$25 Loan Instant Apps

$25 loan instant apps like Dave® and EarnIn can help you get by without the hassle of credit checks. Read on to learn more.

|

Here are great instant loan apps to consider when you only need $25:

- Cleo: $20 to $500 cash advance

- SoLo Funds: $20 to $625 with SoLo Borrow

- Dave®: Up to $500 with ExtraCash™

- EarnIn: Up to $750 with Cash Out

- Current: Up to $500 with Paycheck Advance

- MoneyLion®: $25 to $1,000 with Instacash℠

- Brigit: Up to $250 with Instant Cash

- Varo: $20 to $500 with Varo Advance

- Chime®: Up to $200 with SpotMe®

Short on just a few bucks?

Whether you need a quick gas refill or a few essentials, a loan instant app can deliver in a pinch before payday.

Discover the best options to help you overcome a minor financial hiccup, like $25. Or maybe a little more.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

9 Best $25 Loan Instant Apps

Access to $25 should be relatively easier since it's a small amount. The best $25 loan instant apps can offer minimal fuss and maximum convenience.

Let's start with a more accommodating option.

Cleo: $20 to $500 cash advance

- How soon do I get the money? Within 24 hours for a fee, or up to four business days via standard transfer.

- When do I pay it back? On your set repayment date, usually within 14 days of your advance.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $0 |

| Fast transfer fee | Starts at $3.99[1] |

App Rating:

Why Choose Cleo

Cleo is a finance app that's proud to cater to those with poor credit. And unlike other loan instant apps, it welcomes gig workers who often get disqualified from similar providers.

Nonetheless, having a source of income, whether from part-time or regular employment, remains important.

After all, Cleo still has to protect its interests. At the same time, it would effectively be promoting unhealthy financial habits if it totally abandoned an income requirement.

First-time users can advance from $20 to $100.[4] Cleo offers higher cash advances for users with direct deposits. Cleo Builder subscribers can access up to $500, based on monthly deposits and consistent income. You must repay between 3 and 28 days—no charge for late payments.

You can get a Cleo cash advance faster but not instantly. Even if you pay an express fee, the fastest you can expect is a same-day transfer.

|

|

Does Cleo approve everyone?

While Cleo doesn't disqualify individuals with poor credit, it won't approve all requests either. Your recent bank transaction histories and spending patterns still help determine your eligibility and advance amount.

Meanwhile, here's how you can get started:

- Sign up for a Cleo account.

- Choose between a Cleo Plus and Cleo Builder subscription types. Alternatively, email team@meetcleo.com to request an advance without a subscription.

SoLo Funds: $20 to $625 with SoLo Borrow

- How soon do I get the money? Instantly to an external debit card for a fee, or via standard ACH transfer

.

- When do I pay it back? Within 35 days

.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $0 |

| Fast transfer fee | 1.99%/transfer to an external debit card[5] |

App Rating:

Why Choose SoLo Funds

SoLo Funds is a marketplace that connects borrowers and lenders for short-term small-dollar loans. This means, individual members are funding loans 100%—ranging from $20 to $625[8]. It's essentially members helping members.

Unlike traditional payday lenders, any loan taken out through this platform is interest-free. So if you borrow $25, you repay $25—unless you tip, which SoLo accepts on behalf of the lender. You can also donate separately to the SoLo platform.

Unlike some loan instant apps, SoLo has no monthly membership fee. However, late penalties cost $5 or 10% of your loan amount, whichever is higher.[9] You'll also fork over a transaction fee for missing your due date. That said, you'll want to pay on time!

|

|

How to get a loan on SoLo Funds?

Here's what you'll need when applying for a loan at SoLo Funds:

- Sign up for a SoLo membership.

- SSN and driver's license.

- A linked external bank account and debit card.

- A good SoLo score

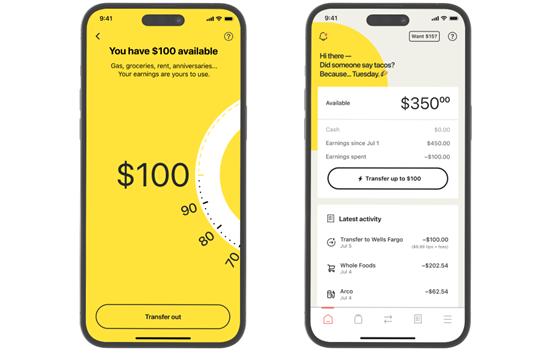

Dave®: Up to $500 with ExtraCash™

|

| CREDIT DAVE |

- How soon do I get the advance? Within seconds to a Dave® debit card—with a lower express fee, or within three business days.

- When do I pay it back? Next payday or nearest Friday if Dave® can't determine your payday.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $1 monthly subscription fee |

| Fast transfer fee | Applies to select instant transfers[10] |

App Rating:

- 4.4 out of 5 ✰ from 528K+ reviews on Google Play[11]

- 4.8 out of 5 ✰ from 692K+ reviews on App Store[12]

Why Choose Dave®

If you're looking for a small amount and need it quickly, Dave® might be the right app. This financial technology company lets you access $25 (up to $500) without a lengthy approval process.

With Dave®, getting your ExtraCash™ advance is as simple as overdrawing your ExtraCash™ account. But if you're using an external debit card and need the funds urgently, you'll have to pay an express fee to receive your advance within an hour.

An ExtraCash™ advance is treated like an overdraft. Your bank account may reflect a negative balance when you use it. No worries—you won't be hit with any overdraft fees.

One reason you can't get an advance from Dave® is an outstanding ExtraCash™ balance. It must be repaid first before getting another. But if you're having trouble qualifying for this feature, it could be due to insufficient recurring deposits or your bank account showing an unfavorable spending pattern.

|

|

How do I get $500 on the Dave app?

Here are things you need to do to be eligible for up to $500 Dave® ExtraCash™:

- Sign up for Dave® and open an ExtraCash™ account.

- Link your bank account or a Dave® checking account with a minimum 60-day history and a positive balance.

- Have at least three recurring deposits.

- Pay a monthly membership fee.

- Have a $1,000 total monthly deposit or more.

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

EarnIn: Up to $750 with Cash Out

|

| credit earnin |

- How soon do I get the money? Within 1-3 business days via ACH

, or in minutes with Lightning Speed transfers, starting at just $2.99/transfer.

- When do I pay it back? Upcoming payday.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $0 |

| Fast transfer fee | $2.99 to $5.99/Cash Out transfer[13] |

App Rating:

- 4.7 out of 5 ✰ from 244K+ reviews on Google Play[14]

- 4.7 out of 5 ✰ from 285K+ reviews on App Store[15]

Why Choose EarnIn

EarnIn allows its Community Members to access part of their paycheck early with its Cash Out feature. It bears no interest and no monthly subscription charges. This is particularly helpful for small cash withdrawals, like $25. With Cash Out, you can transfer up to $150/day, with a max of $750 between paydays.

EarnIn runs on a "pay-what-you-think-is-fair" tipping model. So, if you're feeling generous, you can tip the service—but of course, it's completely optional.

Aside from Cash Out, EarnIn has Balance Shield. It protects your bank account balance once it drops to a set threshold (up to $500[16]). When activated, it will automatically transfer $100 from your earnings to your account to reduce overdraft risk.

|

|

What are the requirements to use EarnIn?

Here's what you've got to do to be eligible for EarnIn Cash Out:

- Sign up for an EarnIn account if you're at least 18 and with a valid U.S. mobile number.

- Have a linked checking account with consistent paychecks.

- Provide employment details.

- Earn a minimum of $320 per pay period.[18]

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $150 a day

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get paid as you work

Get money in your bank in minutes with Lightning Speed for a small fee, or in 1-3 business days at no cost.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

Here's another great option to get $25 without additional costs.

Current: Up to $500 with Paycheck Advance

- How soon do I get the money? Minutes or up to an hour for a fee, or within three business days.

- When do I pay it back? Next paycheck or whenever you can.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $0 |

| Fast transfer fee | Shown on the app when you request a Paycheck Advance[19] |

App Rating:

- 4.6 out of 5 ✰ from 157K+ reviews on Google Play[20]

- 4.8 out of 5 ✰ from 158K+ reviews on App Store[21]

Why Choose Current

Current can be incredibly useful for managing your finances between pay periods. It's one of the few that doesn't have mandatory fees to access its Paycheck Advance and other services.

There's no penalty for an unpaid advance, but you might not get another if the previous one is still outstanding—which is a fair deal.

Additionally, Current offers financial tools like savings pods, budgeting, and crypto trades. With such versatility, you may only have to keep all your finances in one place.

|

|

How to get paycheck advance on Current?

To be eligible for Current Paycheck Advance, you must:

- Sign up for a Current account using the IOS or Android app.

- Link an external bank account and debit card to Current. Or have a Current account with an eligible payroll deposit.

- Present at least a total of $500 worth of eligible payroll deposits

(at least one with $200).[19]

What if you're unemployed but still have a reliable income source? Check if you qualify for this next app.

MoneyLion®: $25 to $1,000 w/ Instacash℠

- How soon do I get the money? Within minutes for a fee, or at least one business day via standard transfer.

- When do I pay it back? On the scheduled repayment date, usually based on your next paycheck.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $0 |

| Fast transfer fee | Tiered fee starts at $0.49/transfer[22] |

App Rating:

- 4.5 out of 5 ✰ from 123K+ reviews on Google Play[23]

- 4.7 out of 5 ✰ from 135K+ reviews on App Store[24]

Why Choose MoneyLion®

MoneyLion®'s Instacash℠ offers zero-interest cash advances of up to $1,000. However, you may be limited to $500 if you link an external checking account. Either way, that's enough buffer if you only need $25 or thereabouts.

While many loan instant apps require recurring payroll deposits, MoneyLion® doesn't. However, you still need to have direct deposits. They could be from government benefits or a pension provider like Social Security.

Most notably, there's Trial Instacash℠ which may easily get you $25. This is an option for those who couldn't qualify for the standard Instacash℠ limit by approving a smaller amount on your first request.

|

|

How do you qualify for MoneyLion advance?

To qualify for MoneyLion® Instacash℠, you must:

- Sign up for a MoneyLion® account.

- Link your checking account with a minimum 60-day history and a positive balance.

- Have at least three direct deposits from the same source or payroll provider into the linked account.

This next option also offers some flexibility to unemployed users.

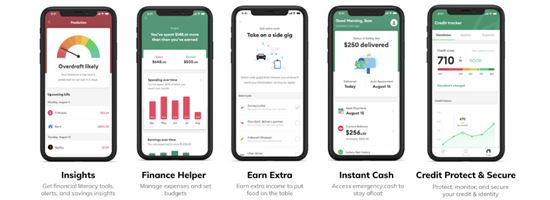

Brigit: Up to $250 with Instant Cash

|

| CREDIT hellobrigit |

- How soon do I get the money? Within 20 minutes for a fee, or at least one business day.

- When do I pay it back? Your next payday or preferred date using an extension.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $8.99/mo. Plus plan or $14.99/mo. Premium plan[25] |

| Fast transfer fee | Starts at $0.99/transfer;[26] free for Premium members[27] |

App Rating:

- 4.7 out of 5 ✰ from 206K+ reviews on Google Play[28]

- 4.8 out of 5 ✰ from 312K+ reviews on App Store[29]

Why Choose Brigit

You may have noticed that most cash advance apps don't have the usual credit checks. In Brigit's case, it uses its own scoring system and eligibility criteria for Instant Cash, which looks into:

- Your bank account health

- Earnings profile

- Spending behavior

Instant Cash users can advance $50 to $250,[30] so it should be easy to access $25. Your chances are good as long as you meet Brigit's requirements—even those without regular employment.

However, access to Instant Cash requires a paid Brigit subscription. So, if you don't plan to maximize other tools available in the Brigit app for budgeting and expense tracking, this option might not make financial sense to you.

|

|

How do I get a cash advance from Brigit?

Here's what you'll need to do to be eligible for Brigit Instant Cash:

- Sign up for a paid Brigit subscription.

- Link an external bank account with a minimum 60-day history, three recurring deposits from the same source and a positive balance.

- Maintain a minimum average end-of-day balance on scheduled paydays.

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Varo: $20 to $500 with Varo Advance

- How soon do I get the money? Instantly.

- When do I pay it back? Within 30 days.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | Tiered cash advance fee starts at $1.60[31] |

| Fast transfer fee | $0 |

App Rating:

- 4.7 out of 5 ✰ from 235K+ reviews on Google Play[32]

- 4.9 out of 5 ✰ from 224K+ reviews on App Store[33]

Why Choose Varo

Varo offers a straightforward, cost-effective solution for small, urgent expenses. At best, Varo Advance can spot you up to $500.

While you can access $25 or more instantly without paying an express fee, each transaction comes with a cash advance fee.

Since both fees are often in the same ballpark, you might say it's just a matter of appropriating the fee for a different purpose. But, you can argue that paying a cash advance fee may be better than other apps that charge a monthly subscription.

Don't forget that Varo is an all-in-one digital bank. You can benefit from streamlined access to checking, savings, and other financial products and services in a single app.

You have to build a positive repayment behavior with Varo Advance to increase your succeeding advance limit. New users are usually limited up to $250.[34] In addition, having a healthy bank account activity and increased direct deposit amounts may also help in getting a higher advance.

|

|

How do I get a cash advance on the Varo app?

Here's what you'll need to do to be eligible for Varo Advance:

- Sign up for a Varo account. If you already have one, it must be active and in positive standing.

- Have at least $800[35] in total qualifying direct deposits

to your Varo Bank Account, Savings Account, or combined.

So, can you truly have a fee-free experience, considering all you need is $25? You finally can—with this next option.

Chime®: Up to $200 with SpotMe®

|

| credit chime |

- How soon do I get the money? Immediately after initiating a SpotMe® transaction.

- When do I pay it back? On your next direct deposit or fund transfer, whichever comes first.

What fees can I expect?

| Interest rate | 0% |

|---|---|

| Mandatory fee | $0 |

| Fast transfer fee | $0 |

App Rating:

- 4.6 out of 5 ✰ from 663K+ reviews on Google Play[36]

- 4.8 out of 5 ✰ from 838K+ reviews on App Store[37]

Why Choose Chime®

Interest-free cash advance apps charge monthly membership or instant transfer fees. That's not the case with Chime®.

When you spot $25 or any amount up to $200 through the aptly named SpotMe®, you can get it instantly. No need to sign up for a paid subscription or pay to get it in real-time. Unless you don't have at least $200 qualifying direct deposits in your bank account, Chime® can be a no-brainer choice.

Chime® also provides early access to your paycheck for up to two days—perhaps a simpler solution to minor cash flow issues and short-term financial needs.

|

|

How to qualify for Chime instant loan?

Here's what you'll need to do to be eligible for Chime® SpotMe®:

- Apply for a Chime® debit card or Credit Builder card.

- Activate SpotMe® in your app settings.

- Have at least $200 qualifying direct deposit from an employer or benefits provider regularly.[39]

Now that you know which loan instant apps to consider in case you need $25, let's re-learn the basics.

What Is A Loan Instant App?

Also referred to as a cash advance app, a loan instant app provides users with quick access to short-term loans or cash advances. It often skips extensive credit checks and lengthy approval processes.

A loan instant app typically offers small-dollar amounts intended to cover urgent financial needs and paid back within several days or a few weeks. Usually, it has no interest but may charge either a monthly subscription or instant transfer fee, or both.

Eligibility requirements often include qualifying direct deposits to a linked checking account with an external bank or app provider. Such deposits may come from a single source, either an employer or government benefits.

Chime®, Varo, and Dave® are some examples of apps that can spot you small amounts whenever you need a financial boost. You must be signed up on the app and meet corresponding criteria to access its cash advance or loan services.

When to Consider a Loan Instant App

Loan instant apps may be useful during these situations:

- Cover unexpected expenses

If you encounter an emergency medical bill or home repair that isn't that costly but you don't have anything set aside for it, a loan instant app can be a savior. - Bridging cash flow gaps

Small loans in the form of cash advances can help you tide over when in between living paychecks and need money for a few more groceries and other essentials. - Snap up time-sensitive opportunities

Getting a limited-time deal that couldn't wait until your payday may be a good excuse to use a loan instant app service.

Reputable loan instant apps are generally safe to use. They usually follow strong security measures, comply with financial regulations, and have transparent terms.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

How to Choose the Best $25 Loan App

If you need $25 right now and still confused which loan instant app to go with, here are some questions to guide you:

- Since there usually is no interest charge, is there a signup or monthly subscription fee to get a cash advance?

- Can I get my funds faster at zero or less cost if I open their checking account?

- Does my current salary qualify for a $25 cash advance or overdraft?

- Are there prepayment penalties in case I want to repay my advance earlier?

- If I need to pay for membership, am I getting more than just a cash advance app?

By asking the above questions, you don't only get to land the right loan app, but also help you make smart financial decisions.

Loan apps are usually repaid within a short time frame, which can be unmanageable for some. In addition, you often cannot access the maximum loan amount as a new user since this is typically reserved for those who have already built a good repayment history with the provider.

Can I pay my $25 loan instant app early?

Loan instant apps often set the repayment date on your next paycheck, but you could repay ahead of schedule.

With EarnIn for example, you simply click View and Pay in your app and confirm your payment details.

In the case of Albert Instant overdrafts, you just have to deposit the funds in your Albert Cash account within the first couple of days of your grace period.

Alternatives to $25 Loan Instant Apps

Need fast cash but couldn't qualify for a $25 loan instant app? Consider these other options:

- Ask from friends or family members.

Borrowing money from someone you know with extra cash can be an option. Family loans are even better if that's possible. Make sure to repay them on your agreed date to avoid straining relationships. - Consider payday alternative loans.

Offered by several credit unions, these loans may charge lower interest than regular payday loans. But you have to be a member of a particular credit union first. - Use plastic money.

There's your credit card, especially if you're running short on groceries before your paycheck arrives. And then, pay it in full on the due date to avoid interest. - Check if your employer has a payroll advance.

Some employers have their own earned wage access programs that allow you to get an advance on your upcoming paycheck without interest or low fees. - Sell personal items.

Consider selling stuff you no longer need online via Facebook, Instagram, or eBay to raise cash. - Pawn jewelry.

You can use valuable items like gold jewelry or watches as collateral in exchange for a portion of its estimated worth. Reclaim your pawned item before the term is up.

Methodology

We chose loan instant apps that cover your need for $25 without interest and late payment charges.

But more importantly, we considered the time of processing and disbursement of funds. Quick access is king. So, most apps can transfer to your linked checking or debit card in minutes for a low fee (if not free) if the receiving account is from the same provider.

Lastly, we took note of other useful features for budgeting and savings, which can help you optimize the app long-term.

Bottom Line

Cleo tops our list of nine best $25 loan instant apps because of its flexibility and more relaxed requirements.

Top contenders offering $25 loans or higher without mandatory fees include EarnIn, Current, and MoneyLion®.

Remember to use loan instant apps only for true emergencies. Focus more on income opportunities to avoid a cycle of debt.

Get up to $750 per paycheck

- Access up to $150/day, with a max of $750 between paydays

- There's no interest, no credit check, and no mandatory fees.

Tips are always optional.

- Over 19M downloads — and counting

Get up to $500

- No interest, credit checks, or late fees

- No lengthy application process or waiting period

- Sign up in minutes

Get up to $250 in minutes with Instant Cash

- No interest, late fees, or tipping

- No credit check

- Just $8.99/mo. Cancel anytime

Get Up to $200 Now

- Sign up in seconds: Just enter your name, email and phone to get started

- Connect your account: Link your bank, so we know where to send your money

- Access your cash: Get a Klover advance - up to $200 - with no credit check

Borrow $100 to $50,000

- Loans from $100 to $50,000 subject to approval

- Online form takes less than 5 minutes to complete

- If approved, you may get your money in as little as 24 hours

References

- ^ Cleo. Terms & Conditions, Retrieved 03/20/2025

- ^ Google Play. Cleo: Budget & Cash Advance, Retrieved 03/20/2025

- ^ App Store. Cleo: Cash advance & Credit, Retrieved 03/20/2025

- ^ Cleo. Cash Advance, Retrieved 01/03/2025

- ^ SoLo. Are There Additional Fees?, Retrieved 03/20/2025

- ^ Google Play. SoLo Funds: Lend & Borrow, Retrieved 03/20/2025

- ^ App Store. SoLo Funds: Lend & Borrow, Retrieved 03/20/2025

- ^ SoLo. How Much Can I Request?, Retrieved 03/20/2025

- ^ SoLo. Terms of Service, Retrieved 03/20/2025

- ^ Dave®. Dave Disclosures - Last Update October 28, 2024, Retrieved 03/20/2025

- ^ Google Play. Dave: Fast Cash & Banking, Retrieved 03/20/2025

- ^ App Store. Dave: Fast Cash & Banking, Retrieved 03/20/2025

- ^ EarnIn. Lightning Speed fees and Details, Retrieved 03/20/2025

- ^ Google Play. EarnIn: Make Every Day Payday, Retrieved 03/20/2025

- ^ App Store. EarnIn: Make Every Day Payday, Retrieved 03/20/2025

- ^ EarnIn. Balance Shield, Retrieved 03/20/2025

- ^ EarnIn. FAQ - What is EarnIn Card?, Retrieved 03/20/2025

- ^ EarnIn. Cash Out FAQ - Do I Have to be a Full-time Employee to Qualify?, Retrieved 03/20/2025

- ^ Current. Paycheck Advance Terms and Conditions, Retrieved 03/20/2025

- ^ Google Play. Current: The Future of Banking, Retrieved 03/20/2025

- ^ App Store. Current: The Future of Banking, Retrieved 03/20/2025

- ^ MoneyLion®. MoneyLion Fee Schedule, Retrieved 03/20/2025

- ^ Google Play. MoneyLion: Bank & Earn Rewards, Retrieved 03/20/2025

- ^ App Store. MoneyLion: Banking & Rewards, Retrieved 03/20/2025

- ^ Brigit. How Much Does Brigit Cost?, Retrieved 03/20/2025

- ^ Brigit. Brigit Terms of Service, Retrieved 03/20/2025

- ^ Brigit. Our Pricing, Retrieved 03/20/2025

- ^ Google Play. Brigit: Borrow & Build Credit, Retrieved 03/20/2025

- ^ App Store. Brigit: Fast Cash Advance, Retrieved 03/20/2025

- ^ Brigit. What is the Size of the Advances You Give?, Retrieved 03/20/2025

- ^ Varo. Varo Advance Fees, Retrieved 03/20/2025

- ^ Google Play. Varo Bank: Mobile Banking, Retrieved 03/20/2025

- ^ App Store. Varo Bank: Mobile Banking, Retrieved 03/20/2025

- ^ Varo. Varo Cash Advance, Retrieved 03/20/2025

- ^ Varo. Varo Advance Overview, Retrieved 03/20/2025

- ^ Google Play. Chime - Mobile Banking, Retrieved 03/20/2025

- ^ App Store. Chime - Mobile Banking, Retrieved 03/20/2025

- ^ Chime®. What's MyPay™?, Retrieved 03/20/2025

- ^ Chime®. If SpotMe® Covers Me, Do I Pay it Back?, Retrieved 03/20/2025

Penelope Besana is a research analyst at CreditDonkey, a personal finance comparison and reviews website. Write to Penelope Besana at penelope.besana@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

EarnIn is not a bank. Access limits are based on your earnings and risk factors. Available in select states. Terms and restrictions apply. Visit EarnIn.com for full details

|

|

| ||||||

|

|

|