How to Open a Business Bank Account

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Opening a business bank account is easy. You can even do it online. Find out the types and requirements, and read on for some tips as well.

|

Small business owners often manage business and personal finances in one checking account.

But that's a big mistake.

It increases your personal liability. Imagine what would happen if you were audited by the IRS. You'll be glad you took 5 minutes now to learn what you need to open a business bank account properly.

We'll cover everything you need to get started. Plus, how to avoid unnecessary fees.

- Choose your account type: Savings, checking, free, online, traditional.

- Choose your bank: Look at fees, benefits, balance requirements, interest, customer service.

- Collect required documents: EIN or SSN, business formation documents, ownership agreements, business license (at minimum).

- Open the account: Have physical documents if opening the account in person; submit documents digitally for online banks.

- Make your first deposit: Check for cash deposit fees, minimum amount requirements, and more.

Business Checking Account - $400 Bonus

- Open a new Truist Simple Business Checking or Dynamic Business Checking account online, via phone, or in a branch from 4/1/2025 through 9/30/2025 and earn $400 by making Qualifying Deposits* of $2,000 or more into your new account within 30 days of account opening. Must be a new Truist business checking client, Terms Apply.

- Enrollment in the promotion is required at the time of account opening using promo code SB25Q2BIZAFL to be eligible for a promotion reward. Refer to the Account Opening & Promotion Enrollment sections below for instructions.

- *Qualifying Deposits for new business checking accounts exclude debit card credit transactions and NSF fee refunds. Deposits can be made on a one-time basis or cumulatively over the 30 days.

1. Choose the Right Business Account Type

|

| © CreditDonkey |

Each type of business banking account serves a different purpose. For example, checking accounts let you write checks to vendors.

Savings accounts let you take advantage of high interest rates. Merchant accounts let you accept debit and credit card sales.

Read on to see which account type would be best for your business.

- Business Checking Account

With a business checking account, you can write checks under your business name.You can use debit cards to withdraw and deposit cash and checks. Or you can transfer funds electronically to different accounts and recipients.

These services are often essential. So, checking accounts are often a good choice.

- Online Business Bank Accounts

Not all business checking accounts have the same exact services or requirements. For example, most online checking accounts will not accept cash deposits.On the other hand, online business bank accounts tend to offer lower fees. If the restrictions won't hinder your business operations, consider opening an online bank account.

- Free Business Checking Account

Free business checking accounts are more affordable. They don't charge monthly service fees.But "free" business checking accounts may still have certain fees. This includes fees for overdrafts or for too many withdrawals or transfers.

It's always best to read the fine print. Many online checking accounts are examples.

Important note about monthly service fees

While many banks do charge monthly service fees, many will waive the fee if the account holder meets certain conditions. These can include maintaining a minimum balance amount or making regular deposits. - Business Savings Account

Business savings accounts are designed for funds that do not need to be as easily accessible. Instead, they serve more as safe place to park extra money or reserve cash.They often provide higher interest rates. That way, business owners can see better returns on their deposits.

- Merchant Bank Account

Merchant accounts can be valuable to certain types of businesses. Retailers, for example, can accept credit card and debit card payments through this account.But you must also have a business checking account with it. That way, you can accept funds through the merchant account, then, have them transferred to your business checking account after.

If you need a POS for your business, a merchant account is essential. Especially if you're a restaurant, you'll be able to easily accept credit card payments.

- Write and deposit checks

- Build interest on your funds

- Accept payments from customers

- Transfer money

- Protect your funds

2. Choose Your Bank

|

| © CreditDonkey |

Many business owners are tempted to use the same bank from their personal bank accounts.

In some cases, this can offer the advantage of efficiency because all your accounts would be in one place. But for others, having the same bank could have them miss out on certain benefits.

The ideal bank for you depends on how your business operates and what it needs for its financial operations. That may not necessarily be what your personal bank offers.

These are the main factors to consider when choosing a bank for your business:

- Fees

- Services offered

- Benefits

- Balance requirements

- Interest

We'll discuss them in detail later.

Personal savings accounts just aren't made for business purposes. You'll be missing out on features that are essential for your daily operations. With a business account, not only can you separate your personal and business funds so there are no mix-ups. It also lets you save time during tax season.

You'll also be using a business debit card instead of a personal debit. With personal accounts, you won't have protection from business liabilities.

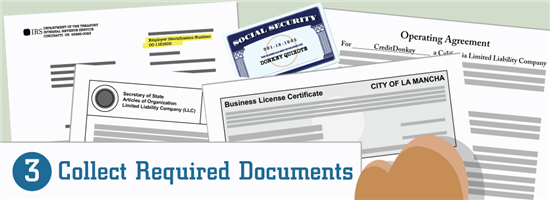

3. Collect Required Documents

|

| © CreditDonkey |

Once you've settled on a bank, it's time to gather the paperwork you'll need to actually establish the account.

You'll be asked for your personal identification. You'll need to present your SSN and any government issued photo ID. You can use your driver's license, for example.

Regarding business identification, each bank will have different requirements, but generally, the documents you'll need depend on the type of business structure you have.

- Employer identification number (EIN) or Social Security number (SSN).

- Business formation documents (articles of incorporation, etc.)

- Ownership agreements

- Business license

| Document | Sole Proprietorship | Partnership | LLC | Corporation (S Corp & C Corp) |

|---|---|---|---|---|

| EIN/SSN | x | x | x | x |

| Business License | x | x | x | x |

| Partnership Agreement | x | |||

| Articles of Organization | x | |||

| Articles of Incorporation | x |

If you're a sole proprietor, you'll need to present your SSN instead of an EIN. The rest of the documents for a limited liability company, partnership, and corporation serve essentially as proof of your business' existence.

Keep in mind that business licenses are typically required regardless of your type of business.

For any document you'll present, the bank will likely ask for an original or certified copy.

Other Potential Documentation

Your business type will determine other requirements. If applicable, banks may also ask for the following:

- Doing-business-as (DBA) certificate

- Signed declaration of unincorporated business

- Corporate charter or resolution

- Operating agreement

- 501 (c)

The DBA certificate is required if you're using a different name (from your company's legal name) when advertising or marketing.

On the other hand, non-profit and unincorporated associations need to provide the signed declaration. And corporations need to present the corporate resolution for the bank details.

Operating agreements or by-laws are for LLCs.[1] And 501 (c) letters are for non-profit organizations. It serves as proof of eligibility from the IRS for tax exemption.[2]

The process of opening a small business bank account is very similar to opening an account for a larger business. But small business bank accounts usually require less paperwork.

To open a small business bank account, you'll need to provide an employer identification number or Social Security number along with the business name filing documents.

4. Open Your Account

|

| © CreditDonkey |

How to Open a Business Account in Person

Make sure you have physical copies of your documents. You can also ready a check to make a deposit. Then, make an appointment with the bank.

You'll be working with a professional to open the account. The process may take a bit longer than opening an account online. But opening an account in-person means you can address all your concerns and questions with the bank employee.

Banks may require you to open an account in person if you are in a certain industry or area of business. You could be in telemarketing, gambling, government, or precious metals, for example.

Whether you should open an account online or in person depends on your priorities. Do you prefer physical documents to be submitted? This makes it easier to sign the paperwork as needed.

Or do you prefer faster account opening? Online banks are good for that.

Not all traditional banks may have online applications. If you need access to physical branches, you might have to apply in person. But applying online means you can do so anytime, even outside business hours.

How to Open a Business Account Online

When opening a business account online, you can submit your forms digitally. You can also scan the hard copy of your documents.

You won't get the benefit of face-to-face customer service, but the process is often much faster.

Generally, there is no fee just to open a business bank account, but the bank may require an opening deposit.

In some cases, banks will offer a cash bonus for opening a bank account if certain terms are met. Be sure to ask your bank about any current promotions they have for business bank accounts.

5. Make Your First Deposit

|

| © CreditDonkey |

You'll make your first deposit to a business bank account similar to a personal bank account. You can deposit through cash, check (e.g., from your personal account), or transfer of funds.

Be aware of any fees your bank may charge for a particular type of deposit. There may be a cash deposit fee, for example. It's best to learn what deposit methods your bank allows. Know whether you can deposit remotely, online, or in person.

You need to also make sure you meet the minimum deposit requirements. You could incur a fee otherwise. Then, that's it! You can now effectively manage your business finances with your new business bank account.

How to Choose a Business Bank Account

There are 5 main things to consider when choosing a bank to open an account with.

Let this be your criteria when selecting a bank for your business finances:

1. Fees

Banks typically have minimum balance fees, cash deposit fees, ATM fees, wire transfer fees, and transaction fees.

Some of them charge a monthly service fee. Other banks waive the fee if you meet certain conditions.

These fees vary depending on the bank and type of account.

2. Services offered

Business owners can benefit significantly from services like cash flow visibility reports. A personal bank account might not provide such. It's best to find out if the banks you're considering have these tools.

Do they have online or mobile banking? A mobile app would be convenient for monitoring your balance, paying bills, and transferring funds.

Also, think long term and consider if you'll need other financial services like small business loans or lines of credit. You can check if your prospective bank provides them.

- Gaining capital

- Developing new technologies

- Business planning and strategy

- Operations

- Financial management

There are many other technical assistance they can provide. They can even help you work with the SBA. It could be a great help in trying to achieve your business goals.

3. Benefits

Many banks provide extra benefits. Some provide user-friendly account management online. Others have reliable customer support.

Some banks will have introductory offers. This could be a cash bonus for making an initial deposit of a certain amount. Or it could be due to maintaining a specific balance for a certain period.

Consider also whether you'll have a wide network of branches that can provide in-person services. Or if there are enough convenient ATMs if you need them.

4. Balance Requirements

Some banks have minimum balance requirements. This means you must always have a certain amount of money in your account.

A large enough balance can get the monthly service fees waived. If you have it, a bank's balance requirements should be less of a concern.

However, if your business has a tighter cash flow, it would be wise to research minimum balance fees.

5. Interest

Many business bank accounts provide interest on your business funds. Banks typically offer them on checking accounts that meet the minimum balance requirements.

If building interest is important to you, compare rates from several banks. It can pay to shop around.

Tips When Opening a Business Bank Account

It's easy to open a business bank account. But you want to be sure you're opening the right one for your business.

Here are some tips to help you out:

1. Decide on your business banking needs

What type of business bank account do you plan to open? Whether it's a savings or checking account, make sure your preferred bank can offer it.

You can also inquire if they offer certificates of deposits, money market, or business lines of credit.

That way, all your accounts would be accessible through a single bank.

A small business development center near you may be able to help you out.

2. Build a relationship with your bank

Before deciding to open the account, you can inquire about the details from your prospective financial institution. You can discuss your business needs with them. They can also guide you through the process.

Not to mention, it could help process your account faster if your banker already knows you. Some may also provide lenient deadlines if not all your documents are readily available.

3. Take note of physical branches available

If you decided on a traditional bank, take note of where their physical branches are. A bank with ATMs available in many places will also be convenient.

Visiting banks in person can help you address issues quickly and personally. It's also easier to have complex financial discussions in person should you need to.

You can also deposit cash, or deposit and cash-in checks when you're near a bank's physical branch.

4. Ready your documents before you apply

To open a business bank account easily (and smoothly), prepare the necessary documents beforehand.

Incomplete requirements can delay the process. Whether you're applying in-person or online, it's best to submit all documents at once.

With a solid credit score, you'll likely increase your chances with any financial institution.

The Best Business Bank Accounts

The "best" business bank accounts vary from business to business, depending on the services the business needs and its financial situation.

Still, some banks may offer more business-friendly terms than others. Here are some banks to consider when you're determining how to open a business checking account:

Business Checking Account - $400 Bonus

- Open a new Truist Simple Business Checking or Dynamic Business Checking account online, via phone, or in a branch from 4/1/2025 through 9/30/2025 and earn $400 by making Qualifying Deposits* of $2,000 or more into your new account within 30 days of account opening. Must be a new Truist business checking client, Terms Apply.

- Enrollment in the promotion is required at the time of account opening using promo code SB25Q2BIZAFL to be eligible for a promotion reward. Refer to the Account Opening & Promotion Enrollment sections below for instructions.

- *Qualifying Deposits for new business checking accounts exclude debit card credit transactions and NSF fee refunds. Deposits can be made on a one-time basis or cumulatively over the 30 days.

Free Checking Account for Small Business Owners

- Sign up in 3 minutes; no credit check

- No account fees - $0 monthly fee, overdraft fee, foreign transaction fee, or ATM fees at approximately 40,000 locations

- Automatic Savings

- Get paid up to 2 days early

Chase Business Complete Banking® - Up to $500 Bonus

- Earn up to $500 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities.

- Multiple ways to waive the $15 Monthly Service Fee, including maintaining a minimum daily balance or purchases on your Chase Ink® Business credit card.

- Full-service business banking. Convenient access to all your business banking services in one place -- lending, checking, credit card and payment solutions.

- Your choice of payment types. Choose from a full range of options for accepting payments and making deposits that include Zelle®, Online Bill Pay, wire transfers and ACH payments.

- Convenient access to payment processing. Process all major debit and credit cards with QuickAccept®. It's a built-in feature with your Business Complete Checking account.

- Get support you can rely on. Get access to our customer support team, plus a wide array of solutions that carter to every stage of your business

- Full-featured banking online and on-the-go. Manage your business' finances on your terms with the latest online and mobile banking technology.

- Associate Debit and Employee Deposit Cards available upon request

What the Experts Say

As part of our series on small businesses and entrepreneurship, CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Most business owners open a business bank account for good reason—to keep their personal and company finances separate.

Separate accounts can help you manage your accounting more efficiently. It also makes sure you file your taxes accurately.

Fortunately, with a little planning, learning how to open a business bank account is easy. And you have several choices in business account types and banks to consider.

References

- ^ U.S. Small Business Administration. Basic Information About Operating Agreements, Retrieved 11/29/2022

- ^ IRS. EO Operational Requirements: Obtaining Copies of Exemption Determination Letter from IRS, Retrieved 11/29/2022

Write to Rebecca M at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|