Chase Credit Card Application Status

Ad Disclosure: This article contains references to products from our partners. We receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Just applied for a new Chase credit card? Here's how to check your Chase credit card application status in 3 easy ways.

3 Ways to Check Chase Application Status

|

| © CreditDonkey |

With large welcome bonuses and high rewards, Chase offers some of the most coveted credit cards on the market.

While an immediate approval is the most desired outcome, that's not always the case. So what can you do if it's been a few days and your application is still under review or pending?

Here are a few ways you can check your Chase credit card application status.

Call the Automated Status Hotline

Chase has an automated hotline to check your application status. You just need to enter your Social Security number. It should provide your current Chase card application status.

The hotline phone number to check your status is:

- For Chase personal cards: 1-888-338-2586

- For Chase business cards: 1-800-453-9719

This line is open 24/7 and you can call as often as you want.

This simply means that your application has been neither approved nor denied yet. Usually, you should receive a decision in 7–10 business days. It could be that the issuer needs to verify identity or review other personal information.

Check Online

Unfortunately, Chase doesn't have a dedicated site to check your card application status online. However, if you already have other products (like another Chase bank credit card or a Chase checking account), you can log into your Chase account and check your status.

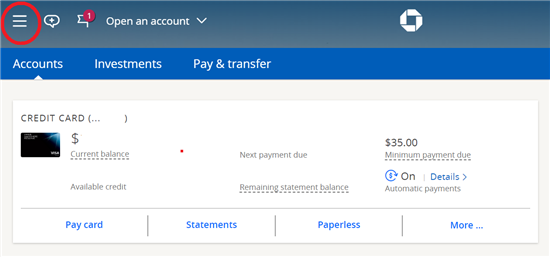

First go to the menu icon on the very upper left corner:

|

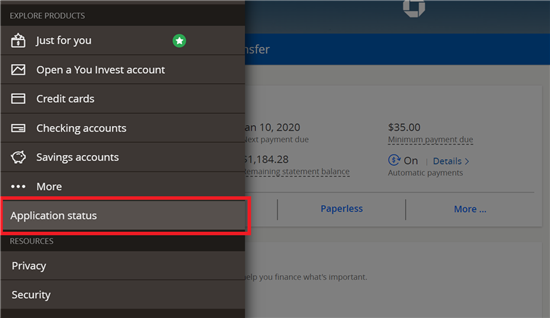

Open the pop-up menu and scroll down to the bottom. You'll see an option for "Application status."

|

Click on this to check the status of any outstanding applications.

You may even be able to see a new credit card account once you've logged into Chase. This would mean that your application has been approved, even if you haven't gotten an approval email yet.

Call the Reconsideration Line

If it has been a few days and your application is still pending or denied, it doesn't hurt to call the reconsideration line and check the status with a rep.

The Chase reconsideration line is 1-888-270-2127. The operating hours are 8 am–10 pm (Monday to Friday) and 8 am–8 pm (Saturday and Sunday).

- Be polite and ask if there's any more information you can provide that can help them reach a decision.

- Be ready to explain any recently opened credit accounts or credit inquires (for example, if you just took out a mortgage or switched to a new cell phone provider).

- Explain why you'd like the card. For example, maybe you want the Chase Sapphire Preferred® because of its airline partners. Don't say you just want the welcome bonus.

Many people report being approved after calling the reconsideration line and providing more information. If it's a denial, you can review the reason for denial and work towards approval next time.

If you've called recon once and were denied, you could call again and try your luck with another representative. However, note that the rep will be able to see that you've phoned in before and why you were denied. If you want to call again, be ready to say why you're calling back. Maybe you feel that you didn't properly explain something earlier.

Application Status for Chase Business Cards

Chase offers some of the most rewarding business credit cards on the market. If you're pending for a business card application, we suggest that it's best to just patiently wait. DON'T jump the gun and call the reconsideration hotline to check your application status.

The reconsideration call is much tougher for business credit cards. Remember that business card applications may take a little longer to process, so it's better to just wait for the official decision.

If you call recon right away, you may be asked for more information about your business or to provide some legal documentation. In this case, the analyst will decide your approval. If you're not very good at answering questions, it could hurt your chances.

- The nature of your business

- Why you need this business credit card

- What kind of products/services you sell

- Your annual revenue and expenses

- Your expected revenue and expenses for the next year

- How long you've been operating

It's important to be confident and know your business. Even if it's new and has no revenue yet, explain why you need a business card now. Explain what kind of purchases you plan to make and how much you expect in revenue.

On the other hand, if you just wait, you could be auto-approved by the system once it's done processing.

If you've been denied, then you may call the reconsideration line to further explain your business.

The reconsideration phone number for Chase business cards is 1-800-453-9719. This line is open Monday to Friday 1 pm–10 pm (no weekend hours).

Business cards aren't just for corporations. You can apply for a business card even if you're running a tiny Etsy store, tutor students, sell cookies, or work as a freelancer. Basically, if you do anything for profit, it can count as a business.

