Best Car Insurance for College Students

How much is the average car insurance for a college student? A lot. But there are ways to drive down the cost. Here are the best cheap insurance companies.

|

The broke college student life is real. You're supposed to pay for rent, food, school, and car insurance?

As a young driver, you'll have to deal with high premiums until you have more experience.

But there are plenty of ways you could be saving right now. Did you know you could get a discount just for being in a student organization?

Here are the best cheap car insurance for students. Plus, learn how to find the best insurance deals no matter where you shop.

- State Farm - Best discounts

- GEICO - Cheapest rates

- Progressive - Best coverage options

- Allstate - For students without a car

- Esurance - For infrequent drivers

- Liberty Mutual - For students away from home

Best Car Insurance for College Students

|

| © CreditDonkey |

Statistically, young drivers are involved in more car crashes. According to the Centers for Disease Control and Prevention, drivers aged 16–19 are nearly 3 times more likely than drivers aged 20 and older to get in a fatal car crash.

The high risk of getting in an accident means young drivers pay the highest premiums. In fact, we found the average cost of car insurance for college students to be $3,500 per year. That's 274% higher than the national average of $936!

But there's some good news. While you can't change your age, you can still save money on car insurance.

We compared prices for a 20-year-old male college student living in a mid-size Midwest city. He drives a 2016 Ford Fusion. The premiums quoted are for a policy with the following coverages without discounts:

- $100,000/$300,000/$100,000 liability limits

- $5,000 medical payments

- $100,000/$300,000 uninsured/underinsured motorist bodily injury

- $25,000 uninsured motorist property damage

| Insurance Company | Annual Liability Premium |

|---|---|

| GEICO | $1,534 |

| Progressive | $1,640 |

| State Farm | $2,111 |

| Allstate | $2,476 |

| Esurance | $2,534 |

| Liberty Mutual | $4,284 |

State Farm: Best Discounts

|

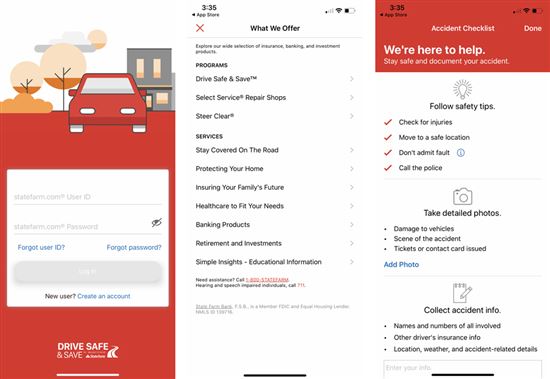

| Screenshot of Statefarm |

State Farm is the biggest car insurance company in the U.S. You've probably seen their khaki-wearing agents in commercials, but how do they stack up in real life?

While they don't have the lowest rates, they make up for it with discounts. They might not be the cheapest option if you want your own policy. But their multi-car family pricing is great if you're staying on your parents' policy.

They offer other great discounts like:

- Good Student Discount: State Farm's 25% discount is higher than most companies'.

- Good Driver Discount: You'll get a 10% discount for keeping a clean driving record over 3 consecutive years.

- Defensive Driver Discount: State Farm's has a short online driving course called Steer Clear. You'll get a 15% discount for completing it.

- Safe Driving App: The Drive Safe & Save program tracks your driving for 3 months. They'll give you a 5%–50% discount based on your driving habits. Most discounts will be closer to 5%, but any amount helps.

- Liability only = $2,111

- Full coverage = $4,539

Great discounts aren't always enough. Find out below where you can get the lowest rates as a college student.

GEICO: Cheapest Rates

|

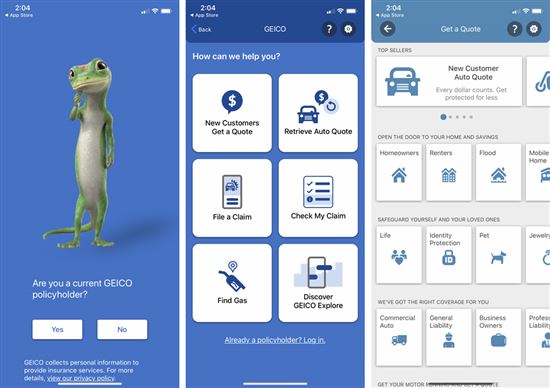

| Screenshot of Geico |

GEICO is the second largest auto insurance company in the U.S. according to the Insurance Information Institute. But can it really save you 15% or more on car insurance? It sounds too good to be true, but it turns out it can.

From our research, GEICO offers the lowest rates for college students. They also have an easy-to-use app for Android and Apple that gives you convenient access to your policy.

Their discounts include:

- Good Student Discount: GEICO offers 15% off for high school and college students with at least a B average.

- Good Driver Discount: If you've had a clean driving record for the last 5 years, you can get up to 26% off your premium.

- Student Organization Discount: They've partnered with over 500 fraternities, sororities, and student organizations. If you're in one of them, you can get up to 8% off.

- Seat Belt Discount: Buckle up every time you drive for up to 15% off your medical payments or personal injury protection premiums.

- Liability only = $1,534

- Full coverage = $3,322

Just because GEICO has the cheapest base rates, doesn't mean you don't have to shop around. Stick to the end for the steps to get the lowest prices.

Progressive: Best Coverage Options

|

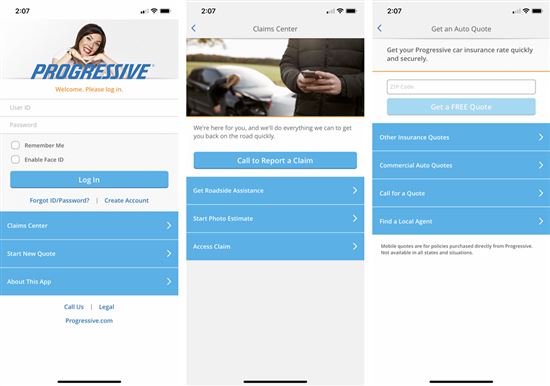

| Screenshot of Progressive |

Progressive offers competitive rates for college students. Their Name Your Price tool gives you a range of coverage options to fit your budget. They also give discounts for going paperless and enrolling in auto-pay.

A few of their other discounts include:

- Good Student Discount: Students with a B average or better earn a discount when they provide a recent transcript.

- Good Driver Discount: If you've had a clean driving record for the last 3 years, Progressive offers up to 31% off.

- Distant Student Discount: This applies to students on their family's policy who attend college over 100 miles away from home.

- Safe Driving App: The Snapshot program monitors your driving habits in exchange for discounts. They'll give you a 5% discount just for trying the program.

- Liability only = $1,640

- Full coverage = $3,212

Instead, look for companies like the one below that give good discounts for leaving it at home.

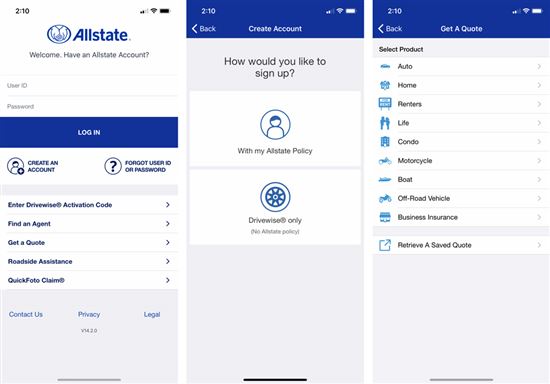

Allstate: For Students Without a Car

|

| Screenshot of Allstate |

When you think of Allstate, you can't help but hear that deep voice asking, "Are you in good hands?" For college students who need insurance while away at school, the answer is yes.

They have competitive rates whether you stay on your parents' insurance or get your own. They're a popular choice especially for students who leave their car at home.

Their discounts include:

- Good Student Discount: Allstate gives you a 9% discount for good grades, which is a little lower than others on this list.

- Resident Student Discount: If you're on your parents' policy and you're not taking a car with you to college, you could reduce your portion of the insurance bill by up to 35%.

- Liability only = $2,476

- Full coverage = $4,539

If you don't drive often, it doesn't make sense to pay as much as someone who does.

Some companies only charge you for what you drive, and not a mile more. See how you can save below.

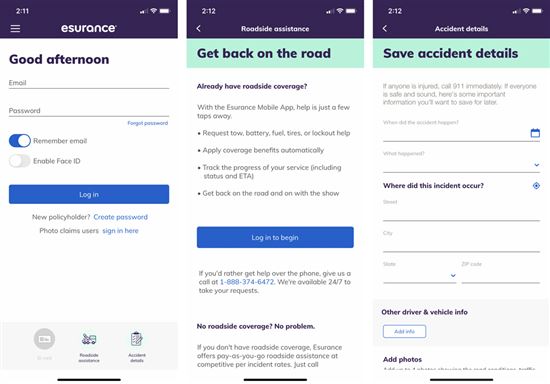

Esurance: For Infrequent Drivers

|

| Screenshot of Esurance |

Esurance, which is owned by Allstate, was designed to target a younger crowd. It combines an easy-to-use website and app with competitive rates for younger drivers.

Their pay-per-mile system is similar to online competitor Metromile. But, they offer more traditional discounts to help you save.

Discounts include:

- Good Student Discount: Esurance offers up to 10% off for students who have a 3.0 GPA or higher.

- Good Driver Discount: Earn 30% to 40% off your premiums for keeping a clean driving record over the last 3 years.

- Defensive Driver Discount: If you've taken an online defensive driver course, you could get another 10% off your premiums.

- Pay Per Mile: Esurance has a pay-per-mile option that's similar to Metromile. You'll pay a low base cost, then a few cents per mile after that. This is a great option if you drive less than 10,000 miles/year.

- Liability only = $2,534

- Full coverage = $4,684

Here's a little secret: No matter which companies you shop with, there are steps that'll guarantee you'll get the lowest prices.

Stay until the end to learn how to shop for car insurance.

Liberty Mutual: For Students Away From Home

Liberty Mutual has incentives for college students staying on their parents' policy, including accident forgiveness. This prevents a rate increase after your first accident.

The insurance company also offers:

- Good Student Discount: Like other companies, Liberty Mutual will give you a discount for having a B average or better.

- Distant Student Discount: Similar to Allstate and Progressive, you qualify for this discount if you go to college over 100 miles from home and you stay on your family's insurance policy.

- Driver Training Discount: Complete a defensive driving course to get this discount. The amount varies by state.

- Student Organization Discount: Earn a 10% discount for belonging to one of more than 14,000 partnered alumni associations, employers, or professional groups.

- Liability only = $4,284

- Full coverage = $7,128

You're living away from your parents now, but should you still stay on their insurance? Not necessarily.

Find out below whether it's worth it to get your own policy.

Other Insurance Companies to Consider

USAA

USAA caters to military members and their families. They offer lots of discounts for safe driving, good grades, and more.

They're also known for their stellar customer service. J.D. Power ranks USAA as the top auto insurer for customer satisfaction.

USAA's rates are very competitive. This is a great option if you or a parent have served in the military. If you're able to stay on an existing policy, this will be your best bet.

Metromile

Founded in 2011, Metromile offers an innovative pay-per-mile system. It tracks your usage through an app or a device in your car. You pay only what you drive—usually between $0.03 and $0.10 per mile.

Metromile still offers full coverage and all the usual perks. If you don't drive a lot, this can save you quite a bit of money.

- Arizona

- California

- Illinois

- New Jersey

- Oregon

- Pennsylvania

- Virginia

- Washington

Should I Stay on My Parents' Policy?

|

| © CreditDonkey |

Your cheapest option as a college student usually is staying on your parents' policy, even if it bumps up their premiums. Why?

- Your parents don't fall under the "riskiest" category with insurers.

- They likely have better credit, which also matters when it comes to insurance rates.

Your parents could also have discounts for bundled insurance, a multi-car policy, or having more years with a clean driving record.

But sticking with their insurance isn't always your best bet.

If you don't drive a lot, it might be more cost-effective to just Uber everywhere. You'd definitely save on gas, insurance, and car maintenance costs.

When to Stay on Your Parents' Auto Insurance:

- Your car is titled in a parent's name.

- Your car is titled in both your name and a parent's name.

- Your car is titled in just your name, but your permanent residence is still your parents' house.

In other words, college is just a temporary residence—you haven't fully moved out of your parents' house yet.

When to Buy Your Own Auto Insurance:

- You have fully moved out of your parents' house and the car is titled in your name.

This means that you live in your college town year round, get all your mail there, and might only visit your parents once in a while.

If you drive, you need car insurance. It's simple as that.

Most states require you to have car insurance if you have a registered vehicle—even if you don't plan on driving it.

But how much auto insurance do you really need? It might be more than you think. Find out what you'll need to stay protected below.

How Much Car Insurance Do I Need?

Every state requires a minimum amount of liability insurance. This covers damages you cause to other people or their property.

The minimum liability limits vary by state, but they're usually about:

- $25,000 per person

- $50,000 per accident

- $25,000 in property damage

You should strongly consider purchasing more than the minimum. Your premiums will cost more, but it's worth the extra protection.

But a bad accident can easily cost over $100,000. If you don't carry enough liability insurance, you'll have to pay the remainder out-of-pocket.

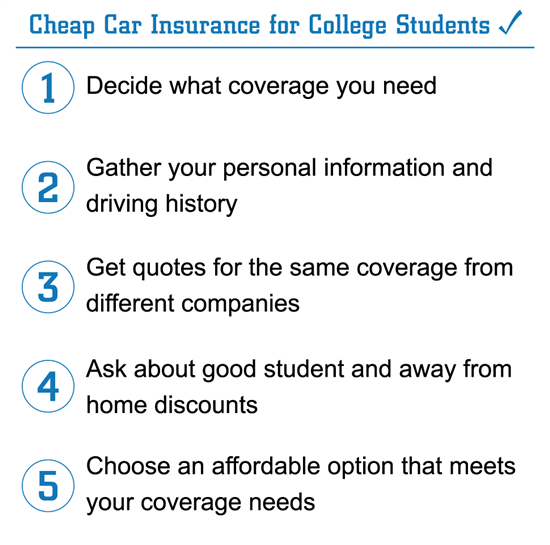

How to Shop for Car Insurance

|

| © CreditDonkey |

Car insurance prices depend on a lot of factors, but these steps will get you the best deal.

It's a lot of work, but it's worth it to make sure you're not getting ripped off.

You'll need to know what coverage you need before you ask for quotes. If you can afford it, it's best not to skimp out on coverage. The state minimum isn't always enough, especially if your car is worth a lot.

Here are more tips for choosing the right policy:

Don't Skimp on Coverage

We know it's not possible for everyone, but try to get more than your state's minimum coverage if you can afford it. Comprehensive and collision could be worth it if you have a newer car. Find a quote with at least a $500 deductible.

Be Consistent

Use the same amounts when getting quotes from different car insurance companies. You'll be able to comparison shop more effectively.

Take Your Time

Explore the insurance discounts that each company offers. Not all companies have the same discounts, so it pays to slow down and find all the ones you qualify for.

What the Experts Say

As part of our series on saving and car insurance, CreditDonkey asked a panel of experts for our readers' most pressing questions. Here's what they said to say:

Tips to Save on Car Insurance

Leave Your Car at Home

This sounds like a no-brainer, but insurance companies will charge less if they know you won't drive a lot. There are always alternate ways you can get around, like the bus or ridesharing. If you don't need your car, leave it at home.

Drive a Safe, Used Vehicle

Going with a reliable, safe car can lower your premium. It might not be the most fun option, but you'll pay less for insurance. Used cars are also generally less expensive to insure than brand-new cars.

Raise Your Deductible

You can lower your premium if you raise your deductible to $1,000 or more. But make sure you can pay that amount if you get into an accident.

Get Usage-Based Insurance

All the car insurance companies we mentioned offer usage-based insurance (UBI). It's a great way to reduce your premiums while in college.

UBI tracks your driving habits through an app or device in your car. They collect information like how hard you brake and how many miles you drive. Typically, you'll get a 5% discount just for joining a program. Most drivers can expect to get 10% to 20% off.

Bottom Line

The average cost of car insurance for college students is high, but young drivers still have a lot of options. Make sure you shop around and take advantage of all possible discounts.

Take time to discuss your situation with your auto insurance company. It always pays to know what coverages you need (and what you don't).

Additional Resources

Write to Andrew Flueckiger at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next: