Seeking Alpha Review: Is Premium Worth It for 2026?

Seeking Alpha eliminates the "guesswork from your investing decisions." But is it worth the subscription fee? Is Seeking Alpha right for you?

| |||

$45 Off Seeking Alpha Premium with 7 Day Free Trial | |||

Overall Score | 4.4 | ||

Price | 4.0 | ||

Mobile App | 4.0 | ||

Ease of Use | 4.0 | ||

Performance | 5.0 | ||

Research | 5.0 | ||

Pros and Cons

- High-quality content

- High performance of recommended stocks

- Access to expert analysis

- Highly technical

- Lack of interface customization

- Some inaccurate articles

Bottom Line

Crowdsourced investment analysis for research-driven stock investors

- What is Seeking Alpha

- What you get with Seeking Alpha Premium

- Who is it Best For?

- Pros and Cons

- How do Seeking Alpha Stock Picks Perform?

- Is it Worth It?

- Pricing Plans

- Premium Features

- Pro Features

- Free Features

- Alpha Picks

- Customer Support

- User's Experience

- How to Start Using Seeking Alpha

- How Seeking Alpha Compares

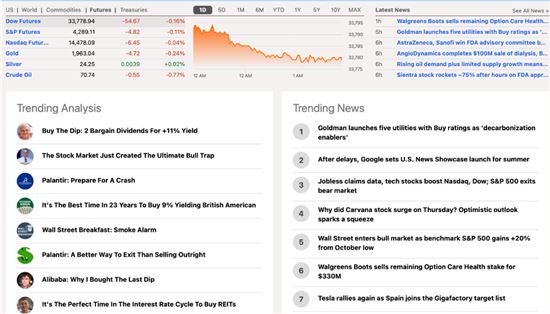

Choosing which stocks to buy can be a daunting task. Without the needed information, how do you make smart investment decisions? Seeking Alpha claims their Premium plan can guide you.

In this review, find out the key features, price, pros and cons of Seeking Alpha. Plus, learn whether its Premium service is worth the money.

What Is Seeking Alpha?

Seeking Alpha is an online investment research platform. It offers market analysis, stock reviews, and crowdsourced investing perspectives. It's like the Yelp of stocks.

It stands out with in-depth ratings on approx. 5,600 stocks - notably the highly sought-after Strong Buy stock recommendations.

Seeking Alpha is also a community. Seeking Alpha is now the largest investing community with 20 million monthly users. It also has 18,000+ contributors publishing 5,000+ investing insights each month.[1]

Yes, Seeking Alpha is reliable based on its historical performance. Over the past decade, its top-rated stocks have consistently brought higher returns than the S&P 500. It has an average annualized return of 25%.[2]

Unfortunately, only some of this information is free. The deepest well of insights is only available with their Premium plan for $299/year. But is it worth your time and money? Let's take a closer look.

Bottom line: Seeking Alpha Premium is worth it if you're picking your stocks. With its expert analyses and 'Strong Buy' recommendations that consistently outpace the S&P 500, it's a genuine game-changer for any serious investor.

What You Get with Seeking Alpha Premium

|

With Seeking Alpha Premium, you gain essential tools for discovering and assessing which stocks to buy, sell, or hold.

- Stock Ratings and Factor Grades

The ratings and factor grades provide you with a quick objective assessment of each stock. This is good if you want to use data to make your own investing decisions. - Top-rated Stocks

These stocks received the highest rating from Seeking Alpha authors, Wall Street analysts, and Seeking Alpha's quantitative metrics. You can choose from this list if you're wondering about which stocks to buy.Seeking Alpha's top-rated stocks have consistently beaten the market. By how much? Learn more in this section.

- Customized Content

This gives you a quick view of analysis and breaking news that may affect your investments. - Stocks Screener

This feature tells you the stocks rated as "Strong Buy" in various sectors, categories, and industries. - Data Visualizations

You get access to charts, graphs, and trends that help you understand the historical performance of each company.

- mutual funds

- ETFs

- commodities

- cryptocurrency

Now, let's look at how premium features fit different kinds of investors.

Who is Seeking Alpha Premium Best For

Seeking Alpha Premium is best for:

- Research-driven investors

- Long-term investors

- Those who need help in choosing what stocks or funds to buy

- Investors and traders who value technical content

Most of Seeking Alpha's stock analysis articles are not for beginners. The analysis tends to be too technical.

However, the Premium subscription can also be good for beginners because of the list of top-rated stocks. Those are good if you don't want to do research.

Who Should Skip Seeking Alpha Premium

The Premium plan may not be for:

- Traders who lean on shorter time frames

- Investors who don't want to pick individual stocks

- Those who may easily get overwhelmed with a wealth of information

- Investors who are not interested in managing their own portfolio

Pros And Cons of Seeking Alpha Premium

Here is an overview of what you should consider before subscribing to Seeking Alpha's Premium Plan.

Pros:

- High-quality content

- Recommended stocks consistently outperform the market

- Access to Expert Analysis

- Free trial to try it out

Cons:

- Subscription Cost

- Highly technical

- Lack of interface customization

- Some articles may be inaccurate

How do Seeking Alpha Stock Picks Perform?

Access to Seeking Alpha's Strong Buy Recommendations is one of the main reasons to get the Premium membership.

Since 2010, Seeking Alpha's Strong Buy Recommendations haven't just been solid - they've been exceptional. They've had an average annualized return of 25%. Even more impressive? They've beaten the S&P 500 every single year since 2010.[2]

- S&P 500: If you had invested $10,000 in the S&P 500 back in 2010, your return today would be a commendable $39,783.

- Seeking Alpha's 'Strong Buy' stocks: Had that same $10,000 been invested following Seeking Alpha's Strong Buy picks? You'd be sitting on a staggering $190,805.

That's not just a slight edge. It's a landslide - 480% higher return than the S&P 500. Seeking Alpha's recommendations have proven to deliver results. But remember that past success does not guarantee future results.

So Is Seeking Alpha Membership Worth It?

Yes! Seeking Alpha is worth it if you want to outperform the market. Its insights can level up your investing game and lead to bigger wins than if you picked stocks yourself.

Just the fact that its Strong Buys have beaten the S&P 500 by miles is reason enough to join. You only gain access if you're a premium member.

And the top-rated stocks have an impressive 25% average annual return.[2] That means just a $1,000 investment on its recommended picks could potentially earn back your entire membership fee.

The solid investment research and expert analysis are also invaluable. You get access to investing ideas, ratings, and comparisons not covered anywhere else.

For $299/year, the price is very fair for the edge it could give you. If you're ready to enhance your investment skills, try it out with the link below.

Pricing Plans For Seeking Alpha

Seeking Alpha offers three plans: Basic, Premium, and Pro. Check out the table below for a quick comparison of the plans.

| Features | Basic | Premium | Pro |

|---|---|---|---|

| Email alerts | ✓ | ✓ | ✓ |

| Real-time news updates | ✓ | ✓ | ✓ |

| Free portfolio health check | ✓ | ✓ | ✓ |

| Stock prices & charts | ✓ | ✓ | ✓ |

| Wall Street Ratings | ✓ | ✓ | ✓ |

| Seeking Alpha Author Ratings | ✓ | ✓ | |

| Quant Ratings | ✓ | ✓ | |

| Stock Dividend Grades | ✓ | ✓ | |

| Top Ideas | ✓ | ||

| PRO content & newsletters | ✓ | ||

| Short ideas portals | ✓ | ||

| VIP Service | ✓ |

Basic Plan (free)

The Basic plan has a paywall for its content. You can only access one article per month. This plan is right for you if:

- You're just a market observer

- You only need to see the latest industry headlines, article summaries, and stock prices

Premium Plan ($299/year)

The Premium plan gives you unlimited access to Premium content, and includes valuable stock ratings and the Top Rated Stocks. It's right for you if:

- You're a DIY investor who needs help in choosing what stocks to buy, sell, or hold

- You need research and data to make your own investment decisions

Pro Plan ($2,400/year)

The Pro plan gives you quick access to the cream-of-the-crop investing perspectives. It's right for you if:

- You're managing a significant investment portfolio

- You want to filter the thousands of ideas in the platform

Next, let us check each plan's key features and see how they might fit your investment needs.

Key Features Of Seeking Alpha Premium

Seeking Alpha has a ton of features to help you manage, explore, and analyze stocks and other assets. It has all the features of the Basic plan, plus more. Let's dive into its key features:

- Portfolio Syncing

The Premium plan allows you to link your portfolio from your brokerage account. It allows you to monitor your investments all in one place.It also has additional data, including ratings, rating history, factor grades, and financial statements from over five years ago.

Haven't started investing yet? You can create a Seeking Alpha portfolio with stocks you want to monitor.

- Content Optimization

What's so good about Seeking Alpha is that it caters to investors of varying levels. It offers optimized content depending on your preference, goals, and chosen stocks.You will mostly see ratings, analysis, and news that may affect your portfolio.

![]() Right off the start of your subscription, it will immediately ask you to choose among these three goals:

Right off the start of your subscription, it will immediately ask you to choose among these three goals:- Manage: "Track and Optimize Your Portfolio"

- Explore: "Discover New Exciting Stocks to Invest In"

- Analyze: "Evaluate Stocks You're Interested In"

- Manage: "Track and Optimize Your Portfolio"

- Stock Ratings

![]()

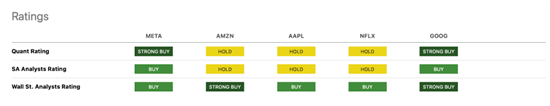

Seeking Alpha offers three types of stock ratings to guide your analysis:

- Wall Street Ratings from Wall Street analysts

- SA Authors Ratings from Seeking Alpha authors

- Quant Ratings based on quantitative objective data

The SA Authors Ratings tell you whether the investors and analysts in the community are leaning more toward buying, holding, or selling a particular stock.Aside from expert and analyst opinions, you can use Quant rating, too. This is best if you prefer to assess the statistics.

- Wall Street Ratings from Wall Street analysts

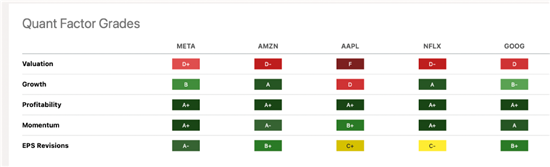

- Quant Rating and Factor Grades

Seeking Alpha's Quant Rating compares competing stocks in terms of value, growth, profitability, momentum, and earnings per share revisions. Stocks are graded based on Factor Grades to determine their Quant rating.![]()

If the stock has a high Quant rating (the highest is 5), then it's most likely a great choice to buy that stock. You also get an alert once your stocks' ratings change.

You can also choose a stocks or funds category with Predefined Comparisons. These categories include, but are not limited to:- FAANG Stocks: Comparison of Facebook, Amazon, Apple, Netflix, and Google

- Big Bank Stocks: Comparison of the top U.S. banks

- Cash Equivalents: Comparison of ETFs

- FAANG Stocks: Comparison of Facebook, Amazon, Apple, Netflix, and Google

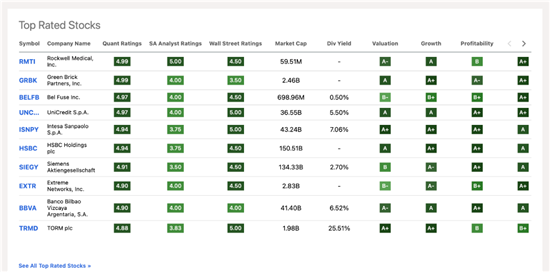

- Top Rated Stocks and Stocks Screeners

![]()

The Top Rated Stocks is a list of stocks with the highest SA Authors rating, Wall Street Analysts rating, and Quant rating. You would want to buy and hold these stocks for the long term.

There are top-rated stocks in various categories. With screeners, you get to screen stocks according to their quant ratings, profitability, or industry.

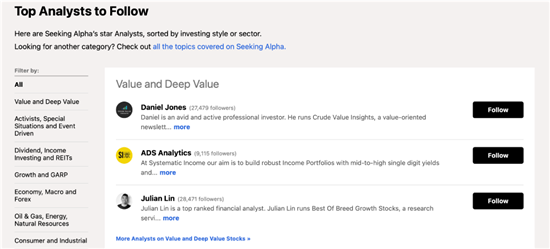

- Top Analysts to Follow

![]()

The 'Top Analysts to Follow' feature allows you to filter authors by style or sector. This tells you who the star contributors are.

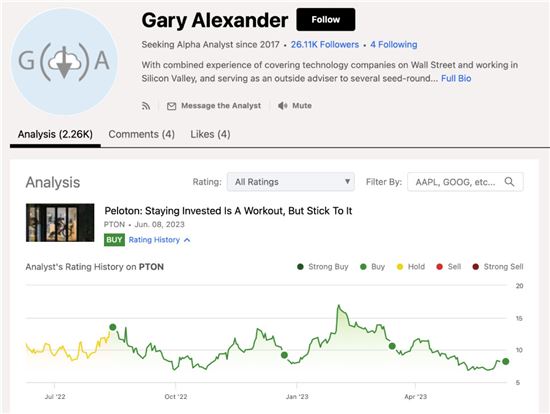

- Author Performance Metrics

![]()

The Author Performance Metrics gives you an idea about the credibility of each author.

You get to know the author's thoughts on a specific stock and the stock's performance since the day of the article's publication.

This tells you whether the author's recommendation (Strong Buy, Buy, Hold, Sell, or Strong Sell) has proven to be correct so far.

- Community and Content

Seeking Alpha's community offers investing ideas for stocks, ETFs, precious metals, and even currencies.You also get access to each company's earning calls transcripts, earning forecasts, and financial statements for the past decade. These data help you analyze the profitability of each stock.

Seeking Alpha's content are crowdsourced. That means the analysis and articles in the platform are written by the users.

If you subscribe to its Premium plan, you can also contribute platform content. Though this will not be easy as the article will have to pass Seeking Alpha's editorial review to ensure quality.

Yes, you can also make money by being a contributor. Seeking Alpha pays $45 for every published article on under-covered stocks.

Community #1: Seeking Alpha High Yield Landlord

High Yield Landlord is the biggest and best-rated community of real estate investors on Seeking Alpha. With over 2,000 members and an impressive 4.9/5 rating from more than 500 reviews, it's a trusted source for savvy investors.

They invest more than $100,000 each year in market research to find the most profitable investment opportunities, and they share their insights with you at a fraction of that cost.

This comprehensive service, ranked #1 in real estate, focuses on high-yielding securities at attractive valuations, aiming for an overall yield of 8%. Out of 300+ analyzed opportunities, they've handpicked the best ones to help you achieve higher income and total returns in the long run.

Community #2: Seeking Alpha High Dividend Opportunities

High Dividend Opportunities (HDO) is all about bringing you the latest and most profitable dividend ideas and fixed income securities at great valuations. Its portfolio aims for yields over 9% in high-quality securities, focusing on diversification, safety, and reliable dividends.

HDO offers a smart strategy to grow your savings and thrive even in tough times. With HDO, your portfolio can start generating high income right away, without having to wait years to see the benefits.

This has a community of over 6,800 members who are dedicated income investors. They invest in companies and funds that pay dividends now. Dividend investing is a defensive strategy that provides regular cash flow and tends to do well in volatile markets.

Key Features Of Seeking Alpha Pro

Not satisfied with the Premium features? Consider the Pro plan. Seeking Alpha Pro is touted as a profit accelerator for investors with a large portfolio. It has all the features of the Premium plan with these advanced add-ons.

- Top Ideas

You get exclusive access to the platform's most well-researched and high-conviction investment ideas. - Exclusive Newsletters

You get exclusive access to newsletters with interviews and money-making opportunities. - VIP Customer Service

You get personalized support through email or phone. - Pro Screener

You get to filter the noise or irrelevant articles on the platform. This allows you to quickly see articles written by Pro authors or investment experts. - 100% Free Ads

The Premium plan has a few ads. The Pro plan has no ads at all. This helps you to focus on what matters.

What Is Free On Seeking Alpha

Seeking Alpha's Basic plan offers limited access to content, news, and analysis. Nevertheless, it gives you free unlimited access to headlines and article summaries. You also get free access to the following:

- Education Section

You can access educational articles that can help you understand the investment landscape. Some articles include an explanation of bearish and bullish markets, inflation, and portfolio management, among many others. - Portfolio Health Check

This allows you to see whether your investment portfolio is at risk or not. It also reveals the quality and performance of your stocks. - Wall Street Stock Ratings

This tells you the sentiment of Wall Street analysts for each stock. A stock receives a high rating if Wall Street analysts recommend a Strong Buy for that stock. - Stock Prices and Charts

You can freely access stock prices and charts on stock performances for the past years. - Email Alert and News Updates

You get news updates that may affect your portfolio. This is sent directly to your email. - Mobile App

This gives you easy access to the free content, anytime, anywhere.

Seeking Alpha's Alpha Picks

The Alpha Picks is the newest subscription offering of Seeking Alpha. This plan was launched in July 2022.

With this, you get two stock recommendations each month. These are stock picks with the highest rating, chosen from the thousands of stocks available on the platform.

These two highest-rated stocks are chosen using Seeking Alpha's data-driven quant system. This system analyzes stocks according to their profitability, valuation, growth, and earnings-per-share estimates.

Alpha Picks costs $499/year.

Seeking Alpha Customer Support

Seeking Alpha's customer support is designed to assist users with issues related to subscriptions, account management, and platform usage.

Seeking Alpha has a dedicated online Help Center with FAQs, articles, and guides to assist users with common issues related to account setup, billing, and platform features.

You can send an email or you can call them if you have questions regarding your subscription.

Email: subscriptions@seekingalpha.com

Call: 1-347-509-6837

Seeking Alpha is a valuable service that offers crowdsourced investment analysis and data-driven insights. Its customer service is said to be quick in responding to inquiries.

Seeking Alpha User's Experience

The platform can be overwhelming for new investors, with a vast amount of content and sometimes complex financial jargon. Navigating and filtering through the various opinions and data points can be challenging for those unfamiliar with investing.

Many users value the interactive environment, where they can engage with authors and other investors to share insights, ask questions, and debate viewpoints.

Some users have noted that while certain articles provide well-researched insights, others may be opinion-driven with less rigorous analysis.

While community interaction is a strength, some users feel that confirmation bias can occur. They think that contributors may overly promote stocks they already own or have a vested interest in. This can lead to potentially skewed analysis.

You can cancel your subscription any time. Your subscription will be cancelled at the end of the current billing period for both monthly and annual subscriptions.

How to Start Using Seeking Alpha

To start using Seeking Alpha, follow these steps:

- Create an Account

You can start by visiting Seeking Alpha's website. Click the "Sign Up" button and create a free account. You can sign up using your email, Google, Facebook, or Apple credentials. - Explore Free Content

After signing up, you can explore free articles, stock analysis, news, and opinions from contributors. - Set Up a Portfolio or Watchlist

Add your investments to your portfolio to track performance. If you don't have investments yet, create a watchlist of stocks you're interested in. - Upgrade to Premium

For advanced features such as Quant Ratings, Top Stock Picks, Earnings Transcripts, and in-depth financial data, you can upgrade to Seeking Alpha Premium.You can test premium features with a free trial to determine if it's worth the subscription.

How Does Seeking Alpha Compare?

Morningstar Investor and Motley Fool Stock Advisor are some alternatives to Seeking Alpha.

- Seeking Alpha Premium vs Morningstar Investor

Morningstar caters best to fund investors and active traders. Its rating system is primarily for ETFs and mutual funds, though it also has individual stocks. On the other hand, Seeking Alpha's rating system is primarily for stocks, though it also has resources on ETFs and other funds.In terms of the membership fee, Seeking Alpha Premium ($299/yr)[3] is more expensive than Morningstar Investor ($249/yr).[4]

- Seeking Alpha Premium vs Motley Fool Stock Advisor

Motley Fool Stock Advisor is primarily used for its stock picks. It gives you 2 top stock picks per month, along with suggestions for other timely buys.It is best for new investors who may not need too much data on a certain stock. On the contrary, Seeking Alpha is for those who need data and research.

Unlike Motley Fool, Seeking Alpha's stock analysis is more technical. It also has more depth.

In terms of price, Motley Fool Stock Advisor ($199/yr)[5] is cheaper than Seeking Alpha Premium ($299/yr). But they sometimes offer a discount for new members.

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

Bottom Line

Seeking Alpha Premium is a valuable resource for stock investors of any level.

The stock ratings and investment research it offers can benefit beginners and advanced investors alike. It helps you choose which stocks to buy, hold, or sell.

Without knowledge and investment research, it is difficult to make profits in investing.

You need information on the intrinsic value of a stock and what the investing community thinks. These are all beneficial in forming your own investment decision.

Seeking Alpha's Premium service provides just what you need to become an informed investor.

References

- ^ Seeking Alpha. About Us, Retrieved 09/25/2025

- ^ Seeking Alpha. Seeking Alpha's Quant Performance, Retrieved 09/25/2025

- ^ Seeking Alpha. Subscription Plan Pricing, Retrieved 09/25/2025

- ^ Morningstar. Morningstar Investor, Retrieved 09/25/2025

- ^ Motley Fool. Motley Fool Premium Services, Retrieved 09/25/2025

Stock Advisor - $99/year for New Members

*$99 is an introductory price for new members only. 50% discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then-current list price.

$20 Investment Bonus

- Open an Acorns account (new users only)

- Set up the Recurring Investments feature

- Have your first investment be made successfully via the Recurring Investments feature

Write to Del Exconde at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

| ||||||

|

|

|

Compare: