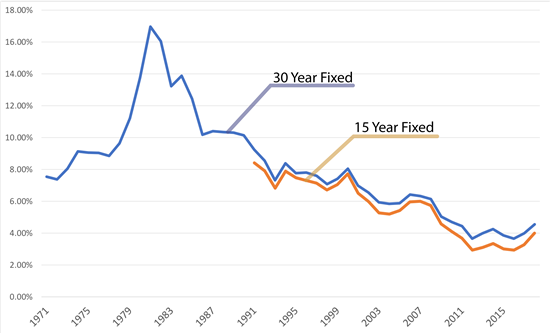

Historical Mortgage Rates

Mortgage rates have seen major highs and lows since Freddie Mac started tracking them in 1971. Rates have gotten as high as 18.63% and as low as 3.31% for a 30-year fixed rate loan. Mortgage rates today remain on the low end, with the average around 4.48% for a 30-year fixed loan.

|

| © CreditDonkey |

Mortgage Rates from the 1970s to 2019

Since the housing crisis ended around 2008, borrowers have been able to get mortgage rates between 3.5% and 4.98% for a 30-year fixed rate loan. Borrowers who can afford a 15-year payment have enjoyed rates as low as 2.9%.

What was the highest mortgage rate in history?

October of 1981 saw the highest 30-year fixed mortgage rate in history. The rate was around 18.63%. That's 14.13% higher than the average 30-year fixed mortgage rate today.

What was the lowest mortgage payment in history?

November of 2012 saw the lowest 30-year fixed mortgage rate in history. The rate dropped all the way down to 3.31%. Interest rates remained in that range until June 2013, when interest rates increased to 4.3% to 4.5%.

What was the highest 15-year fixed rate mortgage in history?

December of 1994 saw the highest 15-year fixed mortgage rate in history. The rate was around 8.89%. That's 5% higher than interest rates are today on the average 15-year fixed loan.

What was the lowest 15-year fixed rate mortgage in history?

The lowest 15-year fixed mortgage rates in history occurred during May 2013. At that time, 15-year rates were just 2.56%. A $100,000 mortgage would cost just $670 per month.

Historical Mortgage Rates by Year

Interest rates rise and fall throughout the years. Many factors affect them, including inflation, the state of the housing market, and the rate the Fed sets at the time. The Fed doesn't directly affect interest rates like many people think, though.

They only step in when things are getting out of hand. In other words, if market rates get too high and housing becomes unaffordable, or if market rates get too low and housing is too easy to obtain. Neither situation bodes well for the economy as a whole.

30 Year vs 15 Year Historical Fixed Mortgage Rates

|

| © CreditDonkey |

30-Year Fixed Mortgage Rates by Year

| Year | Average |

|---|---|

| 1971 | 7.54% |

| 1972 | 7.38% |

| 1973 | 8.04% |

| 1974 | 9.12% |

| 1975 | 9.05% |

| 1976 | 9.04% |

| 1977 | 8.84% |

| 1978 | 9.64% |

| 1979 | 11.2% |

| 1980 | 13.74% |

| 1981 | 16.96% |

| 1982 | 16.04% |

| 1983 | 13.23% |

| 1984 | 13.87% |

| 1985 | 12.43% |

| 1986 | 10.18% |

| 1987 | 10.4% |

| 1988 | 10.34% |

| 1989 | 10.31% |

| 1990 | 10.13% |

| 1991 | 9.25% |

| 1992 | 8.55% |

| 1993 | 7.31% |

| 1994 | 8.38% |

| 1995 | 7.76% |

| 1996 | 7.81% |

| 1997 | 7.6% |

| 1998 | 7.08% |

| 1999 | 7.4% |

| 2000 | 8.05% |

| 2001 | 6.97% |

| 2002 | 6.54% |

| 2003 | 5.94% |

| 2004 | 5.83% |

| 2005 | 5.87% |

| 2006 | 6.41% |

| 2007 | 6.33% |

| 2008 | 6.14% |

| 2009 | 5.03% |

| 2010 | 4.69% |

| 2011 | 4.44% |

| 2012 | 3.66% |

| 2013 | 3.98% |

| 2014 | 4.24% |

| 2015 | 3.85% |

| 2016 | 3.65% |

| 2017 | 3.98% |

| 2018 | 4.54% |

15-Year Fixed Mortgage Rates by Year

| Year | Average |

|---|---|

| 1991 | 8.4% |

| 1992 | 7.9% |

| 1993 | 6.82% |

| 1994 | 7.89% |

| 1995 | 7.48% |

| 1996 | 7.31% |

| 1997 | 7.13% |

| 1998 | 6.71% |

| 1999 | 7.05% |

| 2000 | 7.71% |

| 2001 | 6.5% |

| 2002 | 5.98% |

| 2003 | 5.27% |

| 2004 | 5.2% |

| 2005 | 5.42% |

| 2006 | 5.96% |

| 2007 | 6.0% |

| 2008 | 5.73% |

| 2009 | 4.57% |

| 2010 | 4.1% |

| 2011 | 3.68% |

| 2012 | 2.93% |

| 2013 | 3.1% |

| 2014 | 3.35% |

| 2015 | 3% |

| 2016 | 2.93% |

| 2017 | 3.27% |

| 2018 | 4% |

Why Were Mortgage Rate So High in the '80s?

In the '80s, interest rates in the high teens were the norm. It was a result of the Fed having the task of taming inflation. They needed to decrease the desire and/or ability of consumers to buy a home.

Affordability became a serious issue up through the late 1980s - early 1990s, when things started to come down and rates continually fell until the housing crisis occurred.

Interest Rates during the housing/mortgage crisis?

Prior to the housing crisis, consumers could get their hands on mortgages rather easily. Many of those mortgages were interest-only loans, which means many homeowners never even touched the principal on their loan. Banks started selling the loans they held in their own portfolios in an effort to offset their own default. Soon enough, too many homeowners were defaulting and housing prices began to fall at incredible speeds.

It was then like a domino effect, taking down the mortgage industry, housing industry, and the economy as a whole. As a result, interest rates rose in an effort to offset the default occurring throughout the industry. It wasn't until 2009 that rates started dropping to more affordable figures again.

Mortgage Rates Today

Today, the average mortgage rate for a 15-year fixed rate mortgage is 3.94%; for a 30-year fixed, it is 4.48%. While this isn't the lowest we have seen rates, they are definitely on the lower end of what we've seen through the years.

Bottom Line

Mortgage rates have been all over the board since 1971. While we haven't seen the insanely high interest rates of the 1980s anymore, there's no predicting what they will do in the future. Mortgage rates depend on a large number of variables that can change at any given moment.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next: