Cash-on-cash Return Calculator

What's the cash-on-cash return for your investment?

How do you calculate cash-on-cash return in real estate? Use this handy tool to evaluate potential investments.

|

And there you go! Cash-on-cash returns are a simple metric for analyzing an investment's cash flow. But it shouldn't be your only metric. To better understand your investment, let's figure out how cash-on-cash return works.

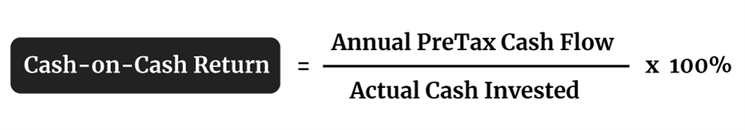

How do you calculate cash-on-cash return?

To calculate cash-on-cash return, just divide the received net cash flow for the year by the amount of cash invested.

|

Net cash flow = The sum of all cash received (inflow) over a period of time from sales and loans - the total money spent (outflow) by the company over the same period.

The formula itself is pretty simple. But there are a few things you need to know about your annual pre-tax cash flow and actual cash invested.

What's your annual pre-tax cash flow?

For your annual pre-tax cash flow, follow these steps:

- Add your gross scheduled rent and any other income

- Gross scheduled rent - The property's gross rents multiplied by 12

- Any other income - Consider other earning opportunities like pet income, non-refundable deposits, parking space payments and rates for utilities

- Gross scheduled rent - The property's gross rents multiplied by 12

- Then subtract actual vacancy, operating expenses and annual debt service

- Actual vacancy - Multiple your vacancy rate (number of days your property was vacant) by the daily rental rate

- Operating expenses - Consider insurance, taxes, maintenance, HOA and bank fees, property management, and repairs

- Annual debt service - Your monthly payment to cover both principal and interest related to your loan (does not include insurance and taxes)

- Actual vacancy - Multiple your vacancy rate (number of days your property was vacant) by the daily rental rate

What's your actual cash invested?

For your actual cash invested, add these numbers:

- Down payment - The amount paid for the property

- Closing costs - Combine the costs paid (not including down payment) and then subtract from any seller or lender credits given to you

- Pre-rental improvements and repairs - Your out-of-pocket expenses to fix the unit before renting it out

When should you calculate cash-on-cash return?

Many real estate industry insiders, such as investors and agents, apply this metric. But should you? Here are cash-on-cash return's main use cases.

- Determining how much financing to use

- Comparing multiple investments

Cash-on-cash return is a general rule of thumb that anyone can use. Other concepts like modified internal rate of return provide more insight but are harder to learn.

Simply, you just need to divide the physical cash after 12 months by the physical cash invested for cash-on-cash returns.

Is cash-on-cash return a bad metric?

Okay, there are a few instances where cash-on-cash return falls flat.

- Doesn't factor tax implications for actual returns

- Doesn't account for equity

- Doesn't account for appreciation

- Ignores the risk associated with investments

- Ignore opportunity costs

- Ignores the effect of compounding interest

Despite its flaws, cash-on-cash return is still useful for real estate transactions. It measures the annual return the investor makes on a property in relation to the amount of mortgage paid during the same year.

What does cash-on-cash return mean in real estate

Cash-on-cash return calculates the income earned on the cash invested in a property. It's fairly easy to understand and an important formula to use.

Cash-on-cash return is not the same as ROI. ROI is a profitability ratio while cash-on-cash return measures the return on the actual cash invested.

- Cash on Cash Return = (Annual Pre-Tax Cash Flow/ Actual Cash Invested) x 100%

- ROI= Net Profit/ Total Cost

Cash-on-cash return tends to be more accurate than calculating ROI.

Should you use the cash-on-cash return?

Cash-on-cash return is a great metric for evaluating the first year's performance of a property.

It's not a good idea to use the metric for a property you've heard for more than 12 months. That's because your denominator - the actual cash invested - will constantly change as you pay down the loan and spend money on improvements and repairs.

Finally, while cash-on-cash return is not perfect, it's a solid way to screen properties for value investors.

Amber Kong is a content specialist at CreditDonkey, a personal finance comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

|

|

| ||||||

|

|

|