Average Bank Account Balance

The average American has just $5,300 in their bank accounts. Is this enough? Keep reading for detailed breakdowns and learn how much you should keep in your bank accounts.

Average Bank Account Balance in the US

The average bank account balance for Americans is $41,700, while the median account balance is $5,300, according to the Federal Reserve.

The average figure of $41,700 may seem very high, as the average is skewed by a small number of high-net-worth individuals with a lot of savings.

For a more realistic figure of where the average American stands, look at the median number instead. This number represents the midpoint value, where half of the people have below that number and half of the people have above.

- Checking

- Savings

- Money Market accounts

- Prepaid debit cards

Certificate of Deposits (CDs) are not included, as this type of savings is not liquid.

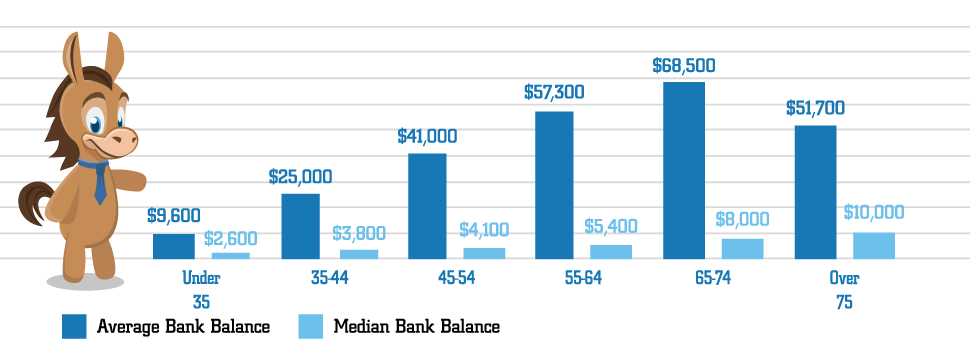

Average Account Balance by Age

Here's a breakdown of account balances by age. If you want an idea of where you stand, it's best to compare to others in your age group.

Average Balances by Age

| Age | Average Balance | Median Balance |

|---|---|---|

| Under 35 | $9,600 | $2,600 |

| 35-44 | $25,000 | $3,800 |

| 45-54 | $41,000 | $4,100 |

| 55-64 | $57,300 | $5,400 |

| 65-74 | $68,500 | $8,000 |

| Over 75 | $51,700 | $10,000 |

The data proves that the older you get, the more you leave in your bank account balances. Younger people under 35 are still establishing their careers and things like student loan debt make it hard to have extra funds.

As you get older, your savings increase. Having a cushion in your bank accounts make it easier to handle emergencies and larger purchases.

Average Bank Account Balance by Family

Here's how bank account balances break down by family type:

| Family Type | Average Balance | Median Balance |

|---|---|---|

| Single adults with children | $11,700 | $1,200 |

| Single adults under 55, no children | $13,300 | $2,400 |

| Single adults over 55, no children | $34,400 | $3,000 |

| Couples with children | $42,800 | $5,700 |

| Couples without children | $66,600 | $9,000 |

It's not surprising that single parents struggle the most with having enough in the bank. The median number indicates that half have less than $1,200 in their accounts.

Couples fare much better because of the dual income. Couples with children have almost 5 times more than single parents in their accounts (based on the median number). Couples without children enjoy the most discretionary income, and therefore have the biggest bank balances.

Education Level

A person's level of education can have an impact on their income and ability to save. The Federal Reserve surveyed Americans with varying education statuses to calculate the numbers.

| Education Level | Average Balance | Median Balance |

|---|---|---|

| No high school diploma | $7,600 | $900 |

| High school diploma | $16,700 | $2,100 |

| Some college | $18,900 | $3,500 |

| Associate degree or higher | $86,100 | $15,000 |

Those who did not finish high school have the least in their bank accounts, with half having less than $900. The median income for this group is $30,056/year (or $578.00/week), which makes it hard to save.

Those with college bachelor degrees earn the most, with a median income of $70,200/year (or $1,350.00/week). Their bank account balances also see a huge jump.

Balances by Occupation

Americans in certain professions may have an easier time saving money due to their higher income.

| Occupation | Average Balance | Median Balance |

|---|---|---|

| Managerial | $72,700 | $11,000 |

| Blue-collar workers | $20,700 | $3,000 |

| Retirees | $39,900 | $4,300 |

Americans who work in a managerial or professional position have the highest incomes, and therefore the highest bank account balances. Blue-collar workers in sales, technical, or services industries have significantly less average bank account balances.

How Much Should I Have In My Bank Account

After reviewing the data above, you're probably now wondering...

What does this mean to me? What is the right amount of money to keep in a bank account?

How much to keep in checking:

In general, for a checking account, we recommend that you only keep what is needed for 1 month's worth of expenses plus some cushion. This means keep what is needed for your rent/mortgage, utilities, other payments like car loans, everyday spending, and credit card payments. Add in about 25-50% more as a cushion to prevent overdrafts and any unusual larger purchases.

For example, if your total monthly expenses add up to $4,000, you may want to keep an average of $5,000 - $6,000 in your checking account. Of course, as you pay bills and spend, your checking balance will go down, but it'll be replenished as you receive paychecks.

How much to keep in savings:

If you have additional cash, they should go into a savings account where you can earn more interest. Dedicated savings accounts will also ensure you don't accidentally spend the money.

We recommend having enough in your savings account to cover 3 - 6 months of expenses. This way, you'll be covered if the worst happens and you lose your job. You'll have enough to stay afloat for a while. It's also important to have these savings for big emergencies, like if your roof collapses or your car breaks down.

For any more additional funds beyond this, it's best to invest them to earn more returns.

Frequently Asked Questions

How much should I save each month?

The basic rule of thumb is to save 20% of your take-home income each month. This is called the 50/30/20 Rule.

This means your budget should look like this:

- Use 50% for living necessities

- Spend 30% on fun stuff

- Save 20% of paychecks

The 20% savings is be split up between emergency funds, retirement savings, and other goals.

How much money should I save before buying a house?

Try to save at least 20% of the purchase price for a down payment, plus 5% of the loan amount available for closing costs, real estate taxes, and homeowner's insurance.

To know how much you'll need, you'll first need to know how much home you can afford. An estimate is to spend no more than 28% of your monthly income on housing payments.

Saving an extra 3% of the home's value can help pay for annual maintenance and repair costs.

How much money should I save for retirement?

As a general rule, you should have 8-10 times your salary saved by the time you hit 65 years old. The younger you start saving for retirement, the closer you'll be to this benchmark.

For example, at age 30, you should have the amount of your annual salary saved for retirement. By the time you hit 50 years old, the amount saved should be 5-6 times your annual salary.

Are my savings insured?

The FDIC insures deposit accounts up to $250,000, per depositor, per financial institution. Joint accounts are insured up to $500,000.

If you have additional savings, consider opening accounts at other banks to get more coverage.

Bottom Line

Create a savings plan as early as possible to give yourself the best chance of achieving your financial goals. You can start by setting aside a percentage of your income to build up your balance.

- Average Savings by Age

- Federal Reserve Bulletin: Changes in U.S. Family Finances from 2016 to 2019, September 2020

- Modern Wealth Index 2017

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: