Best Places to Buy Gold Coins

Looking for gold? See why JM Bullion, SD Bullion, APMEX and others made this list of the best places to buy gold online.

|

- JM Bullion - Best Overall

- SD Bullion - Lowest Prices

- APMEX - Best Selection

- Vaulted - Easiest Buying Process

- The U.S. Mint - Best for Frequent Buys

- Kitco - Best for Larger Investments

- Augusta Precious Metals - Best for Gold IRAs

- GoldSilver - Best Discounts

Gold is an appealing investment for several reasons. It's still seen as a good safeguard against inflation and can be spent just like paper currency.

So where do you buy gold coins for your portfolio?

A gold dealer is the answer. In this guide, review the best online gold dealers to shop with. Plus, learn what to look for in a trustworthy gold dealer.

Best Places to Buy Gold Coins

|

It's super important to only buy from a trusted online dealer, so you know you will receive what you purchased. Here are some of the most reputable places to buy gold coins online.

- JM Bullion is best if you're looking to get physical gold coins shipped to your home. It has a large selection of coins, competitive pricing, and no hidden fees.

- Vaulted is best for small investors because you can buy fractional shares. You can even create an automatic gold savings plan and dollar-cost-average your investments.

- Augusta Precious Metals is best if you want to invest in gold for your retirement. They have the best professionals to help you set up a gold IRA, which will have tax benefits.

This rule helps you remember the key aspects to consider when buying gold coins:

- Genuine: Ensure the gold coins are authentic and certified.

- Options: Explore different types of gold coins and sellers.

- Liquidity: Consider how easily the coins can be sold or traded.

- Diversify: Don't put all your money into one type of coin; diversify your investments.

JM Bullion - Best Overall

|

Founded in 2011, the quickly growing JM Bullion offers a wide range of gold coins and bars from all over the world, including the U.S., South Africa, and Mexico.

Pros

- Reasonable prices

- User-friendly site

- Strong customer service

- 4% discount if you pay by paper check, ACH, or bank wire[1]

Cons

- US only

They also offer IRA-approved gold, if you're interested in investing for your retirement through a self-directed IRA. In addition to gold, they carry silver, platinum, copper, and palladium.

JM Bullion's prices are transparent and competitive. They have no commissions or fees, and their site is easy and intuitive to navigate.

They accept payment via credit card, PayPal, wire transfer, e-checks, and even purchases made with Bitcoin and Ethereum,[2] two popular cryptocurrencies. Different payment methods will have slightly different rates.

They have some unique collectible offerings, like Chibi coins for fans of anime and movies, and a variety of themed coins. They also offer a military discount and one-bulk purchases.

They offer free shipping for orders over $199, and charge $7.99 for orders less than that.[3]

Secure storage is available through TDS Vaults, which they've partnered with to ensure the safety of your gold.

Unfortunately for international buyers, they're only available in the U.S.

Their return policy has a 5-day limit, but they don't indicate whether there's a restocking fee. You are expected to pay for any market losses. They won't buy back anything less than $1,000 worth,[4] and you can find their buyback prices at their site. JM Bullion's support is available via live chat or phone.

Shipping Policy:

JM Bullion offers free shipping on orders over $199.

Tip: Don't miss out on the benefits of owning gold. Invest in a Gold IRA and enjoy potential tax advantages and long-term security. Start planning for your future now.

Gold IRA Company Integrity Checklist

Free report and checklist that helps consumers compare and choose a reputable gold IRA company

Free Gold IRA Kit

- Up to $10,000 in free silver for eligible customers

- Highest buyback price, guaranteed

- Endorsed by Sean Hannity and Chuck Norris

SD Bullion - Lowest Prices

While SD Bullion was only founded in 2012, they have a good reputation as a gold dealer. They offer lower prices than some competitors and even have a low-price guarantee, meaning if you find a lower price somewhere else, they'll match it.

Pros

- Price-matching policy

- Free shipping on orders over $199

- Gold storage at $9.99/mo

Cons

- Higher cancellation fee

They offer a range of gold coins and bars, including coins from the U.S., Canada, Australia, China, and Great Britain, as well as pre-1933 gold, produced prior to the end of circulation of gold coins in the United States.

Their gold coins and bars vary in size and weight (and therefore price), some as small as 1/100th of an ounce, and some as much as a whole kilogram.

They have a deals page called "Doc's Deals," where they offer gold and silver at reduced prices.

In addition to their other offerings, SD Bullion sells IRA-approved gold, including:

- American Gold Eagles

- Canadian Gold Maple Leafs

- American Gold Buffalos

- Perth Mint Gold Coins

- British Gold Coins

- Chinese Gold Pandas

- 999 Fine Gold Bars

They also sell IRA-approved silver and platinum.

Shipping costs $9.95 for purchases under $199, but after that, it's free on domestic orders.[5] Or you can choose to store your gold in the SD Depository vaults, located in Michigan and Ohio, at prices starting at $9.99 a month.[6]

Rest assured, they won't mix your gold with that belonging to other investors. Deposits stored with them are insured by Lloyd's of London.

SD Bullion's customer service team is accessible via email, chat, and by phone.

They have a 3-day return policy, and their cancellation fee is fairly high. Returned products are subject to a 5% restocking fee or $35, whichever is higher. Returned products from the SD24K jewelry line are subject to a 10% restocking fee.[7]

They may also make you pay the cost of any market loss. While they will buy back your gold, their prices are not publicly available.

Shipping Policy:

SD Bullion offers free shipping on orders over $199.

APMEX - Best Selection

|

You can find an extensive variety of gold in all shapes and sizes at APMEX (American Precious Metals Exchange), from coins to bullion to gold jewelry.

Pros

- Wide range of products

- AutoInvest program

- Free shipping on orders over $199

Cons

- Higher prices than competitors

With over 40,000 unique products, they have one of the biggest varieties of any of the dealers on this list. However, their prices aren't the lowest.

In addition to gold, they also carry other metals, including silver, platinum, and palladium.

Their AutoInvest program allows you to set up recurring purchases, which can help you achieve a more balanced purchase price than attempting to time the market.

Like many of the other dealers on this list, they have a discounts page where you can find the lowest prices, and also offer discounts for those who purchase in bulk.

They offer free shipping for orders over $199, and you can pay via credit card, PayPal, bank transfer, or cryptocurrency. Orders over $500k can be paid only by bank wire. Note that all bank wire payments must be received by APMEX within 3 business days. Orders $500k and below can be paid within 5 business days.[8]

There are no hidden fees, and their buyback prices are publicly listed on the site. Prices are updated every 60 seconds, and once you start an order, you have 15 minutes to complete it to lock in the current price.

They offer storage through Citadel Global Depository Services.

APMEX has a seven-day return policy, which is longer than some. However, there is a $50 or 10% restocking fee.[9]

Shipping Policy:

APMEX offers free shipping on orders over $199.[10]

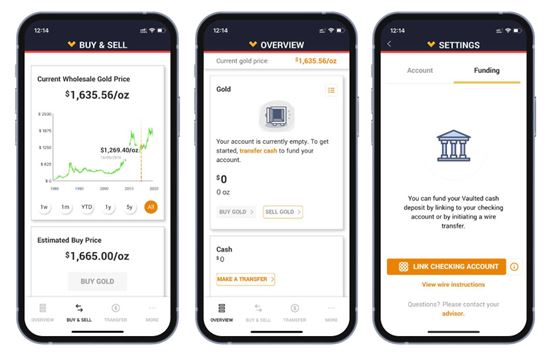

Vaulted - Easiest Buying Process

|

Vaulted is a mobile-first gold dealer, bringing gold investing into the app era. Their goal is to make gold buying "easier than ordering a pizza," according to their site.

Pros

- Buy gold easily

- Stored at the Royal Canadian Mint

- Mobile app

Cons

- No gold coins

It takes just a few minutes to set up an account, and then you can get started investing in 99.99% pure gold kilo bars that are manufactured by the Royal Canadian Mint and certified Conflict-Free.

Your bars can be stored at the Canadian Mint as well, always ensuring they're in safe hands. They also let you buy fractional shares at regular intervals by linking a checking account.

Unfortunately, they don't sell gold coins—only bars. For coins, you'll have to look elsewhere.

Their fees include an annual 0.4% maintenance fee and a 0.8% transaction fee on all gold purchases.[11]

Shipping Policy:

Royal Canadian Mint charges a $50 fee per bar for handling cost. FedEx charges you Next-Day or Second-Day shipping rates, the cost is generally around $150.[12]

The U.S. Mint - Best for Frequent Buys

You may not know this, but you are able to buy gold coins directly from the United States Mint, which produces all of the currency circulating in the country today.

Pros

- Free shipping on frequent orders

- Trusted American institution

Cons

- Limited selection

Their selection is a fair deal more limited than many of the other sites on this list, including only coins produced by the U.S. Mint itself, like American Eagles, and a variety of other American coins.

They sell coins ranging from a few hundred dollars to a thousand or more.

One advantage of buying through the U.S. Mint is that you can get free shipping if you purchase from them frequently.

You'll have to pay shipping for your first three orders, but any further orders in the same year will be shipped for free.

Shipping Policy:

The US Mint offers free shipping on accounts with more than 3 orders per year.[13]

Kitco - Best for Larger Investments

|

If you're looking to make a larger investment, you might consider buying your gold through Kitco, where the minimum order is $2,000.

Pros

- Buy digital gold

- Opt for delivery later

- Buy a range of metals

Cons

- Mixed customer reviews

Like many of their competitors, they have a deals page where you can find gold coins at discounted prices, and they offer currency from a range of countries including the U.S., Canada, Australia, and more.

You can also invest over time by buying fractional quantities of gold bullion and opt for delivery at a later date. Or you can trade digital gold through the Kitco Vaultchain.

This digital currency represents real gold held at the Royal Canadian Mint, but is easily tradable for an annual fee. Unlimited transactions and storage are included. Your fee is prorated depending on what part of the year you sign up.

Besides gold, you can buy a range of other metals including silver, palladium, rhodium, and platinum.

Shipping Policy:

Kitco offers free shipping on orders $5,000 or more.[14]

Augusta Precious Metals - Best for Gold IRAs

If you're interested in investing in gold coins for your retirement, Augusta Precious Metals is one of the best gold IRA companies.

Pros

- Offers gold IRAs

- Focuses on providing education

- Lifetime support

- Gold coin storage

Cons

- Prices not posted online

- $50,000 minimum

The great thing about opening a gold IRA is that you get tax advantages. Just like normal IRAs, your gold investments are tax-deferred.

Not sure if a gold IRA is right for you? Augusta Precious Metals will first give you a free 1-on-1 web conference to teach you all about gold, the market, and the risks. They want to make sure you're making the right choice for your future.

If you decide to go ahead, they will help you through the process of opening a self-directed IRA and rolling over your 401k or other retirement accounts.

Your gold coins and bullions are securely stored in their IRS-approved depository. When it's time to withdraw, you can either get it as a cash distribution or have your gold coins shipped to you.

Silver IRA Retirement Diversification

Learn how to diversify your retirement savings with a silver IRA.

GoldSilver - Best Discounts

GoldSilver offers a somewhat limited selection of gold coins and bullion—and, as the name suggests, they carry silver as well.

Pros

- International storage options

- Will match competitor prices

- Low cost storage

Cons

- Somewhat limited selection

They have a range of IRA-approved options for those looking to save for retirement, as well as a deals section offering precious metals at discounted prices.

You can earn discounts up to 4% by using certain payment methods, including check, wire transfer, and Bitcoin. You're also welcome to pay via PayPal or credit card, but they'll incur a small fee that you could otherwise avoid.

You can also earn discounts by becoming an "Insider," which you can do by buying 10 ounces of gold or 500 of silver. It will also grant you access to exclusive investment research.

GoldSilver is another platform that will match prices with competitors, up to $5,000.

GoldSilver offers gold storage at vaults around the world (Toronto, Salt Lake City, Singapore, and Hong Kong) for rates as low as 0.06% of the value of the assets held, paid monthly. The minimum storage fee is set at $4.[15]

Shipping Policy:

Goldsilver rate for free shipping is higher than many of their competitors and is only available for orders of $499 or more.[16]

Other Gold Dealers to Consider

Money Metals Exchange

Buy a variety of gold coins and bullion through Money Metals Exchange, and save money by enrolling in a monthly plan of $100 or more to lower costs.

Set up price alerts to find the best prices, and pay with a variety of methods including certain cryptocurrencies.

They offer free shipping for orders $199 or higher.

David Hall Rare Coins

If you want a personal touch, consider David Hall Rare Coins, where you shop by talking to an agent directly. They sell gold and silver over the phone, including coins and bullion.

BGASC (Buying Gold and Silver Coins)

BGASC has a wide selection of gold coins at low prices. They have a reputation for solid customer support and excellent shipping times.

Their return window is only 3 days, and their payment options are more limited than some of their competitors.

BGASC has a Trustpilot score of 4.7 out of 5.

Golden Eagle Coins

Golden Eagle Coins has a 50-year history in the business of dealing gold, with a good reputation online that has been proven over time.

They are reported to have strong customer service, a wide selection of coins, and a generous 7-day return policy.

Golden Eagle Coins has a Trustpilot score of 4.0 out of 5.

Is Investing in Gold a Good Idea?

While they're popular, stocks and crypto are some of the most volatile investments you can make.

That's where gold comes in. Here are a few reasons why you might want to consider investing in gold.

- It's limited in quantity.

Because of its finite quantities, it's a hedge against the inflation of paper money. After all, central banks can always print more money, but there's a limited amount of gold on Earth. - It's a more stable long-term investment.

Precious metals like gold historically hold their value better during a recession in the market. - You'll only owe taxes on your gains once you sell it. And even that can be avoided or mitigated by investing in gold through a self-directed IRA.

- Gold can be spent.

And it has been for thousands of years, by countries around the world, longer than any paper currency. It has many uses, as well. Try making a microchip or a necklace using chopped-up bits of dollar bills.

What Is a Gold Dealer

Gold dealers are trusted sources for buying gold. They may sell it in the form of coins, bullion, and even collectible pieces.

Many gold dealers are now online. They offer the ability to shop around the market, checking prices from multiple sellers, as well as how soon it can be delivered.

Gold dealers will often let you choose between receiving the gold yourself or keeping it safe in a vault, and, of course, they will buy gold as well should you decide to sell it.

How to Choose a Gold Dealer

In the gold dealing business, the best thing to look for is a good reputation. Consistently positive customer reviews should be a good indication that the dealer you're looking at is a respectable one. And the more reviews a dealer has, the better.

Make sure that any gold dealer you choose has physical offices or walk-in stores. If a dealer only lists a P.O. Box rather than an address, you should consider it a red flag.

They should have transparent pricing, ideally without commissions or extra fees, which you'll need to check for before you make any purchases. And since the price of gold changes from moment to moment, you'll want to be sure their prices are current.

Try to find a gold dealer with payment options that match your preferences. In general, you'll be able to pay via credit card, wire transfer, PayPal, check, money order—and sometimes even Bitcoin.

Certain payment methods, like credit cards, may incur a fee that you should watch out for.

And lastly, you'll want to know their return and buyback policies. It's common to accept returns within three days of purchase, but look out for restocking fees. Since most reputable dealers will also buy gold back from you, look for their listed buyback prices.

Buying gold online is safe if you transact with legitimate precious metal dealers. If you're unsure, you can always reach out to the CFTC or NFA to check the company's registration status, business background, and disciplinary history.

Where Else to Buy Gold Coins?

Here are the other places to buy physical gold:

- Local Banks

Not all banks offer physical gold, but some, like Leader Bank, do. Although their selection is small, you can trust that your purchase is legit because it's from a regulated bank.Private banking clients might have more options. You can call your bank if they are selling gold.

- Local Coin Shops

You can also buy gold through the nearest precious metals shop in your location. This way, you get to see the actual metal before purchasing it.However, compared to online retailers, it might be more expensive since the store has rent and utilities to pay as a brick-and-mortar. The selection might also be quite limited to what's only available in the store.

Physical vs Paper Metals

There are various ways to invest in gold. One is to buy coins and bars from dealers; another is to buy funds that track their price. The former means physical, the latter means paper.

Physical Metals

- You own a coin, bar, or ingot of a precious metal

- Can be bought directly or through a Gold IRA

- Gold directly bought from a dealer can be stored anywhere

- Gold bought through an IRA must be stored in an IRA-approved depository

An example of gold dealers are those included in this list such as JM Bullion. As for Gold IRA, popular Gold IRA companies include Goldco or Augusta Precious Metals.

The fees associated with physical investing are typically higher than paper metals since shipping, storage, and account set-up (if applicable) are to be considered.

Paper Metals

- You don't physically own the precious metal

- These are funds that track the price of the metal

- Can be easily bought and sold through the stock market

- More transparent pricing and fees

An example of paper metal is a Gold ETF like SPDR Gold Shares (GLD). If you compare the price chart of GLD to the gold spot price, you'll see similar trends.

Gold ETFs are more affordable since you can start with just 1 share, and some cost less than $100 per share. They also have lower fees as expense ratios are usually under 1% annually.

How to Avoid Gold Scams

Protect yourself from gold scams by keeping an eye out for these red flags:

- Promises Guaranteed Returns

Be wary if a salesperson promises that you will profit from gold. The market's future movement can't be guaranteed. - Pushy Salespeople

Some salespeople use fear and false claims to pressure you into investing all your money in gold, claiming it will "protect" your savings. - Excessive Fees

Some dealers deliberately hide their markup but will actually charge you 30% to 300% or more. - Bait-and-Switch

Scammers will lure you in with ads for low bullion fees, and then once you invest, they'll switch to numismatic coins, which typically have higher markups. - Unsolicited Sales Pitches

Aggressive salespeople who suddenly call, email, or send brochures to get you to invest in precious metals. - Fear of Missing Out (FOMO)

Gold dealers convincing you to invest in precious metals simply because others did too. - Unregulated Platforms

Precious metals sellers who use unregulated platforms like eBay, Facebook, or other social media sites. - Unaccredited and Bad Reviews

Gold providers that are unaccredited on sites like the Better Business Bureau, or have unresolved bad ratings on review sites such as BBB, BCA, Consumer Affairs, and Trustpilot. - Heavy Advertisements

Precious metals companies that heavily advertise on radio, television, or online. - Non-Existent Vaults

When a Gold IRA company makes you store gold in a distant depository for extra fees, but it's actually non-existent.

Bottom Line

Investing in gold has never been easier, with a variety of options that cater to whatever type of buyer you happen to be.

You can buy coins or bullion, historical or collectible, and with several dealers offering price-match guarantees, there's no reason you can't get the best price possible.

If you want to save for retirement, consider a self-directed IRA, and if you're worried about the state of the stock market or inflation of your national currency, gold can be a safe place to store value.

Free Gold IRA Kit

- Up to $10,000 in free silver for eligible customers

- Highest buyback price, guaranteed

- Endorsed by Sean Hannity and Chuck Norris

Gold IRA Company Integrity Checklist

Free report and checklist that helps consumers compare and choose a reputable gold IRA company

References

- ^ JM Bullion. Payment Methods at JM Bullion, Retrieved 09/03/2024

- ^ JM Bullion. Payment Methods, Retrieved 09/03/2024

- ^ JM Bullion. JM Bullion Shipping, Retrieved 09/03/2024

- ^ JM Bullion. JM Bullion Buyback, Retrieved 09/03/2024

- ^ SD Bullion. SD Bullion Shipping, Retrieved 09/03/2024

- ^ SD Bullion. Storage Rates, Retrieved 09/03/2024

- ^ SD Bullion. SD Bullion Returns & Refunds, Retrieved 09/03/2024

- ^ APMEX. Payments, Retrieved 09/03/2024

- ^ APMEX. APMEX Return Policy, Retrieved 09/03/2024

- ^ APMEX. APMEX Shipping, Retrieved 09/03/2024

- ^ Vaulted. Vaulted Fees, Retrieved 09/03/2024

- ^ Vaulted. Vaulted Physical Delivery, Retrieved 1/15/2024

- ^ United States Mint. United States Mint Loyalty Program, Retrieved 09/03/2024

- ^ Kitco. Kitco Shipping, Retrieved 09/03/2024

- ^ GoldSilver. GoldSilver Gold Storage Fees & Pricing, Retrieved 09/03/2024

- ^ GoldSilver. Goldsilver Shipping, Retrieved 09/03/2024

Jeremy Harshman is a creative assistant at CreditDonkey, a personal finance comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|