If you're a sole proprietor, just apply with your Social Security number. For incorporated businesses and partnerships, you'll need your employer identification number.

Approval Time for Chase Credit Cards

If you have an excellent credit score and strong qualifications, you may get an instant approval. In this case, your new Chase card will be sent to you within 2 weeks.

If you didn't get the instant approval, you may get an email saying a decision will be made in 7–10 business days. In most reported cases, this means a rejection. But sometimes, this simply means that Chase needs some additional verification information. Wait a few days and give the reconsideration line a call.

Another popular response is the 30 days message. This most likely means your application hasn't yet been processed. Keep an eye out on whether this turns into an approval or the 7–10 day message.

Common Reasons You May Not Get Approved

Here are some of the most common reasons you don't get instant approval:

- Too many newly opened credit cards

If you've opened more than 5 new credit cards in the past 2 years, you will not be approved no matter how qualified you are. This is called the Chase 5/24 rule (more below). - Too many recent hard inquiries

People have reported being rejected because there were too many inquiries on their credit recently. This tells banks that you're desperate for credit. This could be explained easily, like if you're shopping for a new car. - Too much credit with Chase

Chase usually has an overall amount of credit they're willing to give you based on your income and other financial factors. If you already have a couple of Chase cards, maybe you're nearing or maxed out on the limit. In this case, you can ask if you can transfer some limit over to the new card. - Poor credit

In general, Chase credit cards require good to excellent credit. This usually means a credit score of around 650+ for the lower-tier cards and 720+ for the premium cards. If you know your credit isn't quite there, focus on building credit first. - Mistake on the application

If you have a typo, that could send your application to limbo-land. In these cases, just simply phone them up and verify your personal information.

Now, remember that just because you didn't get instant approval doesn't mean that your application is definitely denied. Keep checking the status. If your application is still pending after a few days, you can try calling reconsideration.

Chase Credit Card Application Rules

|

| © CreditDonkey |

Chase is one of the tougher credit card issuers, with more applications rules than others. Here are some of the application restrictions.

Chase's 5/24 Rule

This rule says that if you've opened 5 credit card accounts in the past 24 months (with any bank), you will not be approved for a new Chase card, even if you have an excellent credit score. This is an unofficial, but widely accepted, rule.

As of November 2018, ALL Chase credit cards are subject to this rule. There are no longer any Chase cards to which this rule does not apply.

Mostly, the 5/24 limit is for new personal card accounts. So if you opened some new business credit cards in the past 2 years, they may not be counted (with some exceptions). Be sure to read our detailed article about this 5/24 rule.

Chase's 2/30 rule

This is another unofficial rule that says that you cannot be approved for more than 2 Chase cards within any 30-day period. Usually, this goes for 2 personal cards.

Many applicants have luck when they apply for 2 personal cards at the same time. An advantage is that this will be just one hard inquiry on your credit report. However, this usually works best when the 2 cards are not from the same family (for example, a Chase Freedom Unlimited® and a Chase co-branded card).

If you're not sure whether you'd be approved, we think it's better to just apply to one first. And then apply for the second one after you've been approved.

There are also reports of people who were approved for 2 personal cards AND 1 Chase business card within 30 days. From user reports, it's usually best to submit the business credit card application separately.

Chase Sapphire Rules

There are some rules specifically for the popular Chase Sapphire cards. This includes the Sapphire Preferred (See Rates & Fees) and Sapphire Reserve (See Rates & Fees) (and an old no-annual-fee Sapphire card that's no longer open to new applicants).

You cannot own more than one card in the Sapphire family. So for example, if you already have the Sapphire Preferred and now want the Reserve, you will not be able to apply. In this case, you have to call customer service and do one of either 2 things:

- Upgrade your current Preferred to Reserve, or

- Close your Preferred account and apply for Reserve

There are some rules regarding the welcome bonus too. You can only earn the welcome bonus on a Sapphire card once every 48 months.

Chase Contact Numbers

Personal Credit Cards:

- Automated Status Hotline: 1-888-338-2586

- Reconsideration Line: 1-888-270-2127

- Customer Service: 1-800-432-3117

Business Credit Cards:

- Automated Status Hotline: 1-800-453-9719

- Reconsideration Line: 1-800-453-9719

- Customer Service: 1-888-269-8690

Bottom Line

If you didn't get instant approval, there are some ways to check your Chase credit card application status online and by phone. Getting the pending message is frustrating, but just keep calm and see if there's any more information you can provide to facilitate the approval.

If you are denied for a new Chase card, it's not the end of the world either. Call the reconsideration hotline and talk to an agent. If you're still not approved, work on building your credit and apply for Chase when you're ready. In the meantime, there are tons of other great credit cards out there.

Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. This site may be compensated through the Advertiser's affiliate programs.

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by Chase. This site may be compensated through the Advertiser's affiliate programs.

For rates and fees of the Chase Sapphire Preferred® Card, please click here.

For rates and fees of the Chase Sapphire Reserve® card, please click here.

For rates and fees of the Chase Freedom Unlimited® card, please click here.

Read Next: