eToro Review: Pros and Cons

eToro is a stock and crypto exchange known for its CopyTrading feature. Find out if it's worth the fees and how it compares to other platforms.

| |||

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC | |||

Overall Score | 3.8 | ||

Cryptocurrency Trading | 3.5 | ||

Mobile App | 3.5 | ||

Commissions and Fees | 4.0 | ||

Ease of Use | 3.5 | ||

Research | 5.0 | ||

Safety | 4.0 | ||

Pros and Cons

- Copy actions of top traders

- Virtual practice account

- Slow customer service response time

Bottom Line

Good crypto exchange for learning, socializing and copy-trading

Securities trading offered by eToro USA Securities, Inc. ("the BD"), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC ("the MSB") (NMLS: 1769299) and is not FDIC or SIPC insured.

Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance.

Interested in crypto trading, but too busy to do the research?

With eToro's popular CopyTrading feature, you can mimic the moves of other successful traders.

But why do so many people lose money on eToro? And is it really a smart choice for your investments? In this review, find out how it works, the fees they charge, and how it compares to Coinbase and Robinhood.

Read our detailed review to find out for sure.

What is eToro?

eToro is a user-friendly brokerage platform for buying and selling cryptocurrencies in the U.S., with a wider range of assets available to non-U.S. residents.

eToro is based in Tel Aviv, and was launched by co-founders Ronen Assia, David Ring, and Yoni Assia in 2007. It originally operated under the name RetailFX, as a forex online broker.

eToro customers in the United States may now diversify their portfolio with investments in US stocks, ETFs, and crypto. They can also invest in fractional stocks for as little as $10, with 0% commission and gain access to a community.

eToro trading instruments include:[1]

- 24 crypto (BTC, ETH, BCH, LTC, Doge, and others)

- 2089 stocks

- 269 ETFs (SPY, GLD, XLE, VOO, SLV, VTI, VNQ and others)

The platform was founded with the goal of making trading more accessible. Since then, they've become the world's leading social trading platform and have made plans to go public.

What makes eToro stand out is their popular CopyTrading feature, added in 2010 as part of the OpenBook social investment platform. It allows users to automatically mimic the trades of top-performing traders.

In 2013, they began offering the ability to trade stocks and CFDs (not available for US customers), as well as expanding into the UK. They started offering cryptocurrencies in 2014.

In 2017 eToro joined CoinDash in an effort to support Blockchain social trading. This was also the year they launched their CopyPortfolio feature, which lets users copy portfolios instead of individual trades.

eToro introduced a cryptocurrency wallet in 2018, and began offering services in the US market, with initial access to 10 cryptocurrencies.

As of 2019, eToro was reportedly operating in 140 countries, and in 2020 they acquired Marq Millions, the e-money division in the UK, and renamed it eToro Money.

In 2021 they launched the eToro Money debit card for users in the UK.

As of 2023, eToro reported over 30 million users worldwide.

You can also chat with the traders you copy and learn from their strategy, which makes eToro a great platform for education.

However, it's worth noting that these stand-out features come at a price. Below, find out how much eToro costs and what you get for your money.

eToro is available in 46 states in the US, as well as Washington DC, however you won't be able to trade crypto if you live in Hawaii, Minnesota, Nevada, or New York.[2]

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC

- Sign up for an eToro account

- Deposit funds

- Invest in $100 worth of crypto

You'll automatically receive $10 directly to your account balance. Offer only applies to US customers. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Pros and Cons

Yes. eToro operates within the regulations of FINCEN in the U.S. and FCA, CySEC, and ASIC internationally. As of June 2023, eToro had over 30 million registered users worldwide. eToro keeps clients' funds in tier-1 banks with the capital reserves to fulfill customer withdrawals even in the event that eToro went out of business.

As with any investing platform, eToro has its own set of unique upsides and downsides. First, let's take a look at the reasons eToro is good.

Pros

- Easy to get started, sign up in minutes, and get to trading.

- Mobile and desktop platforms are very user-friendly.

- CopyTrading allows inexperienced or busy users to trust their investments to experienced traders.

- The social platform encourages discussion and learning.

Cons

- High fees compared to more expert-level platforms.

- Basic training materials

Why is eToro bad? They have relatively high non-trading fees, as there are fee for inactivity. Some users have found it difficult to contact customer support. And of course, it is difficult to withdraw your crypto.

App Download: Apple, Google Play

eToro is primarily designed for trading, and while you can buy and sell cryptocurrency, it can be difficult or impossible to access it directly. If you're interested in using cryptocurrency for financial transactions, eToro may not be your best bet.

How eToro Works

|

eToro makes money in exchange for the service they provide their users, in this case, offering the ability to trade cryptocurrencies and other investments, as well as the unique methods they offer for optimizing returns. Much of their income is generated by a 1% fee they charge on all buy and sell orders, detailed further down.

Overall Score: 3.8

eToro has a lot to offer for cryptocurrency enthusiasts, including their popular social trading feature, the CopyTrading option. In the sections below, we'll break down how they stand up in a range of important aspects including their exchange, commissions and fees, safety, and more.

Cryptocurrency Trading

eToro makes buying and selling cryptocurrency easy via their mobile app or desktop site. After signing up, you'll fund your account. The minimum first deposit varies from $50 to $10,000 depending on your region and country and $200 if you're using CopyTrader.

For U.S. residents, eToro currently offers trading in cryptocurrency, US stocks, and ETFs. Non-U.S. residents can trade cryptocurrencies, as well as forex, CFDs, stocks and more. (This review focuses on eToro's U.S. offerings.)

eToro has different trading minimums for each asset class, as you'll see in the table below:[3]

| Asset | Minimum Trade |

|---|---|

| Stocks and ETFs | $10 |

| Crypto | $10 |

| Currencies | $1,000 |

| Commodities+ | $1,000 |

| Indices | $1,000 |

eToro Virtual Portfolio

The eToro Virtual Portfolio is a virtual trading account that lets you practice trading risk-free with $100,000 of virtual currency.

You can practice trading crypto, ETFs, and stocks, as well as discuss strategy with other users, in order to hone your trading skills and test market theories without worrying about losing real money in the process.

CopyTrader

Their CopyTrader feature is where eToro really shines. Instead of paying for an expensive fund manager or advisor, eToro's top-performing traders are available to follow absolutely free. Note: regular trading fees apply.

They're just everyday people who've been successful and are willing to be transparent about their trades. They do, however, have to apply to be in eToro's Popular Investor program, so not just anybody can be copied.

Popular Investors are given a Risk Score out of 10 to help you gauge how risky their strategy is (most top traders score 7 or 8). You can also see their trade frequency, average holding time, portfolio composition, and historical performance.

Remember, past performance is not a guarantee of future results.

And because eToro is a social platform, Popular Investors can also post comments and interact with their "copiers".

The minimum for copy trading is $200, and the max is $500,000. You can follow up to 100 traders at a time.[4] In order to mitigate risk, you can stop copying any trader if the value drops below a certain percent.

Smart Portfolios

This feature is a step up from eToro's CopyTrading. With a minimum investment of $500, it allows you to minimize risk by investing in a portfolio of cryptocurrencies, rather than following a single trader.

In the U.S., there are currently three to choose from:

- Crypto-Currency: Made up of Bitcoin and Ethereum

- CryptoPortfolio: Made up of cryptocurrencies with a market cap of $1 billion or more

- CryptoEqual: Made up of equal amounts of a number of large cap cryptocurrencies

What cryptocurrencies does eToro support?

eToro currently supports 24 different cryptocurrencies and stablecoins, including:

- Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Ethereum Classic, IOTA, Stellar, EOS, NEO, TRON, ZCASH, Tezos, Maker, Compound, Chainlink, Uniswap, Yearn.finance, Dogecoin, Aave, Enjin, Basic Attention Token, Shiba

CFD Trading (not available for US customers)

Trading CFDs or Contracts for Difference is one method of investing available to eToro users.

The difference between purchasing a CFD and a regular trade is that you won't own the underlying asset.

When you purchase a CFD from your broker, whether it's for Bitcoin or oil, the two of you are agreeing to honor the market price of the asset in question at the time of purchase and sale, without trading the asset itself.

This can be beneficial if all you're interested in is trading for profit. However, if you're interested in owning cryptocurrency itself, CFDs may not be right for you.

Commissions and Fees

eToro accounts are free to open and they charge no commissions or management fees. However, they do charge "spread fees" when you trade cryptocurrencies.

The spread is the difference in buying and selling prices for assets available on a platform.

Essentially, eToro and other platforms make their money by including their fee in the price of the currency. It charges 1% fee on all buy and sell orders of crypto assets on its platform.[5]

Deposit Fees

- Cryptocurrency transactions, including transferring funds, will also incur a fee. Fees vary, depending on each blockchain provider.

- eToro does not charge for USD deposits.

- When converting funds to USD, a conversion fee is charged which depends on the currency.

Withdrawal Fees

- $5 withdrawal fee for non-U.S. customers. eToro USA LLC does not charge any fees on withdrawals.[6]

- The minimum withdrawal is $30.

Other Fees

- eToro charges a $10 inactivity per month if your account has no activity for 12 months.

- eToro charges an overnight fee for leveraged positions held overnight, per night.

eToro may appear to be free, but they charge a 1% fee for buying or selling crypto. The fee is already included in the price when you open or close a position.

eToro Club

eToro users can enjoy a variety of perks if they meet the equity requirements of their tiered VIP accounts.

Base users start at the Bronze level with no requirements. The extra benefits start at Silver, which requires $5,000 in equity, and go up to Diamond, which requires $250,000.[7]

Benefits include dedicated account managers, various newsletters and reports, access to webinars, and customer service benefits, among other things.

| Tier | Equity Requirement |

|---|---|

| Silver | $5,000 |

| Gold | $10,000 |

| Platinum | $25,000 |

| Platinum+ | $50,000 |

| Diamond | $250.000 |

Research

Compared to other top cryptocurrency exchanges, eToro offers an impressive wealth of research tools, though perhaps not quite as extensive as more traditional investors might expect.

Along with the standard features like economic calendars and news, they also incorporate fundamental analysis, sentiment data of top traders, daily market commentary by their own staff, and a social wall section for each currency that lets users see what others are saying about it.

Practice Account

If you'd like to experiment with investing in cryptocurrency without the risk, eToro will give you $100k in a practice account. Obviously, you won't be able to earn anything this way, but it's a useful way for beginners to get a feel for the platform.

Educational Resources

eToro's blog publishes Weekly Crypto Roundups to keep you updated on the latest in crypto news. They also offer in-depth financial guides and video tutorials to help new traders understand the ins and outs of cryptocurrency and how to trade on the platform.

Ease of Use

For a platform that is designed to let novice traders benefit from the experience of more established investors, eToro could benefit from putting more effort into designing a user-friendly interface. Because, unlike some other trading platforms, eToro takes some getting used to.

Users have access to a wide range of useful information, social media posts, news feeds, watchlists, and more, and for those new to the world of cryptocurrency, all of that can be a little overwhelming at first. Given time, it's likely that almost all users will be able to accustom themselves to the layout of the eToro platform, which does have a lot to offer.

But whether it's better labeling, clearer icons, or a more obvious central menu, there are undoubtedly improvements that could make eToro a lot more user-friendly.

Safety

It's important for any crypto investor that your cash and your coins stay safe. In order to ensure that, eToro employs the following security features:

- Insurance

- $1m investment insurance for clients of eToro Europe, UK, and Australia

- Two-Factor Authentication

- SMS

- Secure Socket Layer (SSL) Encryption to protect transactions and personal information

- Cold Storage

It's definitely possible to make money with eToro, but when it comes to investing, there are no guarantees. Cryptocurrency is a very volatile investment option, with big changes often occurring over very short periods. As a general rule, never invest money you aren't willing to lose.

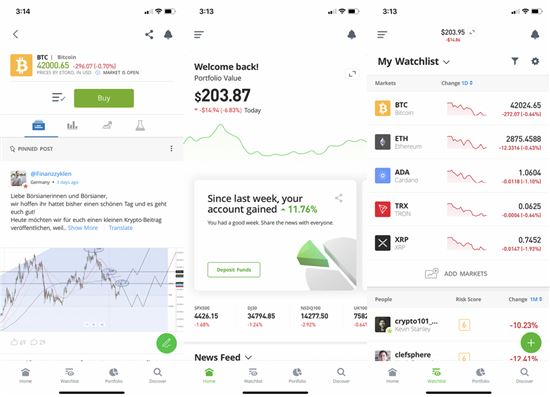

eToro Mobile App Review

eToro has a useful mobile app that offers all of the same features available on its desktop site. Where some of the top competitors in the crypto space have gone for ease of use, eToro has focused on offering all the bells and whistles that a trader could want.

|

| Screenshot of eToro |

On the one hand, this is great for experienced traders who know their way around analytical tools, market charts and graphs, and price histories. But for less experienced traders, opening the eToro app for the first time may prove somewhat daunting.

Simply put, there's a lot going on, and it isn't always clear what buttons will take you where, or how to do what you intend to.

eToro's mobile app is by no means impossible to get the hang of, but when competing with beginner-friendly exchanges like Coinbase, there's a lot they could do to make their interface more intuitive.

Customer Service

eToro's customer service appears to be on par with a lot of other popular cryptocurrency exchanges, which is to say it leaves something to be desired. While there are multiple ways to get in contact with them, either via live chat or web-based ticketing, they don't offer phone support.

They are not available 24/7, and live chat is, unfortunately, frequently offline. On top of that, you can't get ahold of them on weekends.

When you do get ahold of them, it appears their response time is quite fast, and they provide useful, relevant answers to user questions.

eToro Customer Satisfaction

eToro has reported over 30 million users, which should give you some indication of their popularity.

On Trustpilot, over 19,000 users have given eToro an average score of 4.4 out of 5 stars, with 62% of reviewers rating the company excellent.[8]

App users also generally liked eToro. On the App Store they've received a 4.2 out of 5 stars,[9] and on the Google Play Store, their rating is 4.0.[10]

There have been negative reviews, however. Many of them revolve around the difficulty involved with withdrawing funds, and trouble with customer support, which some users found frustrating to deal with.

How to Get started on eToro

Opening an account with eToro is very easy, and should only take a couple of minutes.

- First, visit their website or download the app, pick a username, and set a password.

- After your account is created, they recommend filling out your profile. This helps eToro tailor your News Feed to you.

You'll also need to verify your identity with one of the following:

- Valid U.S. passport

- Valid driver's license

- Valid state ID

- Valid U.S. passport

- Then you will fund your account. The minimum first deposit varies by country. In the US and UK it's $100. See the table below for other countries' requirements. After your first deposit, the minimum deposit requirement in the US is just $1. [11]

- After that, you're ready to start trading. Be sure to explore the 'Watchlist', which features other traders and markets that might interest you. Virtual trading is also a great place to get started for beginners.

| Country | Minimum First Deposit |

|---|---|

| Australia, Austria, Cyprus, Denmark, Estonia, Finland, Greece, Guernsey, Hungary, Indonesia, Ireland, Latvia, Liechtenstein, Malaysia, Malta, Netherlands, Norway, Portugal, Singapore, Sweden, Switzerland, Taiwan, Thailand, Vatican City | $50 |

| Belgium, Czech Republic, France (including French Guiana, Guadeloupe, Martinique, Mayotte), Germany, Italy, Luxembourg, Monaco, Poland, Romania, Slovakia, Slovenia, Spain, United Arab Emirates, United Kingdom, United States | $100 |

| All other eligible countries | $200 |

| French Polynesia, Isle Of Man, Jersey Island, Kuwait, New Zealand, the Philippines, Reunion Island | $1,000 |

| Bulgaria, Cayman Islands, Croatia, Gibraltar, South Africa, Vietnam | $2,000 |

| Israel | $10.000 |

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC

- Sign up for an eToro account

- Deposit funds

- Invest in $100 worth of crypto

You'll automatically receive $10 directly to your account balance. Offer only applies to US customers. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Contact Customer Service

|

To contact eToro customer service, visit their Customer Service page, where you can open a ticket as a new or existing user or access live chat.

Due to a high volume of requests, they recommend checking their Help Center for answers to your questions, as responses to support tickets can take up to 14 days.

Compare Similar Apps

|

When it comes to buying and selling cryptocurrencies, there are a number of popular platforms to choose from. See how eToro compares.

Coinbase vs eToro

| ||

| Visit Site | Learn More | |

eToro | Coinbase | |

|---|---|---|

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC - | Earn $5 in bitcoin on your first trade on Coinbase - | |

Benefits and Features | ||

| Stock Trading | ||

| Options Trading | ||

| Annual Fee | ||

| Cryptocurrency Trading | ||

| Minimum Deposit | $100 ($200 to start copy trading) | |

| Mutual Fund Trading | ||

| Cryptocurrencies Supported | ||

| Countries Supported | ||

| Fiat Currencies Supported | USD, EUR, GBP, AUD, RMB, THB, IDR, MYR, VND, PHP, SEK, DKK, NOK, PLN, CZK, PEN, MXN, QAR, BHD, OMR, AED, SGD. Not available for US customers. | |

| Digital Wallet | ||

| Transaction Fee | 1% fee for buying or selling crypto. 0% commission for buying or selling stocks and ETFs. | Greater of Minimum Flat Fees or Variable Fees (1.49%+) by Location and Payment Method. Minimum Flat Fees:

|

| Copy Trading | ||

| Limit Orders | ||

| Margin Trading | Yes. Not available for US customers. | |

| Crypto Loans | ||

| Bank Account Purchase Fee | ||

| Debit Card Purchase Fee | ||

| Wallet Purchase Fee | ||

| Banking | ||

| Mobile App | ||

| ACH Transfer Fee | ||

| Wire Transfer Fee | ||

| Crypto Conversion Fee | ||

| Other Fees | Crypto transfer fee: 0.0005 units - .25 units; $10 monthly fee after 12 months inactivity | Instant Card Withdrawal: up to 1.5% + minimum fee of $0.55 |

| Address Allowlisting | ||

| Anonymity | ||

| Biometric Login | ||

| Cold Storage | ||

| Two-Factor Authentication | ||

| Withdrawal Limit | ||

| Visit Site | Learn More | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. eToro: Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. CreditDonkey Inc may be compensated if you access certain products or services offered by the MSB and/or the BD. Coinbase: Pricing information from published website as of 04/13/2021. | ||

Coinbase is arguably the best-known cryptocurrency exchange platform working today, currently offering over 150 unique cryptocurrencies for trade, compared to the 24 on eToro.

Coinbase fees are around 2.49% for bank transfer purchases,[13] but eToro's fees are variable, so which are better depends to some extent on the currency you're buying.

If you're looking for more options, Coinbase may be your best bet, but eToro will offer more opportunities for new buyers looking to learn.

Robinhood vs eToro

|  | |

| Visit Site | Visit Site | |

eToro | Robinhood | |

|---|---|---|

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC - | Get a Free Stock (worth between $5 and $200) - | |

Benefits and Features | ||

| Stock Trading | ||

| Options Trading | ||

| Annual Fee | ||

| Cryptocurrency Trading | ||

| Minimum Deposit | $100 ($200 to start copy trading) | |

| Mutual Fund Trading | ||

| Commission Free ETFs | All U.S. listed ETFs | |

| Phone Support | ||

| Live Chat Support | Online 24 hours, Monday to Friday | Available 24/7 (requires sign in) |

| Email Support | ||

| Human Advisors | ||

| Robo Advisor | ||

| Assets Under Management | $7.5 Billion (as of 09/30/2023) | |

| Cryptocurrencies Supported | AAVE, AVAX, BTC, BCH, LINK, COMP, DOGE, ETH, ETC, LTC, SHIB, XLM, XTZ, UNI, USDC | |

| Fiat Currencies Supported | USD, EUR, GBP, AUD, RMB, THB, IDR, MYR, VND, PHP, SEK, DKK, NOK, PLN, CZK, PEN, MXN, QAR, BHD, OMR, AED, SGD. Not available for US customers. | |

| Digital Wallet | ||

| Tax Loss Harvesting | ||

| Transaction Fee | 1% fee for buying or selling crypto. 0% commission for buying or selling stocks and ETFs. | |

| Copy Trading | ||

| Limit Orders | ||

| Margin Trading | Yes. Not available for US customers. | Margin rates will vary based on a customer's margin balance, ranging from 4.7% to 5.75%. |

| Goal Tracker | ||

| Automatic Deposits | ||

| Crypto Loans | ||

| Broker Assisted Trades | ||

| Good For | ||

| Inactivity Fee | ||

| Maintenance Fee | ||

| Online Platform | ||

| iPhone App | ||

| Android App | ||

| Bank Account Purchase Fee | ||

| Debit Card Purchase Fee | ||

| Banking | Offers Robinhood spending account with Robinhood Cash Card issued by Sutton Bank | |

| Mobile App | ||

| ACH Transfer Fee | ||

| Wire Transfer Fee | ||

| Crypto Conversion Fee | ||

| Anonymity | ||

| Biometric Login | ||

| Cold Storage | ||

| Two-Factor Authentication | Device approvals, Authenticator app, SMS | |

| Withdrawal Limit | ||

| Forex Trading | ||

| Futures Trading | ||

| Locations | ||

| Online Community | ||

| Seminars | ||

| Virtual Trading | Yes (eToro virtual account with $100,000 virtual funds) | |

| Fractional Shares | ||

| Taxable Accounts | ||

| 401k Plans | ||

| IRA Accounts | ||

| Roth IRA Accounts | ||

| SEP IRA Accounts | ||

| Trust Accounts | ||

| 529 Plans | ||

| Visit Site | Visit Site | |

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Please visit the product website for details. eToro: Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. CreditDonkey Inc may be compensated if you access certain products or services offered by the MSB and/or the BD. Robinhood: Pricing information from published websites as of 01/25/2025. | ||

Robinhood is an investment platform offering commission-free trades. Users can purchase stocks, options, ETFs, and cryptocurrency, which means it has more options than eToro, which only offers crypto, stocks, and ETFs to U.S. customers.

Robinhood does not offer pre-made portfolios like eToro's CopyTrading platform but instead has a wealth of educational resources for new investors.

Investors looking to be more hands-on, who want to buy stocks and crypto on the same platform, may prefer Robinhood. While investors looking to mimic successful CopyTraders, who are only interested in cryptocurrencies, will probably prefer eToro.

Is eToro a Good Platform for Bitcoin Trading?

For those who are confident in their ability to read the market, and who want to take a hands-on approach to investing, eToro's relatively high fees may not make it the first choice.

And if you are interested in using cryptocurrency for something other than an investment vehicle, then you ought to consider exchanges that make it easier to transfer to and from your personal crypto wallet.

Which are the best eToro trading tips?

Those looking to succeed on eToro should take advantage of its unique services, like CopyTrading and Smart Portfolios, as well as the social aspect that lets you learn from your peers.

Remember, no investment is risk-free, and past performance doesn't guarantee future results, but sometimes it's wiser to go it together.

Regardless of your level, eToro's user-friendly platform and wealth of experienced and successful traders to learn from make it a great place to dive deeper into the world of crypto.

eToro FAQs

In case you still have any questions about eToro, here are some of the most frequently asked questions regarding the popular social trading platform.

- How long does eToro verification take?

According to eToro, the verification process can take up to a couple of days.Users will be notified as soon as their verification is complete, and they can also stay up to date on the process by logging in and checking their account via the app or site.

- How long does eToro withdrawal take?

eToro places a 7-day hold on all funds deposited into an eToro account for withdrawals.After that period is over, eToro can take up to 2 days to process withdrawal requests, and online bank transfers can take up to 3 business days to complete, according to their site.

Wire transfers can take up to 7 business days, while debit card withdrawals typically take around 4 business days.

- What's the difference between an order and a trade on eToro?

An order is an instruction by a trader to buy or sell an asset on eToro.While there is no strong distinction between an order and a trade, they may be tracked separately through an Order Book and a Trade Book. In this case, open orders refer to trades that have not been completed, and while the trade book records those that have.

- How many users does eToro have

At time of writing, eToro reports having over 30 million registered users worldwide. - Why does eToro ask for social security number

eToro asks for certain information to verify user identity, including their social security number.This is done in order to comply with regulations such as those with the Financial Crimes Enforcement Network ("FinCEN").

References

- ^ eToro USA LLC. Trade Markets on eToro, Retrieved 6/16/2023

- ^ eToro USA LLC. eToro US availability map, Retrieved 6/16/2023

- ^ eToro USA LLC. What is the minimum trade size?, Retrieved 3/8/2022

- ^ eToro USA LLC. What is CopyTrader™?, Retrieved 6/16/2023

- ^ eToro USA LLC. Trading Fees, Retrieved 3/30/2022

- ^ eToro USA LLC. Are there withdrawal fees?, Retrieved 3/8/2022

- ^ eToro USA LLC. eToro Club Membership tiers, Retrieved 3/8/2022

- ^ Trustpilot. eToro Reviews, Retrieved 6/16/2023

- ^ App Store. eToro Ratings and Reviews, Retrieved 6/16/2023

- ^ Google Play. eToro Reviews, Retrieved 6/16/2023

- ^ eToro. What's the deposit minimum? , Retrieved 03/11/2024

- ^ eToro USA LLC. Are my funds insured?, Retrieved 3/8/2022

- ^ Coinbase. Coinbase Pricing and Fees Disclosures, Retrieved 1/12/2022

Buy $100 in Crypto and Get $10 Bonus from eToro USA LLC

- Sign up for an eToro account

- Deposit funds

- Invest in $100 worth of crypto

You'll automatically receive $10 directly to your account balance. Offer only applies to US customers. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

Up to $100 Transfer Fee Reimbursement

Transfer fees of up to $100 will be reimbursed when you make an initial transfer of $2,000 or more.

Jeremy Harshman is a creative assistant at CreditDonkey, a crypto comparison and reviews website. Write to Jeremy Harshman at jeremy.harshman@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

|

|

|

Compare: