How Much Money Should I Have Saved by 30?

Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

Are you on track financially at 30? Learn how much you should have saved towards retirement goals. Not there? Don't worry, there's time to catch up.

|

Retirement planning starts in your 20s. You probably think it's too far in the future to worry. Today, however, it is more important than ever. Scarce pensions and dwindling Social Security make it necessary.

According to Fidelity, by age 30 you should have the amount of your annual salary saved.

Scary, I know. This means if you make $50,000, you should have $50,000 saved. This seems like a lofty goal at such a young age.

It is possible, though. We show you how.

How to Save Your Annual Salary by 30

Does it sound impossible to you to save your annual salary by the age of 30?

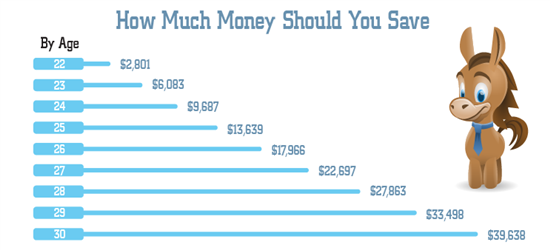

Before we start, let's give you some motivation. Below is an example of how you can reach that goal. This example is based on:

- A starting salary of $35,000

- An annual 3% cost of living increase

- A contribution of 5% to your 401(k)

- An employer match of 3%

- An estimated 7% annual return

And here is how we arrived at these numbers:

|

| How Much Money Should You Save in Your 20s © CreditDonkey |

This is doable for anyone, even if you only start by saving 5%. The key is taking advantage of your employer match. That, along with interest earned on your account, will take you to your goal easier and faster.

Keep on reading to learn how to achieve this.

Start Right Now

Starting early is the best advice you can receive. No amount is too small.

Even if you save 5% of your income, and you make $35,000, it's something. $1,750 is better than nothing. Unfortunately, $1,750 a year for the next 40 years won't give you much to live on. You must keep striving for more.

The ultimate goal is to spend 80% and save 20% of your income. With a $35,000 a year income, this means spending $28,000 and saving $7,000. Chances are your income will change drastically as you gain experience. This means your savings should increase too.

The 80/20 goal won't happen overnight. It could even take you many years to get there. The key is to make saving a habit. Set up automatic deposits into the appropriate accounts. Don't forget to account for inflation and salary increases. As your income increases, so should your savings.

That being said, not everyone will have their annual salary saved by 30. This doesn't mean a dismal life ahead. You must start somewhere, though. If you are 29 and have no savings, don't panic. Just start saving. We discuss how below.

Where Should You Save?

Emergency funds and retirement funds are two different things. You should have both.

Retirement funds (such as Roth IRA) are untouchable investments until you are 59½ years old. Emergency funds are liquid funds you can use right now. You should have at least 6 months of living expenses in case of unexpected job loss. If you work in a volatile industry, consider 12 months.

What if you don't have either amount? We'll discuss that later. For now, let's look at where you should save.

- 401(k) savings. Invest in an employer-sponsored 401(k). Your employer deducts a percentage of your income before they take out taxes. Some employers match a portion of your contributions. Take advantage of this! This furthers your savings. Keep in mind, though, that you pay the taxes when you withdraw the money from your 401(k) for retirement.

- IRA savings. If your employer doesn't offer a 401(k) or you work for yourself, start an IRA. A Roth IRA is made with after-tax dollars, so when you withdraw the money upon retirement, everything plus interest earned is all tax-free. Even if your employer offers 401(k) matching, it's smart to set up an account yourself.

- Emergency fund. This is also saved with after-tax dollars. You should have a savings account for emergencies and short-term goals. Some savings accounts even provide a bit of interest. Check out our top online savings accounts with the highest interest rates.

CIT Bank Platinum Savings - $300 Bonus

- Transfer a one-time deposit of $50,000+ for a Bonus of $300

- 4.10% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- No monthly maintenance fee

- Member FDIC

CIT Bank Platinum Savings - $225 Bonus

- Transfer a one-time deposit of $25,000 - $49,999.99 for a Bonus of $225

- 4.10% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- No monthly maintenance fee

- Member FDIC

CIT Bank Platinum Savings - 4.10% APY

- 4.10% APY with a balance of $5,000 or more

- 0.25% APY with a balance of less than $5,000

- $100 minimum opening deposit

- No monthly maintenance fee

- Member FDIC

Get Rid of That Debt

But wait! Before you put all your extra money into savings, if you have any debt, you must get rid of it.

Don't forgo your retirement and emergency savings though. You must find the right balance.

Keep on reading for just how to find this balance. For now, let's look at how debt can eat away at your savings.

Chances are, the interest you pay on your debt far exceeds the interest you may earn on your savings. In short, every dollar you borrow exceeds the interest you make in saved dollars. Today, for example, you are lucky if you can make 1% on any savings. Banks usually offer much less. Credit cards, however, have no problem charging upwards of 15% in interest. In both cases, the interest compounds. You could probably guess which one wins.

Here's an example:

Let's say you put $250 in a savings account. At a generous 1% interest rate, you would have $252.50 at the end of one year. That same $250 charged on a credit card would cost much more. If you make the minimum payment each month, after one year, you would pay close to $30 in interest. Suddenly the $2.50 you gained in interest pales in comparison to what it costs you. Rather than saving the $250, you are much better off paying off your debt.

There are exceptions to this rule. Read on to see our "Simple Strategy" to make the most out of your savings strategy.

Saving for Short-term Life Goals

There is more to life than paying off debt and retiring. What about those "middle years"?

This is a time when things can drastically change. Getting married, buying a house, having babies - these are just a few key things people do in their 30s. They all have something in common - they cost money.

You don't need an IRA or liquid savings account for mid-term savings. You have several options here.

- If you have the money, invest aggressively in a brokerage account. Consider stocks or bonds. Diversify your portfolio and spread out the risk in order to maximize your gains. This way, when the next five years fly by and you are ready to buy a house, you have the money. With these general brokerage accounts, you can withdraw whenever you like (but you are liable for taxes on the earnings).

- If you're nervous about investing yourself, consider a robo-advisor. These are computers that use an algorithm to automatically make investments for you based on your goals and risk tolerance.

- If you prefer not to invest aggressively, consider high-yield savings accounts or CDs. These accounts are virtually risk-free, and provide a small decent return on your investment.

Use This Simple Strategy

Whether you are in your early 20s or are approaching your 30th birthday, you can tailor the following strategy:

- Always save, no matter how small your income (5% is a good starting point)

- Always maximize your employer 401(k) contributions

- Minimize your living expenses as much as possible

- Aggressively save in various accounts

Step 1: Before anything else, we recommend starting with your 401(k) if your employer matches contributions. Always contribute at least the maximum amount your employer matches. Most companies give you the option of automatically deducting your contribution from your paycheck. That way, it's automatically saved for you and won't even miss it.

If you work for yourself, open an IRA. While you don't have the benefit of matching contributions, you still must save for retirement. Keep in mind the annual maximums, which we discussed above. Maximize your contributions and then focus on saving in other areas.

Step 2: If you have debt, divide any remaining funds you can spare between paying off debts and saving. Still contribute to your 401(k) up to the amount of the employer match. And then split the rest of your funds: half to pay off debt and half to emergency savings. Don't stop until you have paid off your debt and hit that 6-month savings goal.

But, of course, use your judgement to tailor a strategy that suits your individual circumstance. If you're carrying a lot of credit card debt, but your job is secure, you'll probably want to allocate more to paying off that debt.

Step 3: After you have cleared the debt and have a solid emergency fund, then it's time to get aggressive. Split the remaining funds between your 401(k) contributions, Roth IRA contributions, and investing for short-term plans. Aim to max out your yearly Roth IRA contributions if possible.

Bottom Line: It's All About the Plan

|

Let's be honest here. Life is uncertain. No one can predict what will happen tomorrow, let alone 25 years from now. Don't panic if things change for you. Life happens. By age 30, you should have an actionable plan in place. This doesn't mean it cannot change. You can adjust as necessary. Sticking to the plan as much as you can helps maximize your savings.

If life throws you a curveball and you can't save, let it be. Just jump back into the savings plan as soon as you can.

Your focus by age 30 should be to be out of debt, or close to it. It should also be to have a concrete savings plan in place. Pick an amount and stick to it. Make it a percentage of your income and adjust your deposits as your income increases.

If you are behind, don't give up on your savings plan. Even when you hit a roadblock. Come back to the plan as soon as you can. Make it your goal to save the amount of your annual salary by age 30. Don't beat yourself up if you are nowhere near that goal, though. Create a plan and stick to it. Your future self will thank you.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next: