Wealthfront Review: Is It Good?

Wealthfront simplifies long-term, low-cost investing with a diversified portfolio. But is it safe? Read on to learn if Wealthfront is worth it.

Overall Score | 4.0 | ||

Annual Fee | 4.5 | ||

Minimum Deposit | 4.5 | ||

Investment Types | 4.0 | ||

Customer Service | 3.0 | ||

Pros and Cons

- Minimal opening deposit & fees

- Advanced goal tracker

- Tax loss harvesting

- No human advisors

- No fractional shares

Bottom Line

Good robo-advisor for hands-off investor. Fees are low, but lack human advisors

- What is Wealthfront

- Who Wealthfront is Good For

- Fees

- Free Financial Planning

- PassivePlus Services

- Returns

- Pros

- Cons

- App

- Wealthfront vs Betterment

- Wealthfront vs Vanguard

What is Wealthfront?

Wealthfront is a robo-advisor that automatically invests and manages your portfolio for you. You simply fill out a form stating your goals and risk tolerance. The algorithm invests based on your answers.

There's no human intervention. Because it's automated, the fees are much lower than if you were to hire a financial advisor.

Wealthfront offers 3 main services:

- Robo advisement: The platform is focused on investing in ETFs (Exchange Traded Funds). It automatically adjusts your portfolio to stay in line with your investment goals.

- Financial planning: Wealthfront offers free software-based financial planning to help you plan for retirement and different life situations.

- Short-term cash management: Wealthfront offers a cash account with a high yield APY and FDIC insurance up to $1 million. That is up to 4x the coverage a standard bank offers because Wealthfront holds your cash account deposits at multiple FDIC-insured banks. They also offer a unique service to robo-advisors that allows investors with $100,000 to borrow against their portfolios.

Keep reading to see if Wealthfront is right for you.

Wealthfront Cash Account

- 4.00% APY on all your cash

- $0 monthly fees

- No overdraft fees

- Wealthfront is not a bank. Funds held in Wealthfront Cash Account are FDIC-insured up to $8 million through partner banks.

This way, you can see if Wealthfront's methodology is right for you.

Who Wealthfront Is Best For

- Beginners unsure about investing.

Many novice investors lack the confidence to select their own investments. A robo-advisor does all the work for you.Beginners don't have to manage their own portfolios, which takes the fear out of investing.

Did you know: While Wealthfront only has a $500 minimum, it may surprise you that the majority of their accounts are at $100k or above. Wealthfront offers value-added services available at $100k+, such as stock-level tax-loss harvesting and risk parity. - Hands-off investors.

Wealthfront will handle complicated tasks like rebalancing and tax strategizing. - Investors saving for retirement.

With Wealthfront's advanced financial planning tools, you can estimate your retirement savings. This helps you see what you need to do to reach your goals.Wealthfront also offers IRA accounts and 401k rollovers.

SIPC protects against loss of securities at a brokerage due to bankruptcy or other financial troubles (like if Wealthfront were to go out of business). It does NOT protect against losses due to the market or bad investment advice.

Other Trading Apps

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

How much does Wealthfront Cost?

Currently, Wealthfront charges an annual fee of 0.25% of your assets under management. Wealthfront does not charge:

- Account opening fees

- Account closing fees

- Trading fees

- Commission fees

- Account transfer fees

- Withdrawal fees

The platform deducts the annual fee from your account each month, based on your average monthly balance. With an average monthly balance of $100,000, you would pay $20.83 per month.

You will also incur an ETF expense ratio. Though charged through Wealthfront, this fee comes from the funds in which you're investing. ETF expense ratios cost an average of 0.8% - 0.12%.

Minimum Investment Required: $500 minimum to open an account. This enables Wealthfront to allocate your funds over eight asset classes.

If you want to take advantage of the Stock-level Tax Loss Harvesting, though, you will need an account minimum of $100,000.

Wealthfront Free Financial Planning

|

| © CreditDonkey |

Wealthfront offers free financial planning to help you plan for retirement, powered by its automated financial advice engine, Path. You can link all your financial accounts to get an overall picture based on your current finances and retirement goals.

Based on that, Path estimates how much you'll need to save in the future. Here's what else you can do with Path:

- See how spending and/or saving more or less would impact your retirement income

- Calculate what happens if you retire at different ages

- Estimate how big financial decisions (like buying a house) would impact retirement

- See the tax implications of withdrawals for your different accounts

The retirement calculations also consider factors like Social Security and inflation.

Wealthfront helps you plan for big events:

- Homeownership: Path helps you calculate when you'll save enough for the down payment, the amount of mortgage you'll realistically qualify for, and the neighborhoods in your price range.

- College: See the estimated cost and how much your kid can expect in financial aid. Path will help you set a realistic monthly savings goal for your child's education costs.

- Travel: Want to take some time off to travel? Path will tell you how much time you can take off and still maintain your financial goals.

See how much a trip is expected to cost. Path will also show you how things like renting out your home will impact its affordability.

Wealthfront PassivePlus Services

|

| © CreditDonkey |

PassivePlus is a suite of services aimed at improving your investment returns. These services are automatically enabled once you hit a certain amount in your portfolio. They include:

- Tax Loss Harvesting (for all taxable accounts)

Should you lose money on a particular ETF, tax loss harvesting uses that loss to offset capital gains you may have made with other investments. This can lower your tax bill.Wealthfront offers daily tax loss harvesting, whereas most brokers only offer this service annually. The daily tax loss harvesting watches for movement in the market to capture investment losses. The tax savings are then reinvested to help grow your investments.

- Stock-level Tax Loss Harvesting (for accounts $100,000+)

This advanced program looks for movement in individual stocks, not just the overall index. It purchases individual stocks from the S&P 500, rather than ETFs. This is more tax-efficient. - Risk Parity (for accounts $100,000+)

Risk parity is an advanced strategy that aims to even out risk among the different asset classes. It weighs the risk among the asset classes and creates an ideal allocation according to the optimal risk target level.This affords you a better return for a portfolio with the same risk level.

- Smart Beta (for accounts $500,000+)

Smart Beta (formerly Advanced Indexing) weighs the stocks in your portfolio more intelligently to increase returns. It uses factors like value, momentum, dividend yield, market beta, and volatility to determine how much to invest.

Returns

As with any broker, Wealthfront offers no guarantee of returns. You run the risk of losing your investment at any point.

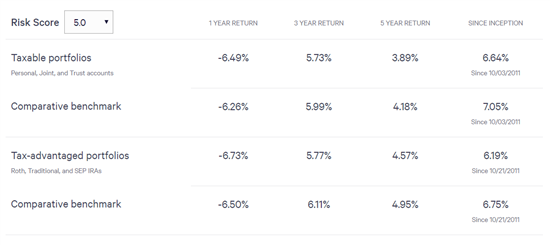

You can see the historical performance for different risk levels on the site. Here's the historical performance for a moderate risk score of 5.0 (after fees, pre-tax).

|

A benefit of Wealthfront's strategy is their focus on creating and rebalancing a balanced portfolio over time. This portfolio consists of indexed ETFs that help minimize individual investment risk.

In other words, by investing in the overall market rather than individual stocks, you can protect yourself if a few of these companies go bust.

However, in case of a market correction, where the entire market loses value, your portfolio will also take a hit.

Wealthfront Pros

- Minimal opening balance

Beginner investors usually don't have large amounts of cash. Wealthfront allows you to get started with just $500. They charge no fees if you drop below that amount. - Automatic rebalancing

To start, you set your allocation (e.g., 70% stocks and 30% bonds). It's not unusual for this to drift over time, since stocks and bonds increase at different rates.Wealthfront automatically rebalances your portfolio to your target allocation. If you change your risk profile, Wealthfront will also automatically reassess your asset allocation.

- Advanced financial planning

Wealthfront free financial planning helps you determine if you are on track for your investment goals, whether for retirement, college, or something else. - Tax loss harvesting for everyone

Some robo-advisors only provide tax loss harvesting to high-net-worth investors. Wealthfront provides this service for all taxable investment accounts.The ability to maximize your tax savings can save you thousands of dollars come tax time.

- Tax efficient transfers

To transfer funds from another brokerage, rather than sell your old portfolio and transfer the investments into cash, Wealthfront offers a "Tax-Minimized Brokerage Account Transfer."Certain assets, such as stocks and ETFs, can be electronically transferred to your Wealthfront portfolio. Investments less than one year old are left to sit until they hit that milestone.

The software then automatically sells the securities after one year. That way, you pay capital gain taxes instead of ordinary income tax, helping you save money.

Some types of investments will not qualify, including:- Penny stocks

- Mutual funds

- Annuities

- Individual bonds

- Penny stocks

- Retirement accounts

Wealthfront offers traditional, Roth, and SEP IRA accounts. You can also rollover a 401 (k) from a previous employer to an IRA tax-free. - College 529 plans

Wealthfront offers 529 college savings plans if you are saving for your child's education. The Path tool further helps you get an idea of how much you need to save.The tool takes into account the school's costs and estimated financial aid you may receive, and then automatically determines your monthly saving requirements.

TIP: Check out your state's 529 plan first. Many state-sponsored plans offer tax benefits (deductions or credits) to residents.If you've exhausted this benefit or your state doesn't offer one, then Wealthfront offers a great alternative.

- Wealthfront Cash Account

A Wealthfront Cash Account is a secure place to save cash you plan to invest or spend within the near future.Compare Bank Promotions:- Chase coupon for National Bank

- CIT Bank promo code for Savings (read latest review)

- Chase coupon for National Bank

- Portfolio line of credit

If you need cash for something, Wealthfront allows a secure line of credit against your portfolio for investors with $100,000 or more. This way, you can borrow money without having to sell off your investments.The interest rate is low - generally lower than credit cards and many personal loans. You're allowed to borrow up to 30% of your account. You pay back the loan on your own time.

- Withdraw funds: Go to "Transfer Funds" and select the accounts to withdraw from and transfer into. You must withdraw at least $250, and the account balance cannot go below $500 (in other words, you need at least $750 in the account). There are no withdrawal fees, and you can withdraw as often as you like.

- Close your account: Select "Withdraw funds" and "Withdraw the entire account balance." You can liquidate your account and transfer the cash to your bank account. This may incur taxes. You'll have to call Client Services to close your account.

Cons

- No access to an advisor

As a beginning investor, it can be difficult not talking to a human about your investments. However, Wealthfront has a blog that answers many questions you may have. - No fractional shares

You could end up with a cash balance that just sits if you don't have enough money in your account to purchase a full share of an ETF.

Compare Returns

- Create your own pies by choosing your own investments.

- Use one of the preset templates.

- Tweak a preset template to your liking.

App

Wealthfront is one of the few robo-advisors to provide the same desktop experience on an app. The app is available on both iOS and Android systems.

It allows you to:

- See your Wealthfront account balance and performance chart

- Link your external financial accounts

- Make deposits to your Wealthfront accounts

- Withdraw money into your linked account

- Use the retirement planning tools to see if you're on track

- Calculate the costs of your goals (such as buying a house, travel, etc.)

- Get recommendations on how to reach your goals

- See houses you can afford

- Borrow cash with Portfolio Line of Credit (for accounts $100,000+)

Wealthfront vs Betterment

Wealthfront and Betterment are both good choices for a robo-advisor. They offer similar services, including portfolio rebalancing and tax loss harvesting.

They also have similar account types, including IRAs and taxable accounts. However, Wealthfront's fees are lower for accounts over $100,000; Betterment increases the fee for high-balance accounts.

Choose Betterment IF: You need a human advisor.

Betterment offers unlimited access to financial experts, no matter your balance. And if you have a minimum of $100,000 invested, their Certified Financial Planners offer advice on outside investments and guidance for life events.

Wealthfront has no human advisors. But they do have financial planning tools that look at your entire overall financial health.

Choose Wealthfront IF: You're saving for college.

Wealthfront has 529 savings plans for those saving for college. The platform offers a tailored program based on when your child will enter college. (You can even name a specific college at any point.)

These features allow you to maximize your tax savings while saving for your child's education.

Choose Wealthfront. Their fees are among the lowest of all robo-advisors we've encountered for customers with less than $100,000.

Wealthfront | Betterment | |

|---|---|---|

Wealthfront Cash Account - | Compare Pricing - | |

Benefits and Features | ||

| Savings |

| |

| Annual Fee |

| |

| Minimum Deposit | ||

| Checking | ||

| Phone Support | ||

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | ||

| Tax Loss Harvesting | ||

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Banking | Offers checking account with a free debit card, and a high-yield cash account | |

| Mobile App | ||

| Single Stock Diversification | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Wealthfront: Pricing information from published website as of 04/20/2024. Betterment: Pricing information from published website as of 11/22/2025 | ||

Wealthfront vs Vanguard

Vanguard Personal Services is a robo-advisor geared toward the investor with a higher net worth. It requires a $50,000 minimum deposit. The program offers IRAs, taxable accounts, and joint accounts, just like Wealthfront.

Choose Vanguard IF : You want human interaction and have more than $50,000 to invest.

Vanguard offers personal financial advisors you can talk to Monday - Friday. The human advisors select investments based on your goals. They also monitor and rebalance your portfolio.

Both Wealthfront and Betterment rely on technology to build and manage your portfolio. However, Vanguard has a $50,000 minimum investment requirement.

If you have specific investments you want to make or want advice on those selections, it's made available to you with Vanguard.

Choose Wealthfront IF: You have less than $50,000 to invest and/or you're concerned about fees.

Wealthfront's annual fee is lower than Vanguard's, at 0.25% versus 0.30%. You can't even invest in Vanguard with less than $50,000. And you'll pay commission fees if you trade anything other than Vanguard securities.

If you have over $50,000 to invest, the additional human interaction Vanguard offers is an advantage. Otherwise, you're better off with Wealthfront's lower fees.

Wealthfront | Vanguard Personal Advisor | |

|---|---|---|

Wealthfront Cash Account - | ||

Benefits and Features | ||

| Savings | ||

| Annual Fee | ||

| Minimum Deposit | ||

| Phone Support | ||

| Live Chat Support | ||

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | ||

| Tax Loss Harvesting | ||

| Goal Tracker | ||

| Automatic Deposits | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Mobile App | ||

| Single Stock Diversification | ||

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. Wealthfront: Pricing information from published website as of 04/20/2024. Vanguard Personal Advisor: Pricing information from published website as of 04/04/2018 | ||

Wealthfront vs Acorns

Acorns uses an "invest spare change" approach.

You link a bank account and credit cards to your account. And every time you make a purchase, Acorns will round up the spare change and automatically invest it for you.

This is a good way to invest without thinking. But you're not going to build real wealth from spare change.

Wealthfront is a better option for those serious about retirement savings. And Acorns' monthly fee may be high if you keep a very small balance.

Bottom Line: Is Wealthfront Worth It?

|

| © CreditDonkey |

Wealthfront is a good option for both beginning investors and advanced ones looking to grow their portfolios.

If you want personal investment advice, though, you may want to look elsewhere. Wealthfront is best suited for the investor who can manage their account digitally.

For people with little to invest who want to jumpstart their goals, Wealthfront provides the opportunity with their minimal investment requirement and low fees.

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Invest in Real Estate with $10+

- Only $10 minimum investment

- Get a diversified portfolio of real estate projects across the US

- Open to all investors

Donna Tang is a content associate at CreditDonkey, a personal finance comparison and reviews website. Write to Donna Tang at donna.tang@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next:

Compare: