado (PO boxes and virtual addresses aren't allowed)

- Can legally conduct business in the state (if you hire registered agent services)

- Has a physical business address in Colorado (if you hire third-party services)

- Always available during regular business hours (Mondays to Fridays, 9 AM to 5 PM)

You can be your own registered agent in Colorado. That's as long as you meet the criteria mentioned. Colorado is also one of the few states that allow the business entities themselves (like LLCs and corporations) to be their own registered agents.

File your Articles of Organization

You need to file your Articles of Organization with the Secretary of State's office. All applications should be sent online through their official website.

This will serve as your LLC's official document. And it should contain all relevant information about your business.

For Colorado LLCs, you need to include the following:

- Business entity name

- Official business address (can't be a PO box)

- Official mailing address (if different from your business address)

- Registered agent's details (name, address, contact details, statement of consent, etc.)

- LLC members' information (name and mailing addresses)

- Management structure (member- or manager-managed)

Once you've provided all the required information, you just need to pay the filing fee and wait for approval.

Make sure you double-check everything and that all the details are accurate. If you need to change or correct anything, you need to file your Articles of Amendment online.

Take note that foreign LLCs (LLCs operating outside of Colorado) need to file a Statement of Foreign Entity Authority instead of the Articles of Organization.

Create an operating agreement

An LLC operating agreement outlines and defines a company's structure and operations, including each member's role and responsibility. By establishing clear boundaries within the company, you can decrease the chances of future conflicts and reinforce your Colorado LLC's liability protection.

Although operating agreements aren't mandatory for LLCs in Colorado, creating one is still advisable, especially for multi-member LLCs. Even if you're the only owner of your Colorado LLC, you can still benefit from having a written operating agreement.

It can give you more control over what happens to your LLC if you can't run the business anymore. Without one, the state's default rules will apply, which may not be favorable for your business.

To dissolve a Colorado LLC, you need to file a Statement of Dissolution online. Just search for your LLC's record and follow the instructions to start the process.

In general, LLC operating agreements should contain the following:

- Ownership (members' details, division of company interests, roles, responsibilities, etc.)

- Management structure

- Distributions and dividends

- Voting protocols (e.g., when adding new members or existing ones leave)

- Transfer process for ownership interests

- Dissolution

Since an operating agreement isn't required for Colorado LLCs, you don't have to file it with the state. Just keep it with your company's other important paperwork.

No, there aren't any limits. You can include anything you want in an operating agreement as long as none of it goes against the state's laws and regulations.

Get the Secretary of State's approval

Once the state approves your application, they will issue a certificate proving your LLC now exists.

Unfortunately, they won't send you a physical copy. But you can access it via your company's online records. You can find it under "Filing history and documents" on the website's summary page.

This certificate will allow you to apply for an EIN, open an LLC bank account, and get the necessary business licenses and permits.

All documents submitted online are processed as soon as the state receives them. So you can check if your application was approved almost immediately.

Obtain an EIN

Once your registration is approved and you have the certificate, you can apply for an Employer Identification Number (EIN). It works like a person's Social Security Number (SSN). It will be your business' unique identifier, mainly used for tax purposes.

Getting an EIN is easy. You can apply directly with the IRS online to receive your EIN immediately (if eligible). Or apply through fax, mail, or phone for international applicants.

There is an exemption, however. You can skip the EIN if you're a single-member LLC. But we still recommend getting one since you can use it for many business purposes. You can open a business bank account, hire employees, pay taxes, etc.

Submit a periodic report

Colorado requires all reporting business entities, like LLCs and corporations, to file a yearly Periodic Report (aka an "annual report"). This ensures that your business records are always accurate and updated with the state.

You're required to file one even if there are no changes to your company information. You can do so online by following the state's instructions.

Also, you can file two months earlier than the due date. This will help you avoid non-compliance for missing the deadline AND the $50 penalty fee for late filings.

Pay corporate taxes (if applicable)

Paying taxes is another requirement Colorado LLCs must comply with. The ones that apply to your business will depend on several factors, like its tax classification and specific business activities.

Here are the common ones you need to remember:

- Business income taxes

LLCs in Colorado are taxed like sole proprietors or partnerships by default, which are both "pass-through" entities. That means you only have to pay income taxes on the company's profits once (as part of your personal tax returns).But Colorado LLCs can also choose to be taxed like corporations (C- or S-Corp). If you opt for this tax classification, your company must pay taxes twice (on individual and corporate levels).

- Self-employment taxes

Colorado LLC owners must also pay self-employment taxes because they're not considered employees of the business, unlike with C- or S-corporations. The current federal rate is 15.3% (12.4% for social security, 2.9% for Medicare).[6] - Sales and use tax

If your Colorado LLC sells taxable goods, you need to pay the state's sales and use tax to the Colorado Department of Revenue. The current state tax rate is 2.90%.[7]Take note that some localities impose their own rates on top of the state's tax rate, which can range from 0% to 8.30%. You can use the state's online lookup tool to check what rate applies in your area. - Unemployment insurance tax

Colorado requires certain businesses with employees to pay an unemployment insurance premium. The rate varies depending on several factors. This can range from 0.81% to 12.34%.[8]

Your Colorado LLC might also need to pay industry-specific taxes, like liquor, fuel, and aviation taxes. You can check the Colorado Department of Revenue's official website to learn more about them.

Things to Do After Forming a Colorado LLC

After your LLC in Colorado is approved, there are a few more things you need to do.

Here are some of them:

Obtain the necessary licenses and permits.

Colorado doesn't require LLCs to have a general business license on the state level to operate legally. However, you may need to get specific business licenses/permits, depending on your industry, business activities, and location.

For example, you need to get a sales tax license if your LLC sells taxable goods, so you can collect sales taxes. You can apply for one from the Colorado Department of Revenue.

You should also check with the Colorado Department of Regulatory Agencies (DORA) to see if your LLC needs industry-specific licenses or permits.

Open a business bank account.

Opening a separate bank account for your new LLC is critical to reinforcing its liability protection. With separate accounts, you can easily prove that you're not using company funds for personal purchases (and vice-versa).

In addition, a dedicated business bank account makes your company look more official and professional. This makes it easier for you to build its credit score and apply for additional funding.

Get business insurance.

An LLC's liability protection only secures your personal assets in case your business has unpaid debt or is sued. It doesn't cover legal expenses and losses. That's why it's a good idea to also get business insurance for your limited liability company.

And depending on your business activities and industry, some types of business insurance are actually required. For example, you need workers' compensation if you have employees. And commercial auto insurance for any company-owned vehicles.

Some of the other types you can get are:

- General liability insurance

- Professional liability insurance

- Commercial property insurance

In some cases, you can bundle several types in one policy, like a Business Owner's Policy (BOP).

Create a business website.

In today's digital age, having a strong online presence for your business is a must. The best way to do this is through an official company website.

A website makes your business appear more credible to potential customers, especially if it's well-designed. It also helps them learn more about your business, like what it offers and if it's the right fit for their needs.

You can create one yourself from scratch or use tools like website builders. You can also hire professionals to build it if you want something comprehensive and customized. However, this option usually costs more than doing it yourself.

Benefits of Starting an LLC in Colorado

Colorado is considered one of the best states for businesses. And starting a limited liability company in this state can offer additional benefits you won't get as a sole proprietorship or partnership.

Here are some of them:

- Liability protection

An LLC safeguards your personal assets if your business gets into trouble. You don't have to worry about losing your home, car, or other personal properties to pay for company debt or legal expenses. - Flexible management structure

LLC owners can choose to handle the management themselves (member-managed) or appoint someone else to oversee its operations (manager-managed). - More tax options

LLCs are disregarded entities, so they're taxed like sole proprietorships (single-member LLCs) or partnerships (multi-member LLCs) by default. However, they can also choose to be taxed like corporations if they want additional benefits. - Less "red tape"

In most cases, an LLC only needs to submit an annual/biennial report to remain compliant with state requirements. Meanwhile, corporations need to elect a board of directors, hold annual shareholders' meetings, and practice strict record-keeping. - Cheaper and easier to start

Colorado's state filing fee for LLC formation is only $50. While the filing fee for periodic reports is just $10. - Great support from the state

The state of Colorado offers extensive support for small businesses. Colorado LLCs can access the state's various programs and funding sources to help them succeed.

However, the main downside of an LLC is that you can't sell company shares or stocks to investors as a way to raise capital, unlike corporations. LLC owners also need to pay self-employment taxes since they're not considered company employees.

Yes, you can form a professional LLC in Colorado. Just file your Articles of Organization through the state's online portal and pay the associated fees, like with regular LLC formation.

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Colorado has a highly business-friendly environment, making it one of the best states to start an LLC in. Just follow these 8 steps to do so.

Keep in mind the state's unique requirements to avoid delays, mistakes, and rejections. And be sure to read the full instructions on their site when you begin.

References

- ^ Colorado Secretary of State. Trademarks, Retrieved 03/14/2024

- ^ Colorado Secretary of State. Fee Schedule, Retrieved 4/20/2024

- ^ Colorado Secretary of State. Business FAQs: Q2. Can anyone be a registered agent?, Retrieved 4/20/2024

- ^ Colorado Department of Revenue. Individual Income Tax Guide, Retrieved 03/14/2024

- ^ Colorado Department of Revenue. Corporate Income Tax Guide, Retrieved 03/14/2024

- ^ Internal Revenue Service. Self-Employment Tax, Retrieved 03/19/2024

- ^ Colorado Department of Revenue. Sales Tax Guide, Retrieved 04/04/2024

- ^ Colorado Department of Labor and Employment. Premium Rates, Retrieved 04/04/2024

Write to Alyssa Supetran at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

|