Credit Card Processing Fees

Explore the hidden cost of credit card processing fees and their impact on your business. Stay ahead with well-advised strategies.

|

| © CreditDonkey |

How much are credit card processing fees? The average credit card processing fee is 1.5% - 2.9% for an in-person swiped transaction and 3.5% for an online transaction (due to higher fraud risk).

It goes without saying that being able to accept cards is important for any small business. Unfortunately, processing fees are a necessary cost of doing business nowadays.

Read on to learn what business owners should know about credit card processing fees, including some smart tips to reduce them.

- Average Credit Card Processing Fees

- Credit Card Processing Fees Explained

- Four Pricing Models

- Credit Card Processing Comparison Chart

- Other Credit Card Processing Fees

- What Parties are Involved in Credit Card Processing?

- Are Flat Rate or Interchange-Plus Fees Better?

- Is it Legal to Pass Credit Card Fees to Customers

- Ways to Reduce Processing Fees

- How to Negotiate Lower Credit Card Processing Fees

Average Credit Card Processing Fees

The average credit card processing fee ranges from 1.5% - 3.5%. Here is a breakdown for the 4 major credit card networks:

- Visa: 1.4% - 2.5%

- Mastercard: 1.5% - 2.6%

- Discover: 1.55% - 2.5%

- American Express: 2.3% - 3.5%

The above rates represent the common range across networks. Your specific processing rates will vary based on how you take cards, whether it's a credit or debit card, and more.

We'll break down all of these factors below so that you know how to avoid overpaying.

American Express charges higher processing rates because they target more affluent cardholders. They offer more rewards and perks, so they offset these benefits by charging merchants higher processing fees. But if you find that the processing rates are too high, you can opt for Amex's OptBlue program. If eligible, you can work with other payment processors and use the rates they offer.

Credit Card Processing Fee Explained

|

| © CreditDonkey |

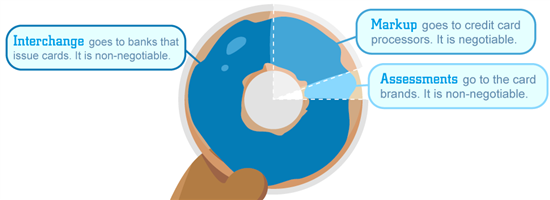

There are 3 factors that go into the total credit card processing fee:

- Interchange fees

These fees go to the banks that issue the credit cards (for example, Chase or Capital One). This makes up the largest bulk of your processing fees. - Assessment fees

These fees go to the credit card networks (Visa, Mastercard, Discover) for using their cards. This is just a very tiny amount. - Processing markup fees

These fees go to the processing provider that helps you process credit card payments. They can take a cut with every transaction plus charge a variety of other account fees.

Read on to learn more about these fees in detail, plus how they are charged.

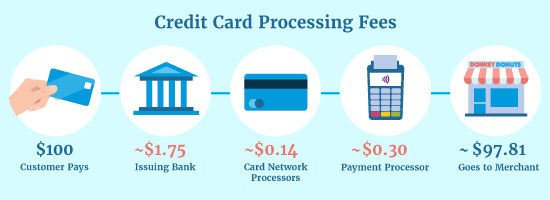

The average credit card processing fee is 1.5%-2.9% for in-person payments and 3.5% for online transactions. So, for a $100 sale, your fee can range from $1.50 to $3.50 depending on the type of payment. But keep in mind that this depends on your payment processor. The total processing cost includes monthly fees and other extra fees.

Stop Overpaying on Credit Card ProcessingSelect your state to talk to an expert on the

The interchange fee is non-negotiable and goes to the credit card company. The assessment fee is non-negotiable and goes to the card association. The markup fee is negotiable and goes to the card processing company.

1. Interchange Fees

Interchange fees are also known as "wholesale fees." These fees are set by the credit card networks (Visa, Mastercard, Discover, and Amex). They go to the issuing bank to cover risk.

Interchange rates are the largest part of the total credit card transaction fees. They are non-negotiable so there's nothing you can do about them.

See list of current interchange rates for Visa, Mastercard, Discover, and American Express.

The rates vary depending on many factors, including:

- Type of card used

Debit cards with PIN have the lowest rates. Premium rewards credit cards have the highest rates since credit card companies use that to make up for the rewards.For example, Visa categorizes cards by retail, rewards, corporate, and business. Each type has its own interchange rate. Right now, Visa Rewards Signature cards cost merchants 2.3% + $0.10 of a transaction. So a $100 transaction would cost you $2.40. - Card brand

Each card brand sets their own rates. They may differ even for the same business. American Express cards have higher processing fees than Visa, Mastercard, and Discover. - Processing method

In-person swiped cards have lower rates, while online purchases have higher interchange fees for the higher risk of fraud. - Type of business

All businesses have a Merchant Category Code. Each code has their own interchange rates. Lower-risk industries have lower interchange rates, while higher-risk industries have higher interchange rates.For example, grocery stores have lower interchange rates than airlines.

However, Amex's OptBlue program offers a more affordable way for small businesses to process Amex cards. With this program, the processing provider sets the Amex processing rates. They are usually in line with that of Visa and Mastercard. This is eligible for merchants who process less than $1 million in Amex transactions per year.

For large businesses processing over $1 million in Amex transactions per year, you must enter a direct processing agreement with Amex. In this case, you'll pay the standard Amex interchange rates.

2. Assessment Fees

Assessment fees are charged by the card networks (Visa, Mastercard, Discover) to cover operation costs. These are also fixed non-negotiable fees.

These fees aren't as high as interchange fees, but they still take away a small percentage. The current assessment fees[1] are:

- Visa: 0.14% (credit), 0.13% (debit)

- Mastercard: 0.1375% (0.1475% for transactions over $1,000)

- Discover: 0.14%

3. Processor Markup Fees

|

On top of the interchange fees, credit card processors charge their own markup. This is the commission they get for each purchase.

The cost will vary depending on the credit card processing company. This is the fee you should be comparing when shopping around for a provider.

Often, the markup fee can be negotiated. Especially higher volume businesses may be able to get discount rates.

For example, the processor may charge 0.20% + $0.10 per transaction. On a $100 transaction, this would cost you $0.30.

Let's say the payment processing provider charges 2% plus $0.15 per transaction, you'd pay $0.15 one hundred times for the lower transaction. Compare that to the five times you'd pay it for the $100 transactions and you'll see the difference.

All these fees are charged through your processing provider. Each one may have their own way of charging. Next, learn about the different pricing structures you will encounter.

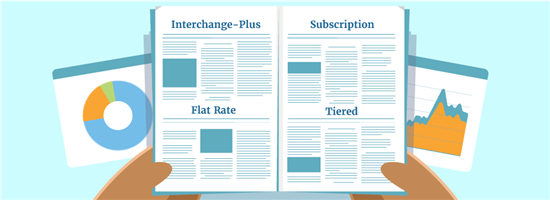

4 Types of Pricing Models

|

Credit card processing providers have four main pricing models. We go over them below, as well as what kind of business each is best for.

| Interchange-Plus | Flat Rate | Subscription | Tiered |

|---|---|---|---|

| Interchange & markup are separate | Interchange & markup are blended | Interchange & markup are separate | Interchange & markup are blended |

| Markup is a % and per-transaction fee | All transactions cost the same, regardless of type and processor | Membership fee for the service, plus each transaction has a small markup | Rates vary according to which tier the transaction falls under |

| Best for: Most businesses | Best for: Low-volume businesses | Best for: High-volume businesses | Best for: Not recommended |

1. Interchange-Plus

This is the most common and transparent model. The interchange fee and markup fee are clearly separated.

Some examples of this pricing structure are:

- Helcim: Interchange rate + 0.40% + $0.08 (for processing up to $50,000/mo; discounts for larger volume) for swiped[2]

- Dharma: Interchange + 0.15% + $0.08 for swiped[3]

The 0.2% + $0.10 is the processor markup over standard interchange rates. It's easy to compare this price against other providers.

The Interchange-Plus pricing model works for most businesses. It can potentially come out to be the lowest cost.

2. Flat Rate

In this model, all transactions are charged the same flat fee. All cards - Visa, Mastercard, Discover, and Amex - get the same processing rate. This structure is usually used by third-party payment services providers.

Some examples of providers with flat rate are:

- Square: 2.6% + $0.10 for swiped cards[4]

- PayPal Here: 2.70% for swiped cards[5]

- Quickbooks Payments: 2.4% + 25¢ for swiped cards[6]

- Stripe: 2.9% + $0.30 for online transactions[7]

The interchange and markup fees are blended together. This is the most simple pricing and the most predictable. You can estimate what each transaction will cost ahead of time.

Flat-rate providers usually don't have any extra monthly fees, as it's all mixed into the processing rate.

The downside is that the transaction cost could be quite high. This option is best for very small business owners with small ticket sizes or lower volume (up to $5,000 in card transactions per month).

With a flat rate of 2.6% + $0.10, a $100 sale would cost you $2.70. This is more than the Interchange-Plus pricing.

On a $10 purchase, however, the flat fee transaction would cost $0.36, while the Interchange-Plus fee would cost $0.38.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 10¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

3. Subscription/Membership

With this model, you pay a monthly membership fee for using the service. On top of that, you may pay a small fixed per-transaction fee. The idea is that the membership fee covers most of the processing costs.

Some merchant account providers with subscription pricing model include:

- Payment Depot: starts at $79/mo[8]

In-store: Interchange rate + $0.08 per transaction

Online: Interchange rate + $0.18 per transaction - Stax: starts at $99/mo[9]

In-store: Interchange rate + $0.08 per transaction

Online: Interchange rate + $0.18 per transaction

This pricing model is best for businesses with high sales volume ($10,000 or more in monthly transactions). Both Stax and Payment Depot don't charge percentage markup on interchange rates, so your savings would justify the membership fees.

4. Tiered

The tiered model was designed to simplify interchange-plus pricing, but it actually ends up being more confusing.

The concept is simple. Instead of the literally hundreds of different interchange rates, you get just 3 flat rates depending on the type of card used:

- Qualified rates for debit cards and non-rewards cards

- Mid-qualified rates for standard rewards cards

- Non-qualified rates for premium cards and card-not-present transactions

But the problem is that most transactions will fall under the mid-qualified and non-qualified tiers, which have much higher rates. In general, your processing fees will end up being a lot more expensive, so we don't recommend this model.

Credit Card Processing Comparison Chart

Here is a quick comparison of the credit card processing rates charged by the top payment processing services.

| Company | Pricing Model | Processing Rates |

|---|---|---|

| Square | Flat rate | 2.6% + $0.10 (retail) 2.9% + $0.30 (online) |

| Stripe | Flat rate | 2.7% + $0.05 (retail) 2.9% + $0.30 (online) |

| PayPal | Flat rate | 2.29% + $0.09 (retail) 2.99% + $0.49 (online) |

| Helcim | Interchange-plus | Interchange rate + 0.40% + $0.08 (for processing up to $50,000/mo; discounts for larger volume) (retail) Interchange rate + 0.50% + $0.25 (for processing up to $50,000/month; discounts for larger volume) (online) |

| Dharma | Interchange-plus | Interchange + 0.15% + $0.08 (retail) Interchange + 0.20% + $0.11 (online) |

| Stax | Subscription | Interchange rate + $0.08 (retail) Interchange rate + $0.18 (online) Starts at $99/month |

| Payment Depot | Subscription | Interchange rate + $0.08 (retail) Interchange rate + $0.18 (online) Starts at $79/month |

It's hard to understand what these numbers mean in real terms. So here's a look at what you can expect to pay with the different companies.

Processing costs for a $20 transaction:

| Company | In-person | Online |

|---|---|---|

| Square | $0.62 | $0.88 |

| PayPal | $0.55 | $1.08 |

| Stripe | $0.59 | $0.88 |

| Dharma | $0.54 | $0.64 |

| Stax by Fattmerchant | $0.51 | $0.67 |

| Payment Depot | $0.51 | $0.67 |

Processing costs for a $100 transaction:

| Company | In-person | Online |

|---|---|---|

| Square | $2.70 | $3.20 |

| PayPal | $2.38 | $3.48 |

| Stripe | $2.75 | $3.20 |

| Dharma | $1.98 | $2.36 |

| Stax by Fattmerchant | $1.83 | $2.23 |

| Payment Depot | $1.83 | $2.23 |

Processing costs based on a Visa Rewards Traditional credit card (based on interchange rates as of 1/25/22).

Of course, don't only compare the processing costs per transaction. It's also important to consider the monthly fees and other account fees, which we'll get into next.

Payment processors charge your business processing fees for using their services. These pile up for every card transaction done in person or online. There are three parts to this fee. The markup goes to the processor and the interchange goes to the issuing bank. The card network takes the assessment fee.

Other Credit Card Processing Fees

|

| © CreditDonkey |

Besides the processing fees for each transaction, your merchant account provider may also charge other account fees for using the service. These could include:

- Hardware fees: If you have a physical store, you'll need a card reader, terminal, or register to swipe cards. Some companies charge a one-time purchase fee, while others lock you into a lease and potentially charge cancellation fees.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 10¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

- Payment gateway: This is necessary for e-commerce stores to process online orders. Some providers charge a separate monthly fee for the service. Some, like Square, include this for free.

- Virtual terminal: If you get phone orders, a virtual terminal lets you manually key-in card info. Again, some companies charge extra for this feature.

- PCI compliance fees: Some providers offer PCI compliance services and some leave the responsibility up to you. Make sure you understand what's provided and if there's a fee charged.

- Set-up fees: Some merchant account providers charge a fee to set you up on their network. This could be for a technician to come out and set up the hardware or even for over-the-phone support.

- Early cancellation fee: Some providers may require a contract and charge a fee if you cancel early. Dharma and Payment Depot are month-to-month with no cancellation fees.

- Chargeback fee: This is a fee charged if credit card charge is disputed. Square is one processor that does not charge any chargeback fees.

- Monthly minimum fee: This is a fee that's charged if you don't meet a monthly processing dollar amount. But there are a lot of providers that don't have a minimum requirement.

- Statement fees: Your merchant provider may charge you for statements, whether paper or online. They may call it a processing fee or even a miscellaneous fee.

- IRS reporting fee: Some merchant providers charge a fee to report your transactions to the IRS and provide you with the required 1099-K. This practice isn't widely accepted and the fee should be disputed if you see it on your statement.

You should know the cost of these charges ahead of time to help you choose the right processor.

What Parties Are Involved in Credit Card Processing?

|

When your customers swipe their credit card or insert it into the chip reader, a lot goes on behind the scenes. It's not just a transaction between your store and the credit card company. There are many parties at work, including:

- Card issuer: This is the credit card company - the one that provides the credit card to consumers, such as Chase or Bank of America (among others).

The banks work with Visa and Mastercard (the brand) to process the transactions. The interchange fee goes to these banks and credit card companies to cover their operations and risk.

- Credit card network: This is the brand of the card, such as Visa, Mastercard, Discover, and Amex. The assessment fee is charged by the card networks for using their card brands.

- Merchant: This is you, the store or business accepting the credit card, either in person or online.

- Acquiring bank: Also called a "merchant bank", this is the bank that maintains your merchant account. You actually don't get direct access or contact with this bank. Your processing provider is the one who facilitates this relationship.

- Merchant account provider or payment processor: The third-party that sets you up with a merchant account and processes your transactions. This is the "middle man" that connects you with the banks. This is the only party you directly deal with.

A few common examples are Square and Stripe.

Sometimes, the acquiring bank and the merchant account provider are the same company. For example, Chase has their own processing service and it's also the merchant bank. But you'd only deal with the merchant services part. - Payment gateway: This is necessary if you conduct business online. The payment gateway encrypts the data and sends the request for authorization to the card issuer (through the merchant account provider).

The issuer's bank approves or denies the request and the result is sent back to the merchant. This all happens in the matter of a few seconds (sometimes longer for EMV cards).

It's the reality of the world we live in that people just don't carry cash. I have watched others at pop-up sales lose sales because they don't accept them and suggest people go to a cash machine. So the fee is worth it to me.

Stacy Verdick Case, Owner, Peony Lane Designs

Are Flat Rate or Interchange-Plus Fees Better?

These are the two most popular pricing models. Wondering whether you should choose a flat rate or interchange plus provider?

Unfortunately, the answer is different for each business. But here is the general rule of thumb:

- Flat rate pricing is better for low-volume businesses or those with smaller average ticket size.

- Interchange-Plus pricing works for most businesses that process $5,000 or more each month. If you process more than $10,000/mo, consider subscription pricing.

Also figure in any monthly account fees or other add-on fees the merchant services provider charge. Those will all add up.

Is it Legal to Pass Credit Card Fees to Customers?

In most states, it is legal to add a credit card surcharge so that your customers can cover the processing fees.

This is an additional fee added to the customer's purchase for using a credit card instead of cash.

Generally, merchants are required to pay the processing fees in exchange for the services by the payment processor and card networks. But in states where surcharging is legal, merchants can pass on the fees to the customers who use credit cards for payment.

But there are some important rules to follow if you plan to surcharge your customers:

- Any surcharges must be clearly displayed at checkout.

- The surcharge cannot exceed the cost of the processing fee or 4% of the transaction, whichever is lower.[10]

- Surcharge cannot be imposed on debit or prepaid debit card transactions.

- The surcharge must be clearly stated on the receipt.

- You must notify Visa and Mastercard that you plan to surcharge.

Free Credit Card Processing with Surcharging

- You keep 100% of every credit card sale: when you sell $100, you receive $100. Pay only for debit card transactions.

- Fully Compliant

- CardX passes on the fee for credit card transactions only. Your customers can always choose debit as a no-fee option.

This is one way to lessen credit card processing fees and help your bottom line. But extra fees can also turn away customers, so think carefully if this is really best for your business.

The following states cannot impose surcharges for their customers: California, Florida [11], Kansas, Massachusetts, New York, and Puerto Rico. Conditions apply for Connecticut [12], Minnesota, Oklahoma, Maine, and Texas.[13] [14] The rest of the states have no prohibitions but check with your legal counsel. [15]

Ways to Reduce Credit Card Processing Fees

|

Processing fees can really eat into your bottom line. While you can't avoid them altogether, there are some ways to reduce processing fees so you keep more profits.

- Encourage debit card payments

Debit cards have much lower interchange rates. For example, a standard Visa rewards credit card has an interchange fee of 1.65% + 10¢, while a Visa debit card is 0.05% + 22¢. On a $25 purchase, a debit card will cost you $0.23, compared to $0.51 for credit cards. - Set a credit card minimum

You are allowed to set a credit card minimum purchase amount up to $10.[16] This helps you avoid paying high per-transaction fees for small purchases. - Add fraud protection tools

For online stores, use credit card fraud detection tools such as CVV and AVS match. Visa and Mastercard offer lower interchange rates if you use an AVS tool. - Offer cash discounts

If you don't want to add a surcharge (and it's not even legal in certain states), you can offer a cash discount to encourage cash payments. Just make sure that the listed price is the regular price. - Switch processors

This will have the biggest impact on your processing fees. Use the right processing provider for your needs. For example, if your business grew but you're still using a pricey flat-rate provider, switching to an interchange-plus provider can help you save a lot.

You can deduct credit card fees from your taxes if you're a business. This includes almost any expense related to accepting credit card payments such as annual or monthly fees, late fees, flat fees, etc. You can generally deduct the full amount. Any business expense that's ordinary and necessary is deductible.

How to Negotiate Credit Card Processing Fees

|

| © CreditDonkey |

Remember, you can negotiate markup fees charged by merchant account providers. You cannot negotiate the wholesale interchange fees.

In general, merchants with high transaction volume usually have better luck getting a discount rate. What you negotiate should depend on the type of sales you make.

- If you have large average ticket size:

Negotiate the percentage instead of the fixed per-transaction fee. For example, if the markup is 0.3% + $0.10, getting it down to 0.2% + $0.10 can save a lot.If you have a $250 transaction, that's a savings of $0.25. This adds up over many transactions.

- If you have small average ticket size:

Negotiating the fixed per-transaction fee will have a bigger impact. For example, if the markup is 0.3% + $0.10, getting it down to 0.3% + $0.05 will save you 5 cents each transaction.

You may see a merchant provider advertising wholesale processing fees. In short, this does not exist. Wholesale pricing is the rates charged by the credit card networks. Processing providers need to charge their own markup on top of that to make money. In order to get true wholesale processing, you need to work directly with Visa, Mastercard, etc., and that is not possible.

What Experts Say

CreditDonkey assembled a panel of experts to answer readers' most pressing questions:

- How do sellers benefit from allowing customers to use credit cards?

- Why don't more small businesses accept credit cards?

Here's what they said:

Bottom Line

To be a successful business owner, it's necessary to be able to accept credit card purchases. However, you should choose your merchant account provider wisely. If you don't understand their fee structure, ask questions.

Compare the flat fee companies to the interchange plus companies on a per transaction as well as monthly basis. Only then will you be able to make the decision that works best for your company's bottom line.

And don't forget to inquire about early termination fees or equipment rental fees.

References

- ^ Payment Network Pass-Through Fee Schedule

- ^ Helcim. Pricing, Retrieved 7/30/2023

- ^ Dharma Merchant Services Rates

- ^ Square Pricing

- ^ PayPal Merchant Fees

- ^ Quickbooks Payment Pricing

- ^ Stripe Pricing & Fees

- ^ Payment Depot Pricing Plans

- ^ Stax Pricing and Payments for Platforms

- ^ Mastercard. Merchant Surcharge FAQ, Retrieved 2/9/2022

- ^ Florida Senate. 2022 Florida Statutes, Retrieved 01/13/23

- ^ DCP. Credit Card Surcharges, Retrieved 01/13/23

- ^ NCSL. Credit or Debit Card Surcharges Statutes, Retrieved 01/13/23

- ^ VISA. Surcharging Credit Cards, Retrieved 01/13/23

- ^ Colorado General Assembly. Credit Transaction Charge Limitations, Retrieved 01/13/23

- ^ Visa. Minimum Transaction Amount On A Visa Credit Card, Retrieved 2/9/2022

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Not sure what is right for your business?

|

|

|

Answer a few short questions in our credit card processing quiz to receive tailored recommendations to help you keep more profits.