10+ Best Investment Apps for 2025

There are a ton of investing apps to help you get started. But which ones will fit your investing style? Read on to find out.

|

| © CreditDonkey |

A good investment app helps you make trades and manage your portfolio on-the-go.

With just a few taps of the screen, you can trade stocks, ETFs, options, mutual funds, and even cryptocurrency. You never need to miss an important trade again.

Whether you're a beginner, more experienced trader, or like a particular style of trading, here are the best investment apps to fit your needs.

| App | Best For |

|---|---|

| Fidelity | Mutual Funds |

| Acorns | Micro-Investing |

| Robinhood | Beginner Investing |

| Charles Schwab | ETF Investing |

| E*TRADE | Frequent Traders |

| Webull | Advanced Analysis Tools |

| Ally Invest | Casual Traders |

| Public | Passive Investing |

| Betterment | Automated Investing |

| M1 Finance | DIY Investing App |

| Wealthfront | Robo Advisor |

| Stash | Stocks for Beginners |

| Interactive Brokers | High Volume Trades |

| SoFi Invest | Financial Advisors |

Best Investing Apps

|

| Annual Fee | Minimum Deposit | ||

|---|---|---|---|

|

| $0 | See Offers |

| None | $0 | See Offers |

| None | $0 | See Offers |

| Starts at $0 | $0 | See Offers |

An investment is an app for a mobile device that lets people invest and manage their investments on-the go. These investments could include stocks, bonds, mutual funds, cryptocurrency, options, and more.

Fidelity: Best for Mutual Funds

| App Store | 4.8/5 stars (2.1+ million reviews) |

|---|---|

| Google Play Store | 4.3/5 stars (124,000+ reviews) |

Fidelity is one of the largest investment companies in the world with over 43 million users and over $11.7 trillion in assets managed.[1] It's a full-service investment firm, so it's a great choice for investors looking for a long-term brokerage to grow with them.

They offer securities to a broad range of investors. With Fidelity, you can trade stocks, ETFs, options, crypto, mutual funds, bonds, and more.

Cost/Fees:

Fidelity is free to use and an account requires no minimums to open. There are also commission-free trades, no trade minimums, and barely any account fees.

The only fees to take note of are on FAST trades ($12.95), broker-assisted trades ($32.95), and options on contract ($0.65 per contract).[2]

Why we like Fidelity:

Fidelity is your best option if you're planning on dealing with mutual funds. Through their FundsNetwork, they offer over 10,000 funds to invest in. These include hundreds of companies outside Fidelity, including over 3,000 no-transaction-fee funds (NTFs).

Additionally, with Fidelity, you get access to research tools like:

- Quotes on individual stocks, company financial statements, key company statistics, and more

- Key information like a stock's earnings, growth rates, dividend yield, and more

- News and research reports

- Screeners for stocks, ETFs, and mutual funds

- Real-Time Analytics - Identify trading opportunities with clear and actionable alerts

- Trade Armor - Visualize risks, define entry and exit strategies, and be alerted of price movements

- Daily Dashboard - Get position-relevant information like news, earnings announcements, and economic events in real time

Pros + Cons:

|

|

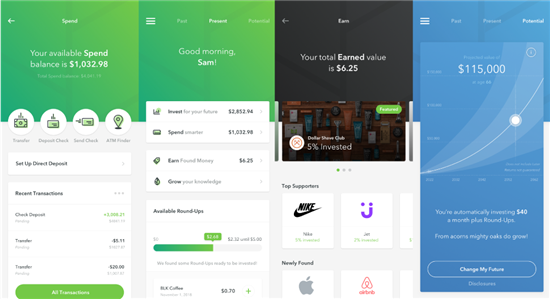

Acorns: Best for Micro-Investing

|

| Screenshot of Acorns |

| App Store | 4.7/5 stars (875,000+ reviews) |

|---|---|

| Google Play Store | 4.6/5 stars (285,000+ reviews) |

Acorns is a "spare change" robo advisor. You link your credit and debit cards and Acorns will automatically round up the change from your purchases and invest them into pre-built ETFs.

Acorns is perfect for hands-off investors that don't have time to do research. It's also great for those who have a "set-it-and-forget-it" approach.

They also have paid subscription plans that give you more perks like their Custom Portfolio. This allows you to purchase individual stocks from a limited list of companies.[3]

Cost/Fees:

Acorns has three main subscription plans (in which all fees are built in):

- Acorns Bronze ($3/mo) - includes personal taxable account, IRA, and checking account

- Acorns Silver ($6/mo) - includes everything in Bronze, emergency fund, 25% match on rewards, and 1% IRA match on Acorns Later contributions

- Acorns Gold ($12/mo) - includes everything in Silver, investment accounts for kids, 50% match on rewards, custom portfolio, Trust & Will, $10K Life Insurance, free Acorns Early account, and 3% IRA match on Acorns Later contributions

Why we like Acorns:

Acorns make investing easy for anyone. In fact, it allows anyone to get started in micro-investing. All you need to do is link your cards to the account and it'll do all the heavy lifting for you.

With their Round-Ups feature, your spare change is automatically invested into expert built portfolios.[5] All you need to do is choose how aggressive you want to be and Acorns invest it in ETFs for you.

Pros + Cons:

|

|

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

It depends on the app. The most common assets you can trade are stocks, bonds, options, and ETFs. Others may include mutual funds, forex, or cryptocurrencies.

Robinhood: Best for Beginner Investing

| App Store | 4.2/5 stars (4.2+ million reviews) |

|---|---|

| Google Play Store | 4.1/5 stars (476,000+ reviews) |

Robinhood is one of the most popular investment apps with over 22 million users.[6] It offers stocks, ETFs, options and cryptocurrencies.

Robinhood is perfect for beginners who want a no-frill approach to investing. The app lets you choose the security you want to buy and what type of order you want to set (market/limit order) on your own. This gives investing a DIY approach.

They also offer very cheap fractional shares, allowing you to get started with as little as $1.[7]

Cost/Fees:[8]

Robinhood is free to use and an account requires no minimums to open. There are also commission-free trades, no trade minimums, and little to no account fees.

Robinhood also has a premium account that'll cost you $5 a month. However, it'll come with extra perks like access to professional research from Morningstar, level II market data from Nasdaq, and bigger instant deposits.

Why we like Robinhood:

Robinhood is the perfect jumping-off point for those who want a DIY approach to investing. It offers a no-frills approach, allowing you to get started right away with as little as $1.

The Robinhood app is also very clean and beginner-friendly. This means as soon as you start trading, you won't be bombarded with jargon and charts that may overwhelm you.

You also have educational and research tools like real-time market updates, side-by-side stock comparisons, and prices paid by Robinhood investors.

Pros + Cons:

|

|

Charles Schwab: Best for ETF Investing

| App Store | 4.8/5 stars (719,000+ reviews) |

|---|---|

| Google Play Store | 2.9/5 stars (24,000+ reviews) |

Charles Schwab is a full-service brokerage that offers stocks, bonds, ETFs, mutual funds, options, and futures.

If you're looking for an all-around experience while trading, Charles Schwab is a great pick. They're one of the oldest names in investing, being established in 1973. Since then, they've evolved into today's affordable brokerage with a wide array of services.

Cost/Fees:

Charles Schwab is free to use. Also, it offers commission-free trades, no account or trade minimums, and no hidden fees.

However, like Fidelity, Charles Schwab has a $0.65/contract fee on options contracts.[10]

Why we like Charles Schwab:

Whether you're just starting out or have years of investing under your belt, Charles Schwab can offer something for any type of trader. They have resources for everything. These include:

- Educational resources

- Customizable platforms and tools

- 24/7 customer service

- Top-rated screeners

- Advanced analysis tools

They also have a robo advisor and AI tool called Schwab Intelligent Portfolios to help you stick to your financial goals. Answer questions to establish your goals, get a diversified portfolio of ETFs chosen by experts, and have AI manage and balance your portfolio for you.

This feature can help you save for retirement, college, vacations, building long-term wealth, or creating an income stream.

Pros + Cons:

|

|

Charles Schwab: $0 Commissions on Online Stock, ETF, and Options Trades

E*Trade: Best for Frequent Traders

| App Store | 4.6/5 stars (140,000+ reviews) |

|---|---|

| Google Play Store | 3.9/5 stars (41,000+ reviews) |

| App Store (Power E*TRADE) | 4.5/5 stars (8,300+ reviews) |

| Google Play Store (Power E*TRADE) | 3.8/5 stars (1,500+ reviews) |

E*TRADE appeals to both beginner and advanced investors with two mobile apps. It offers stocks, options, ETFs, mutual funds, futures, and bonds and CDs.

In Feb 2020, E*TRADE was acquired by Morgan Stanley for $13 billion.[12] Now, Morgan Stanley handles the custody and clearance services provided by E*TRADE Securities.

Cost/Fees:[13]

E*TRADE is free to use. It also has no account minimums and offers commission-free trading on stocks, options, mutual funds, and ETFs.

It has a $1.50 fee on futures contracts and a $1.00 fee on bonds (minimum $10, maximum $250).

It also has the standard $0.65 fee on options contracts. However, if you execute at least 30 stock, ETF, and options trades per quarter, you can drop that fee down to $0.50.

Why we like E*TRADE:

E*TRADE has something for every investor, no matter your experience level. For beginners, they offer the standard E*TRADE app. This includes all your basic functionalities like:

- Investment options like stocks, mutual funds, and options (with 2-,3-, and 4-legged spreads)

- Commission-free trading for US-listed stocks, ETFs, and options

- Market news and third-party research from Bloomberg TV

For more sophisticated investors, they offer the Power E*TRADE app. On top of the benefits from the standard app, this includes features like:

- The ability to quickly trade stocks, ETFs, simple and complex options, and futures on a single ticket

- Execute strategies using customizable options chances (including custom and four-legged spreads)

- More info on market movement with streaming quotes, news, earnings, dividends, depth view, gains, and more

E*TRADE also offers pre-built and automated portfolio builder options for mutual funds and ETFs. With these, you can choose how aggressive you want to be as an investor and E*TRADE will recommend/build a portfolio for you. You can even customize them to focus on funds of your choice.

Pros & Cons:

|

|

A dividend reinvestment plan (DRIP) is a program that lets you reinvest your returns into more shares of the company. This allows you to compound your returns over time by getting more shares (which, in turn, pay dividends that will again be reinvested).

Webull: Best for Advanced Analysis Tools

| App Store | 4.7/5 stars (291,000+ reviews) |

|---|---|

| Google Play Store | 4.3/5 stars (186,000+ reviews) |

With Webull, you can trade stocks, ETFs, and options. On top of that, you can also set up retirement options like Traditional and Roth IRAs.

It also includes features that support:

- Short selling - Webull is one of the few entries on this list that supports short selling.

- Margin trading - Get access to margin trading for free and up to 4x buying power with up to a $25,000 loan (you need at least $2,000 to qualify).

- Day trading - Perform up to 3 day trades in a five-trading day period (unlimited for those with $25,000 or more in account balance).

Cost/Fees:[14]

Webull is free to use. Additionally, all trades on Webull are commission-free. There are also no account minimums and barely any account fees.

Additionally, on Webull, you'll be able to find fractional shares for as low as $5.

Why we like Webull:

Webull offers some of the most advanced charting and technical analysis tools on the market. This makes it perfect for those who like to dive deep into research and make their own investment decisions. These tools include:

- Real-time market quotes

- Price alerts (for stocks on your watchlist)

- Stock screeners

- Market data from 5 categories and 100+ exchanges

- 50 technical indicators

- Analyst ratings

- Video replay (for historical stock price action)

Webull also offers a free paper trading account. This is a practice trading account that includes unlimited virtual money and real-time market data. This lets you simulate trades and see how they pan out.

Pros + Cons:

|

|

20 Free Fractional Shares

Open a new Webull individual brokerage account. Make a qualifying single initial deposit of $500 or more during the promotional period to get 20 fractional shares, each valued between $3 - $3,000. Maintain a balance of $500 or more in the account for 30 days or more. Terms and conditions apply.

It depends on the investment app. Some require no minimum deposits or investments. Others may require up to $500 or more.

Ally Invest: Best for Casual Traders

| App Store | 4.7/5 stars (68,000+ reviews) |

|---|---|

| Google Play Store | 3.4/5 stars (26,000+ reviews) |

Ally Invest offers US-listed equities, ETFs, options, and mutual funds. They also have fixed-income products (US Treasuries, CDs, and corporate, municipal, and agency bonds).

It has options for investors of all experience levels. Whether you're just starting out or a more experienced investor, Ally Invest can help.

Ally Invest is the brokerage side of Ally Bank. So, if you already have an account with Ally Bank, it'll be easy for you to get started in investing with them.

Cost/Fees:[15]

Ally Invest is free to use. They also offer commission-free trades on US stocks and ETFs.

However, they have a $0.50 per contract fee on options (lower than most brokers), a $1 fee on bonds, and $24.95 on CD transactions.

Why we like Ally Invest:

Ally Invest offers some of the most competitive costs and fees on the market. Their $0.50 fee on options contracts are some of the lowest on the market. Their banking side of things, Ally Bank, also offers competitive rates on their fees and minimums.

If you're a beginner, their Ally Invest Robo Portfolios feature could be a great place to start. It offers fee-free rebalancing, a low minimum of $100, and 24/7 support.

Pros + Cons:

|

|

Ally Invest: Commission-Free Stock Trades

With no minimum account balance and no minimum trade activity

While you're still learning how to navigate the app, it may be best to start small. Thanks to commission-free trading, most platforms will allow you to start with as little as $5. Once you feel more confident with your trading decisions, you can move on to larger amounts.

Public: Best for Passive Investing

| App Store | 4.7/5 stars (65,000+ reviews) |

|---|---|

| Google Play Store | 4.2/5 stars (46,000+ reviews) |

On Public, you can trade ETFs, treasuries, and crypto. It even offers alternative investments like fractional shares of art or collectibles.

Public takes a social approach to investing. It makes the whole process interactive by combining it with a social community.

You can even engage in "thematic" investing. This means choosing a theme and putting money into what's behind the theme.

For example, they have a theme called Combat Carbon. By choosing this theme, you put your money into companies that actively work towards reducing their carbon footprint. This also serves a collaborative investment community where you can follow and chat with other investors in that theme.

Cost/Fees:[16]

Public is free to use. They offer commission-free trades and have zero transaction fees. It also offers fractional shares for as low as $5.

The biggest fees to take note of are the $2.99 per trade fee on extended hours fees and OTC trading fees. However, these fees are waivable if you subscribe to their Premium account ($10/mo).

Why we like Public:

Public is renowned for their transparency. They don't engage in payment for order flow (PFOF), meaning they don't sell trades to market makers. Essentially, this means that you're getting your securities at the best possible price.

Additionally, not many platforms offer the sense of community Public does. Through their platform, you can follow traders you like, see what they're trading, and even contact them. Doing this continuously will build a social feed of investors to learn from and collaborate with.

Pros + Cons:

|

|

Betterment: Best for Automated Investing

| App Store | 4.7/5 stars (12,000+ reviews) |

|---|---|

| Google Play Store | 4.7/5 stars (44,000+ reviews) |

Launching in 2010, Betterment was one of the first brokerages to ever automate the investment process.[17] With over $40 billion assets under management and over 800,000 users, they're definitely one of the biggest supporters of automated investments. [18]

The only assets they offer are ETFs. But inside those ETFs, they have different asset classes like stocks, bonds, crypto, and more.

Cost/Fees:[19]

The cost of using Betterment will depend on the plan you get:

- Investing account - $4/month

or 0.25% annual fee

- Crypto account - 1% + trading expenses (0.15% fee per trade from Gemini)

- Cash Reserve account - No fee

- Checking account - No fee

Why we like Betterment:

Betterment simplifies the entire process for you by automating everything. All you need to do is let them know what your goals are and how you want to invest. From there, your money is put to work and managed by Betterment.

One of the best parts about this is that you don't need to do any heavy lifting. There's no need to pick stocks, you can invest with the expert-built, diversified portfolio provided.

It even has Tax Loss Harvesting+ and asset location strategies that help you minimize taxes and maximize returns.

Pros + Cons

|

|

Betterment: Compare Pricing

M1 Finance: Best DIY Investing App

| App Store | 4.7/5 stars (56,000+ reviews) |

|---|---|

| Google Play Store | 4.5/5 stars (23,000+ reviews) |

M1 Finance offers 6,000+ stocks and ETFs listed on the NYSE and NASDAQ exchanges. It also offers a select number of OTC securities. It also offers crypto, but you'll need to create a Crypto account for that. M1 is not a robo-advisor and only offers self-directed brokerage services.

M1 lets their users build what they call "Pies." Basically, these are visual representations of your portfolio. These Pies can go up to 100 slices, with each slice representing a stock, ETF, or even another Pie.

Cost/Fees:[20]

M1 Finance offers commission-free trading. However, they may charge for additional services like account services and maintenance. A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active M1 Personal Loan.

M1 Finance also has a low account minimum of $100 ($500 for retirement accounts).

What we like about M1 Finance:

M1 Finance is the perfect in-between when it comes to DIY investing and using a managed service. However, unlike robo advisors, it will let you create and customize the portfolio yourself.

On top of that, the account minimums of M1 Finance are also very low. This makes it much easier for anyone to get started.

Pros + Cons:

|

|

Wealthfront: Best in Robo Advisors

| App Store | 4.8/5 stars (16,000+ reviews) |

|---|---|

| Google Play Store | 4.9/5 stars (6,000+ reviews) |

Wealthfront is one of the best robo advisors out there, making it perfect for hands-off investors. It offers traditional investing accounts and options for specific financial goals, like 529 College Savings accounts.

On top of 529 college accounts, they also offer retirement accounts (Traditional, Roth, and 401(k) Rollovers) and joint and trust accounts.

Wealthfront lets you automatically invest and manage your portfolios of ETFs, REITs, ESG options, or crypto funds. If you want to invest in individual stocks, you'll need to open a separate account. But it starts with fractional shares as low as $1 and offers commission-free trades.

Cost/Fees:

The only fee you'll be paying on Wealthfront is their advisory fee of 0.25% per year.[21] For the automated investing account, you'll also need to deposit at least $500.[22]

Why we like Wealthfront:

Wealthfront has a ton of tools that help you invest for college, retirement, homeownership, travel, or just because you want to start investing.

Because Wealthfront is one of the biggest robo advisors on the market, it does all the heavy lifting for you. It'll rebalance your portfolio for you and even offer tax strategies to maximize returns/minimize losses.

Pros + Cons:

|

|

Wealthfront Cash Account

- 4.00% APY on all your cash

- $0 monthly fees

- No overdraft fees

- Wealthfront is not a bank. Funds held in Wealthfront Cash Account are FDIC-insured up to $8 million through partner banks.

Stash: Best for Educational Materials

| App Store | 4.7/5 stars (297,000+ reviews) |

|---|---|

| Google Play Store | 3.8/5 stars (103,000+ reviews) |

Stash is an app designed for beginners in mind. You don't need any experience, you can learn, save, and invest—all with one app. They offer stocks, ETFs, and cryptocurrency.

As soon as you answer questions about your goals, risk tolerance, and interests, the app gives you investment recommendations. It'll help you build a personalized, diversified, portfolio based on your financial goals.

Cost/Fees:

Stash offers two subscription plans:

- Stash Growth ($3/month)

This plan includes basic advice for both personal finances and beginner investing, access to stocks, ETF, and crypto, Smart Portfolio, Retirement Portfolio, and banking access. - Stash+ ($9/month)

This plan includes all the features of Stash Growth plus advice for family finances, market insights, kids portfolios, and bonus perks on their banking features.

At the time of writing, both these plans offer 1 free month.[23] Trades are also commission-free.

Why we like Stash:

Stash offers free access to Stash101, a hub for extensive and readily-available educational materials. This includes articles about investing, financial literacy, and even lesson plans you can follow.

With both of Stash's plans, they offer a Stock-Back Card. If you're also looking for banking features, this is a debit card that allows you to earn stock with purchases. For example, if you use your card to buy something on Amazon, you can earn Amazon stock.[24]

Pros + Cons:

|

|

Stash: Sign Up and Get $5

- Sign up, add at least $5 to your account and get a $5 bonus.

- Invest with fractional shares

- Get portfolio recommendations

Interactive Brokers: Best for High Volume Trades

| App Store | 4.3/5 stars (4,700+ reviews) |

|---|---|

| Google Play Store | 4.5/5 stars (19,000+ reviews) |

Interactive Brokers (IBKR) is one of the most complete investment platforms on the market. They offer stocks, options, futures, currencies, bonds, funds, crypto, and more on 150 global markets.

IBKR offers two free tiers of accounts: IBKR Lite and IBKR Pro. The Pro version is more geared towards high-volume traders and the Lite version is more for smaller, more frequent traders.

Cost/Fees:

IBKR has no annual, account, transfer, or closing fees. There are also no account minimums or inactivity fees.

IBKR Lite users enjoy commission-free trades on US-listed stocks and ETFs. IBKR Pro users will enjoy fixed or tiered pricing on almost all the other assets (non US-listed stocks/ETFs, options, futures, currencies, bonds, and mutual funds).

Why we like Interactive Brokers:

Because their platform is separated into two versions (Lite and Pro), you can choose the plan that'll minimize the cost of trading. Their fixed and tiered prices on almost every security you can buy make it ideal for high-volume traders who want lower fees.

If you're an IBKR Pro user, they also have a SmartRouting feature that helps you look for the best prices on stocks, options, and combinations across exchanges and dark pools. [25]

Pros + Cons:

|

|

SoFi Invest: Best for Financial Advisors

| App Store | 3.7/5 stars (2,000+ reviews) |

|---|---|

| Google Play Store | 4.1/5 stars (30,000+ reviews) |

SoFi Invest offers both DIY and robo investing. With it, you can invest in ETFs, stocks, and crypto. They offer both active and automated types of investing.

SoFi's Active Investing lets you choose US-listed stocks and ETFs (NYSE, NASDAQ, AMEX, etc.) to add to your portfolio. It also has social features that let you share your portfolio with anyone else on the app.

SoFi's Automated Investing is a robo advisor that creates a diversified portfolio for you. From there, all you need to do is deposit money and SoFi will invest it for you for free.

Cost/Fees:[26]

SoFi doesn't have any advisory fees and offers commission-free trades.

Why we like SoFi Invest:

Whether you're just starting out or are already trading in high volumes, SoFi offers free consultations. It connects you with a financial advisor that'll help you:

- Reach your financial goals with recommended strategies

- Build your budget by providing good spending habits

- Leverage debt positively by balancing repayment

- Save for the future as well as for emergency funds

- Create investment strategies based on your risk tolerance

SoFi also gives you access to IPO trading. As long as you have an Active Investing account, you're eligible to participate. You'll be able to see what IPOs are live and select which ones you want to participate in.

Pros + Cons:

|

|

SoFi Invest: Active Investing with SoFi

What to Look for in Investing Apps

Each investment app will cater to a different type of trader. Make sure to consider these important points before trading with a particular investment app:

- Fees

Be sure to look at how an app's fees are structured and what you'll be charged for. The fees for each investment app will differ. Some offer subscription-based services, others may charge you per trade. Some may even be completely free to use.Also, take note of the minimums involved. Some may require you to start with a certain amount, others won't.

- Tradable assets

Each investment app will let you trade a different range of assets. Most will just offer the basics like stocks, options, or ETFs. Others will have wider selections that include assets like mutual funds, bonds, forex, and cryptocurrencies. - Research and other investment tools

If you're the type to do a deep dive on the company behind the stock before investing, these tools are crucial. You may want an app that offers in-depth research and analysis.If you're just starting out, you may want educational tools to help you learn more. You may even want a robo advisor to do the investing for you.

If the investing app is registered with the SEC and FINRA, you can trust that it's a legit broker.

If the brokerage goes out of business, your money is insured by the Securities Investor Protection Corporation (SIPC). The SIPC will cover up to $500,000 per account type. Note that the SIPC does NOT protect against the decline in the value of your assets due to market loss.[27]

Methodology

To come up with this list of investment apps, we considered a few things:

- Costs and fees

You wouldn't want costs and fees eating into your returns, right? We looked at the investment apps that let you get started for little to no cost. - Investing features

Even though some apps would charge a little bit to start, sometimes the features they offer are worth it. Not only did we look at features that make investing easier, but we also looked at features that can help you diversify your assets. - Tradable assets

Every investor will have different preferences when it comes to the assets they trade. We made sure to include different platforms with various assets available. So, no matter what you like to trade, it was important that there was an option for you on this list. - Investing experience required

Some investment apps are more beginner-friendly than others. We made sure to include plenty of options for those just starting out and those who've been in the game for much longer.

If you like to take your trading on the go, investment apps can be worth it. Just remember that when it comes to investing in stocks, there will always be risks involved.

What the Experts Say

As part of our series on investments and saving, CreditDonkey asked a panel of industry experts to answer some of our readers' most pressing questions. Here's what they had to say:

Bottom Line

Investment apps are meant to make trades easier and more convenient. However, each investor will have different needs and trading styles. So, it's important to figure yours out before choosing an investment app.

Take time to look at each platform, see what features you need, check what specific assets you want to trade, and then you can begin investing responsibly.

Investment apps are meant to make life easier. Each investor has different needs, so know yours before choosing an investment app. Take the time to research fees and features and read reviews, then begin investing responsibly.

References

- ^ Fidelity. Our Company, Retrieved 10/19/2023

- ^ Fidelity. Brokerage Commission and Fee Schedule, Retrieved 10/21/23

- ^ Acorns. New Custom Portfolios: Choose Your Acorns Investments, Retrieved 10/19/2023

- ^ Acorns. Acorns Subscriptions, Retrieved 10/20/2023

- ^ Acorns. Round-Ups by Acorns, Retrieved 10/19/2023

- ^ Statista. Number of users of Robinhood from 2014 to Q2 2022, Retrieved 10/12/2023

- ^ Robinhood. How to start investing for as little as 1 dollar, Retrieved 10/19/2023

- ^ Robinhood. Standard Pricing Fee Schedule, Retrieved 10/23/23

- ^ CNET. Robinhood backlash: What you should know about the GameStop stock controversey, Retrieved 10/12/2023

- ^ Charles Schwab. Pricing, Retrieved 10/23/23

- ^ Charles Schwab. One combined company dedicated to serving investors across every phase of their financial journeys, Retrieved 10/13/2023

- ^ CNBC. Morgan Stanley to buy E-Trade for $13 billion in latest deal for online brokerage industry, Retrieved 10/13/2023

- ^ E*TRADE. Pricing and Rates, Retrieved 10/23/23

- ^ Webull. Pricing, Retrieved 10/23/23

- ^ Ally. Commissions and Fees, Retrieved 10/23/23

- ^ Public. Fee Schedule, Retrieved 10/23/23

- ^ Betterment. The History of Betterment: Changing an Industry, Retrieved 10/19/2023

- ^ Betterment. Making people's lives better, Retrieved 10/19/2023

- ^ Betterment. Pricing, Retrieved 10/23/23

- ^ M1 Finance. Invest Fees, Retrieved 05/04/2024

- ^ Wealthfront. Some things you pay for. The best things pay for themselves., Retrieved 10/20/2023

- ^ Wealthfront. Account minimums to invest with Wealthfront, Retrieved 10/20/2023

- ^ Stash. Your investing journey starts here., Retrieved 10/20/2023

- ^ Stash. Shop like an investor., Retrieved 10/19/2023

- ^ Interactive Brokers. Dedicated to Best Price Execution, Retrieved 10/19/2023

- ^ SoFi. Fee Schedule, Retrieved 10/23/23

- ^ SIPC. What SIPC Protects, Retrieved 10/18/2023

Jeremy Harshman is a creative assistant at CreditDonkey, a personal finance comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|