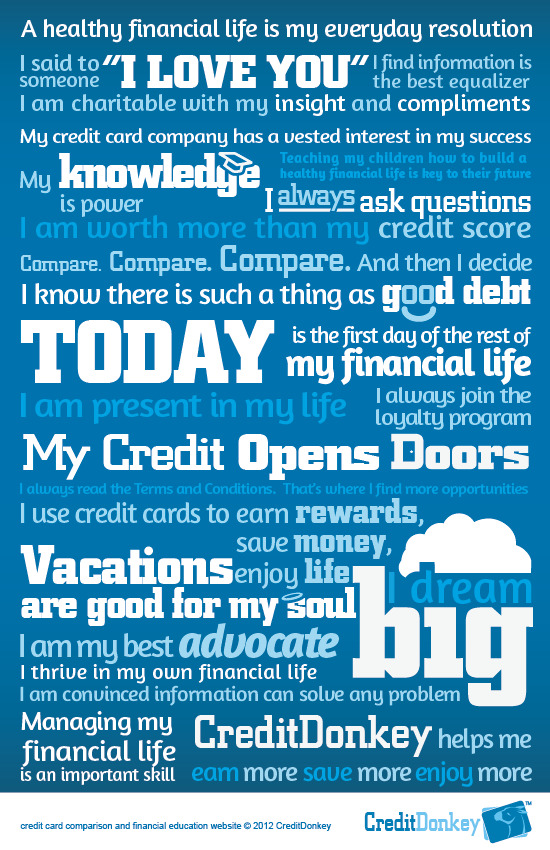

The CreditDonkey Manifesto

While credit is a serious subject, empowering people to live a healthier financial life should be

|

| The CreditDonkey Manifesto © CreditDonkey |

The CreditDonkey Manifesto

- A healthy financial life is my everyday resolution

- I use credit cards to earn rewards, save money and enjoy life

- My knowledge is power

- I always ask questions

- Teaching my children how to build a healthy financial life is key to their future

- I am worth more than my credit score

- Compare. Compare. Compare. And then I decide

- I know there is such thing as good debt

- Today is the first day of the rest of my financial life

- I am present in my life

- I always join the loyalty program

- My credit opens doors

- I always read the Terms and Conditions. That's where I find more opportunities

- Today I said to someone "I love you"

- I find information is the best equalizer

- I am charitable with my insight and compliments

- My credit card company has a vested interest in my success

- Vacations are good for my soul

- I dream big

- I am my best advocate

- I thrive in my own financial life

- I am convinced information can solve any problem

- Managing my financial life is an important skill

- CreditDonkey helps me earn more, save more and enjoy more

Frequently Asked Questions

How does CreditDonkey help me earn more, save more and enjoy more?

CreditDonkey helps consumers and small businesses understand the credit card landscape to reap bigger benefits:

- earn rewards with credit card deals

- save money with low interest rates and balance transfers

- enjoy life with airline miles, hotel stays, and credit card tips

How does CreditDonkey make money?

CreditDonkey is a free online service for consumers that generates revenue from advertisers, such as credit card issuers. CreditDonkey usually receives revenue from the issuer when a visitor is approved for a card.

What is the best credit card?

There is not a universal “best” card. To find what’s best for you, compare, compare, compare. And then decide.

For example, someone who always pays their bill in full should look for generous rewards. Individuals who carry a balance should look for low interest rates. Most individuals should opt for a credit card with no annual fee unless they spend a significant amount each month.

Need help? Have questions? Contact us