Square vs Merchant Account

Square is simple with flat rate pricing, but a merchant account can provide better savings. Which is better for your business? Read on to compare.

|

Maybe you just started your own business and wonder if Square is the right choice.

Or maybe you're using Square and are considering switching to a real merchant account.

In either case, you're wondering what exactly is the difference. Which one is cheaper? Does it really matter what you pick?

We'll answer all those questions and more in this detailed comparison guide.

1 Minute Comparison: Square vs Merchant Account

|

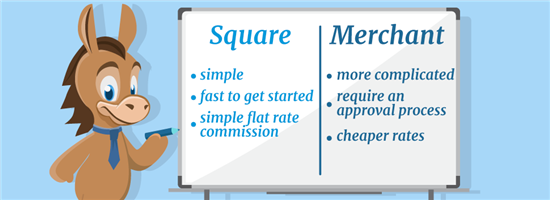

Square is a third-party payment service provider. It's a simple way for small businesses to accept credit card payments without a merchant account.

It's fast to get started (literally in just minutes). Square charges a simple flat rate of 2.6% + $0.10 per swipe.[1] This pricing is easy to understand and predictable.

Merchant accounts are more complicated to set up and require an approval process. But they typically offer cheaper rates than Square. If your business processes at least $5,000 each month, you can save a lot on processing fees with a merchant account.

Who Square Is Best For

Square is ideal for:

- New and small businesses: If you process less than $5,000 per month, there's no need for a full merchant account. Square is much easier to get started.

- Seasonal businesses: You can stop and restart at any time. There are no monthly fee or minimums if you have no sales.

- Mobile businesses: You get a free mobile reader and Square has one of the best POS apps. It's ideal for businesses on-the-go like food trucks, market vendors, and pop-up shops.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 10¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Who a Merchant Account Is Best For

A traditional merchant account is better for:

- Established businesses: If your business is steadily processing at least $5,000 per month, you'll be able to benefit from the lower rates and see some significant savings.

- High risk businesses: This usually means you need a custom agreement (check out PaymentCloud). Square doesn't accept high-risk merchants.

High Risk? No Problem

- Competitive Options for Payment Processing at All Risk Levels

- Fast Funding

- No Setup/Hidden Fees

- No Minimum Credit Score

- All Industries Accepted

But first, let's go over the difference between a merchant account and Square. We know, it's a little confusing.

How a Merchant Account Works

Merchant account providers offer full-service credit card processing. The main thing is that you get your own merchant account with a unique merchant ID number just for your business.

When you take a credit card payment, the money doesn't just go straight to your bank account right away. The payments are first settled into your merchant account. After the processing fees are deducted, then the money is transferred to your bank account in 1-2 days.

Traditional merchant accounts require underwriting to approve you as a client. They want to know that your business isn't a risk to them. They'll run a credit check and scrutinize your business to see if they want to take you on.

How Square Works

Square is a third-party payment processor. You don't get your own unique merchant account ID. Instead, your transactions are processed together with many other businesses into one huge shared merchant account.

When Square came onto the scene in 2009, it was a game changer for small businesses. Square allowed anyone to create an account in literally just minutes without any credit checks or approval process. You don't even need to be an official business.

Previously, tiny businesses could only accept cash. But Square made it possible for them to expand their customer base by taking cards. Even if you sell cookies at weekend farmers markets or jewelry at craft fairs, you can charge credit cards.

Since then, Square has expanded to offer an impressive suite of features for retail and online sellers.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 10¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Is Square Cheaper Than Merchant Account?

Square's fees are 2.6% + $0.10 per-swipe and $2.9% + $0.30 for online transactions.[1] This rate is higher than what typical merchant accounts charge. However Square has no monthly fee and no other miscellaneous fees.

Square's pricing is flat rate. You pay the same processing fee no matter what type or brand of card. Whether it's Visa, Mastercard, American Express, debit, premium rewards card… it's all the same fee. This is easy and predictable for small businesses.

Merchant account pricing is harder to explain. They typically offer Interchange-Plus pricing. This means the interchange fee is separated from the processor markup. You pay different rates for different types of cards. This comes out to be lower than flat-rate.

One provider with this type of pricing is Helcim. It charges Interchange rate + 0.40% + $0.08 (for processing up to $50,000/mo; discounts for larger volume) per swipe. The "0.40% + $0.08" is Helcim's commission for each transaction."

The average interchange rate for credit cards is 1.7% - 2%. So even after you add the merchant account provider's markup, it's less than Square's rate.

If you process mostly debit cards, then Square will be way more expensive. The interchange for debit cards only averages 0.5%. But Square's pricing is no different for debit or credit. On a $100 debit card sale, a merchant account provider may charge only $0.80, but Square will charge $2.70.

Now let's go over some of the other major differences between Square and a merchant account.

Contract

|

Square is pay-as-you-go with no contract. If you don't have any sales for a month, then you don't pay anything. You only pay for actual processing.

That's why Square is great for new businesses, or if you have inconsistent sales (like seasonal businesses).

Traditionally, merchant accounts required contracts. But with processors like Square now on the scene, a lot of merchant account providers have also done away with lengthy contracts.

There's no reason anymore to commit to a contract with a merchant account. You should be able to cancel whenever you want with no termination fees. However, a lot of them still have monthly fees. So even if you don't process anything that month, you still pay a fee.

Approval Process

As mentioned before, Square has no approval process or credit check. Anyone can set up an account. All that's required is an electronic identity verification.

To get a merchant account, you'd have to go through a more rigorous underwriting process. You need to be an official business with a business license and business bank account.

Essentially, the provider wants to know that you're a legit business and how risky you'll be to them. This process can involve reviewing your credit, business's operations, billing, inventory, chargeback history, shipping procedures, and more.

New businesses may have trouble getting a merchant account because they haven't yet established business history. But with Square, you can just sign up and get started right away.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 10¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Account Stability

This is one downside for Square. It has no approval process, which is great for new businesses. But this means you were not evaluated for risk beforehand. Instead, you'll be examined more afterwards.

Because of this, Square tends to hold or freeze your account if they see suspicious activity. For example, if you process a larger transaction than usual, that could be cause for holding funds while Square reviews the sale.

And if you are deemed too risky (like getting a lot of chargebacks), they can even terminate your account with little warning.

On the other hand, because you go through an underwriting process for a merchant account, they've already approved you and are less likely to freeze or shut down your account.

Hidden Fees

Square has no hidden fees. You only pay the flat rate for processing. There are no extra fees for a payment gateway or virtual terminal. Online sellers even get a free online store.

Square doesn't even charge a fee for chargeback disputes. It also maintains PCI compliance so you don't need to worry about it. This is another reason why Square makes it simple for new businesses to operate.

Merchant accounts could charge a number of extra fees like:

- Monthly / annual fee

- Not meeting a monthly processing minimum

- Payment gateway / virtual terminal

- PCI compliance fee

- Chargebacks

- Statement fee

This is where you'll want to do some math. If the processing fees are low enough, then paying some extra monthly fees could still overall come out to be less than Square's fees.

If you're shopping around for merchant accounts, be sure to get a list of all their fees. Make sure there are no "junk fees" that you don't understand.

Equipment and Hardware

Square offers a free mobile swipe reader to all users. Just plug it into the charging port on your phone and use with Square's mobile app.

If you'd like a chip and contactless reader, you can purchase one for $59. If you need more robust equipment, it also offers a terminal, iPad stand and register for purchase.

Square Contactless and Chip Card Reader

- Pay 2.6% + 10¢ per tap or dip for Visa, Mastercard, Discover, and American Express

- Accept Chip Cards and Contactless Payments Anywhere

Square's equipment is built to work seamlessly with its POS software. You can expect a really smooth experience. But note that they only work with Square account. In other words, if you switch providers later, you can't reuse them with someone else.

Merchant accounts typically offer a wide range of equipment for purchase or lease (though we don't recommend leasing). And if you already have your own equipment, they can usually reprogram it to work with their systems.

Customer Service

Square provides customer service via email, auto live chat, and phone. Their customer service can be lacking. They want you to rely on the online knowledge database first.

Only active account holders can get an access code to call Square's phone support. This means if Square terminated your account for whatever reason, you're going to have a very hard time reaching them. In that case, you can only reach them through email.

Merchant account providers usually have better customer support with more knowledgeable reps. Because you get your own merchant account just for your business, some may even provide a dedicated account manager.

But of course not all companies have good customer support. It's important to shop around, talk to the reps, and get a feel for how helpful and responsive they are.

Bottom Line: Is Square or Merchant Account Better?

So which is right for your business? In our opinion, the decision ultimately comes down to the age of your business and your sales.

If you're a brand-new business, you probably don't have a choice but to first use Square (or a similar payment service provider). A traditional merchant account most likely won't approve you without an established business history and proof of sales.

A third-party processor like Square gives you the opportunity to set up quickly and start taking credit card payments.

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 10¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Once you have steady sales of at least $5,000 a month, then we recommend looking into a merchant account. You'll be able to save on processing fees by switching to an Interchange-Plus provider. Plus, you'll have less account stability issues.

Finally, if your business falls in the high-risk industry, then your best option is a custom agreement with a merchant account provider.

References

Square Reader: Free Mobile Credit Card Reader

- Pay 2.6% + 10¢ Per Swipe for Visa, Mastercard, Discover, and American Express

- Accept Credit Cards Anywhere

- Fast Setup, No Commitments

Online Payment Processing

- Accept payments worldwide and automate payouts and financial workflows seamlessly

- Grow with confidence: Whether you're running an e-commerce store, subscription service, or marketplace, Stripe adapts to any business model

- Trusted by millions: From startups to Fortune 500 companies, Stripe powers businesses of every size

- Predictable costs: Transparent flat-rate pricing with no setup fees or monthly charges – pay only for what you use

- Enable more sales: Support credit cards, mobile wallets, and 135+ international payment methods

- Developer-friendly tools: Integrate payments quickly with Stripe's intuitive APIs and documentation

Save Up to 40%

- Flat Monthly Subscription Price, Starting at $99

- 0% Markup on Direct-Cost Interchange

- 24/7 Support

Anna G is a research director at CreditDonkey, a credit card processing comparison and reviews website. Write to Anna G at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: